Macro2 Problem #3key

... Spending Multiplier = 1/(1-Marginal Propensity to Consume) The MPC is 0.9 in this module. Explain why the two results are different. The two results are different because crowding out. The increase in government spending started to increase real GDP. However, as real income rose so did the demand fo ...

... Spending Multiplier = 1/(1-Marginal Propensity to Consume) The MPC is 0.9 in this module. Explain why the two results are different. The two results are different because crowding out. The increase in government spending started to increase real GDP. However, as real income rose so did the demand fo ...

Mankiw: Brief Principles of Macroeconomics, Second Edition

... GDP will increase but so will the price level. The economy will experience a drop in the unemployment rate but a positive inflation rate. If the AD had shifted to the left, inflation would have fallen, but unemployment would have risen. ...

... GDP will increase but so will the price level. The economy will experience a drop in the unemployment rate but a positive inflation rate. If the AD had shifted to the left, inflation would have fallen, but unemployment would have risen. ...

question 1 - Institute of Bankers in Malawi

... Say the economy starts at point U with expected inflation at 0%, and the government decide that they want to lower the level of unemployment because it is too high. They therefore decide to boost demand by 5%. The attempt to reduce unemployment would primarily be through boosting aggregate demand ( ...

... Say the economy starts at point U with expected inflation at 0%, and the government decide that they want to lower the level of unemployment because it is too high. They therefore decide to boost demand by 5%. The attempt to reduce unemployment would primarily be through boosting aggregate demand ( ...

Gold, Black Gold, Steel, and World Inflation: A SAS Study

... inflation and stagnation (recession). In theory this is known as an external supply shock causing aggregate supply to shift inward and up thus leading to cost push inflation and unemployment. A policy of economic expansion was followed to cure recession has caused another type of inflation known as ...

... inflation and stagnation (recession). In theory this is known as an external supply shock causing aggregate supply to shift inward and up thus leading to cost push inflation and unemployment. A policy of economic expansion was followed to cure recession has caused another type of inflation known as ...

Business Cycles

... • Frictional unemployment refers to the unemployment that results from the time that it takes to match workers with jobs. In other words, it takes time for workers to search for the jobs that are best suit their tastes and skills. • Structural unemployment is the unemployment that results because th ...

... • Frictional unemployment refers to the unemployment that results from the time that it takes to match workers with jobs. In other words, it takes time for workers to search for the jobs that are best suit their tastes and skills. • Structural unemployment is the unemployment that results because th ...

Fiscal Policy - Cloudfront.net

... • Fiscal Policy - Government effort to control the economy and maintain stable prices, full employment, and economic growth. Fiscal Policy deals with adjusting government spending (G) and tax revenue (T) in order to achieve these goals. IT is aimed at manipulating the federal budget. • Macro Economi ...

... • Fiscal Policy - Government effort to control the economy and maintain stable prices, full employment, and economic growth. Fiscal Policy deals with adjusting government spending (G) and tax revenue (T) in order to achieve these goals. IT is aimed at manipulating the federal budget. • Macro Economi ...

File

... Curve analysis that when the actual rate of inflation is greater than the expected rate, the unemployment rate will: A) rise temporarily, but decreases in nominal wages will decrease unemployment to its natural rate and bring the expected and actual rates of inflation into balance. B) rise temporari ...

... Curve analysis that when the actual rate of inflation is greater than the expected rate, the unemployment rate will: A) rise temporarily, but decreases in nominal wages will decrease unemployment to its natural rate and bring the expected and actual rates of inflation into balance. B) rise temporari ...

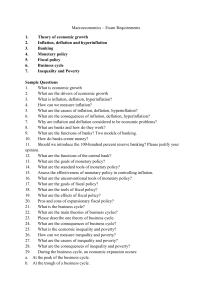

Macroeconomics – Exam Requirements 1. Theory of economic

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

Inflation 11.2

... employees’ wages buy as much as it did the year before. 4) But wait…the companies’ costs went up again so they raise the price of their products again. 5) And this continues on and on in an effect known as ...

... employees’ wages buy as much as it did the year before. 4) But wait…the companies’ costs went up again so they raise the price of their products again. 5) And this continues on and on in an effect known as ...

