By the end of this chapter, students will be able to

... marginal costs and marginal benefits, and to explore that many ways in which one action causes secondary actions. Course Objects: This course builds on foundations prepared in the introductory economics course, focusing and expanding on macroeconomic concepts (e.g., aggregate national income and out ...

... marginal costs and marginal benefits, and to explore that many ways in which one action causes secondary actions. Course Objects: This course builds on foundations prepared in the introductory economics course, focusing and expanding on macroeconomic concepts (e.g., aggregate national income and out ...

C omparative statics without total differentiation of the first

... where the last equation follows from the substitution of l from (12) and the x j in the last line of (15) can be any j 5 1, . . . , n. We may first apply the result above to the simple case discussed in the previous section. In the simple case, we have only one-level maximization, thus y and z do no ...

... where the last equation follows from the substitution of l from (12) and the x j in the last line of (15) can be any j 5 1, . . . , n. We may first apply the result above to the simple case discussed in the previous section. In the simple case, we have only one-level maximization, thus y and z do no ...

The Great Austerity War: James Crotty

... bonuses, governments believe they have to bail them out or their collapse will bring the rest of the economy down with them. When they do implode and trigger a deep recession that causes government deficits to rise, financial markets get control over government economic policy and use it on behalf o ...

... bonuses, governments believe they have to bail them out or their collapse will bring the rest of the economy down with them. When they do implode and trigger a deep recession that causes government deficits to rise, financial markets get control over government economic policy and use it on behalf o ...

Slide 1

... An increase in the price of oil leads, in the short run, to a decrease in output and an increase in the price level. Over time, output decreases further and the price level increases further. ...

... An increase in the price of oil leads, in the short run, to a decrease in output and an increase in the price level. Over time, output decreases further and the price level increases further. ...

UK Economic Forecast Q4 2015 BUSINESS WITH CONFIDENCE icaew.com/ukeconomicforecast

... should be done in a managed way, preferably using macroprudential tools (such as mortgage restrictions) rather than interest rate rises. Overall, the balance of arguments continues to lean in favour of keeping rates on hold for now. 2016 should also be an interesting year for fiscal policy. In Novem ...

... should be done in a managed way, preferably using macroprudential tools (such as mortgage restrictions) rather than interest rate rises. Overall, the balance of arguments continues to lean in favour of keeping rates on hold for now. 2016 should also be an interesting year for fiscal policy. In Novem ...

OECD Countries Local Government Fiscal Context

... Table 6 presents local government direct general spending as a percentage of all government direct general spending (i.e., exclusive of grants provided to other levels of government) for each of the IMF categories. Those functions for which the local government system is responsible for more than 25 ...

... Table 6 presents local government direct general spending as a percentage of all government direct general spending (i.e., exclusive of grants provided to other levels of government) for each of the IMF categories. Those functions for which the local government system is responsible for more than 25 ...

- Indiana State University

... be higher than expected in the first half of 2006, this will be a serious risk. Also congressional concern for the budget deficit risks raising taxes on capital income beginning in three years or so, which would worsen the long-term climate for U.S. saving and investment and threaten higher interest ...

... be higher than expected in the first half of 2006, this will be a serious risk. Also congressional concern for the budget deficit risks raising taxes on capital income beginning in three years or so, which would worsen the long-term climate for U.S. saving and investment and threaten higher interest ...

Tentative Lessons from Recent Capital Account Crises

... additional fiscal adjustment, beyond what is called for by short-term financing constraints. ...

... additional fiscal adjustment, beyond what is called for by short-term financing constraints. ...

Course Calendar - North Charleston High School

... ninety minutes per session with a total of about thirty-five sessions prior to the National AP Exam. It is designed to replicate the introductory college level macroeconomics course. It introduces senior level students to the field of macroeconomics and teaches basic economic concepts and analytical ...

... ninety minutes per session with a total of about thirty-five sessions prior to the National AP Exam. It is designed to replicate the introductory college level macroeconomics course. It introduces senior level students to the field of macroeconomics and teaches basic economic concepts and analytical ...

Econ 20B- Additional Problem Set I. MULTIPLE CHOICES. Choose

... 1 . Explain how an increase in the price level changes interest rates. How does this change in interest rates lead to changes in investment and net exports? ANS: When the price level increases, the purchasing power of money held in purses and bank accounts declines. This decline makes people feel le ...

... 1 . Explain how an increase in the price level changes interest rates. How does this change in interest rates lead to changes in investment and net exports? ANS: When the price level increases, the purchasing power of money held in purses and bank accounts declines. This decline makes people feel le ...

12 Joaquin Vial_Engl

... accrued interests as current expenditure and principal repayments as debt reductions (below the line operations) ...

... accrued interests as current expenditure and principal repayments as debt reductions (below the line operations) ...

Is Fiscal Policy Contracyclical in India?

... activity; as in the face of rising budget deficit, farsighted and intertemporally optimising tax payer, taking into account also the interests of future generations, would increase savings so as to provide for the higher tax burden in the future, offsetting the likely impact of budget deficit on mac ...

... activity; as in the face of rising budget deficit, farsighted and intertemporally optimising tax payer, taking into account also the interests of future generations, would increase savings so as to provide for the higher tax burden in the future, offsetting the likely impact of budget deficit on mac ...

PDF Download

... Contrary to this conventional wisdom, we show that, to finance additional government spending, deferred taxation may also harm a large fraction of the elderly. For this reason, we consider a New Keynesian stochastic Overlapping Generations (OLG) model with two types of households, Ricardian househol ...

