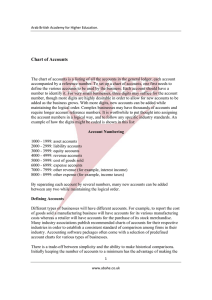

Chart of Accounts

... accounting system simple. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. However, following this strategy makes it more difficult to generate consistent historical comparisons. For example, if the ...

... accounting system simple. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. However, following this strategy makes it more difficult to generate consistent historical comparisons. For example, if the ...

FORM 10-Q - corporate

... only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated profit for the three and six months ended June 30, 2016 and 2015, (b) the consolidated comprehensive income for the three and six months ended June 30, 2016 and 2015, (c) the consolidated financial position ...

... only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated profit for the three and six months ended June 30, 2016 and 2015, (b) the consolidated comprehensive income for the three and six months ended June 30, 2016 and 2015, (c) the consolidated financial position ...

Form 10-K - Kimco Investor Relations

... In addition, the Company has capitalized on its established expertise in retail real estate by establishing other ventures in which the Company owns a smaller equity interest and provides management, leasing and operational support for those properties. The Company has also provided preferred equit ...

... In addition, the Company has capitalized on its established expertise in retail real estate by establishing other ventures in which the Company owns a smaller equity interest and provides management, leasing and operational support for those properties. The Company has also provided preferred equit ...

the law of turkmenistan on investment activities in

... persons, economic associations, societies and companies as well as public and religious organizations, other juridical persons in the priority sectors of the economy, as well as for involving them in participation in state investment activities including implementation of special state complex prog ...

... persons, economic associations, societies and companies as well as public and religious organizations, other juridical persons in the priority sectors of the economy, as well as for involving them in participation in state investment activities including implementation of special state complex prog ...

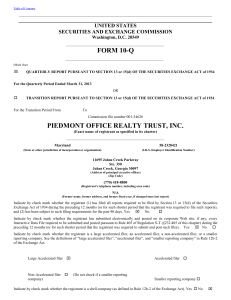

united states securities and exchange commission

... assumptions could prove inaccurate. The forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond Piedmont’s ability to control or predict. Such factor ...

... assumptions could prove inaccurate. The forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond Piedmont’s ability to control or predict. Such factor ...

RTF format

... In order to forge a link to the word “sale” in the definition of “trading stock”, appellant has attempted to characterise as sales transactions which are not capable in law of being so characterised. The transaction which a participant in a participation bond scheme enters into can by no stretch of ...

... In order to forge a link to the word “sale” in the definition of “trading stock”, appellant has attempted to characterise as sales transactions which are not capable in law of being so characterised. The transaction which a participant in a participation bond scheme enters into can by no stretch of ...

McGraw-Hill Global Education Intermediate Holdings

... was completed, the result of which was that the HPI business and the SEG business were separated into two legal entities. The HPI business is now owned by MHGE Holdings, and the SEG business is owned by McGraw-Hill School Education Intermediate Holdings, LLC (“MHSE Holdings”), a separate wholly owne ...

... was completed, the result of which was that the HPI business and the SEG business were separated into two legal entities. The HPI business is now owned by MHGE Holdings, and the SEG business is owned by McGraw-Hill School Education Intermediate Holdings, LLC (“MHSE Holdings”), a separate wholly owne ...

ADVANCED MACROECONMICS ECO 442

... you meet the objectives of the course and, therefore, will help you pass the exam. Submit all assignments no later than the due date. 9. Review the objectives for each study unit to confirm that you have achieved them. If you feel unsure about any of the objectives, review the study material or cons ...

... you meet the objectives of the course and, therefore, will help you pass the exam. Submit all assignments no later than the due date. 9. Review the objectives for each study unit to confirm that you have achieved them. If you feel unsure about any of the objectives, review the study material or cons ...

Investing for trustees - The Personal Finance Society

... IHT PLANNING POST TNRB Married couples with estates of up to ...

... IHT PLANNING POST TNRB Married couples with estates of up to ...

Foundation for significant price increase eroding

... purchase a home in Amsterdam, a buyer must pay virtually the same number of annual incomes as in 2008. Use of price-to-income ratio as indicator? Comparing house prices to income is a commonly used means* of investigating whether house prices are overvalued. The price-to-income ratio is mainly used ...

... purchase a home in Amsterdam, a buyer must pay virtually the same number of annual incomes as in 2008. Use of price-to-income ratio as indicator? Comparing house prices to income is a commonly used means* of investigating whether house prices are overvalued. The price-to-income ratio is mainly used ...

adolph coors company

... which are necessary for a fair presentation of the financial position, results of operations and cash flows for the periods presented. The accompanying condensed consolidated financial statements include our accounts, the accounts of our majority-owned domestic and foreign subsidiaries, and, effecti ...

... which are necessary for a fair presentation of the financial position, results of operations and cash flows for the periods presented. The accompanying condensed consolidated financial statements include our accounts, the accounts of our majority-owned domestic and foreign subsidiaries, and, effecti ...

“Azerbaijan Caspian Shipping” Closed Joint Stock Company

... The Group classifies all other liabilities as non-current. Deferred tax assets and liabilities are classified as non-current assets and liabilities. Business combinations. Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured as the aggregate of ...

... The Group classifies all other liabilities as non-current. Deferred tax assets and liabilities are classified as non-current assets and liabilities. Business combinations. Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured as the aggregate of ...