ITRN503-005 - Schar School of Policy and Government

... so that arguments, evidence, and claims can be critically examined. Plagiarism is wrong because of the injustice it does to the person whose ideas are stolen. But it is also wrong because it constitutes lying to one’s professional colleagues. From a prudential perspective, it is short-sighted and se ...

... so that arguments, evidence, and claims can be critically examined. Plagiarism is wrong because of the injustice it does to the person whose ideas are stolen. But it is also wrong because it constitutes lying to one’s professional colleagues. From a prudential perspective, it is short-sighted and se ...

Impact on Public Sector Finances

... ESA10 requires a change in treatment of funded pension schemes where there is a shortfall between the annual change in entitlements and contributions. This specifically affects the calculation of local government contributions to the Local Government Pension Scheme (a funded scheme administered by t ...

... ESA10 requires a change in treatment of funded pension schemes where there is a shortfall between the annual change in entitlements and contributions. This specifically affects the calculation of local government contributions to the Local Government Pension Scheme (a funded scheme administered by t ...

Saving, Investment, and the Financial System

... national saving is unchanged, so investment is unchanged. 2. If consumers save $50 billion and spend $150 billion, then national saving and investment each fall by $150 billion. ...

... national saving is unchanged, so investment is unchanged. 2. If consumers save $50 billion and spend $150 billion, then national saving and investment each fall by $150 billion. ...

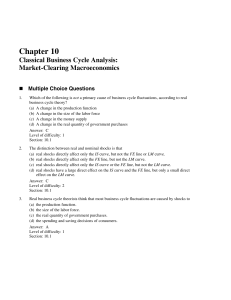

Chapter 10 Classical Business Cycle Analysis

... An adverse supply shock would directly _____ labor productivity by changing the amount of output that can be produced with any given amount of capital and labor. It would also indirectly _____ average labor productivity through changes in the level of employment. (a) increase; increase (b) increase; ...

... An adverse supply shock would directly _____ labor productivity by changing the amount of output that can be produced with any given amount of capital and labor. It would also indirectly _____ average labor productivity through changes in the level of employment. (a) increase; increase (b) increase; ...

chapter outline

... Chapter 13 is the second chapter in a four-chapter sequence on the production of output in the long run. In Chapter 12, we found that capital and labor are among the primary determinants of output. For this reason, Chapter 13 addresses the market for saving and investment in capital, and Chapter 14 ...

... Chapter 13 is the second chapter in a four-chapter sequence on the production of output in the long run. In Chapter 12, we found that capital and labor are among the primary determinants of output. For this reason, Chapter 13 addresses the market for saving and investment in capital, and Chapter 14 ...

aggregate demand curve

... prices is just like a tax that decreases the income of consumers. • An increase in taxes will shift the aggregate demand curve to the left. Between 1997 and 1998, the price of oil on the world market fell from $22 a barrel to less than $13 a barrel. The result: gasoline prices were lower than they h ...

... prices is just like a tax that decreases the income of consumers. • An increase in taxes will shift the aggregate demand curve to the left. Between 1997 and 1998, the price of oil on the world market fell from $22 a barrel to less than $13 a barrel. The result: gasoline prices were lower than they h ...

On Keynes`s How to Pay for the War

... at the onset of war. However, it was evident that debt-financed government spending for military purposes on a large scale would result in inflation if no compensating measures were taken. Household income was bound to rise even with constant wage rates, exceeding disposable consumption goods. When ...

... at the onset of war. However, it was evident that debt-financed government spending for military purposes on a large scale would result in inflation if no compensating measures were taken. Household income was bound to rise even with constant wage rates, exceeding disposable consumption goods. When ...

Objectives for Chapter 24: Monetarism (Continued) Chapter 24: The

... 1. The Short-Run As their name implies, according to Monetarist economists, a change in economic behavior requires a change in the money supply. So let us begin our explanation by assuming that there is an increase in the money supply. The Federal Reserve buys Treasury Securities in the open market. ...

