Answer Key - uob.edu.bh

... 6. Which combination of policies would be the most contractionary? a. An increase in government spending and an increase in taxes. b. An increase in government spending and a decrease in taxes. * c. A decrease in government spending and an increase in taxes. d. A decrease in government spending and ...

... 6. Which combination of policies would be the most contractionary? a. An increase in government spending and an increase in taxes. b. An increase in government spending and a decrease in taxes. * c. A decrease in government spending and an increase in taxes. d. A decrease in government spending and ...

Word Document

... gross national expenditure (GNE) – total national spending on final goods and services personal consumption (C) – total household spending on final goods and services gross private domestic investment (I) – total spending by firms and households on final goods and services that add to the nati ...

... gross national expenditure (GNE) – total national spending on final goods and services personal consumption (C) – total household spending on final goods and services gross private domestic investment (I) – total spending by firms and households on final goods and services that add to the nati ...

Adobe Acrobat

... • gross national expenditure (GNE) – total national spending on final goods and services • personal consumption (C) – total household spending on final goods and services • gross private domestic investment (I) – total spending by firms and households on final goods and services that add to the n ...

... • gross national expenditure (GNE) – total national spending on final goods and services • personal consumption (C) – total household spending on final goods and services • gross private domestic investment (I) – total spending by firms and households on final goods and services that add to the n ...

rh351_transparencies6_std - Rose

... … the Phillips Curve can be expected to be reasonably stable and well defined for any period for which the average rate of change of prices, and hence the anticipated rate, has been relatively stable. For such periods, nominal and real wages move together … The higher the average rate of price chang ...

... … the Phillips Curve can be expected to be reasonably stable and well defined for any period for which the average rate of change of prices, and hence the anticipated rate, has been relatively stable. For such periods, nominal and real wages move together … The higher the average rate of price chang ...

MACROECONOMICS

... Which of the following statements about the U.S. federal (public) debt is false? A. The vast majority of this debt is owed to private institutions and individuals within the United States. B. If this debt was paid off by simply printing up the amount of money required, inflation would be the likely ...

... Which of the following statements about the U.S. federal (public) debt is false? A. The vast majority of this debt is owed to private institutions and individuals within the United States. B. If this debt was paid off by simply printing up the amount of money required, inflation would be the likely ...

Economics

... Emerging economies are often dependent on exports to achieve an increase in GDP. Some economists suggested that it would be better for their economic growth if these countries were to concentrate on domestic demand rather than exports. China, in particular, they said could lead the world out of the ...

... Emerging economies are often dependent on exports to achieve an increase in GDP. Some economists suggested that it would be better for their economic growth if these countries were to concentrate on domestic demand rather than exports. China, in particular, they said could lead the world out of the ...

14.02 Principles of Macroeconomics

... 2. What is the equilibrium level of output in this economy? The equilibrium level of output in this economy is derived from the equilibrium in the goods market, demand equal supply: Y = C + I + G – IM + X Y = c0 + c1 (Y – T) + d0 + d1 Y – d2 i – m1 Y + X Y = 1/(1 – c1 – d1 + m 1 ) * (c0 + d0 + G – c ...

... 2. What is the equilibrium level of output in this economy? The equilibrium level of output in this economy is derived from the equilibrium in the goods market, demand equal supply: Y = C + I + G – IM + X Y = c0 + c1 (Y – T) + d0 + d1 Y – d2 i – m1 Y + X Y = 1/(1 – c1 – d1 + m 1 ) * (c0 + d0 + G – c ...

Fiscal and Monetary Policy - Northern Oak Wealth Management

... government may also choose to slow programs or close public works projects that are no longer needed. A tighter budget reduces deficits and potentially creates budget surpluses that can offset the debt caused when loose policy was needed. Temporary measures to tighten or loosen fiscal policy may be ...

... government may also choose to slow programs or close public works projects that are no longer needed. A tighter budget reduces deficits and potentially creates budget surpluses that can offset the debt caused when loose policy was needed. Temporary measures to tighten or loosen fiscal policy may be ...

