PDF Download

... Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia, Hong Kong, South Korea and Singapore and capture third market effects. Real rates are calculated using national CPIs. Where CPI data are not yet available, estimates are used. ...

... Kingdom, Sweden, Denmark, Greece, Norway, Canada, Australia, Hong Kong, South Korea and Singapore and capture third market effects. Real rates are calculated using national CPIs. Where CPI data are not yet available, estimates are used. ...

Macroeconomic Theory

... of the labor market. Many economists believe that these data are uninformative. Cite three indicators that you would use to explain the state of the labor market. Carefully explain your choices. ...

... of the labor market. Many economists believe that these data are uninformative. Cite three indicators that you would use to explain the state of the labor market. Carefully explain your choices. ...

Macro_5.2-_Foreign_Exchange_FOREX

... What happens if you need less dollar to buy one euro (the price for a euro decreases)? Ex: From $3= €2 to $1= €2 •The U.S. Dollar APPRECIATES relative to the euro. Appreciation- The increase of value of a country's currency with respect to a foreign currency •Less units of dollars are needed to buy ...

... What happens if you need less dollar to buy one euro (the price for a euro decreases)? Ex: From $3= €2 to $1= €2 •The U.S. Dollar APPRECIATES relative to the euro. Appreciation- The increase of value of a country's currency with respect to a foreign currency •Less units of dollars are needed to buy ...

UNCTAD N° 5, December 2008

... countries have been the victims of “carry trade” – portfolio investment based on borrowing in lowyielding currencies and investing in high-yielding ones, which has led to overvaluation and a loss of competitiveness. Typical cases are Brazil, Hungary, Iceland, Romania and Turkey, but there are many o ...

... countries have been the victims of “carry trade” – portfolio investment based on borrowing in lowyielding currencies and investing in high-yielding ones, which has led to overvaluation and a loss of competitiveness. Typical cases are Brazil, Hungary, Iceland, Romania and Turkey, but there are many o ...

Exchange Rates Theories

... people are indifferent between the use of one currency or another all currencies would have to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

... people are indifferent between the use of one currency or another all currencies would have to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate ...

Chap31

... The annual fiscal deficit not to exceed 3% of GDP. Cumulative public debt not to exceed 60% of GDP. Other economic, political, and social requirements Approval by voters of a country seeking membership ...

... The annual fiscal deficit not to exceed 3% of GDP. Cumulative public debt not to exceed 60% of GDP. Other economic, political, and social requirements Approval by voters of a country seeking membership ...

Deutsche Bank’s View of the US Economy and the Fed

... initial stock implies long adjustment period ...

... initial stock implies long adjustment period ...

Economics focus

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

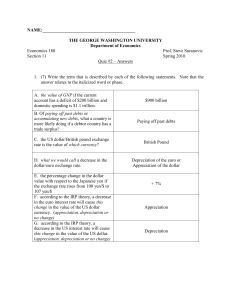

THE GEORGE WASHINGTON UNIVERSITY

... F. according to the IRP theory, a decrease in the euro interest rate will cause this change in the value of the US dollar currency. (appreciation, depreciation or no change) G. according to the IRP theory, a decrease in the US interest rate will cause this change in the value of the US dollar. (appr ...

... F. according to the IRP theory, a decrease in the euro interest rate will cause this change in the value of the US dollar currency. (appreciation, depreciation or no change) G. according to the IRP theory, a decrease in the US interest rate will cause this change in the value of the US dollar. (appr ...

Principles and Concepts: Economic Development

... GDP: is the market value of all final goods and services produced within a country in a given period of time ...

... GDP: is the market value of all final goods and services produced within a country in a given period of time ...

Principles and Concepts: Economic Development

... GDP: is the market value of all final goods and services produced within a country in a given period of time ...

... GDP: is the market value of all final goods and services produced within a country in a given period of time ...

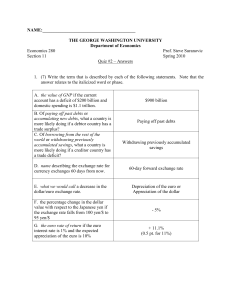

THE GEORGE WASHINGTON UNIVERSITY

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

... 1. (7) Write the term that is described by each of the following statements. Note that the answer relates to the italicized word or phase. A. the value of GNP if the current account has a deficit of $200 billion and domestic spending is $1.1 trillion. ...

understanding demand - Lemon Bay High School

... UNDERSTANDING DEMAND In a market system, the interaction of buyers and sellers determines the price of most goods as well as what quantity of a good will be produced ...

... UNDERSTANDING DEMAND In a market system, the interaction of buyers and sellers determines the price of most goods as well as what quantity of a good will be produced ...

Measuring Trade

... of a currency. It takes more of a currency to buy another currency. This currency is “weakening” ...

... of a currency. It takes more of a currency to buy another currency. This currency is “weakening” ...

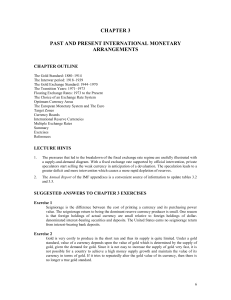

Chapter 3

... currencies are linked together in a system of “pegged” exchange rates. All currencies are convertible into gold. The Bretton Woods system, although essentially a pegged exchange rate system, allowed for changes in exchange rates when economic circumstances required such changes. Therefore, the syste ...

... currencies are linked together in a system of “pegged” exchange rates. All currencies are convertible into gold. The Bretton Woods system, although essentially a pegged exchange rate system, allowed for changes in exchange rates when economic circumstances required such changes. Therefore, the syste ...

Purchasing power parity

_per_capita_by_countries.png?width=300)

Purchasing power parity (PPP) is a component of some economic theories and is a technique used to determine the relative value of different currencies.Theories that invoke purchasing power parity assume that in some circumstances (for example, as a long-run tendency) it would cost exactly the same number of, say, US dollars to buy euros and then to use the proceeds to buy a market basket of goods as it would cost to use those dollars directly in purchasing the market basket of goods.The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be at par with the purchasing power of the two countries' currencies. Using that PPP rate for hypothetical currency conversions, a given amount of one currency thus has the same purchasing power whether used directly to purchase a market basket of goods or used to convert at the PPP rate to the other currency and then purchase the market basket using that currency. Observed deviations of the exchange rate from purchasing power parity are measured by deviations of the real exchange rate from its PPP value of 1.PPP exchange rates help to minimize misleading international comparisons that can arise with the use of market exchange rates. For example, suppose that two countries produce the same physical amounts of goods as each other in each of two different years. Since market exchange rates fluctuate substantially, when the GDP of one country measured in its own currency is converted to the other country's currency using market exchange rates, one country might be inferred to have higher real GDP than the other country in one year but lower in the other; both of these inferences would fail to reflect the reality of their relative levels of production. But if one country's GDP is converted into the other country's currency using PPP exchange rates instead of observed market exchange rates, the false inference will not occur.