... 1. The Short-Run As their name implies, according to Monetarist economists, a change in economic behavior requires a change in the money supply. So let us begin our explanation by assuming that there is an increase in the money supply. The Federal Reserve buys Treasury Securities in the open market. ...

1 22 SEPTEMBER 2003 CAN WE DISCERN THE EFFECT OF

... approximate the latter by the ratio between high-skill and low-skill wage, it appears that income inequality within the LDCs should go down. Mirroring these developments, income distribution in more developed countries should become more unequal. This is directly derived from factor price-equalizati ...

... approximate the latter by the ratio between high-skill and low-skill wage, it appears that income inequality within the LDCs should go down. Mirroring these developments, income distribution in more developed countries should become more unequal. This is directly derived from factor price-equalizati ...

Objectives for Chapter 24: Monetarism (Continued)

... 1. The Short-Run As their name implies, according to Monetarist economists, a change in economic behavior requires a change in the money supply. So let us begin our explanation by assuming that there is an increase in the money supply. The Federal Reserve buys Treasury Securities in the open market. ...

... 1. The Short-Run As their name implies, according to Monetarist economists, a change in economic behavior requires a change in the money supply. So let us begin our explanation by assuming that there is an increase in the money supply. The Federal Reserve buys Treasury Securities in the open market. ...

3. terms, definitions and explanations[1]

... (possibly goods) for individual or collective consumption and redistribute income and wealth. The general government sector in Israel includes the following units: government ministries, the National Insurance Institute, local authorities, national institutions, and non-profit institutions which are ...

... (possibly goods) for individual or collective consumption and redistribute income and wealth. The general government sector in Israel includes the following units: government ministries, the National Insurance Institute, local authorities, national institutions, and non-profit institutions which are ...

Preview

... expanded. Furthermore, we include separate measures for cyclically adjusted spending and revenue from the Organisation for Economic Co-operation and Development (OECD) in addition to International Monetary Fund (IMF) estimates for changes in the cyclically adjusted primary balance. Using this data, ...

... expanded. Furthermore, we include separate measures for cyclically adjusted spending and revenue from the Organisation for Economic Co-operation and Development (OECD) in addition to International Monetary Fund (IMF) estimates for changes in the cyclically adjusted primary balance. Using this data, ...

Reflating Japan: Time to Get Unconventional?

... Monetary policy responded with a delay to the recession that followed the real estate crisis of the early 1990s (McCallum, 2003). The BoJ reduced its policy rate so slowly, that real interest rates rose, as inflation turned negative. By the turn of the century the BoJ had cut the policy rate to zero ...

... Monetary policy responded with a delay to the recession that followed the real estate crisis of the early 1990s (McCallum, 2003). The BoJ reduced its policy rate so slowly, that real interest rates rose, as inflation turned negative. By the turn of the century the BoJ had cut the policy rate to zero ...

Fiscal policy to stabilise the economy in the EMU

... be negative, it is impossible also to achieve negative real interest rates if prices are falling. Japan is a recent example (see EEAG, 2003). But also in more normal situations, there can be limitations to monetary policy, because central banks may be reluctant to change interest rates by much in th ...

... be negative, it is impossible also to achieve negative real interest rates if prices are falling. Japan is a recent example (see EEAG, 2003). But also in more normal situations, there can be limitations to monetary policy, because central banks may be reluctant to change interest rates by much in th ...

NBER WORKING PAPER SERIES INTERNATIONAL LENDING AND BORROWING IN A STOCHASTIC SEQUENCE EQUILIBRIUM

... I would like to thank Truman Bowley, Willem Buiter, Russ Cooper, Roger Farmer, Tom Sargent as well as members of workshops at Harvard, the Cowles Foundation, and Penn for their comments on an earlier draft. Financial support from the National Science Foundation Grant SES-642g227 is acknowledged with ...

... I would like to thank Truman Bowley, Willem Buiter, Russ Cooper, Roger Farmer, Tom Sargent as well as members of workshops at Harvard, the Cowles Foundation, and Penn for their comments on an earlier draft. Financial support from the National Science Foundation Grant SES-642g227 is acknowledged with ...