US. Economics History Review

... mainly due to LAS (SAS), which was in turn due to K, L, T during the American Industrial Revolution AD was stable due to no (slow) increase in (gold) money supply ...

... mainly due to LAS (SAS), which was in turn due to K, L, T during the American Industrial Revolution AD was stable due to no (slow) increase in (gold) money supply ...

Inflation

... – Businesses cannot respond to new demand by expanding output – Excess demand bids up the prices of the limited output – Total spending pulls up prices – “too much money chasing too few goods” – Can be persistent ...

... – Businesses cannot respond to new demand by expanding output – Excess demand bids up the prices of the limited output – Total spending pulls up prices – “too much money chasing too few goods” – Can be persistent ...

Document

... According to the classical dynamic aggregate supply curve, output growth is constant and equal to the rate of productivity growth, g, regardless of the level of inflation. As a result, the classical dynamic aggregate supply curve is simply a vertical line that is consistent with an output growth rat ...

... According to the classical dynamic aggregate supply curve, output growth is constant and equal to the rate of productivity growth, g, regardless of the level of inflation. As a result, the classical dynamic aggregate supply curve is simply a vertical line that is consistent with an output growth rat ...

out-infl-dyn-partI

... Despite the fact that we cheated (just a little, just a little) to get it, this form of the DAD curve has two advantages. First, it is very easy to use. Secondly, it is linear, making it still easier to use. You will use this equation to do the exercises of Problems #3 and #4. This form of the DAD c ...

... Despite the fact that we cheated (just a little, just a little) to get it, this form of the DAD curve has two advantages. First, it is very easy to use. Secondly, it is linear, making it still easier to use. You will use this equation to do the exercises of Problems #3 and #4. This form of the DAD c ...

10. Oil Shocks of the 1970s and the Great Depression

... supply shock-a significant fall in oil prices. As the model predicts, inflation and unemployment ______: ...

... supply shock-a significant fall in oil prices. As the model predicts, inflation and unemployment ______: ...

Test 2 - Dasha Safonova

... 4. Which of the following would shift the aggregate demand curve leftward year after year? A. a one-time tax cut B. inflation C. a one-time increase in government expenditures on goods and services D. negative growth in the quantity of money 5. When workers and employers correctly anticipate an incr ...

... 4. Which of the following would shift the aggregate demand curve leftward year after year? A. a one-time tax cut B. inflation C. a one-time increase in government expenditures on goods and services D. negative growth in the quantity of money 5. When workers and employers correctly anticipate an incr ...

MODELLING IN THE NATIONAL BANK OF TAJIKISTAN Khurshed Ismatulloev Dec 09, 2015 Bangkok

... describe basic workings of monetary transmissions ...

... describe basic workings of monetary transmissions ...

Inflation Cycles

... Explain the short-run and long-run tradeoff between inflation and unemployment Explain how the mainstream business cycle theory and real business cycle theory account for fluctuations in output and employment ...

... Explain the short-run and long-run tradeoff between inflation and unemployment Explain how the mainstream business cycle theory and real business cycle theory account for fluctuations in output and employment ...

Measurement Of Macroeconomic Variables

... 1. The AS curve is drawn using a nominal variable, such as the nominal wage rate. In the short-run, the nominal wage rate is fixed. As a result, an increasing price indicates higher profits that justify the expansion of output. 2. An alternate model explains that the AS curve increases because some ...

... 1. The AS curve is drawn using a nominal variable, such as the nominal wage rate. In the short-run, the nominal wage rate is fixed. As a result, an increasing price indicates higher profits that justify the expansion of output. 2. An alternate model explains that the AS curve increases because some ...

Inflation and Unemployment Day 1

... Limitations of the CPI. Changes in Spending Patterns. Changes in consumption patterns are ongoing and gradual. E.g. More cell phones and CD players were steadily bought in the 1990s. As prices rise consumers tend to buy fewer items. These products have too high a weight in the CPI basket, mea ...

... Limitations of the CPI. Changes in Spending Patterns. Changes in consumption patterns are ongoing and gradual. E.g. More cell phones and CD players were steadily bought in the 1990s. As prices rise consumers tend to buy fewer items. These products have too high a weight in the CPI basket, mea ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.