FACTORS AFFECTING PORTFOLIO INVESTMENT IN PAKISTAN

... Goetzmann and Kumar (2008) examined the equity portfolio diversification. Study analyzed that US investors favoured less-diversified portfolios. Data has been taken from US discount brokerage house (DBH) from the time period 1991 to the end of 1996. Study focused on the improvement of diversificatio ...

... Goetzmann and Kumar (2008) examined the equity portfolio diversification. Study analyzed that US investors favoured less-diversified portfolios. Data has been taken from US discount brokerage house (DBH) from the time period 1991 to the end of 1996. Study focused on the improvement of diversificatio ...

Quarterly Investment Chartbook

... Comerica’s Wealth Management team consists of various divisions of Comerica Bank, affiliates of Comerica Bank including Comerica Bank & Trust, N.A., and subsidiaries of Comerica Bank including World Asset Management, Inc.; Wilson, Kemp & Associates, Inc.; Comerica Securities, Inc.; and Comerica Insu ...

... Comerica’s Wealth Management team consists of various divisions of Comerica Bank, affiliates of Comerica Bank including Comerica Bank & Trust, N.A., and subsidiaries of Comerica Bank including World Asset Management, Inc.; Wilson, Kemp & Associates, Inc.; Comerica Securities, Inc.; and Comerica Insu ...

beyond banks and big government

... two major elements: a lack of long-term investment in business, especially small and medium-sized businesses; and a lack of investment in infrastructure. This lack of access to investment funds for small and medium-sized enterprises (SMEs) was noted as long ago as 1931, when the MacMillan Committee ...

... two major elements: a lack of long-term investment in business, especially small and medium-sized businesses; and a lack of investment in infrastructure. This lack of access to investment funds for small and medium-sized enterprises (SMEs) was noted as long ago as 1931, when the MacMillan Committee ...

Responsible Investment Position Statement

... thematic investment opportunities or a combination of any or all of these approaches. We do recognise that customers may choose to limit their own fossil fuel exposures and, in line with this approach and our Responsible Investment Action Plan, we will make available an investment solution which man ...

... thematic investment opportunities or a combination of any or all of these approaches. We do recognise that customers may choose to limit their own fossil fuel exposures and, in line with this approach and our Responsible Investment Action Plan, we will make available an investment solution which man ...

fiduciary duty in the - Principles for Responsible Investment

... stakeholders to implement clear and accountable policy and practice that embrace the modern interpretation of fiduciary duty. This roadmap was developed through industry consultation and sets out recommendations to ensure that the modern interpretation of fiduciary duty is adopted by German investor ...

... stakeholders to implement clear and accountable policy and practice that embrace the modern interpretation of fiduciary duty. This roadmap was developed through industry consultation and sets out recommendations to ensure that the modern interpretation of fiduciary duty is adopted by German investor ...

Emerging Market Finance

... Initiation of acceleration by 25% bondholder vote In 2003, sovereigns that used CACs include Brazil, South Africa, United Mexican States; Uraquay Query - use for EM corporate issuers under US law ...

... Initiation of acceleration by 25% bondholder vote In 2003, sovereigns that used CACs include Brazil, South Africa, United Mexican States; Uraquay Query - use for EM corporate issuers under US law ...

The Roles and Responsibilities of Investment Committees of Not

... The Role and Authority of the Investment Committee Should Be Clearly Articulated and Understood by the Committee and the Board The role and authority of the investment committee should be clearly spelled out in a committee charter or an investment policy statement approved by the board of directors. ...

... The Role and Authority of the Investment Committee Should Be Clearly Articulated and Understood by the Committee and the Board The role and authority of the investment committee should be clearly spelled out in a committee charter or an investment policy statement approved by the board of directors. ...

Absolute and Relative Measures Explaining Consumption Risk

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

Môc tiªu vµ ý nghÜa cña DAHTP dÇu khÝ cña TCTDKVN

... Promote transparent and efficient markets, consistent with the rule of law Clearly articulate the division of responsibilities among different supervisory, regulatory and enforcement ...

... Promote transparent and efficient markets, consistent with the rule of law Clearly articulate the division of responsibilities among different supervisory, regulatory and enforcement ...

Attracting FDI - World Bank Group

... The investment climate clearly matters for the location decisions of foreign investors (Mukim and Nunnenkamp 2010). It is especially crucial in determining the effectiveness of other factors aimed at promoting inbound FDI, such as incentives. Although lowering effective tax rates can help boost FDI, ...

... The investment climate clearly matters for the location decisions of foreign investors (Mukim and Nunnenkamp 2010). It is especially crucial in determining the effectiveness of other factors aimed at promoting inbound FDI, such as incentives. Although lowering effective tax rates can help boost FDI, ...

grahame robert anderson

... Grahame appeared alongside Jeremy Lewis in Tancock v British Swimming, an arbitral award under the auspices of Sports Resolution. During pupillage, he was involved in defending a claim against a former premiership star brought by a major European club. The case involved alleged contractual breac ...

... Grahame appeared alongside Jeremy Lewis in Tancock v British Swimming, an arbitral award under the auspices of Sports Resolution. During pupillage, he was involved in defending a claim against a former premiership star brought by a major European club. The case involved alleged contractual breac ...

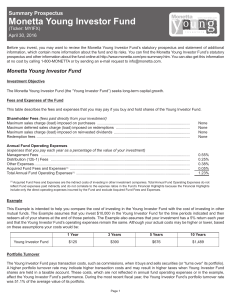

Monetta Young Investor Fund

... After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation, and may differ from those shown, and after-tax returns shown are not rele ...

