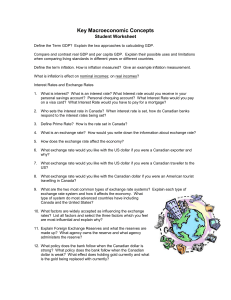

2-1-2 Key Macroeconomic Concepts - Student

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

document

... issue currency in order to meet its function of controlling inflation Accounts at the Bank of Canada ...

... issue currency in order to meet its function of controlling inflation Accounts at the Bank of Canada ...

Model Paper Macro Economics

... a) They alter firm’s cost of production. b) Higher the money wage, lower would be the firm’s cost of production and higher would be the supply. c) Lower the money wage, how would be the firm’s cost of production and higher would be the supply. d) Option (a) and (c) are correct. ...

... a) They alter firm’s cost of production. b) Higher the money wage, lower would be the firm’s cost of production and higher would be the supply. c) Lower the money wage, how would be the firm’s cost of production and higher would be the supply. d) Option (a) and (c) are correct. ...

Demand for Money

... Money is a special form of wealth. It is something that is accepted as a mean of payment. The definition of money is not precise. For empirical purposes we will use rather technical definition – monetary aggregates. First definition of money: currency (banknotes and coins) in the hand of the public ...

... Money is a special form of wealth. It is something that is accepted as a mean of payment. The definition of money is not precise. For empirical purposes we will use rather technical definition – monetary aggregates. First definition of money: currency (banknotes and coins) in the hand of the public ...

Sample Exam Questions

... cuisine, each with its own particular qualities. There are not large barriers to entry ...

... cuisine, each with its own particular qualities. There are not large barriers to entry ...

Formulas for Macro AP

... Monetary multiplier = 1/RRR Total addition to banking system = 1st loan x money multiplier + initial deposit IF IT’S NEW $ • Amt. of $ a bank can loan = excess reserves = total reserves – (RRR x checkable deposits) • Real interest rate = nominal interest rate – expected inflation rate ...

... Monetary multiplier = 1/RRR Total addition to banking system = 1st loan x money multiplier + initial deposit IF IT’S NEW $ • Amt. of $ a bank can loan = excess reserves = total reserves – (RRR x checkable deposits) • Real interest rate = nominal interest rate – expected inflation rate ...

Dear Readers

... The purpose of the publication is to present data about the results of the statistical surveys concerning value, indices and structure of investment outlays (part I) and fixed assets (part II). The subject of surveys included in the publication takes into consideration current rules of economic poli ...

... The purpose of the publication is to present data about the results of the statistical surveys concerning value, indices and structure of investment outlays (part I) and fixed assets (part II). The subject of surveys included in the publication takes into consideration current rules of economic poli ...

economics - kleinoak.org

... The front of the dollar bill features the picture of ________________ ______________________________, our first president. It also features the seal of the Department of the _______________________, which prints the bills, and the signature of the Secretary of the Treasury, currently Henry M. ______ ...

... The front of the dollar bill features the picture of ________________ ______________________________, our first president. It also features the seal of the Department of the _______________________, which prints the bills, and the signature of the Secretary of the Treasury, currently Henry M. ______ ...

FedViews

... Employment growth this year has helped lower the unemployment rate, which edged down from 6.1% in August to 5.9% in September. However, after remaining steady in recent months, labor force participation declined in September to 62.7%, the lowest rate in several decades. We expect the unemployment ra ...

... Employment growth this year has helped lower the unemployment rate, which edged down from 6.1% in August to 5.9% in September. However, after remaining steady in recent months, labor force participation declined in September to 62.7%, the lowest rate in several decades. We expect the unemployment ra ...

Homework assignment 7

... 2) How has your everyday life changed since NAFTA was signed? (think about your consumption behavior, the value of the dollar, etc.). (5%) 3) There were clearly some winners and some losers after NAFTA was signed. Is there any way to make everybody better off (tan before NAFTA) and still keep NAFTA ...

... 2) How has your everyday life changed since NAFTA was signed? (think about your consumption behavior, the value of the dollar, etc.). (5%) 3) There were clearly some winners and some losers after NAFTA was signed. Is there any way to make everybody better off (tan before NAFTA) and still keep NAFTA ...

Why Study Money, Banking, and Financial Markets?

... bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

... bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

AP Macroeconomics Section 8 Practice Test 1. An open economy is

... 10. Use the “Change in the Demand for U.S. Dollars” Figure 42-1. A flow of capital from Europe to the United States would cause a movement in this foreign exchange market that is best represented by the shift from: A. D2 to D1. B. E2 to E1. C. D1 to D2. D. There would be no shift in the foreign exc ...

... 10. Use the “Change in the Demand for U.S. Dollars” Figure 42-1. A flow of capital from Europe to the United States would cause a movement in this foreign exchange market that is best represented by the shift from: A. D2 to D1. B. E2 to E1. C. D1 to D2. D. There would be no shift in the foreign exc ...

