Multiple Choice Questions 1. A payment made out of a

... requires all shareholders to sell a portion of their shares. is utilized only by firms that do not pay dividends. decreases both the number of shares outstanding and the market price per share. has no effect on a firm's financial statements. is essentially the same as a cash dividend program provide ...

... requires all shareholders to sell a portion of their shares. is utilized only by firms that do not pay dividends. decreases both the number of shares outstanding and the market price per share. has no effect on a firm's financial statements. is essentially the same as a cash dividend program provide ...

... pricing and investment behavior. They focus on the evidence from research of a relationship between investor sentiment and trading behavior. Although there is a significantly negative correlation between autocorrelation and volatility, which they recognize, according to the statistical data measurin ...

Financial Accounting and Accounting Standards

... Share Rights - existing stockholders have the right (preemptive privilege) to purchase newly issued shares in proportion to their holdings. ...

... Share Rights - existing stockholders have the right (preemptive privilege) to purchase newly issued shares in proportion to their holdings. ...

Smart Beta - A referential guide for institutional investors

... academic research that suggests these return premia have existed in equity markets – and in other asset classes – around the world for decades, then the likelihood is that smart beta is not just a fad. To the contrary, WisdomTree believes that smart beta indexes in general, and fundamentally-weighte ...

... academic research that suggests these return premia have existed in equity markets – and in other asset classes – around the world for decades, then the likelihood is that smart beta is not just a fad. To the contrary, WisdomTree believes that smart beta indexes in general, and fundamentally-weighte ...

Explaining the Magnitude of Liquidity Premia

... of return predictability and wealth shocks can generate liquidity premia up to 42 times larger than in the standard i.i.d. return case. When returns are predictable, the unconditional distribution of the wealth shocks is always the same as that for the i.i.d. shocks. The liquidity premium is largest ...

... of return predictability and wealth shocks can generate liquidity premia up to 42 times larger than in the standard i.i.d. return case. When returns are predictable, the unconditional distribution of the wealth shocks is always the same as that for the i.i.d. shocks. The liquidity premium is largest ...

CREDIT RISK Credit risk modeling theory and applications

... This drive from the practical side to develop models has attracted many academics; a large number due to the fact that so many professions can (and do) contribute to the development of the field. The strong interaction between industry and academics is the real advantage of the area: it provides an i ...

... This drive from the practical side to develop models has attracted many academics; a large number due to the fact that so many professions can (and do) contribute to the development of the field. The strong interaction between industry and academics is the real advantage of the area: it provides an i ...

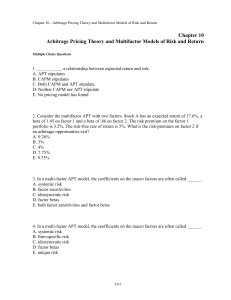

Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk

... 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 9.2% D. 13.0% E. 13.2% ...

... 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return? A. 7.0% B. 8.0% C. 9.2% D. 13.0% E. 13.2% ...

MRK 09-10

... On September 30, 2004, Merck announced the voluntary withdrawal of its COX-2 inhibitor Vioxx.13 The Vioxx withdrawal cost Merck an estimated $700-750 million in 2004 fourth quarter sales.14 Worse, Merck lost billions in annual sales between September 2004 and present and set aside $750 million for ...

... On September 30, 2004, Merck announced the voluntary withdrawal of its COX-2 inhibitor Vioxx.13 The Vioxx withdrawal cost Merck an estimated $700-750 million in 2004 fourth quarter sales.14 Worse, Merck lost billions in annual sales between September 2004 and present and set aside $750 million for ...

Timing “Smart Beta” Strategies? Of Course! Buy Low, Sell High!

... valuations are rarely noticed in the data mining so pervasive throughout the finance community.2 For some factors, such as low beta, we show that most or all past performance was revaluation alpha, which could easily reverse from current valuation levels. For smart beta strategies, the picture is a ...

... valuations are rarely noticed in the data mining so pervasive throughout the finance community.2 For some factors, such as low beta, we show that most or all past performance was revaluation alpha, which could easily reverse from current valuation levels. For smart beta strategies, the picture is a ...

