automatic enrollment under irs revenue ruling 98-30

... from the plan, etc.). The QDIA may be used in any situations where the employee had the right to direct investment but failed to do so. Investment of Contributions The [insert name of company] sponsor of [insert name of 401(k) retirement plan] (the “Plan”) has chosen a default investment fund intend ...

... from the plan, etc.). The QDIA may be used in any situations where the employee had the right to direct investment but failed to do so. Investment of Contributions The [insert name of company] sponsor of [insert name of 401(k) retirement plan] (the “Plan”) has chosen a default investment fund intend ...

The regulatory framework for Hedge Funds in Guernsey

... and what hedging and borrowing powers may be permitted. These are matters which are agreed with the Commission on a case by case basis. Just as the Commission emphasises its flexible approach in granting consent for closed-end funds, so the preamble to the Class B Rules notes the intention that the ...

... and what hedging and borrowing powers may be permitted. These are matters which are agreed with the Commission on a case by case basis. Just as the Commission emphasises its flexible approach in granting consent for closed-end funds, so the preamble to the Class B Rules notes the intention that the ...

Rajiv Gandhi Equity Savings Scheme

... It is hereby verified that I am an eligible new retail investor for availing the benefits under the Rajiv Gandhi Equity Savings Scheme. I undertake to abide by all the requirements and fulfill all obligations under the Scheme, and will comply with all the terms and conditions of the Scheme. I unders ...

... It is hereby verified that I am an eligible new retail investor for availing the benefits under the Rajiv Gandhi Equity Savings Scheme. I undertake to abide by all the requirements and fulfill all obligations under the Scheme, and will comply with all the terms and conditions of the Scheme. I unders ...

A Macroeconomic Theory of the Open Economy

... The demand curve for foreign currency is downward sloping because a higher exchange rate makes domestic goods more expensive. The supply curve is vertical because the quantity of dollars supplied for net foreign investment is unrelated to the real exchange ...

... The demand curve for foreign currency is downward sloping because a higher exchange rate makes domestic goods more expensive. The supply curve is vertical because the quantity of dollars supplied for net foreign investment is unrelated to the real exchange ...

The University of Akron Investment Policy Statement for Endowment Funds

... compensation arrangements, and any other business relationships then existing or then being negotiated between the investment consultant candidate and any investment manager within the universe of investment managers monitored by such investment consultant. Furthermore, after an investment consultan ...

... compensation arrangements, and any other business relationships then existing or then being negotiated between the investment consultant candidate and any investment manager within the universe of investment managers monitored by such investment consultant. Furthermore, after an investment consultan ...

Measuring CRI`s Impact on Performance

... Because our screens — and the resulting substitution and rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates ...

... Because our screens — and the resulting substitution and rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates ...

Sample Glossary of Investment-Related Terms for

... Employer Securities: Securities issued by an employer of employees covered by a retirement plan that may be used as a plan investment option. Equity/Equities: A security or investment representing ownership in a corporation, unlike a bond, which represents a loan to a borrower. Often used interchang ...

... Employer Securities: Securities issued by an employer of employees covered by a retirement plan that may be used as a plan investment option. Equity/Equities: A security or investment representing ownership in a corporation, unlike a bond, which represents a loan to a borrower. Often used interchang ...

www.FirstRate.com | Evaluating Performance of Alternative

... 4. Hedge Funds: There are several forms of hedge funds available today. Each hedge fund has its own individual investment strategy that focuses on investments appropriate for that specific strategy. Hedge funds are generally available to a limited number of qualified investors who pay performance fe ...

... 4. Hedge Funds: There are several forms of hedge funds available today. Each hedge fund has its own individual investment strategy that focuses on investments appropriate for that specific strategy. Hedge funds are generally available to a limited number of qualified investors who pay performance fe ...

Chapter 1

... Business Methods Firms may also penetrate foreign markets by engaging in a joint venture (joint ownership and operation) with firms that reside in those markets. Acquisitions of existing operations in foreign countries allow firms to quickly gain control over foreign operations as ...

... Business Methods Firms may also penetrate foreign markets by engaging in a joint venture (joint ownership and operation) with firms that reside in those markets. Acquisitions of existing operations in foreign countries allow firms to quickly gain control over foreign operations as ...

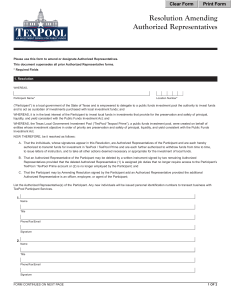

Resolution Amending Authorized Representatives

... a. that the individuals, whose signatures appear in this resolution, are authorized representatives of the participant and are each hereby authorized to transmit funds for investment in texpool / texpool prime and are each further authorized to withdraw funds from time to time, to issue letters of i ...

... a. that the individuals, whose signatures appear in this resolution, are authorized representatives of the participant and are each hereby authorized to transmit funds for investment in texpool / texpool prime and are each further authorized to withdraw funds from time to time, to issue letters of i ...

PDF

... adjustment policies implemented throughout the region may have created an economic environment that attracts U.S. FDI in food and kindred products. In regard to the effect of nominal exchange rates on FDI, the depreciation of the local currency in relation to the dollar was shown to be a generally p ...

