Arshad Zabir

... 1 0, 2 , 3 , 4 0 and 5 0. Based on the above discussion, an increase in the real exchange rate (i.e. depreciation of Pak-rupee) could have a positive or negative effect on the demand for real money balances; therefore, which effect dominates is an empirical issue. 3. Data and Economet ...

... 1 0, 2 , 3 , 4 0 and 5 0. Based on the above discussion, an increase in the real exchange rate (i.e. depreciation of Pak-rupee) could have a positive or negative effect on the demand for real money balances; therefore, which effect dominates is an empirical issue. 3. Data and Economet ...

Slides

... result in a substantial increase in the rate of personal bankruptcies, which could lead to a secondary string of bankruptcies of financial institutions as well. Another long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession.” ...

... result in a substantial increase in the rate of personal bankruptcies, which could lead to a secondary string of bankruptcies of financial institutions as well. Another long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession.” ...

Solutions for Chapters 22-24

... scheme, there will be immediate inflation. The army would demand that the king pay them ten percent more coins for their wages. 8. M2 includes everything in M1, plus savings accounts, money market accounts, and some other categories. A shift of funds between, say, savings accounts and checking acco ...

... scheme, there will be immediate inflation. The army would demand that the king pay them ten percent more coins for their wages. 8. M2 includes everything in M1, plus savings accounts, money market accounts, and some other categories. A shift of funds between, say, savings accounts and checking acco ...

Borrowing, Depreciation, Taxes in Cash Flow Problems

... Match real values with real discount rates, etc How to do sensitivity analysis / which inputs to vary What discount, inflation, etc. rates to use Basically says “use this rate, but do sensitivity analysis ...

... Match real values with real discount rates, etc How to do sensitivity analysis / which inputs to vary What discount, inflation, etc. rates to use Basically says “use this rate, but do sensitivity analysis ...

ch25 - Index of

... Nominal interest rate: The nominal interest rate is the number of additional dollars that must be repaid for every dollar that is borrowed ...

... Nominal interest rate: The nominal interest rate is the number of additional dollars that must be repaid for every dollar that is borrowed ...

pdf white paper

... In the event banks are not willing to lend to other banks as experienced in 2008, the Federal Reserve also acts as the lender of last resort for short-term liquidity needs. Banks are able to borrow short-term funds directly from the Federal Reserve through the Discount Window. When a bank utilizes t ...

... In the event banks are not willing to lend to other banks as experienced in 2008, the Federal Reserve also acts as the lender of last resort for short-term liquidity needs. Banks are able to borrow short-term funds directly from the Federal Reserve through the Discount Window. When a bank utilizes t ...

Money and Money Market ملف

... • The aim of the first lecture is to define money, their forms and functions that the money performs in the economy. Next, we will focus on the origin and evolution of money and the current components of the money supply. In the next step the objective is to define the banking system and to explain ...

... • The aim of the first lecture is to define money, their forms and functions that the money performs in the economy. Next, we will focus on the origin and evolution of money and the current components of the money supply. In the next step the objective is to define the banking system and to explain ...

lecture notes

... held as vault cash. 3. The Fed may lend money to banks and thrifts, charging them an interest rate called the discount rate. 4. The Fed provides a check collection service for banks (checks are also cleared locally or by private clearing firms). 5. Federal Reserve System acts as the fiscal agent for ...

... held as vault cash. 3. The Fed may lend money to banks and thrifts, charging them an interest rate called the discount rate. 4. The Fed provides a check collection service for banks (checks are also cleared locally or by private clearing firms). 5. Federal Reserve System acts as the fiscal agent for ...

Spring 1997 Midterm #2

... Please answer Part II on your coding sheet with a #2 pencil. Choose the best answer from the five alternatives offered. Be sure to fill in the coding sheet carefully and accurately. How to fill in the coding sheet: 1. Print your last name, first name and middle initial in the spaces marked “Last Nam ...

... Please answer Part II on your coding sheet with a #2 pencil. Choose the best answer from the five alternatives offered. Be sure to fill in the coding sheet carefully and accurately. How to fill in the coding sheet: 1. Print your last name, first name and middle initial in the spaces marked “Last Nam ...

Exam 3 - Fresno State Email

... 36. If the Fed wants to raise the interest rate, it will a. increase the money supply b. decrease the money supply c. increase money demand d. decrease money demand e. simply set a higher market interest rate 37. The interest rate charged for loans among banks is known as the a. discount rate b. fed ...

... 36. If the Fed wants to raise the interest rate, it will a. increase the money supply b. decrease the money supply c. increase money demand d. decrease money demand e. simply set a higher market interest rate 37. The interest rate charged for loans among banks is known as the a. discount rate b. fed ...

aggregate demand

... People saving for their retirement will see that the amount saved is less adequate for their future needs. They need to save more, decreasing current spending. ...

... People saving for their retirement will see that the amount saved is less adequate for their future needs. They need to save more, decreasing current spending. ...

LETTER OF INTENT

... 7. In 30/45 days, seller’s bank issues an invitation letter for inspection of SGS or similar inspection company through its bank, and BL (Bill of Lading). 8. Delivery starts as per contract terms and conditions. Financial Instruments are as per UCP 600 Code and any revisions are as set by the Intern ...

... 7. In 30/45 days, seller’s bank issues an invitation letter for inspection of SGS or similar inspection company through its bank, and BL (Bill of Lading). 8. Delivery starts as per contract terms and conditions. Financial Instruments are as per UCP 600 Code and any revisions are as set by the Intern ...

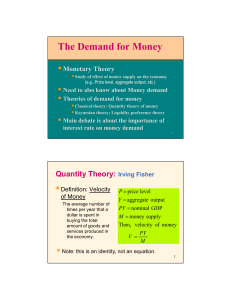

The Demand for Money - Spears School of Business

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

cyprus international university

... “The Short-Run Tradeoff between Inflation and Unemployment,” introduces politicians who control aggregate demand face a tradeoff between inflation and unemployment. It examines why this tradeoff exists in the short run, why it shifts over time, and why it does not exist in the long run. • Learn why ...

... “The Short-Run Tradeoff between Inflation and Unemployment,” introduces politicians who control aggregate demand face a tradeoff between inflation and unemployment. It examines why this tradeoff exists in the short run, why it shifts over time, and why it does not exist in the long run. • Learn why ...

Real vs. nominal GDP.S02

... A distinction between Nominal GDP and Real GDP allows us to measure the actual changes in production, separate and apart from any price changes that may have occurred in the economy during the year. ...

... A distinction between Nominal GDP and Real GDP allows us to measure the actual changes in production, separate and apart from any price changes that may have occurred in the economy during the year. ...

A money Demand Function with Output Uncertainty, Monetary

... What is money demand function or in another word, what do we mean by demand for money? And what does the stability of money demand means? ...

... What is money demand function or in another word, what do we mean by demand for money? And what does the stability of money demand means? ...

A book-keeping analysis of a monetary economy

... and the same motion, the numerical form in which A holds (a claim on) a bank deposit whose value is identically equivalent to that of the commodity he sells to B. Hence, there is no need to go any further into the study of banking activity to substantiate the famous expression ‘deposits make loans’ ...

... and the same motion, the numerical form in which A holds (a claim on) a bank deposit whose value is identically equivalent to that of the commodity he sells to B. Hence, there is no need to go any further into the study of banking activity to substantiate the famous expression ‘deposits make loans’ ...