Chapter 8

... the average standard of living can be attributed to growth in productivity. One key to productivity growth is the nation’s capital stock. If the capital stock grows faster than employment, then capital per worker will rise, and labor productivity will increase. But if the capital stock grows more sl ...

... the average standard of living can be attributed to growth in productivity. One key to productivity growth is the nation’s capital stock. If the capital stock grows faster than employment, then capital per worker will rise, and labor productivity will increase. But if the capital stock grows more sl ...

Additional Help

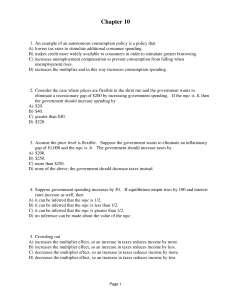

... Higher income generates higher income tax revenues, which cause aggregate demand to increase less rapidly than it otherwise would. C Response: Increasing taxes reduces aggregate demand, causing a decrease in income that exceeds $10 billion because of the multiplier effect. A Response: Property taxes ...

... Higher income generates higher income tax revenues, which cause aggregate demand to increase less rapidly than it otherwise would. C Response: Increasing taxes reduces aggregate demand, causing a decrease in income that exceeds $10 billion because of the multiplier effect. A Response: Property taxes ...

Rising Debt increases the likelihood of a fiscal crisis during which

... The Risk of Fiscal Crisis “Rising Debt increases the likelihood of a fiscal crisis during which investors would lose confidence in the government's ability to manage its budget and the government would lose its ability to borrow at affordable rates. -Doug Elmendorf, Director of the Congressional Bu ...

... The Risk of Fiscal Crisis “Rising Debt increases the likelihood of a fiscal crisis during which investors would lose confidence in the government's ability to manage its budget and the government would lose its ability to borrow at affordable rates. -Doug Elmendorf, Director of the Congressional Bu ...

US Economy Hits Speed Bumps – WSJ 1-31-2015

... But U.S. companies suffered a dual blow. Imports rose briskly as Americans bought foreign goods that were effectively made cheaper by the strengthening dollar. And the slumping world economy tamped down demand for U.S. exports. That caused the trade gap to widen, slicing a percentage point off econo ...

... But U.S. companies suffered a dual blow. Imports rose briskly as Americans bought foreign goods that were effectively made cheaper by the strengthening dollar. And the slumping world economy tamped down demand for U.S. exports. That caused the trade gap to widen, slicing a percentage point off econo ...

This PDF is a selec on from a published volume... Bureau of Economic Research

... in the relative importance of means‐tested and social insurance programs. While they find that transfer program expenditures in total rose from 1984 to 2004, they also find that this increase was very unevenly spread across income and demographic groups. For example, they show that rising Social Sec ...

... in the relative importance of means‐tested and social insurance programs. While they find that transfer program expenditures in total rose from 1984 to 2004, they also find that this increase was very unevenly spread across income and demographic groups. For example, they show that rising Social Sec ...

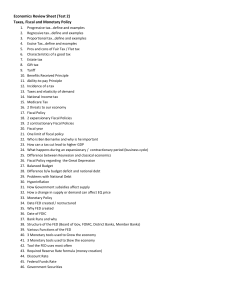

Economics Review Sheet (Test 2) Taxes, Fiscal and Monetary Policy

... Taxes and elasticity of demand National Income tax Medicare Tax 2 threats to our economy Fiscal Policy 2 expansionary Fiscal Policies 2 contractionary Fiscal Policies Fiscal year One limit of fiscal policy Who is Ben Bernanke and why is he important How can a tax cut lead to higher GDP What happens ...

... Taxes and elasticity of demand National Income tax Medicare Tax 2 threats to our economy Fiscal Policy 2 expansionary Fiscal Policies 2 contractionary Fiscal Policies Fiscal year One limit of fiscal policy Who is Ben Bernanke and why is he important How can a tax cut lead to higher GDP What happens ...

THE IMPACT OF FISCAL POLICY ON GROSS DOMESTIC PRODUCT IN

... Ioan Talpoş, West University of Timisoara, Romania Alexandru Avram, West University of Timisoara, Romania Roxana Heteș, West University of Timisoara, Romania ...

... Ioan Talpoş, West University of Timisoara, Romania Alexandru Avram, West University of Timisoara, Romania Roxana Heteș, West University of Timisoara, Romania ...

Fiscal Policy

... Three generalizations about Inflation-Unemployment relationship derived from Extended AD-AS model: 1. Over short run there is inverse relationship between inflation and unemployment 2. Aggregate supply shock can cause increase in inflation and unemployment simultaneously ...

... Three generalizations about Inflation-Unemployment relationship derived from Extended AD-AS model: 1. Over short run there is inverse relationship between inflation and unemployment 2. Aggregate supply shock can cause increase in inflation and unemployment simultaneously ...

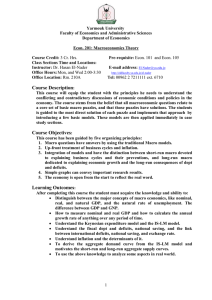

Yarmouk University Economics 200

... After completing this course the student must acquire the knowledge and ability to: Distinguish between the major concepts of macro economics, like nominal, real, and natural GDP, and the natural rate of unemployment. The difference between GDP and GNP. How to measure nominal and real GDP and ho ...

