A Policy Model for Analyzing Macroprudential and Monetary Policies Sami Alpanda Gino Cateau

... Recent global …nancial crisis was a reminder that the real economy and the …nancial system are closely linked …nancial system can be a source of shocks amplify/propagate shocks originating elsewhere ...

... Recent global …nancial crisis was a reminder that the real economy and the …nancial system are closely linked …nancial system can be a source of shocks amplify/propagate shocks originating elsewhere ...

Basic Economics - Semantic Scholar

... Fact: Most big businesses are not monopolies and not all monopolies are big business. Take cranberry juice. How do we know that the price being charged is not far above their costs of production? We don’t. We actually have no idea of how much it costs to produce a bottle or can of cranberry juice. C ...

... Fact: Most big businesses are not monopolies and not all monopolies are big business. Take cranberry juice. How do we know that the price being charged is not far above their costs of production? We don’t. We actually have no idea of how much it costs to produce a bottle or can of cranberry juice. C ...

Lecture 7

... Example: Suppose the money supply is initially $1,000 and the government raises it permanently to $2,000. Since real GDP, y, is determined by the supply and demand for workers and the production function. If M doubles, then P must double. That is, changes in the price level come about because of cha ...

... Example: Suppose the money supply is initially $1,000 and the government raises it permanently to $2,000. Since real GDP, y, is determined by the supply and demand for workers and the production function. If M doubles, then P must double. That is, changes in the price level come about because of cha ...

Makro-14

... is that unexpected increases in the price level can fool workers and firms into thinking that relative prices have changed, causing them to alter the amount of labor or goods they choose to supply. • Rational-expectations theory, combined with the Lucas supply function, proposes a very small role fo ...

... is that unexpected increases in the price level can fool workers and firms into thinking that relative prices have changed, causing them to alter the amount of labor or goods they choose to supply. • Rational-expectations theory, combined with the Lucas supply function, proposes a very small role fo ...

Aggregate Supply and Aggregate Demand

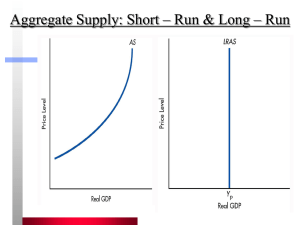

... A rise in the price level with no change in the money wage rate and other factor prices increases the quantity of real GDP supplied. ...

... A rise in the price level with no change in the money wage rate and other factor prices increases the quantity of real GDP supplied. ...

ECO120-Midterm2 Answ..

... 7. Which of the following is true along the investment demand curve? A) When interest rates rise, it becomes more expensive to borrow and more investment is made. B) When interest rates rise, it becomes more expensive to borrow and less investment is made C) When interest rates fall, it becomes more ...

... 7. Which of the following is true along the investment demand curve? A) When interest rates rise, it becomes more expensive to borrow and more investment is made. B) When interest rates rise, it becomes more expensive to borrow and less investment is made C) When interest rates fall, it becomes more ...

All speeches are available online at www

... advice, not of a Government monitor of our wellbeing, but Ken Dodd in 1964. Unfortunately, happy is not the word to describe the global economic scene. As Tolstoy might have said: all happy economies are alike; each .unhappy economy is unhappy in its own way Happy economies combine growth, stability ...

... advice, not of a Government monitor of our wellbeing, but Ken Dodd in 1964. Unfortunately, happy is not the word to describe the global economic scene. As Tolstoy might have said: all happy economies are alike; each .unhappy economy is unhappy in its own way Happy economies combine growth, stability ...

Document

... 44. When the Fed uses an interest rate as an intermediate target, upward pressure on the interest rate is restricted by increasing the supply of reserves. This may lead to a. higher fed funds rates. b. steady economic growth. c. a downward slide into recession. d. higher inflation in the future. ANS ...

... 44. When the Fed uses an interest rate as an intermediate target, upward pressure on the interest rate is restricted by increasing the supply of reserves. This may lead to a. higher fed funds rates. b. steady economic growth. c. a downward slide into recession. d. higher inflation in the future. ANS ...

Complete Syllabus Macroeconomics (12th Grade)

... the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and globalisation meant that the business cycle was a thing of the past. Alas, they were soon proved wrong. 23.Opportunity Cost The ...

... the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and globalisation meant that the business cycle was a thing of the past. Alas, they were soon proved wrong. 23.Opportunity Cost The ...

Monetary Policy Transmission

... monetary base respond to the long-term average growth rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The M ...

... monetary base respond to the long-term average growth rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The M ...

Could A S y m p o S i...

... then the concerns? Some attach more importance to inflation than to other economic outcomes, and always fear inflation. Others attach more weight to some indicators than to others. U.S. unemployment has fallen to 5.5 percent, which some see as entering the danger zone. Most importantly, Federal Rese ...

... then the concerns? Some attach more importance to inflation than to other economic outcomes, and always fear inflation. Others attach more weight to some indicators than to others. U.S. unemployment has fallen to 5.5 percent, which some see as entering the danger zone. Most importantly, Federal Rese ...

Monetary and Credit Targets in an Open Economy

... monetary policy taking the form of achieving target paths for the stock of money or exchange rates.8 Two notable exceptions are the studies of Black (1982b) and Rozwadowski (1983). Black used an extended ModiglianiPapademos (1980) model to suggest the existence of a relationship between the choice o ...

... monetary policy taking the form of achieving target paths for the stock of money or exchange rates.8 Two notable exceptions are the studies of Black (1982b) and Rozwadowski (1983). Black used an extended ModiglianiPapademos (1980) model to suggest the existence of a relationship between the choice o ...

Some Lags in Monetary Policy

... The Importance of the Lag for Policy The fact that economists attempt to measure the lags and argue about their length indicates that there is now much more agreement that monetary policy has some affect on economic activity than there was at one time* However, the lag studies open a new question of ...

... The Importance of the Lag for Policy The fact that economists attempt to measure the lags and argue about their length indicates that there is now much more agreement that monetary policy has some affect on economic activity than there was at one time* However, the lag studies open a new question of ...