Public Debt and Post-Crisis Fiscal Policy in South Africa

... The result was for government spending to quickly outstrip revenue, causing the fiscal balance to turn to a deficit. This difference between spending and revenue was financed by the accumulation of public debt. From a public debt level of 26% of GDP in 2009, South Africa’s debt/GDP ratio rapidly in ...

... The result was for government spending to quickly outstrip revenue, causing the fiscal balance to turn to a deficit. This difference between spending and revenue was financed by the accumulation of public debt. From a public debt level of 26% of GDP in 2009, South Africa’s debt/GDP ratio rapidly in ...

Chapter 8 Measuring the Economy*s Performance

... Similar to how we included imports in C, I and G in the expenditure approach and subtracted it out later, when wages, rent, interest and profit are earned it includes those values for all nationals, whether the funds are earned in the US or abroad. BUT, GDP is a measure of production within the bord ...

... Similar to how we included imports in C, I and G in the expenditure approach and subtracted it out later, when wages, rent, interest and profit are earned it includes those values for all nationals, whether the funds are earned in the US or abroad. BUT, GDP is a measure of production within the bord ...

Setting meaningful investment targets in agricultural R D: Challenges, opportunities, and fiscal realities

... is higher than social rate of return on capital or other opportunities for public investment ‐ more investments will result in more social gains than social costs ■ Failure to maintain on‐farm productivity growth at its historical trends – lost potential is sign of underinvestment ■ Insufficien ...

... is higher than social rate of return on capital or other opportunities for public investment ‐ more investments will result in more social gains than social costs ■ Failure to maintain on‐farm productivity growth at its historical trends – lost potential is sign of underinvestment ■ Insufficien ...

Ch26-7e-lecture

... Macroeconomic Schools of Thought The Keynesian View A Keynesian macroeconomist believes that left alone, the economy would rarely operate at full employment and that to achieve and maintain full employment, active help from fiscal policy and monetary policy is required. The term “Keynesian” derives ...

... Macroeconomic Schools of Thought The Keynesian View A Keynesian macroeconomist believes that left alone, the economy would rarely operate at full employment and that to achieve and maintain full employment, active help from fiscal policy and monetary policy is required. The term “Keynesian” derives ...

Economic and Fiscal Outlook 2017

... tighter profit margins. Based on the forward curve, a modest increase in oil prices is projected for next year. The Department’s near-term forecasts are based on the IMF’s latest economic forecasts, which are set out in the table below. A major source of uncertainty – especially from an Irish perspe ...

... tighter profit margins. Based on the forward curve, a modest increase in oil prices is projected for next year. The Department’s near-term forecasts are based on the IMF’s latest economic forecasts, which are set out in the table below. A major source of uncertainty – especially from an Irish perspe ...

Factor shares: the principal problem of political economy?

... and (2) the change in the value of the store of property rights between the beginning and end of the period’ (Simons, 1938, p. 50). There are, however, two aspects that need to be clarified. (a) The first concerns the valuation of benefits where there is no market transaction; this is, of course, a ...

... and (2) the change in the value of the store of property rights between the beginning and end of the period’ (Simons, 1938, p. 50). There are, however, two aspects that need to be clarified. (a) The first concerns the valuation of benefits where there is no market transaction; this is, of course, a ...

Measuring Nation`s Production and Income

... Controlling for income, education, and other personal factors, they found that in the United States, happiness among men and women reaches a minimum at the ages of 49 and 45 respectively. ...

... Controlling for income, education, and other personal factors, they found that in the United States, happiness among men and women reaches a minimum at the ages of 49 and 45 respectively. ...

Download

... (b) The Golden Rule is a guideline for the operation of fiscal policy. The Golden Rule states that over the economic cycle, the Government will borrow only to invest and not to fund current spending. In layman's terms this means that on average over the ups and downs of an economic cycle the governm ...

... (b) The Golden Rule is a guideline for the operation of fiscal policy. The Golden Rule states that over the economic cycle, the Government will borrow only to invest and not to fund current spending. In layman's terms this means that on average over the ups and downs of an economic cycle the governm ...

Universidade Federal de Viçosa Departamento de Economia Rural

... would be unfeasible at the high interest rates fixed for the entire economy, which is the case of agriculture. Government uses the financial system4 to implement a subsidy policy to the agricultural sector through a program of rural credit with interest rates below that prevailing in the market. Pay ...

... would be unfeasible at the high interest rates fixed for the entire economy, which is the case of agriculture. Government uses the financial system4 to implement a subsidy policy to the agricultural sector through a program of rural credit with interest rates below that prevailing in the market. Pay ...

EC 102.07-08-09 Exercises for Chapter 33 SPRING 2006 1. Ceteris

... 1. Explain how an increase in the price level changes interest rates. How does this change in interest rates lead to changes in investment and net exports? ANSWER: When the price level increases, the purchasing power of money held in purses and bank accounts declines. This decline makes people feel ...

... 1. Explain how an increase in the price level changes interest rates. How does this change in interest rates lead to changes in investment and net exports? ANSWER: When the price level increases, the purchasing power of money held in purses and bank accounts declines. This decline makes people feel ...

Aggregate Demand and Aggregate Supply

... stagflation—a period of recession and inflation. Output falls and prices rise. Policymakers who can influence aggregate demand cannot offset both of these adverse effects simultaneously. ...

... stagflation—a period of recession and inflation. Output falls and prices rise. Policymakers who can influence aggregate demand cannot offset both of these adverse effects simultaneously. ...

