Nonneutrality of Money in Classical Monetary Thought

... ihe structure of excise taxes was fixed in’nomi&l terms, moneyand hence price-level changes could, via their effect on the real tax structure, alter profit rates and thus incentives to produce in different sectors of the economy. The result would be a change in the composition, though not the aggreg ...

... ihe structure of excise taxes was fixed in’nomi&l terms, moneyand hence price-level changes could, via their effect on the real tax structure, alter profit rates and thus incentives to produce in different sectors of the economy. The result would be a change in the composition, though not the aggreg ...

Chapter 10: Budgeting - Oglala Lakota College

... pace of government activity. • The flow of money is important for reporting and evaluating an agency’s performance. ...

... pace of government activity. • The flow of money is important for reporting and evaluating an agency’s performance. ...

Italy`s Spending Maze Runner - European Commission

... over time in response to macroeconomic and contingent circumstances, is in fact a condicio sine qua non to be able to come to more efficient and effective planning and management of public resources. This applies both to the public authority, who has to face this challenge on a daily basis, as well ...

... over time in response to macroeconomic and contingent circumstances, is in fact a condicio sine qua non to be able to come to more efficient and effective planning and management of public resources. This applies both to the public authority, who has to face this challenge on a daily basis, as well ...

PPT

... Because potential GDP grows at a steady pace while aggregate demand grows at a fluctuating rate, real GDP fluctuates around potential GDP. ...

... Because potential GDP grows at a steady pace while aggregate demand grows at a fluctuating rate, real GDP fluctuates around potential GDP. ...

GTAP Resource 4992 - Global Trade Analysis Project

... to be inefficient because they are poorly targeted. In general the higher the household income the higher the subsidy and because high income households consume more petroleum products they benefit relatively more from subsidies (Baig et al, 2007). Environmental protection: It can also be that subsi ...

... to be inefficient because they are poorly targeted. In general the higher the household income the higher the subsidy and because high income households consume more petroleum products they benefit relatively more from subsidies (Baig et al, 2007). Environmental protection: It can also be that subsi ...

Chapter 15: Monetary Policy - the School of Economics and Finance

... 1. De…ne monetary policy and describe the Federal Reserve’s monetary policy goals. 2. Describe the Federal Reserve’s monetary policy targets and explain how expansionary and contractionary monetary policies a¤ect the interest rate. 3. Use aggregate demand and aggregate supply graphs to show the e¤ec ...

... 1. De…ne monetary policy and describe the Federal Reserve’s monetary policy goals. 2. Describe the Federal Reserve’s monetary policy targets and explain how expansionary and contractionary monetary policies a¤ect the interest rate. 3. Use aggregate demand and aggregate supply graphs to show the e¤ec ...

INCOME INEQUALITY AND THE BUSINESS CYCLE

... investigate the impact of economic growth on country level inequality. Another approach is to take a consistent time series for one country (typically the United States) to analyze how growth over time has impacted income inequality without regard to redistributive policy measures such as taxes or s ...

... investigate the impact of economic growth on country level inequality. Another approach is to take a consistent time series for one country (typically the United States) to analyze how growth over time has impacted income inequality without regard to redistributive policy measures such as taxes or s ...

Document

... 220 Chapter 16/Deficits, Surpluses, and Debt: Past, Present, and Future 1. The federal government does not calculate the effect of inflation on its accounts, but it is an important adjustment where the deficit is concerned. 2. Adjusted for inflation, deficits are smaller than they are under curre ...

... 220 Chapter 16/Deficits, Surpluses, and Debt: Past, Present, and Future 1. The federal government does not calculate the effect of inflation on its accounts, but it is an important adjustment where the deficit is concerned. 2. Adjusted for inflation, deficits are smaller than they are under curre ...

Fiscal Policy in the EMU and Outside

... policy. After stating that the "member states shall conduct their economic policies with a view to contributing to the achievement of the objectives of the Community" (article 102A) and outlining some surveillance mechanisms (article 103), the Treaty provides more specific guidelines for fiscal poli ...

... policy. After stating that the "member states shall conduct their economic policies with a view to contributing to the achievement of the objectives of the Community" (article 102A) and outlining some surveillance mechanisms (article 103), the Treaty provides more specific guidelines for fiscal poli ...

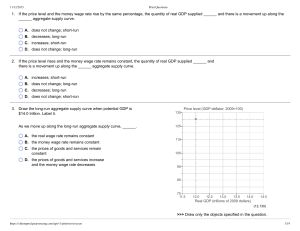

Compiled homework

... A. Along the LAS curve the money wage rate is constant and the real wage rate rises as the price level rises. B. A movement along the LAS curve is accompanied by a change in the prices of goods and services and the prices of the factors of production. C. The LAS curve shows the relationship betwee ...