... After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation, and may differ from those shown, and after-tax returns shown are not rele ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... in the MSCI Emerging Market Index, with an increase in China’s weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking ...

... in the MSCI Emerging Market Index, with an increase in China’s weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking ...

Item 1 Cover Page - Capstone Investment Financial Group

... possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If a Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically aff ...

... possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If a Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically aff ...

Land grab or development opportunity?

... country governments tend to play a key role in allocating them; • Land fees and other monetary transfers are not the main host country benefit, not least due to the difficulty of setting land prices in the absence of well-established formal land markets; ...

... country governments tend to play a key role in allocating them; • Land fees and other monetary transfers are not the main host country benefit, not least due to the difficulty of setting land prices in the absence of well-established formal land markets; ...

Another version of this paper is presented at Academy of... (AIB) Conference 2010 at Rio de Janero, Brazil

... (AIB) Conference 2010 at Rio de Janero, Brazil agricultural sectors in which foreign firms have advantages over the local firms. With the treaty in place, the FDI is assumed to increase by 150%. The model simulation runs until the year 2030 in order to observe the effects of CAFTA in the short term ...

... (AIB) Conference 2010 at Rio de Janero, Brazil agricultural sectors in which foreign firms have advantages over the local firms. With the treaty in place, the FDI is assumed to increase by 150%. The model simulation runs until the year 2030 in order to observe the effects of CAFTA in the short term ...

Building Investment

... over the past year. Angel investment increased from $53.1 million through 114 deals in 2013 to $55.9 million through 118 deals in 2014 – a record high. Growth in angel investment activity over the last few years has been largely driven by the rise of investment in software companies. In 2014, $26.2 ...

... over the past year. Angel investment increased from $53.1 million through 114 deals in 2013 to $55.9 million through 118 deals in 2014 – a record high. Growth in angel investment activity over the last few years has been largely driven by the rise of investment in software companies. In 2014, $26.2 ...

Lazard Alternative Emerging Markets

... transferability of interests in these funds are restricted. The fees imposed, including management and incentive fees/allocations and expenses, may offset trading profits. Investors should not invest in any fund or strategy unless they are prepared to lose all or a substantial portion of their inves ...

... transferability of interests in these funds are restricted. The fees imposed, including management and incentive fees/allocations and expenses, may offset trading profits. Investors should not invest in any fund or strategy unless they are prepared to lose all or a substantial portion of their inves ...

Two Ways to Calculate the Rate of Return on a Portfolio

... Here you have two dramatically different experiences when both investors deposited exactly the same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is rig ...

... Here you have two dramatically different experiences when both investors deposited exactly the same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is rig ...

Communicating Error-Free Investment Results

... automated safeguards in place, it’s easy to see how non-compliance-approved or outdated information can slip into a marketing document or client report — and the hands of regulators. Multiply this by the sheer volume of inputs that go into a typical investment management presentations and the risk e ...

... automated safeguards in place, it’s easy to see how non-compliance-approved or outdated information can slip into a marketing document or client report — and the hands of regulators. Multiply this by the sheer volume of inputs that go into a typical investment management presentations and the risk e ...

Cap Value Fiduciary Services Equity Investment

... Investment products may move from the Focus List to the Approved List, or vice versa. GIMA may also determine that an investment product no longer meets the criteria under either evaluation process and will no longer be recommended in investment advisory programs (in which case the investment produc ...

... Investment products may move from the Focus List to the Approved List, or vice versa. GIMA may also determine that an investment product no longer meets the criteria under either evaluation process and will no longer be recommended in investment advisory programs (in which case the investment produc ...

Tracking Error Regret Is the Enemy of Investors

... Clearly, investors who diversified globally have been disappointed. Unfortunately, that disappointment has led many to consider abandoning their strategy of global diversification. But, should we judge the strategy to have been a poor one based on the outcome? Not when we look at the question throug ...

... Clearly, investors who diversified globally have been disappointed. Unfortunately, that disappointment has led many to consider abandoning their strategy of global diversification. But, should we judge the strategy to have been a poor one based on the outcome? Not when we look at the question throug ...

PDF article file - Krungsri Asset Management

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

... Investors should carefully study fund features, performance, and risk before making an investment decision. Past performance is not a guarantee of future results. For KF-HUSINDX and KF-HJPINDX 1. KF-HUSINDX allocates at least 80% of NAV in each accounting year in a foreign fund titled iShares Cor ...

Bernard L. Madoff Investment and Securities: Broker

... returned as much, or even more, than Madoff’s. So it wasn’t his returns that bothered me so much – his returns each month were possible – it was that he always returned a profit. There was no existing mathematical model that could explain the consistency.”5 Madoff, in reality, never made the invest ...

... returned as much, or even more, than Madoff’s. So it wasn’t his returns that bothered me so much – his returns each month were possible – it was that he always returned a profit. There was no existing mathematical model that could explain the consistency.”5 Madoff, in reality, never made the invest ...

ucits – past, present and future

... “Pooled investment” products of the type described above, amount to investment products. These can be distinguished from investment services. Asset management is an investment service. So for example, a wealthy individual with several million pounds (or Euros) to invest could approach an authorised ...

... “Pooled investment” products of the type described above, amount to investment products. These can be distinguished from investment services. Asset management is an investment service. So for example, a wealthy individual with several million pounds (or Euros) to invest could approach an authorised ...