Guideline - OSFI-BSIF

... minimum Total Ratio of 100% may be considered acceptable. However, life insurers are exposed to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measu ...

... minimum Total Ratio of 100% may be considered acceptable. However, life insurers are exposed to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measu ...

Commodity-Derivatives

... settlement basis. Exchange traded options are exercised into a position in the underlying commodity futures contract. The futures contract will generally be settled by physical delivery if held till maturity. OTC commodity options are frequently cash settled ...

... settlement basis. Exchange traded options are exercised into a position in the underlying commodity futures contract. The futures contract will generally be settled by physical delivery if held till maturity. OTC commodity options are frequently cash settled ...

The Micro Textbook with Calculus - Stand

... Jay Leno says that anybody can become a successful stand-up comic if they give it seven years. . . and the same thing is true about getting an undergraduate degree in economics! This textbook is a companion to The Cartoon Introduction to Economics: Volume One, Microeconomics, by Grady Klein and Yora ...

... Jay Leno says that anybody can become a successful stand-up comic if they give it seven years. . . and the same thing is true about getting an undergraduate degree in economics! This textbook is a companion to The Cartoon Introduction to Economics: Volume One, Microeconomics, by Grady Klein and Yora ...

Do Cash Flows of Growth Stocks Really Grow Faster?

... countercyclical risk premiums, analyzed in the Appendix. This feature implies that stocks are more risky because in bad times, prices go down further, as a result of an increase of the discount rate, than in an i.i.d. world. When applied to a cross section of assets with constant but different cash- ...

... countercyclical risk premiums, analyzed in the Appendix. This feature implies that stocks are more risky because in bad times, prices go down further, as a result of an increase of the discount rate, than in an i.i.d. world. When applied to a cross section of assets with constant but different cash- ...

PRIMERO MINING CORP

... their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as set out in the following disclosure. If Common Shares are listed in an account statement provided to a Company sharehold ...

... their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as set out in the following disclosure. If Common Shares are listed in an account statement provided to a Company sharehold ...

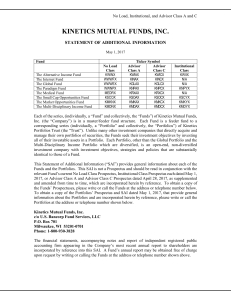

Statement of Additional Information

... Rights of Each Share Class Each share of common stock of a Fund is entitled to one vote in electing Directors and other matters that may be submitted to shareholders for a vote. All shares of all Classes of each Fund generally have equal voting rights. However, matters affecting only one particular ...

... Rights of Each Share Class Each share of common stock of a Fund is entitled to one vote in electing Directors and other matters that may be submitted to shareholders for a vote. All shares of all Classes of each Fund generally have equal voting rights. However, matters affecting only one particular ...

Analyzing Yield, Duration and Convexity of Mortgage Loans under

... with the option to prepay (call) or default (put) the mortgage contract. The values of prepayment and default options are calculated through specifying relevant variable processes such as interest rates, house prices and so forth (see e.g., Kau et al., 1993; Yang, Buist and Megbolugbe, 1998; Ambrose ...

... with the option to prepay (call) or default (put) the mortgage contract. The values of prepayment and default options are calculated through specifying relevant variable processes such as interest rates, house prices and so forth (see e.g., Kau et al., 1993; Yang, Buist and Megbolugbe, 1998; Ambrose ...

VAULT FINANCE INTERVIEWS PRACTICE GUIDE

... 4. At what other firms are you looking? This is another key question. Even if you are looking at every major Wall Street firm, and a few minor ones, your interviewer wants to hear that you are focused, and they hear this by you (truthfully) stating that you are talking to similar firms. For example, ...

... 4. At what other firms are you looking? This is another key question. Even if you are looking at every major Wall Street firm, and a few minor ones, your interviewer wants to hear that you are focused, and they hear this by you (truthfully) stating that you are talking to similar firms. For example, ...