... A. Along the LAS curve the money wage rate is constant and the real wage rate rises as the price level rises. B. A movement along the LAS curve is accompanied by a change in the prices of goods and services and the prices of the factors of production. C. The LAS curve shows the relationship betwee ...

Principles of Macroeconomics, Case/Fair/Oster, 10e

... supply curve holds that at any given moment, the economy has a clearly defined capacity, or maximum, output. With planned aggregate expenditure of AE1 and aggregate demand of AD1, equilibrium output is Y1. A shift of planned aggregate expenditure to AE2, corresponding to a shift of the AD curve to A ...

... supply curve holds that at any given moment, the economy has a clearly defined capacity, or maximum, output. With planned aggregate expenditure of AE1 and aggregate demand of AD1, equilibrium output is Y1. A shift of planned aggregate expenditure to AE2, corresponding to a shift of the AD curve to A ...

Economic and Financial Outlook for 2010

... may receive commissions or other remuneration in relation to the sale of such financial products, securities or other investments), or may perform services for, or solicit business from, any company the subject of this document. If you have been referred to ANZ, ANZ NZ, ANZ S or their affiliated com ...

... may receive commissions or other remuneration in relation to the sale of such financial products, securities or other investments), or may perform services for, or solicit business from, any company the subject of this document. If you have been referred to ANZ, ANZ NZ, ANZ S or their affiliated com ...

3. Personal Income Tax

... revenue structure relies heavily upon the personal income tax (PIT). The income tax accounts for almost 50 percent of total federal government receipts, for New York, it is almost 60 percent of state tax receipts. PIT liability is the amount which taxpayers actually owe based on total earnings durin ...

... revenue structure relies heavily upon the personal income tax (PIT). The income tax accounts for almost 50 percent of total federal government receipts, for New York, it is almost 60 percent of state tax receipts. PIT liability is the amount which taxpayers actually owe based on total earnings durin ...

Chapter 1 U G F

... slowdown in the industry and export sector coupled with the measures taken by the Government to reduce taxes and duties1 meant insignificant growth of less than one per cent in net tax revenue receipts in the previous year. Thus, the relatively high growth in net tax revenue receipts in the current ...

... slowdown in the industry and export sector coupled with the measures taken by the Government to reduce taxes and duties1 meant insignificant growth of less than one per cent in net tax revenue receipts in the previous year. Thus, the relatively high growth in net tax revenue receipts in the current ...

A Theory of Macroprudential Policies in the Presence of Nominal Rigidities ∗

... the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In simple cases, a positive wedge for a particular good indicates the underprovision of this good. Our fo ...

... the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In simple cases, a positive wedge for a particular good indicates the underprovision of this good. Our fo ...

A Theory of Macroprudential Policies in the Presence of Nominal Rigidities

... the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In simple cases, a positive wedge for a particular good indicates the underprovision of this good. Our fo ...

... the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In simple cases, a positive wedge for a particular good indicates the underprovision of this good. Our fo ...

1 - Whitman People

... An economy's aggregate demand curve is not derived by horizontally summing the market demand curves for all the products consumed in the economy. The logic that explains why a simple demand curve slopes downward fails to explain why the aggregate demand curve also has a negative slope. Aggregate dem ...

... An economy's aggregate demand curve is not derived by horizontally summing the market demand curves for all the products consumed in the economy. The logic that explains why a simple demand curve slopes downward fails to explain why the aggregate demand curve also has a negative slope. Aggregate dem ...

Brazil: how macroeconomic variables affect consumer confidence

... threat of a deep recession in economies such as the United States, Europe and Japan has created a wave of global pessimism. Falling equity market values have forced the postponement of investment decisions by firms, thus further contributing to the decline in economic growth. Another important reaso ...

... threat of a deep recession in economies such as the United States, Europe and Japan has created a wave of global pessimism. Falling equity market values have forced the postponement of investment decisions by firms, thus further contributing to the decline in economic growth. Another important reaso ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... plausible circumstances, however, a devaluation may speed up adjustment of the real economy to disturbances, be they exogenous or policy induced. It is in this vein that a devaluation is nearly always one of the major components of stabilization programs, such as those often administered by the Inte ...

... plausible circumstances, however, a devaluation may speed up adjustment of the real economy to disturbances, be they exogenous or policy induced. It is in this vein that a devaluation is nearly always one of the major components of stabilization programs, such as those often administered by the Inte ...