Introduction to Economic Growth and Instability

... has been reached and resource prices will rise with increasing demand, causing producers to raise prices. Note: Chapter 7’s distinction between nominal and real GDP is helpful here. 2. Cost-push or supply-side inflation: Prices rise because of rise in per-unit production costs (Unit cost = total inp ...

... has been reached and resource prices will rise with increasing demand, causing producers to raise prices. Note: Chapter 7’s distinction between nominal and real GDP is helpful here. 2. Cost-push or supply-side inflation: Prices rise because of rise in per-unit production costs (Unit cost = total inp ...

Econ 102: Problem Set 1

... aggregate demand curve? Under what circumstances would it shift horizontally by exactly $100 billion? What aspects of economic behavior would cause it to shift by more than $100 billion? What aspects would cause it to shift by less? This is a change in government purchases, G. Since G is one compone ...

... aggregate demand curve? Under what circumstances would it shift horizontally by exactly $100 billion? What aspects of economic behavior would cause it to shift by more than $100 billion? What aspects would cause it to shift by less? This is a change in government purchases, G. Since G is one compone ...

Document

... (1) As comprehensive as possible, please analyze its separate effects on the FE line, IS curve, and LM curve respectively. Focus on the short run effects. (8 points) (2) Given your analysis in (1), draw graph, what are its net effects on employment, real wage, interest rate, consumption, investment, ...

... (1) As comprehensive as possible, please analyze its separate effects on the FE line, IS curve, and LM curve respectively. Focus on the short run effects. (8 points) (2) Given your analysis in (1), draw graph, what are its net effects on employment, real wage, interest rate, consumption, investment, ...

unemployment

... Predicting average behavior and some pitfalls of faulty economic analysis 1. Macroeconomic behavior may be predicted more accurately because an group average may offset the unusual behavior of individuals who are “outliers.” 2. The fallacy of composition, however, may be a problem in generalizing f ...

... Predicting average behavior and some pitfalls of faulty economic analysis 1. Macroeconomic behavior may be predicted more accurately because an group average may offset the unusual behavior of individuals who are “outliers.” 2. The fallacy of composition, however, may be a problem in generalizing f ...

Exam I from Summer 2006

... d) inflation and currency exchange value are not related 10) Depreciation of the USD will lead to a) an increase in the rate of inflation b) a decrease in the rate of inflation c) inflation being unchanged d) inflation and currency exchange value are not related 11) In order to be counted as unemplo ...

... d) inflation and currency exchange value are not related 10) Depreciation of the USD will lead to a) an increase in the rate of inflation b) a decrease in the rate of inflation c) inflation being unchanged d) inflation and currency exchange value are not related 11) In order to be counted as unemplo ...

Department of Economics, University of Toronto

... e. Given your answer to (d) above, find the New Classical aggregate supply curve (EAS) curve for this economy. f. Assuming that nominal wage contracts were signed when the economy was in the long-run equilibrium, determine the level of contractual nominal wages. g. Given your answer to (f) above, de ...

... e. Given your answer to (d) above, find the New Classical aggregate supply curve (EAS) curve for this economy. f. Assuming that nominal wage contracts were signed when the economy was in the long-run equilibrium, determine the level of contractual nominal wages. g. Given your answer to (f) above, de ...

Unemployment Rate

... Household Survey: unemployment rate – percentage of civilian labor force that is unemployed. Lagging indicator because it responds slowly to changes in the economy. Joblessness can continue to rise 2 years after recession ends. Typically firms are slow to hire & slow to fire. A rise in the unemploym ...

... Household Survey: unemployment rate – percentage of civilian labor force that is unemployed. Lagging indicator because it responds slowly to changes in the economy. Joblessness can continue to rise 2 years after recession ends. Typically firms are slow to hire & slow to fire. A rise in the unemploym ...

Mr - TeacherWeb

... A) All free economies deal with three common economic challenges/problems at some point: 1. Unemployment, Poverty, and Inflation 2. All three can have a negative effect on an economy's Gross Domestic Product (NO #12) and prevent an economy from growing B) All three "challenges" can take place during ...

... A) All free economies deal with three common economic challenges/problems at some point: 1. Unemployment, Poverty, and Inflation 2. All three can have a negative effect on an economy's Gross Domestic Product (NO #12) and prevent an economy from growing B) All three "challenges" can take place during ...

Chap23

... Ratio of unemployment benefits to average pay is higher Unemployment benefits last longer, sometimes years, so workers have less incentive to find new jobs Government regulations make employers in Europe reluctant to hire new workers because firing them is difficult ...

... Ratio of unemployment benefits to average pay is higher Unemployment benefits last longer, sometimes years, so workers have less incentive to find new jobs Government regulations make employers in Europe reluctant to hire new workers because firing them is difficult ...

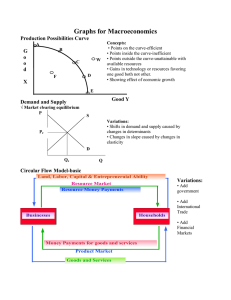

Graphs for Macroeconomics Production Possibilities Curve G o

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

Transcript

... relationship between the quantity of real GDP produced and the overall price level. Keynes hypothesized that the aggregate supply curve was essentially horizontal in the short-run, suggesting that the economy could expand its rate of output without any upward pressure on the price level. In addition ...