ExamView Pro - EC1001 Exam 2007.tst

... Most spells of unemployment are short, and most unemployment observed at any given time is long term. How can this be? ...

... Most spells of unemployment are short, and most unemployment observed at any given time is long term. How can this be? ...

Macroeconomic Constraints on Private Sector Investment in Pakistan Looney, R.E.

... • Private investment in Pakistan was constrained by the availability of funds. Thus, the monetary authority can influence private investment behavior by changing bank credit to this sector. Fiscal policy appears to have a relatively stronger effect on private investment. • Public sector investment i ...

... • Private investment in Pakistan was constrained by the availability of funds. Thus, the monetary authority can influence private investment behavior by changing bank credit to this sector. Fiscal policy appears to have a relatively stronger effect on private investment. • Public sector investment i ...

PDF

... put lagging regions such as Latgale, the poorest in Latvia, at a disadvantage for financial flows outside of income payments through the CAP. Future reforms in CAP are likely to result in more funding available for rural development rather than farm support. The question is whether the transfer of r ...

... put lagging regions such as Latgale, the poorest in Latvia, at a disadvantage for financial flows outside of income payments through the CAP. Future reforms in CAP are likely to result in more funding available for rural development rather than farm support. The question is whether the transfer of r ...

NBER WORKING PAPER SERIES THE POLITICAL ECONOMY OF FISCAL POLICY Daniel E. Ingberman

... If there has been a dominant trend in the evolution of the modern industrial societies of this century it has been the growing importance of government in the allocation of social resources. It is important that we appreciate the fundamentally political nature of the formation of government economic ...

... If there has been a dominant trend in the evolution of the modern industrial societies of this century it has been the growing importance of government in the allocation of social resources. It is important that we appreciate the fundamentally political nature of the formation of government economic ...

Fourth Edition

... Do You Help the Economy More if You Spend or if You Save? Suppose that you have received an income tax refund check from the U.S. government. You are not sure what to do with the money, so you ask your two roommates for advice. One roommate tells you that if you want to help the economy, you should ...

... Do You Help the Economy More if You Spend or if You Save? Suppose that you have received an income tax refund check from the U.S. government. You are not sure what to do with the money, so you ask your two roommates for advice. One roommate tells you that if you want to help the economy, you should ...

Current Issues of China´s Economic Policies - mba

... 1998, the fiscal-monetary mix was generally tight or restrictive and achieved good results, i.e. combating and keeping inflation at the expected level, maintaining high and stable growth rates and low inflation, or ensuring the soft landing of the economy. Since 1998, in order to forestall the negat ...

... 1998, the fiscal-monetary mix was generally tight or restrictive and achieved good results, i.e. combating and keeping inflation at the expected level, maintaining high and stable growth rates and low inflation, or ensuring the soft landing of the economy. Since 1998, in order to forestall the negat ...

Inflation, Inequality and Social Conflict

... political instability in Cukierman et al. are not signi…cant once these other factors are controlled for. Desai et al. (2002) argue that inequality and the political system interact to drive in‡ation performance. In high inequality countries, more democracy leads to higher in‡ation as a result of po ...

... political instability in Cukierman et al. are not signi…cant once these other factors are controlled for. Desai et al. (2002) argue that inequality and the political system interact to drive in‡ation performance. In high inequality countries, more democracy leads to higher in‡ation as a result of po ...

Chapter 7: Putting All Markets Together: The AS

... IS relation: Yn C(Yn T ) I (Yn , i ) G Income and taxes remain unchanged, thus, consumption is the same as before. Government spending is lower than before; therefore, investment must be higher than before deficit reduction— higher by an amount exactly equal to the decrease in G. ...

... IS relation: Yn C(Yn T ) I (Yn , i ) G Income and taxes remain unchanged, thus, consumption is the same as before. Government spending is lower than before; therefore, investment must be higher than before deficit reduction— higher by an amount exactly equal to the decrease in G. ...

![3. terms, definitions and explanations[1]](http://s1.studyres.com/store/data/009861377_1-7f9dd587af700c75642cf13f2f9b82d7-300x300.png)