JAC MACRO ECONOMCS COURSE OUTLINE

... www.canbekeconomics.ca and click on “Economic and Finance Links” ...

... www.canbekeconomics.ca and click on “Economic and Finance Links” ...

Chapter 25 - uob.edu.bh

... 1. From the equation of exchange aggregate spending, P Y equals $2,000 billion (= MV = 400 5). The aggregate demand curve on the graph should show that, when P = 0.5, Y = 4,000; when P = 1, Y = 2,000; and when P = 2, Y = 1,000. If the money supply falls to $50 billion, the aggregate demand curve s ...

... 1. From the equation of exchange aggregate spending, P Y equals $2,000 billion (= MV = 400 5). The aggregate demand curve on the graph should show that, when P = 0.5, Y = 4,000; when P = 1, Y = 2,000; and when P = 2, Y = 1,000. If the money supply falls to $50 billion, the aggregate demand curve s ...

ECON-101 Midterm 1 Practice Key

... GDP def. % change = 4.0% Here, unlike in real life, the baskets used to calculate the 2 indexes are the same, so the difference comes entirely from how they are calculated. The effect of the price changes is reduced in the GDP deflator relative to the CPI because, in the former, account is taken of ...

... GDP def. % change = 4.0% Here, unlike in real life, the baskets used to calculate the 2 indexes are the same, so the difference comes entirely from how they are calculated. The effect of the price changes is reduced in the GDP deflator relative to the CPI because, in the former, account is taken of ...

Principles of Economics

... Carsten Reisinger © Fotolia Pavel Losevsky © Fotolia Wimbledon © Fotolia Vova Pomortzeff © Fotolia Timothy Taylor photo courtesy of Annie Dunnigan Design LLC. ...

... Carsten Reisinger © Fotolia Pavel Losevsky © Fotolia Wimbledon © Fotolia Vova Pomortzeff © Fotolia Timothy Taylor photo courtesy of Annie Dunnigan Design LLC. ...

Executive summary - independent.gov.uk

... universal credit presents similar issues on an even larger scale, with the rollout repeatedly delayed. The implications of these delays for our forecast are limited, in part because universal credit is currently added into our forecast as a marginal cost relative to the legacy benefits system and in ...

... universal credit presents similar issues on an even larger scale, with the rollout repeatedly delayed. The implications of these delays for our forecast are limited, in part because universal credit is currently added into our forecast as a marginal cost relative to the legacy benefits system and in ...

Measuring Economic Performance

... When the type of economy shifts from one sector to another, the skills workers need to have a job also changes Workers who lack the necessary skills will lose their jobs – this is structural unemployment There are 5 causes of structural unemployment: ...

... When the type of economy shifts from one sector to another, the skills workers need to have a job also changes Workers who lack the necessary skills will lose their jobs – this is structural unemployment There are 5 causes of structural unemployment: ...

Economic prospects remain subdued (PDF, 56 KB)

... the coming quarters. Real GDP is forecasted to shrink by 0.6% in Q2 and by 0.4%, respectively, in Q3 and Q4. The fall of industrial production is likely to continue but at a progressively slowing pace: recent business surveys indicate slightly improving production growth expectations but the economi ...

... the coming quarters. Real GDP is forecasted to shrink by 0.6% in Q2 and by 0.4%, respectively, in Q3 and Q4. The fall of industrial production is likely to continue but at a progressively slowing pace: recent business surveys indicate slightly improving production growth expectations but the economi ...

Class 21

... called a “pay as you go” system). (7) Finally, in order to assure that the tax money collected for Social Security would be used exclusively for Social Security, this money goes to a special fund, called the Social Security Trust Fund. A government agency, the Social Security Administration, adminis ...

... called a “pay as you go” system). (7) Finally, in order to assure that the tax money collected for Social Security would be used exclusively for Social Security, this money goes to a special fund, called the Social Security Trust Fund. A government agency, the Social Security Administration, adminis ...

Macroeconomic Aggregates

... Capital and labour income do not include indirect business taxes paid by the businesses to government. But those taxes are part of the income generated in producing GDP. Therefore we have to add those taxes to capital and labour income. ...

... Capital and labour income do not include indirect business taxes paid by the businesses to government. But those taxes are part of the income generated in producing GDP. Therefore we have to add those taxes to capital and labour income. ...

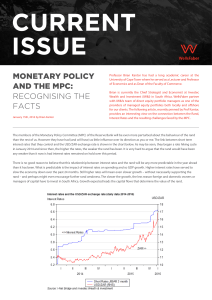

Monetary policy and the Mpc: Recognising the facts

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

Economics Chapter 12

... • When consumers save or invest, money in banks, their money becomes available for firms to borrow or use. This allows firms to deepen capital. • In the long run, more savings will lead to higher output and income for the population, raising GDP and living standards. ...