... relationship between the quantity of real GDP produced and the overall price level. Keynes hypothesized that the aggregate supply curve was essentially horizontal in the short-run, suggesting that the economy could expand its rate of output without any upward pressure on the price level. In addition ...

Business Cycles

... B. Contractionary bad times give us the most problems. First: Real GDP declines during a contraction. Second: Unemployment increases. Third: The incomes of employed resources also tend to fall, or at least not rise as much as in an expansion. Fourth: Business profits decline and bankruptcies ...

... B. Contractionary bad times give us the most problems. First: Real GDP declines during a contraction. Second: Unemployment increases. Third: The incomes of employed resources also tend to fall, or at least not rise as much as in an expansion. Fourth: Business profits decline and bankruptcies ...

Test 1

... than previously, and (b) the growth rate of M2 was much higher than the growth rate of M1. Explain how the high inflation of the decade relates to each of these facts. By the quantity theory of money, rapid growth of the money supply (relative to the growth rate of aggregate output) causes the infla ...

... than previously, and (b) the growth rate of M2 was much higher than the growth rate of M1. Explain how the high inflation of the decade relates to each of these facts. By the quantity theory of money, rapid growth of the money supply (relative to the growth rate of aggregate output) causes the infla ...

FedViews

... inflation by about a percentage point, two scenarios cause some to worry about higher inflation. First, some fear that a sharp drop in the dollar could cause inflation to jump. This seems unlikely. A precipitous dollar depreciation would be associated with global financial instability, but such inst ...

... inflation by about a percentage point, two scenarios cause some to worry about higher inflation. First, some fear that a sharp drop in the dollar could cause inflation to jump. This seems unlikely. A precipitous dollar depreciation would be associated with global financial instability, but such inst ...

Economics Revision: Conflicts between Macro Objectives

... leads to an excess of aggregate supply over demand. Intuitively a period of falling prices seems good news for consumers and ought to prompt a rise in the volume of goods and services sold and ...

... leads to an excess of aggregate supply over demand. Intuitively a period of falling prices seems good news for consumers and ought to prompt a rise in the volume of goods and services sold and ...

FedViews

... by a statistical regression of the funds rate on core consumer price inflation and on the gap between the unemployment rate and the Congressional Budget Office’s estimate of the natural, or normal, rate of unemployment. The resulting policy guideline recommends lowering the funds rate by 1.4 percent ...

... by a statistical regression of the funds rate on core consumer price inflation and on the gap between the unemployment rate and the Congressional Budget Office’s estimate of the natural, or normal, rate of unemployment. The resulting policy guideline recommends lowering the funds rate by 1.4 percent ...

1. Circular Flow. In the circular flow model of the economy, income is

... will magnify the income redistribution effects when the inflation is unexpected. f. Output variability means that actual real GDP will be more volatile when inflation is high. This results from higher and more volatile inflation, which raises uncertainty which reduces risk taking behavior, and highe ...

... will magnify the income redistribution effects when the inflation is unexpected. f. Output variability means that actual real GDP will be more volatile when inflation is high. This results from higher and more volatile inflation, which raises uncertainty which reduces risk taking behavior, and highe ...

Unemployment

... Another key indicator of an economy’s health is its unemployment rate. An economy with a low unemployment rate is usually healthy and growing, because it is not wasting its labor resources. More workers means more production and more consumption ...

... Another key indicator of an economy’s health is its unemployment rate. An economy with a low unemployment rate is usually healthy and growing, because it is not wasting its labor resources. More workers means more production and more consumption ...

Key - Personal.psu.edu

... Government increases spending (infrastructure) by $ 1 Trillion. What is the new expression for the IS curve now? Y = [ 3 + 2.2 -.2 + 4.0 + 1.5 - 1.5] x (1 / 1 - .5) - (.1 + .2 + .2)/(1 - .5) r Y = 18 - r i) Resolve for the new Y, π and r. Again, assume that inflation expectations are unchanged. Labe ...

... Government increases spending (infrastructure) by $ 1 Trillion. What is the new expression for the IS curve now? Y = [ 3 + 2.2 -.2 + 4.0 + 1.5 - 1.5] x (1 / 1 - .5) - (.1 + .2 + .2)/(1 - .5) r Y = 18 - r i) Resolve for the new Y, π and r. Again, assume that inflation expectations are unchanged. Labe ...

Full employment is just that, nobody who is actively seeking a job is

... unemployed people. This means that their unemployment rate is ten percent (because one million divided by ten million is ten percent.) The Costs of Unemployment are numerous. First, the unemployed area resource that goes unused, prevent producing on the production possibility frontier. Another probl ...

... unemployed people. This means that their unemployment rate is ten percent (because one million divided by ten million is ten percent.) The Costs of Unemployment are numerous. First, the unemployed area resource that goes unused, prevent producing on the production possibility frontier. Another probl ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.