... After completing this course the student must acquire the knowledge and ability to: Distinguish between the major concepts of macro economics, like nominal, real, and natural GDP, and the natural rate of unemployment. The difference between GDP and GNP. How to measure nominal and real GDP and ho ...

Azour steps up appeal for international aid

... BEIRUT: Lebanon's finance minister warned on Monday of social and political unrest if international financial assistance is not introduced to help the government cut the size of the public debt. "In the absence of international support, further cuts in spending or more increases in taxes would be ne ...

... BEIRUT: Lebanon's finance minister warned on Monday of social and political unrest if international financial assistance is not introduced to help the government cut the size of the public debt. "In the absence of international support, further cuts in spending or more increases in taxes would be ne ...

Reagan.1982-ERTA.2

... proposed in the Economic Recovery Tax Act (ERTA) of 1981 the reduction of the top tax rates by almost 30 percent, from 70 to 50%- and all other tax rates by approximately 23 percent over a three-year period. The act also required that tax brackets be adjusted for inflation each year to address “brac ...

... proposed in the Economic Recovery Tax Act (ERTA) of 1981 the reduction of the top tax rates by almost 30 percent, from 70 to 50%- and all other tax rates by approximately 23 percent over a three-year period. The act also required that tax brackets be adjusted for inflation each year to address “brac ...

Document

... Impact of Large and Continuing Budget Surpluses •Government continually supplies loanable funds. •Higher investment spending causes the capital stock to grow more rapidly. •National debt - and annual interest payments on the national debt - shrink. ...

... Impact of Large and Continuing Budget Surpluses •Government continually supplies loanable funds. •Higher investment spending causes the capital stock to grow more rapidly. •National debt - and annual interest payments on the national debt - shrink. ...

The IS Curve This lecture describes the relationship between

... the economy for a given inflation rate. This measure captures the amount of planned expenditures (as opposed to actual expenditures) in the economy. ...

... the economy for a given inflation rate. This measure captures the amount of planned expenditures (as opposed to actual expenditures) in the economy. ...

Last day to sign up for AP Exam

... Real-Balance EffectHigher price levels reduce the purchasing power of money This decreases the quantity of expenditures Lower price levels increase purchasing power and increase expenditures Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will like ...

... Real-Balance EffectHigher price levels reduce the purchasing power of money This decreases the quantity of expenditures Lower price levels increase purchasing power and increase expenditures Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will like ...

Chapter 9

... o Households consume most of their disposable income o Consumption and savings are directly related to the income level o Consumption Schedule o Reflects the direct consumption –disposable income relationships suggested by the data o Households spend a larger proportion of a small disposable income ...

... o Households consume most of their disposable income o Consumption and savings are directly related to the income level o Consumption Schedule o Reflects the direct consumption –disposable income relationships suggested by the data o Households spend a larger proportion of a small disposable income ...

the influence of monetary and fiscal policy

... argue that such policies may destabilize the economy rather than help it: By the time the policies affect agg demand, the economy’s condition may have changed. ...

... argue that such policies may destabilize the economy rather than help it: By the time the policies affect agg demand, the economy’s condition may have changed. ...

Ensuring and sustaining macroeconomic stability

... fiscal space The macroeconomic framework should guide us to understand: • Assumptions on sources of growth and employment • Scope for increased revenue collection, domestic (efficiency, coverage) and external • Timing and volume of new revenue from oil&gas (leap in GDP may lead to false expectation ...

... fiscal space The macroeconomic framework should guide us to understand: • Assumptions on sources of growth and employment • Scope for increased revenue collection, domestic (efficiency, coverage) and external • Timing and volume of new revenue from oil&gas (leap in GDP may lead to false expectation ...

ECO 2013 Performance Standards

... Upon successful completion of this course, the student should be able to: 1. Identify the basic economic problems facing any society—scarcity and choices. 2. Describe the main differences between capitalism and socialism—appraising the limitations and values of the market system versus the command s ...

... Upon successful completion of this course, the student should be able to: 1. Identify the basic economic problems facing any society—scarcity and choices. 2. Describe the main differences between capitalism and socialism—appraising the limitations and values of the market system versus the command s ...

Economic Instability: A Critique of the Self

... the self-regulating properties of an economy? What will happen to Real GDP if autonomous spending rises and the economy is operating in the horizontal section of the Keynesian AS curve? Explain. An economist who believes the economy is self-regulating is more likely to advocate ...

... the self-regulating properties of an economy? What will happen to Real GDP if autonomous spending rises and the economy is operating in the horizontal section of the Keynesian AS curve? Explain. An economist who believes the economy is self-regulating is more likely to advocate ...

Government 2302 - 2nd 8 Weeks, Exam II Review What is public

... Federal Deposit Insurance Corporation (FDIC) - purpose, when created? World War II’s effect on the Great Depression inflation Fiscal policy The national debt - what is it estimated to be? Deficit spending North American Free Trade Agreement (NAFTA) and free trade Gross Domestic Product (GDP) – what ...

... Federal Deposit Insurance Corporation (FDIC) - purpose, when created? World War II’s effect on the Great Depression inflation Fiscal policy The national debt - what is it estimated to be? Deficit spending North American Free Trade Agreement (NAFTA) and free trade Gross Domestic Product (GDP) – what ...