PDF Download

... although they have been boosted by low interest rates and a generalised reduction in corporate tax payments. If companies consider these factors unlikely to be sustained in the future, they may hold back on investment and instead raise their savings. • Technological change has reduced the relative p ...

... although they have been boosted by low interest rates and a generalised reduction in corporate tax payments. If companies consider these factors unlikely to be sustained in the future, they may hold back on investment and instead raise their savings. • Technological change has reduced the relative p ...

Prospects for funding for adult social care

... • Social care has been relatively protected by most local authorities – Seen smaller cut than the overall cut to each area’s spending power – But still significant cuts to per person spending ...

... • Social care has been relatively protected by most local authorities – Seen smaller cut than the overall cut to each area’s spending power – But still significant cuts to per person spending ...

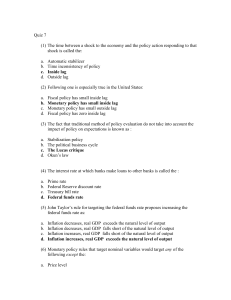

Sample quiz 7

... Inflation increases, real GDP falls short of the natural level of output Inflation increases, real GDP exceeds the natural level of output ...

... Inflation increases, real GDP falls short of the natural level of output Inflation increases, real GDP exceeds the natural level of output ...

GDP growth in 2015 was driven by a generous fiscal stimulus and

... new government's changes to remove macroeconomic imbalances. “GDP growth in 2015 was driven by a generous fiscal stimulus and buoyant activity in the construction and agriculture sectors. Economic activity has slowed in recent months, and although the suspension of publication of some key official s ...

... new government's changes to remove macroeconomic imbalances. “GDP growth in 2015 was driven by a generous fiscal stimulus and buoyant activity in the construction and agriculture sectors. Economic activity has slowed in recent months, and although the suspension of publication of some key official s ...

Belize_en.pdf

... projected to double to 3.4% from 1.5% in 2013. Growth was fuelled by strong value added in tourism, buoyant construction and an improvement in some components of agriculture, which offset a secular decline in oil production. The pickup in demand resulted in an increase in the rate of inflation to 1. ...

... projected to double to 3.4% from 1.5% in 2013. Growth was fuelled by strong value added in tourism, buoyant construction and an improvement in some components of agriculture, which offset a secular decline in oil production. The pickup in demand resulted in an increase in the rate of inflation to 1. ...

Chapter 2

... Prime Rate – the rate the banks make available to their best business customers. Discount Rate – the rate financial institutions are charged to borrow funds from Federal Reserve ...

... Prime Rate – the rate the banks make available to their best business customers. Discount Rate – the rate financial institutions are charged to borrow funds from Federal Reserve ...

Final Exam Study Guide Econ 301 Intermediate Macroeconomics

... f. What would happen to the LM curve if money supply were so large that interest rates went down to zero? (this is called the “liquidity trap”) 3. Working knowledge of the IS and LM curves and simultaneous equilibrium of output and interest rates. To actually derive the effect of a change in govern ...

... f. What would happen to the LM curve if money supply were so large that interest rates went down to zero? (this is called the “liquidity trap”) 3. Working knowledge of the IS and LM curves and simultaneous equilibrium of output and interest rates. To actually derive the effect of a change in govern ...

Chap001

... • Public Finance – the field of economics that analyzes government taxation and spending policies • Public Sector Economics or Public Economics use of real resources rather than money. • What is not part of public finance? ...

... • Public Finance – the field of economics that analyzes government taxation and spending policies • Public Sector Economics or Public Economics use of real resources rather than money. • What is not part of public finance? ...

Insert title here

... make up for changes in the other two. • Keynesian economists argue that fiscal policy can be used to fight both recession or depression and inflation. • Keynes believed that the government could increase spending during a recession to counteract the decrease in consumer spending. ...

... make up for changes in the other two. • Keynesian economists argue that fiscal policy can be used to fight both recession or depression and inflation. • Keynes believed that the government could increase spending during a recession to counteract the decrease in consumer spending. ...

122 переведення працівника на більш високу

... appeared to be necessary, a clear impossibility. This dilemma led to the end of the Keynesian near-consensus of the 1960s, and the rise throughout the 1970s of ideas based upon more neoconservative analysis, including monetarism, supply-side economics and new classical economics (rational expectatio ...

... appeared to be necessary, a clear impossibility. This dilemma led to the end of the Keynesian near-consensus of the 1960s, and the rise throughout the 1970s of ideas based upon more neoconservative analysis, including monetarism, supply-side economics and new classical economics (rational expectatio ...

PC IN ECONOMICS

... When government reduces G (from PPF2 to PPF3 ), taxes go down because we have G=T Lowering taxes will increase the disposable income of the consumer Consumption is a normal good; therefore, an increase in disposable income will increase consumption. Note that PPF3 has a smaller y intercept tha ...

... When government reduces G (from PPF2 to PPF3 ), taxes go down because we have G=T Lowering taxes will increase the disposable income of the consumer Consumption is a normal good; therefore, an increase in disposable income will increase consumption. Note that PPF3 has a smaller y intercept tha ...