... • When consumers save or invest, money in banks, their money becomes available for firms to borrow or use. This allows firms to deepen capital. • In the long run, more savings will lead to higher output and income for the population, raising GDP and living standards. ...

paper i - Madhya Pradesh Bhoj Open University

... economic downturns, leading to unnecessarily high unemployment and losses of potential output. Keynes argued that government policies could be used to increase aggregate demand, thus increasing economic activity and reducing unemployment and deflation. Keynes argued that the solution to depression w ...

... economic downturns, leading to unnecessarily high unemployment and losses of potential output. Keynes argued that government policies could be used to increase aggregate demand, thus increasing economic activity and reducing unemployment and deflation. Keynes argued that the solution to depression w ...

Economics Curriculum

... a. understand the concept of scarcity and how it necessitates allocative decisions b. recognize that trade-offs are part of every decision c. define opportunity costs d. utilize marginal analysis for decision making e. recognize importance of incentives in decision making f. understand that speciali ...

... a. understand the concept of scarcity and how it necessitates allocative decisions b. recognize that trade-offs are part of every decision c. define opportunity costs d. utilize marginal analysis for decision making e. recognize importance of incentives in decision making f. understand that speciali ...

IBEcon3

... downturn, as evidenced by a 4.2 % decline in GDP for the October-December quarter, a rate higher than last month’s estimates. The decrease in GDP results from a sharp decline in the demand for exports, down 35 % since only last month. While GDP is the sum of consumer, investment, and government spen ...

... downturn, as evidenced by a 4.2 % decline in GDP for the October-December quarter, a rate higher than last month’s estimates. The decrease in GDP results from a sharp decline in the demand for exports, down 35 % since only last month. While GDP is the sum of consumer, investment, and government spen ...

secondary school improvement programme (ssip) 2015 - Sci

... creates jobs and raises the level of employment. These newly employed people then use their income to purchase consumer goods. This stimulates the demand for goods and services and results in an increase in production, which will in turn increase the level of employment even further. This raises inc ...

... creates jobs and raises the level of employment. These newly employed people then use their income to purchase consumer goods. This stimulates the demand for goods and services and results in an increase in production, which will in turn increase the level of employment even further. This raises inc ...

Fiscal Policy during the current Crisis

... view, since the private sector is likely to believe in a reversal of a temporary tax cut more than into a reversing of a temporary spending increase. Permanent reductions in VAT or labour taxes could yield short-run effects exceeding those of a permanent expenditure increase, because they reduce dis ...

... view, since the private sector is likely to believe in a reversal of a temporary tax cut more than into a reversing of a temporary spending increase. Permanent reductions in VAT or labour taxes could yield short-run effects exceeding those of a permanent expenditure increase, because they reduce dis ...

The Federal Bureaucracy - jb

... • Each year government takes in amount of money equal to about 20 percent of gross domestic product • Government also spends and borrows similar amount • Increasing taxes, increasing government spending, and borrowing money can cause economy to shift • Government spending and borrowing have huge eff ...

... • Each year government takes in amount of money equal to about 20 percent of gross domestic product • Government also spends and borrows similar amount • Increasing taxes, increasing government spending, and borrowing money can cause economy to shift • Government spending and borrowing have huge eff ...

Bank of England Inflation Report November 2014

... (a) The 2014 household survey carried out by NMG Consulting on behalf of the Bank took place between 3 and 24 September and had 6,001 online respondents. Typically, the survey is conducted on an annual basis, although an additional survey was undertaken in 2014 H1. Further results are reported in th ...

... (a) The 2014 household survey carried out by NMG Consulting on behalf of the Bank took place between 3 and 24 September and had 6,001 online respondents. Typically, the survey is conducted on an annual basis, although an additional survey was undertaken in 2014 H1. Further results are reported in th ...

HW8_ANS

... to reach a long-run equilibrium. Classical economists believe that prices adjust rapidly (within a few months) to restore equilibrium in the face of a shock, while Keynesians believe that prices adjust slowly, taking perhaps several years. Because of the time it takes for the economy’s equilibrium t ...

... to reach a long-run equilibrium. Classical economists believe that prices adjust rapidly (within a few months) to restore equilibrium in the face of a shock, while Keynesians believe that prices adjust slowly, taking perhaps several years. Because of the time it takes for the economy’s equilibrium t ...

A perspective on trends in Australian Government spending

... caused by taxation distorting resource allocation and reducing economic growth. The higher the tax rates, the higher the distortion, so all other things being the same, higher government spending will reduce economic growth. But, importantly, spending may be either welfare reducing or enhancing, dep ...

... caused by taxation distorting resource allocation and reducing economic growth. The higher the tax rates, the higher the distortion, so all other things being the same, higher government spending will reduce economic growth. But, importantly, spending may be either welfare reducing or enhancing, dep ...

G_______ S

... _________________________ is the total value of productive assets that provide a flow of revenue The decrease in value of capital assets are known as ____________________ Net investment is found by subtracting annual depreciation of an entire economy’s __________________________ from _______________ ...

... _________________________ is the total value of productive assets that provide a flow of revenue The decrease in value of capital assets are known as ____________________ Net investment is found by subtracting annual depreciation of an entire economy’s __________________________ from _______________ ...