... Contrary to this conventional wisdom, we show that, to finance additional government spending, deferred taxation may also harm a large fraction of the elderly. For this reason, we consider a New Keynesian stochastic Overlapping Generations (OLG) model with two types of households, Ricardian househol ...

Homework #5

... and what happens to the interest rate (predict whether the interest rate increases or decreases given the central bank's policy action). Show all calculations and provide the modified T-account depicting the overall impact of this policy. d. Suppose that the central bank instead decides to sell $20 ...

... and what happens to the interest rate (predict whether the interest rate increases or decreases given the central bank's policy action). Show all calculations and provide the modified T-account depicting the overall impact of this policy. d. Suppose that the central bank instead decides to sell $20 ...

The Zero Bound on Interest Rates and Optimal Monetary Policy

... target price level is unchanged). An inflation target, on the other hand, lets “bygones be bygones.” That is, an usual drop in prices today does not affect the course of policy in the future since under inflation targeting a central bank is only focused on the current rate of change of prices. Thus i ...

... target price level is unchanged). An inflation target, on the other hand, lets “bygones be bygones.” That is, an usual drop in prices today does not affect the course of policy in the future since under inflation targeting a central bank is only focused on the current rate of change of prices. Thus i ...

12EPP Chapter 12

... • Individuals classified as living in poverty have incomes that fall below the poverty threshold. • Simplified poverty thresholds appear as poverty guidelines and are used to determine eligibility for federal programs. ...

... • Individuals classified as living in poverty have incomes that fall below the poverty threshold. • Simplified poverty thresholds appear as poverty guidelines and are used to determine eligibility for federal programs. ...

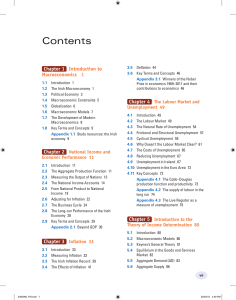

Contents Contents

... $10 would in the USA. An evening meal, for example, would cost much less in Thailand than in the USA. The poorest countries in the world are not as poor as is suggested by comparing their national income per person at market exchange rates. To get a truer picture of relative standards of living roun ...

... $10 would in the USA. An evening meal, for example, would cost much less in Thailand than in the USA. The poorest countries in the world are not as poor as is suggested by comparing their national income per person at market exchange rates. To get a truer picture of relative standards of living roun ...

syllabus - McGraw

... government, and the rest of the world in that economy. 2. The ability to understand and calculate the individual components of the national economy. 3. An understanding of the role of government in developing fiscal and monetary policy for an economy. Student Learning Outcomes: Upon successful compl ...

... government, and the rest of the world in that economy. 2. The ability to understand and calculate the individual components of the national economy. 3. An understanding of the role of government in developing fiscal and monetary policy for an economy. Student Learning Outcomes: Upon successful compl ...

lecture notes chapter 16

... 2. Tax rates above or below this maximum rate will cause a decrease in tax revenue. 3. Laffer argued that tax rates were above the optimal level and by lowering tax rates government could increase the tax revenue collected. 4. The lower tax rates would trigger an expansion of real output and income ...

... 2. Tax rates above or below this maximum rate will cause a decrease in tax revenue. 3. Laffer argued that tax rates were above the optimal level and by lowering tax rates government could increase the tax revenue collected. 4. The lower tax rates would trigger an expansion of real output and income ...

National Income Accounting

... In the upper loop, the arrow emanating from firms to households represents the sale by firms of goods and services to households. On the other hand, the arrow from households to firms represents the payments. n the lower loop, the arrow originating from the households to the firms shows that firms h ...

... In the upper loop, the arrow emanating from firms to households represents the sale by firms of goods and services to households. On the other hand, the arrow from households to firms represents the payments. n the lower loop, the arrow originating from the households to the firms shows that firms h ...

IB ECONOMICS SL

... 88. What is the difference between economic growth and development? How are they linked? 89. What factors need to be in place to enable a country to develop? 90. For each of the following, explain why it is a barrier to a country’s development and suggest examples. a. Lack of education b. Lack of h ...

... 88. What is the difference between economic growth and development? How are they linked? 89. What factors need to be in place to enable a country to develop? 90. For each of the following, explain why it is a barrier to a country’s development and suggest examples. a. Lack of education b. Lack of h ...

Economic Environment - Imperial College London

... their dynamics. Examples include the inflation rate, gross domestic product (GDP), the unemployment rate, and so on. • As we will demonstrate, the state of the macro economy and government economic policy are interrelated. • In this course, we wish eventually to assume the point of view of (a manage ...

... their dynamics. Examples include the inflation rate, gross domestic product (GDP), the unemployment rate, and so on. • As we will demonstrate, the state of the macro economy and government economic policy are interrelated. • In this course, we wish eventually to assume the point of view of (a manage ...

week 2 - cda college

... The development of the framework so far has ignored the factor Price Level (P), as we supposed that the price level is constant. This may be reasonable for most short-run analysis but in fact this state is not correct generally. The Price Level change over time for three basic reasons: 1. Most c ...

... The development of the framework so far has ignored the factor Price Level (P), as we supposed that the price level is constant. This may be reasonable for most short-run analysis but in fact this state is not correct generally. The Price Level change over time for three basic reasons: 1. Most c ...

YÊU CẦU KIỂM TRA ĐẦU VÀO: MÔN KINH TẾ HỌC Ứng

... quantities of these goods. d. large income elasticities because they are necessities. Q. 2: Refer to the Figure below: ...

... quantities of these goods. d. large income elasticities because they are necessities. Q. 2: Refer to the Figure below: ...