Presentation to Arizona State University’s 41 Annual Forecast Luncheon Phoenix, Arizona

... governance scandals. With substantial and growing labor market slack, there was even a concern about the risk of deflation. Though deflation was never very likely to be realized, it still made sense to address the risk by erring on the side of ease--taking out an “insurance policy” against the possi ...

... governance scandals. With substantial and growing labor market slack, there was even a concern about the risk of deflation. Though deflation was never very likely to be realized, it still made sense to address the risk by erring on the side of ease--taking out an “insurance policy” against the possi ...

101 SAMPLE FINAL-Rest of final - Professor Dohan`s Website

... government is now running a $400 billion budget deficit instead of the surpluses of a few years before. Some Presidential candidates state that they want Congress to raise taxes to “eliminate the future burden of the debt” on the people. Other things being equal, what will be the likely impact of th ...

... government is now running a $400 billion budget deficit instead of the surpluses of a few years before. Some Presidential candidates state that they want Congress to raise taxes to “eliminate the future burden of the debt” on the people. Other things being equal, what will be the likely impact of th ...

GDP

... GDP and GNP? GNP is the value of all final goods and services produced by citizens of a nation regardless of their location. GDP is the value of all final goods and services produced within the border of a nation regardless of citizenship. GNP = GDP + net foreign factor income ...

... GDP and GNP? GNP is the value of all final goods and services produced by citizens of a nation regardless of their location. GDP is the value of all final goods and services produced within the border of a nation regardless of citizenship. GNP = GDP + net foreign factor income ...

Economic Crisis & Recovery

... Even the principle that spending provides more stimulus than tax cuts has returned; not just from Larry Summers, e.g., but also from Martin Feldstein. ...

... Even the principle that spending provides more stimulus than tax cuts has returned; not just from Larry Summers, e.g., but also from Martin Feldstein. ...

Chapter 20: Aggregate Expenditure and Equilibrium Output

... Assume consumption is represented by the following: C = 200 + .75Y. Also assume that planned investment (I) equals 300. (a) Given the information, calculate the equilibrium level of income. (b) Given the information, calculate the level of consumption and saving that occurs at the equilibrium level ...

... Assume consumption is represented by the following: C = 200 + .75Y. Also assume that planned investment (I) equals 300. (a) Given the information, calculate the equilibrium level of income. (b) Given the information, calculate the level of consumption and saving that occurs at the equilibrium level ...

NIPA Formulas

... payments and in kind and Social Security taxes (employee and employer) Interest=households receive-household pay Rent=use of assets Profits=gross corporate profit and proprietors income SA=statistical adjustment ...

... payments and in kind and Social Security taxes (employee and employer) Interest=households receive-household pay Rent=use of assets Profits=gross corporate profit and proprietors income SA=statistical adjustment ...

Lecture 3 Theories of output determination

... Active monetary policy During recessions, Keynes supports increases in the nation’s money supply. In the United States, the Federal Reserve Board controls the nation’s money supply. ...

... Active monetary policy During recessions, Keynes supports increases in the nation’s money supply. In the United States, the Federal Reserve Board controls the nation’s money supply. ...

MGMT510 COURSE OUTLINE File - Faculty of Business and

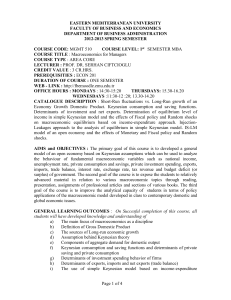

... CATALOGUE DESCRIPTION : Short-Run fluctuations vs. Long-Run growth of an Economy Growth Domestic Product. Keynesian consumption and saving functions. Determinants of investment and net exports. Determination of equilibrium level of income in simple Keynesian model and the effects of Fiscal policy an ...

... CATALOGUE DESCRIPTION : Short-Run fluctuations vs. Long-Run growth of an Economy Growth Domestic Product. Keynesian consumption and saving functions. Determinants of investment and net exports. Determination of equilibrium level of income in simple Keynesian model and the effects of Fiscal policy an ...

12aAggDemandUnit3Macro

... • An important number in this formula is the marginal propensity to consume (MPC). – It is the fraction of extra income that a household consumes rather than saves. ...

... • An important number in this formula is the marginal propensity to consume (MPC). – It is the fraction of extra income that a household consumes rather than saves. ...