monopolistically competitive. - LMS

... These assumptions imply several things about monopolies, including that the monopoly price is well above marginal cost. Monopoly is discussed in full in Chapter 11. Slide 8 ...

... These assumptions imply several things about monopolies, including that the monopoly price is well above marginal cost. Monopoly is discussed in full in Chapter 11. Slide 8 ...

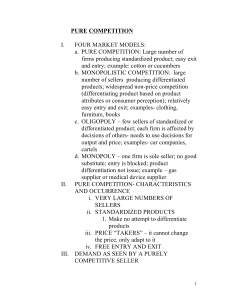

PURE COMPETITION I. FOUR MARKET MODELS: a. PURE

... i. Demand schedule faced by INDIVIDUAL FIRM is perfectly elastic: at any quantity, price stays the same ii. Review figure 7.1 on page 158. iii. Total Revenue (TR) = PxQ iv. Average Revenue (AR) and price are the same ($131) v. Marginal Revenue (MR) is the change in Total Revenue vi. IN PURE COMPETIT ...

... i. Demand schedule faced by INDIVIDUAL FIRM is perfectly elastic: at any quantity, price stays the same ii. Review figure 7.1 on page 158. iii. Total Revenue (TR) = PxQ iv. Average Revenue (AR) and price are the same ($131) v. Marginal Revenue (MR) is the change in Total Revenue vi. IN PURE COMPETIT ...

Managerial Economics & Business Strategy

... Increasing competition with antitrust laws – Examples: Sherman Antitrust Act (1890), Clayton Act ...

... Increasing competition with antitrust laws – Examples: Sherman Antitrust Act (1890), Clayton Act ...

Managerial economics

... (iv) Secular Period- It is a period of more than ten years in which changes in demand fully adjust themselves to supply. On the Basis of Competition- ...

... (iv) Secular Period- It is a period of more than ten years in which changes in demand fully adjust themselves to supply. On the Basis of Competition- ...

Margin Squeeze in Telecommunications Tilburg University, 17

... • The Commission had received complaints from competitors of DT, which claimed that these prices were incompatible with Article 82 EC. DT argued that its local access tariffs had been approved by the RegTP. • The Commission rejected that argumentation on the ground that, “competition rules may apply ...

... • The Commission had received complaints from competitors of DT, which claimed that these prices were incompatible with Article 82 EC. DT argued that its local access tariffs had been approved by the RegTP. • The Commission rejected that argumentation on the ground that, “competition rules may apply ...

P 1 - Arcada

... Monopoly • A monopolist: – is the sole supplier of an industry’s product • and the only potential supplier ...

... Monopoly • A monopolist: – is the sole supplier of an industry’s product • and the only potential supplier ...

Monopolistic Competition

... in long-run equilibrium. If this firm were to realize productive efficiency, it would: A) have more economic profit. B) have a loss. C) also achieve allocative efficiency. D) be under producing. ...

... in long-run equilibrium. If this firm were to realize productive efficiency, it would: A) have more economic profit. B) have a loss. C) also achieve allocative efficiency. D) be under producing. ...

Ch. 16 PP Notes - Mr. Lamb

... Tacit collusion is virtually impossible when there are many producers. ...

... Tacit collusion is virtually impossible when there are many producers. ...

Monopoly, Dominant Firm, Monopsony (in PDF)

... Or, what happens when competitive firms enter a monopoly industry? Structure, Conduct, Performance ...

... Or, what happens when competitive firms enter a monopoly industry? Structure, Conduct, Performance ...

Monopoly

... by many perfectly competitive units at $5/unit firms each with a small plant of size ATC1 ONE firm selling Or Demand can be supplied ...

... by many perfectly competitive units at $5/unit firms each with a small plant of size ATC1 ONE firm selling Or Demand can be supplied ...

MONOPOLY

... Gasoline – Mobil, Chevron and Shell paid $77 million in 1993 to settle charges that they conspired to fix gasoline prices. Music CDs – In 2001, the FTC charged AOL-Time Warner and Universal Music with fixing prices on the ...

... Gasoline – Mobil, Chevron and Shell paid $77 million in 1993 to settle charges that they conspired to fix gasoline prices. Music CDs – In 2001, the FTC charged AOL-Time Warner and Universal Music with fixing prices on the ...

Econ 111 (04) 2nd MT Winter 2015 A.tst

... E) None of the above are differences between monopoly and monopolistically competitive ...

... E) None of the above are differences between monopoly and monopolistically competitive ...

Philippines Adopts New Corporate Rehabilitation And

... exerts any adverse effects on market competition and consumer interests; and whether the act has any negative impact on economic efficiency and common interests. The Draft Provisions are silent on whether the intent of an operator with dominant position should be taken into account. According to the ...