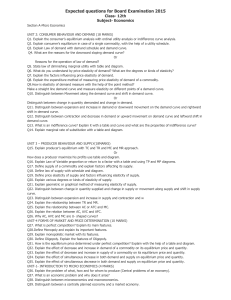

Expected questions for Board Examination 2015

... Q62. Explain determination of equilibrium level of income and employment by AD-AS approach. Q63. Explain determination of equilibrium level of income and employment by Saving and investment approach. Q64. Briefly explain the working of the investment multiplier with an example. Q65. What is excess d ...

... Q62. Explain determination of equilibrium level of income and employment by AD-AS approach. Q63. Explain determination of equilibrium level of income and employment by Saving and investment approach. Q64. Briefly explain the working of the investment multiplier with an example. Q65. What is excess d ...

Electoral Cycles and Fiscal Policy in India

... and calamity relief expenditure expressed as a share of net state domestic income. Their measures of shocks are food grain production and the real value of crops damaged by floods. They find no impact of state income on public food distribution and the fraction of state income devoted to calamity re ...

... and calamity relief expenditure expressed as a share of net state domestic income. Their measures of shocks are food grain production and the real value of crops damaged by floods. They find no impact of state income on public food distribution and the fraction of state income devoted to calamity re ...

Aggregate Demand and Aggregate Supply

... stagflation—a period of recession and inflation. Output falls and prices rise. Policymakers who can influence aggregate demand cannot offset both of these adverse effects simultaneously. ...

... stagflation—a period of recession and inflation. Output falls and prices rise. Policymakers who can influence aggregate demand cannot offset both of these adverse effects simultaneously. ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Inflation: Causes and Effects

... The results of this analysis were quite astounding. In 1973, individuals paid tax on $4.6 billion of capital gains on corporate stock. When the costs of those securities are adjusted for the increase in the price level since they were purchased, that $4.6 billion capital gain is seen correctly as a ...

... The results of this analysis were quite astounding. In 1973, individuals paid tax on $4.6 billion of capital gains on corporate stock. When the costs of those securities are adjusted for the increase in the price level since they were purchased, that $4.6 billion capital gain is seen correctly as a ...

How the Crisis Has Changed the Economic Policy Paradigm

... Fed Is Copying Japan’s Quantitative Easing So many reserves earning target rate (about .25%) that banks have no incentive to lend So many reserves that inflation is “right around the ...

... Fed Is Copying Japan’s Quantitative Easing So many reserves earning target rate (about .25%) that banks have no incentive to lend So many reserves that inflation is “right around the ...

GwartPPT014 - Crawfordsworld

... When the Fed shifts to a more expansionary monetary policy, it will generally buy additional bonds thereby expanding the money supply. This increase in the money supply (shifting S1 to S2 in the market for money) will supply the banking system with additional reserves. Both the Fed’s bond purchases ...

... When the Fed shifts to a more expansionary monetary policy, it will generally buy additional bonds thereby expanding the money supply. This increase in the money supply (shifting S1 to S2 in the market for money) will supply the banking system with additional reserves. Both the Fed’s bond purchases ...

2. Computable General Equilibrium Models: Macroeconomics and

... was theoretical and was derived from an extensive debate after Kaldor’s review on income distribution. A further step in the closure debate was the 1979 paper of Taylor and Lisy. Their work was based on the intuition that the results of an applied CGE model are affected by an aspect which is not usu ...

... was theoretical and was derived from an extensive debate after Kaldor’s review on income distribution. A further step in the closure debate was the 1979 paper of Taylor and Lisy. Their work was based on the intuition that the results of an applied CGE model are affected by an aspect which is not usu ...

The impact of government debt on aggregate investment

... In line with basic growth theory (Acemoglu, 2009; Durlauf et al., 2005), we expect a positive coefficient on the capital stock and a positive one on openness and financial development. We also expect results to be compatible with the idea of conditional convergence (i.e., we expect β prodgr to be n ...

... In line with basic growth theory (Acemoglu, 2009; Durlauf et al., 2005), we expect a positive coefficient on the capital stock and a positive one on openness and financial development. We also expect results to be compatible with the idea of conditional convergence (i.e., we expect β prodgr to be n ...

Aff Inflation DA 7WK - Open Evidence Archive

... faster under one than under the other. I find it especially instructive to look at spending levels three years into each man’s administration – that is, in the first quarter of 1984 in Reagan’s case, and in the first quarter of 2012 in Obama’s – compared with four years earlier, which in each case c ...

... faster under one than under the other. I find it especially instructive to look at spending levels three years into each man’s administration – that is, in the first quarter of 1984 in Reagan’s case, and in the first quarter of 2012 in Obama’s – compared with four years earlier, which in each case c ...

PDF

... land. (These are not nested functions.) There are a series of equations that describe the output of producers and their demand for factors. A Cobb-Douglas production function is used for all private sectors, with first order conditions that guarantee that private firms maximize profits by choosing o ...

... land. (These are not nested functions.) There are a series of equations that describe the output of producers and their demand for factors. A Cobb-Douglas production function is used for all private sectors, with first order conditions that guarantee that private firms maximize profits by choosing o ...

Welfare gains from the adoption of proportional taxation

... it more transparent, and much easier to administer. More specifically, a reduction in both the average and the effective rate generally has a (partial) ”amnesty” effect: tax compliance is expected to improve as the incentive from operating in the unofficial sector is now lower. Labor services are re ...

... it more transparent, and much easier to administer. More specifically, a reduction in both the average and the effective rate generally has a (partial) ”amnesty” effect: tax compliance is expected to improve as the incentive from operating in the unofficial sector is now lower. Labor services are re ...