... adjustment policies implemented throughout the region may have created an economic environment that attracts U.S. FDI in food and kindred products. In regard to the effect of nominal exchange rates on FDI, the depreciation of the local currency in relation to the dollar was shown to be a generally p ...

Fund Manager Sector Minimum Investment Fund Size

... offer to buy/sell or an invita�on to buy/sell securi�es in the fund. The informa�on and any opinions have been obtained from or are based on sources believed to be reliable, but accuracy cannot be guaranteed. No responsibility can be accepted for any consequen�al loss arising from the use of this inf ...

... offer to buy/sell or an invita�on to buy/sell securi�es in the fund. The informa�on and any opinions have been obtained from or are based on sources believed to be reliable, but accuracy cannot be guaranteed. No responsibility can be accepted for any consequen�al loss arising from the use of this inf ...

MiFID II Appointment of tied agents

... hold a client's money in the same way that the investment firm itself would be able to. ...

... hold a client's money in the same way that the investment firm itself would be able to. ...

Educating Your Investment Committee on Behavioral Economics

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

United States Policy Toward Foreign Investment

... internationally-held assets. In turn, these private investments are divided into two categories: "direct" (ownership of 10 percent or more of the equity or its equivalent in a business) investment and "portfolio" (all other) investment. ...

... internationally-held assets. In turn, these private investments are divided into two categories: "direct" (ownership of 10 percent or more of the equity or its equivalent in a business) investment and "portfolio" (all other) investment. ...

ESG - Mondrian Investment Partners

... reasonable expectations for shareholder return, we will more actively discuss this with said management team. Local practice and governance are taken into account when voting shares or engaging with the management of companies particularly in less developed markets, and actions are taken on a case-b ...

... reasonable expectations for shareholder return, we will more actively discuss this with said management team. Local practice and governance are taken into account when voting shares or engaging with the management of companies particularly in less developed markets, and actions are taken on a case-b ...

Tribunals

... In some instances, VCAT may direct the parties to attend a compulsory conference. A compulsory conference is an informal pre-hearing conference. A compulsory conference may be held to: identify and clarify the nature of the issues in dispute promote a settlement identify the questions of fact and la ...

... In some instances, VCAT may direct the parties to attend a compulsory conference. A compulsory conference is an informal pre-hearing conference. A compulsory conference may be held to: identify and clarify the nature of the issues in dispute promote a settlement identify the questions of fact and la ...

Communiqué de presse

... Union Bancaire Privée, UBP SA (“UBP”), has announced a major new collaboration with Partners Group, the global private markets investment manager, to deliver an innovative new approach to credit investing. The new cooperation will combine Partners Group’s extensive experience of investing in private ...

... Union Bancaire Privée, UBP SA (“UBP”), has announced a major new collaboration with Partners Group, the global private markets investment manager, to deliver an innovative new approach to credit investing. The new cooperation will combine Partners Group’s extensive experience of investing in private ...

The Offshore-Intensity Ratio

... measures such as the standard deviation. Moreover, there is no cogent reason that the standard deviation can tell us what proportion of foreign capital is commensurate for the size and the financing of an economy. In essence, we face the problem that there is no ‘objective’ value above which a juris ...

... measures such as the standard deviation. Moreover, there is no cogent reason that the standard deviation can tell us what proportion of foreign capital is commensurate for the size and the financing of an economy. In essence, we face the problem that there is no ‘objective’ value above which a juris ...

Draft Policy Statement to Regulation 81

... investment funds. Investment funds are reminded of the provisions of National Policy 11-201 Delivery of Documents by Electronic Means. In particular, it is noted that the notices required to be given under sections 2.2, 3.2, 5.2 and 6.2 of the Regulation may be given in electronic form and may be co ...

... investment funds. Investment funds are reminded of the provisions of National Policy 11-201 Delivery of Documents by Electronic Means. In particular, it is noted that the notices required to be given under sections 2.2, 3.2, 5.2 and 6.2 of the Regulation may be given in electronic form and may be co ...

Investment Treaty Practice of China, Japan and Korea

... commencement of trilateral free trade negotiations among their states, in an attempt to eventually construct one of the world’s largest free trade zones. Wen expressed that a trilateral free-trade agreement would “unleash [the] economic vitality of the region and boost economic integration.”11 Their ...

... commencement of trilateral free trade negotiations among their states, in an attempt to eventually construct one of the world’s largest free trade zones. Wen expressed that a trilateral free-trade agreement would “unleash [the] economic vitality of the region and boost economic integration.”11 Their ...

05/12/2016 Announcements and Notices

... connected transactions of the Company under Chapter 14A of the Listing Rules. As the highest applicable percentage ratio exceeds 0.1% but is less than 5%, the transactions contemplated are subject to the reporting and announcement requirements, but are exempt from the independent shareholders’ appro ...

... connected transactions of the Company under Chapter 14A of the Listing Rules. As the highest applicable percentage ratio exceeds 0.1% but is less than 5%, the transactions contemplated are subject to the reporting and announcement requirements, but are exempt from the independent shareholders’ appro ...

Barriers to foreign investment

... liberalisation undertaken as a result of future agreements with other countries. ...

... liberalisation undertaken as a result of future agreements with other countries. ...