... exerts any adverse effects on market competition and consumer interests; and whether the act has any negative impact on economic efficiency and common interests. The Draft Provisions are silent on whether the intent of an operator with dominant position should be taken into account. According to the ...

AP Economics Modules 57-60: Pure Competition Outline

... 1. MR = MC rule states that the firm will maximize profits or minimize losses by producing at the point at which marginal revenue equals marginal cost in the short run. 2. Three features of this MR = MC rule are important. a. Rule assumes that marginal revenue must be equal to or exceed minimumavera ...

... 1. MR = MC rule states that the firm will maximize profits or minimize losses by producing at the point at which marginal revenue equals marginal cost in the short run. 2. Three features of this MR = MC rule are important. a. Rule assumes that marginal revenue must be equal to or exceed minimumavera ...

Oligopolistic Competition

... joint choices of both firms, i.e. P ≡ P (q1 + q2 ). That is given what firm j chooses, firm i’s choice will ultimately affect the prices of the market. If we were to plot this, what we will derive is the residual demand of the firm in question. Essentially, given this residual demand, each firm will ...

... joint choices of both firms, i.e. P ≡ P (q1 + q2 ). That is given what firm j chooses, firm i’s choice will ultimately affect the prices of the market. If we were to plot this, what we will derive is the residual demand of the firm in question. Essentially, given this residual demand, each firm will ...

Document

... Tacit Collusion Any form of oligopolistic cooperation that does not involve an explicit agreement ...

... Tacit Collusion Any form of oligopolistic cooperation that does not involve an explicit agreement ...

Economics 11 Caltech Spring 2010

... 2.a.1 Output should go up because if the CEO has adopted the new technology it must reduce its costs. 2.a.2 The new technology is increasing the marginal product of workers (because their machines are going twice as fast) thus the old equilibrium W=pF’ no longer holds and the only way to restore ...

... 2.a.1 Output should go up because if the CEO has adopted the new technology it must reduce its costs. 2.a.2 The new technology is increasing the marginal product of workers (because their machines are going twice as fast) thus the old equilibrium W=pF’ no longer holds and the only way to restore ...

Formulář inovovaného předmětu

... Monopolist sets up the price above marginal cost, what leads to a loss of efficiency. For these reason is the government trying to reduce the costs of monopoly with the following tools: • Increasing taxes reduces monopoly profits, but it does not show in reduction in output. • Price regulation means ...

... Monopolist sets up the price above marginal cost, what leads to a loss of efficiency. For these reason is the government trying to reduce the costs of monopoly with the following tools: • Increasing taxes reduces monopoly profits, but it does not show in reduction in output. • Price regulation means ...

Perfect-Competition

... • Many buyers & sellers (no individual has mkt power) • Homogeneous product – no branding or differentiation • Perfect information – consumers always know what’s on offer for what prices • Freedom of entry & exit – no “barriers to entry” So… firms are price takers. ...

... • Many buyers & sellers (no individual has mkt power) • Homogeneous product – no branding or differentiation • Perfect information – consumers always know what’s on offer for what prices • Freedom of entry & exit – no “barriers to entry” So… firms are price takers. ...

Exercise 5.2

... of the following is a characteristic of perfect competition? a. easy entry into or exit from the market b. a small number of buyers c. a high degree of government regulation d. a differentiated product e. a high degree of collusion (2 points) For a perfectly competitive firm, a. marginal revenue is ...

... of the following is a characteristic of perfect competition? a. easy entry into or exit from the market b. a small number of buyers c. a high degree of government regulation d. a differentiated product e. a high degree of collusion (2 points) For a perfectly competitive firm, a. marginal revenue is ...

12.4 game theory

... A cartel is a group of firms acting together to limit output, raise price, and increase economic profit. Cartels are illegal but they do operate in some markets. Despite the temptation to collude, cartels tend to collapse. ...

... A cartel is a group of firms acting together to limit output, raise price, and increase economic profit. Cartels are illegal but they do operate in some markets. Despite the temptation to collude, cartels tend to collapse. ...

ECON 2010-400 Principles of Microeconomics

... Course description: Microeconomics is about what goods get produced and sold at what prices. The individual must decide what goods to buy, how much to save and how hard to work. The firm must decide how much to produce and with what technology. The course explores how "the magic of the market" coord ...

... Course description: Microeconomics is about what goods get produced and sold at what prices. The individual must decide what goods to buy, how much to save and how hard to work. The firm must decide how much to produce and with what technology. The course explores how "the magic of the market" coord ...

Chapter 10 Market structure and imperfect competition

... extremes of monopoly and perfect competition • An imperfectly competitive firm – would like to sell more at the going price – faces a downward-sloping demand curve – recognises its output price depends on the quantity of goods produced and sold ...

... extremes of monopoly and perfect competition • An imperfectly competitive firm – would like to sell more at the going price – faces a downward-sloping demand curve – recognises its output price depends on the quantity of goods produced and sold ...