Russ BE Enmou Gao Michael Jang Hae Sung Kang Daniel Kim

... b. Industrial policy--government directs investments toward particular industries 4. Supply-side tax cuts--need for less government interference and lower taxes (Arthur Laffer) a. Lower taxes would create incentives for investment b. Greater productivity would produce more tax revenue 3. The policie ...

... b. Industrial policy--government directs investments toward particular industries 4. Supply-side tax cuts--need for less government interference and lower taxes (Arthur Laffer) a. Lower taxes would create incentives for investment b. Greater productivity would produce more tax revenue 3. The policie ...

Gross Domestic Product

... 6. How do government taxation for consumption spending and importing goods for short-term consumption affect economic growth? Main Idea: Technological progress is a key source of economic growth. 7. How do economists measure the impact of technological progress on economic growth? 8. How does the go ...

... 6. How do government taxation for consumption spending and importing goods for short-term consumption affect economic growth? Main Idea: Technological progress is a key source of economic growth. 7. How do economists measure the impact of technological progress on economic growth? 8. How does the go ...

have - Valdosta State University

... Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

... Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

Government Spending

... unchanged, but everybody pays less total taxes – a good example would be the $500/person rebate awarded in 2002 • Since total taxes collected drops, two things happen: – Assuming that government spending in constant, the deficit (government borrowing) increases. – Households see an increase in their ...

... unchanged, but everybody pays less total taxes – a good example would be the $500/person rebate awarded in 2002 • Since total taxes collected drops, two things happen: – Assuming that government spending in constant, the deficit (government borrowing) increases. – Households see an increase in their ...

Document

... After WW II and the Korean War macroeconomics once again was THE issue in a presidential election in 1960. A sitting Vice President was defeated by a relative unknown CATHOLIC promising to get the economy moving. To do that he turned to the rising number of academic scribblers working on turning Key ...

... After WW II and the Korean War macroeconomics once again was THE issue in a presidential election in 1960. A sitting Vice President was defeated by a relative unknown CATHOLIC promising to get the economy moving. To do that he turned to the rising number of academic scribblers working on turning Key ...

Institute of Actuaries of India Subject CT7 – Business Economics INDICATIVE SOLUTIONS

... Specialisation and the division of labour – Two wheelers are generally manufactured at large plants where work is broken down into smaller and smaller tasks. The workers at these companies specialise in their respective tasks and thereby they become more efficient and productive. Indivisibilities – ...

... Specialisation and the division of labour – Two wheelers are generally manufactured at large plants where work is broken down into smaller and smaller tasks. The workers at these companies specialise in their respective tasks and thereby they become more efficient and productive. Indivisibilities – ...

Economic Environment May 2012

... (a) Is the speed at which money changes hands in an economy (b) States that the quantity of money is dependent on deposits in bank accounts (c) States that a change in the supply of money is associated with changes in price level and volume of transactions given the velocity of circulation (d) State ...

... (a) Is the speed at which money changes hands in an economy (b) States that the quantity of money is dependent on deposits in bank accounts (c) States that a change in the supply of money is associated with changes in price level and volume of transactions given the velocity of circulation (d) State ...

West Orange High School

... unemployment will be examined, as well as their possible causes and cures. The role of the government and the Federal Reserve in the economy will be examined in depth; as well as how international economics affects us here in the U.S.A. The class requires a rigorous reading schedule and students wil ...

... unemployment will be examined, as well as their possible causes and cures. The role of the government and the Federal Reserve in the economy will be examined in depth; as well as how international economics affects us here in the U.S.A. The class requires a rigorous reading schedule and students wil ...

AS Economics Answers - Pearson Schools and FE Colleges

... b Reflationary fiscal policy involves changes in government spending and/or changes in taxation designed to increase aggregate demand. Deflationary fiscal policy also involves changes in government spending and taxation but is designed to reduce aggregate demand. c i It will increase AD. By increasi ...

... b Reflationary fiscal policy involves changes in government spending and/or changes in taxation designed to increase aggregate demand. Deflationary fiscal policy also involves changes in government spending and taxation but is designed to reduce aggregate demand. c i It will increase AD. By increasi ...

Causes Of Recession - School

... But full-blown recessions in the UK are unlikely for several reasons 1. Proactive use of monetary policy: The Bank of England is prepared to cut interest rates in a pre-emptive manner to boost confidence and demand if the risk of recession is high – always providing that inflationary pressures are u ...

... But full-blown recessions in the UK are unlikely for several reasons 1. Proactive use of monetary policy: The Bank of England is prepared to cut interest rates in a pre-emptive manner to boost confidence and demand if the risk of recession is high – always providing that inflationary pressures are u ...

D and S side policies wiki - uwcmaastricht-econ

... recession. In a recession, lower i would encourage C and I, increasing AD. This is under the assumption that banks will be willing to ↑ their lending to households and firms and that these will be willing to ↑ their borrowing and their spending. However, in a severe recession banks may be unwilling ...

... recession. In a recession, lower i would encourage C and I, increasing AD. This is under the assumption that banks will be willing to ↑ their lending to households and firms and that these will be willing to ↑ their borrowing and their spending. However, in a severe recession banks may be unwilling ...