Doomsday for the Greenback

... April 10th, 2007 “Of all the contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money.” Daniel Webster The American people are in La-la land. If they had any idea of what the Federal Reserve was up to they’d be out on the s ...

... April 10th, 2007 “Of all the contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money.” Daniel Webster The American people are in La-la land. If they had any idea of what the Federal Reserve was up to they’d be out on the s ...

A Rise In The Price Of Oil Imports Has

... 6. The inflationary gap part of the AD/AS diagram is: a. to the left of QN. b. to the right of QN. c. directly at QN. 7. Who has the legal power to create money in the United States? a. You. b. The President. c. The Congress of the United States. d. The Federal Reserve System. 8. What is the curren ...

... 6. The inflationary gap part of the AD/AS diagram is: a. to the left of QN. b. to the right of QN. c. directly at QN. 7. Who has the legal power to create money in the United States? a. You. b. The President. c. The Congress of the United States. d. The Federal Reserve System. 8. What is the curren ...

Chapter 27 - Money and Banking

... Money eliminates the barter problem and facilitates market transactions. ...

... Money eliminates the barter problem and facilitates market transactions. ...

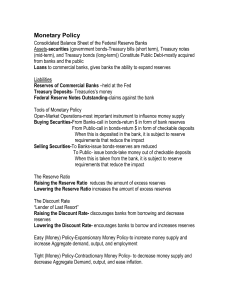

Monetary Policy

... spending. For those who pay interest as an expense, a rise in interest rates reduces spending and a fall in interest rates increases spending. For those who earn interest as income, a rise in interest rates increases spending, while decline will reduce spending. The Federal Funds Rate The Federal Fu ...

... spending. For those who pay interest as an expense, a rise in interest rates reduces spending and a fall in interest rates increases spending. For those who earn interest as income, a rise in interest rates increases spending, while decline will reduce spending. The Federal Funds Rate The Federal Fu ...

第七部分

... • Is the signaling effect “crying ‘wolf!’”? • If governments do not follow up on their exchange market signals with concrete policy moves, the signals soon become ineffective. ...

... • Is the signaling effect “crying ‘wolf!’”? • If governments do not follow up on their exchange market signals with concrete policy moves, the signals soon become ineffective. ...

monetarism & supply

... leading spokesman for monetarists advocates steady and slow monetary growth blames most of the economy’s instability on the federal government ...

... leading spokesman for monetarists advocates steady and slow monetary growth blames most of the economy’s instability on the federal government ...

International Economics PPT

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

... The capital and current account must equal 0 . There is an identity between the current and capital accounts. If we run a trade deficit, we have a deficit in the current account, but a corresponding surplus in the capital account. Investments are part of capital accounts, but income from investme ...

How to conduct monetary policy

... reserves. (money they are not allowed to lend out) These funds, which can be used to meet unexpected outflows, are called reserves, and banks keep them as cash in their vaults or as deposits with the Fed. When a bank makes a loan it increases the money supply. Also, changing reserve ratios changes m ...

... reserves. (money they are not allowed to lend out) These funds, which can be used to meet unexpected outflows, are called reserves, and banks keep them as cash in their vaults or as deposits with the Fed. When a bank makes a loan it increases the money supply. Also, changing reserve ratios changes m ...

Christine M. Farquhar - Fiduciary and Investment Risk Management

... Christine M. Farquhar has served as Managing Director and Associate Counsel of JPMorgan Chase U.S. Private Banking Compliance since January 2002. She co-leads the Bank Compliance Team in the implementation of a Compliance Plan for U.S. Private Banking which provides lending, mortgage, deposits, trus ...

... Christine M. Farquhar has served as Managing Director and Associate Counsel of JPMorgan Chase U.S. Private Banking Compliance since January 2002. She co-leads the Bank Compliance Team in the implementation of a Compliance Plan for U.S. Private Banking which provides lending, mortgage, deposits, trus ...

Tom Allen, Head of Economics, Eton College

... • C Conversely, the MPC would raise Bank Rate if inflation were forecast to rise above target, thus dampening aggregate demand and reducing inflationary pressures. • C The inflation target was changed in January 2004 from 2.5% on RPIX to 2% on the Consumer Price Index (CPI). • C Between 1997 and 200 ...

... • C Conversely, the MPC would raise Bank Rate if inflation were forecast to rise above target, thus dampening aggregate demand and reducing inflationary pressures. • C The inflation target was changed in January 2004 from 2.5% on RPIX to 2% on the Consumer Price Index (CPI). • C Between 1997 and 200 ...

Econ110: Principles of Economics TEST YOUR UNDERSTANDING

... suggests that this is a. above the natural rate, so real GDP growth was likely low. b. above the natural rate, so real GDP growth was likely high. c. below the natural rate, so real GDP growth was likely low. d. below the natural rate, so real GDP growth was likely high. ...

... suggests that this is a. above the natural rate, so real GDP growth was likely low. b. above the natural rate, so real GDP growth was likely high. c. below the natural rate, so real GDP growth was likely low. d. below the natural rate, so real GDP growth was likely high. ...