The Determinants of Idiosyncratic Volatility

... and asset pricing models. Early seminal works in finance, such as that of Markowitz (1952), Sharpe (1964), Lintner (1965), Mossin (1966), and Black and Scholes (1973) assume that the volatility of equity returns is known and constant. We know, however, that volatility is stochastic. Furthermore, whi ...

... and asset pricing models. Early seminal works in finance, such as that of Markowitz (1952), Sharpe (1964), Lintner (1965), Mossin (1966), and Black and Scholes (1973) assume that the volatility of equity returns is known and constant. We know, however, that volatility is stochastic. Furthermore, whi ...

DS-742ET, DS

... sign is omitted are the same priority (Priority 7), so these operations are performed from left to right when both types are mixed in the same calculation. • Operations enclosed in parentheses are performed first. If a calculation contains a negative value, you may need to enclose the negative value ...

... sign is omitted are the same priority (Priority 7), so these operations are performed from left to right when both types are mixed in the same calculation. • Operations enclosed in parentheses are performed first. If a calculation contains a negative value, you may need to enclose the negative value ...

Download paper (PDF)

... of the weighted estimator is determined by the coefficient of variation of the weights. In view of this fact, section 3 poses a quadratic program that minimizes the coefficient of variation of the weights that directly adjust for the empirical distributions of the observed covariates up to levels pr ...

... of the weighted estimator is determined by the coefficient of variation of the weights. In view of this fact, section 3 poses a quadratic program that minimizes the coefficient of variation of the weights that directly adjust for the empirical distributions of the observed covariates up to levels pr ...

How Much Should We Trust Estimates from Multiplicative Interaction

... interaction models which is the issue of common support. Since the conditional effect of D on Y is the difference between two linear functions, it is important that the two functions share a common support of X. In other words, to reliably compute the conditional effect of D on Y at a given value of ...

... interaction models which is the issue of common support. Since the conditional effect of D on Y is the difference between two linear functions, it is important that the two functions share a common support of X. In other words, to reliably compute the conditional effect of D on Y at a given value of ...

Empirical Estimation of Grinding Specific Forces and Energy Based

... model; the maximum average error is 10.68%, whereas the maximum average error in energy model is 16.90%. Models’ estimations for data set 1 present the least error as compared to other data sets. This can be probably justified due to the continuous mode of dressing, whereas in other cases dressing i ...

... model; the maximum average error is 10.68%, whereas the maximum average error in energy model is 16.90%. Models’ estimations for data set 1 present the least error as compared to other data sets. This can be probably justified due to the continuous mode of dressing, whereas in other cases dressing i ...

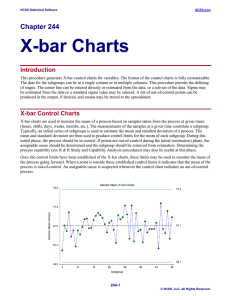

Coefficient of determination

In statistics, the coefficient of determination, denoted R2 or r2 and pronounced R squared, is a number that indicates how well data fit a statistical model – sometimes simply a line or a curve. An R2 of 1 indicates that the regression line perfectly fits the data, while an R2 of 0 indicates that the line does not fit the data at all. This latter can be because the data is utterly non-linear, or because it is random.It is a statistic used in the context of statistical models whose main purpose is either the prediction of future outcomes or the testing of hypotheses, on the basis of other related information. It provides a measure of how well observed outcomes are replicated by the model, as the proportion of total variation of outcomes explained by the model (pp. 187, 287).There are several definitions of R2 that are only sometimes equivalent. One class of such cases includes that of simple linear regression where r2 is used instead of R2. In this case, if an intercept is included, then r2 is simply the square of the sample correlation coefficient (i.e., r) between the outcomes and their predicted values. If additional explanators are included, R2 is the square of the coefficient of multiple correlation. In both such cases, the coefficient of determination ranges from 0 to 1.Important cases where the computational definition of R2 can yield negative values, depending on the definition used, arise where the predictions that are being compared to the corresponding outcomes have not been derived from a model-fitting procedure using those data, and where linear regression is conducted without including an intercept. Additionally, negative values of R2 may occur when fitting non-linear functions to data. In cases where negative values arise, the mean of the data provides a better fit to the outcomes than do the fitted function values, according to this particular criterion.