Which of the following results when federal government

... If the government’s fiscal policy involves stopping high inflation, which choices should Congress consider? A. either cut taxes or increase government spending B. either increase taxes or cut government spending C. either lower the discount rate or sell bonds D. either raise the discount rate or bu ...

... If the government’s fiscal policy involves stopping high inflation, which choices should Congress consider? A. either cut taxes or increase government spending B. either increase taxes or cut government spending C. either lower the discount rate or sell bonds D. either raise the discount rate or bu ...

MACROECONOMICS

... C. This debt rises whenever the federal government borrows to cover budgetary deficits. D. After expenditures for Social Security/Medicare and national defense, paying interest on this debt is the largest current expenditure of the federal government. E. The private debt amassed by households and bu ...

... C. This debt rises whenever the federal government borrows to cover budgetary deficits. D. After expenditures for Social Security/Medicare and national defense, paying interest on this debt is the largest current expenditure of the federal government. E. The private debt amassed by households and bu ...

Powerpoint Presentation

... The permanent income hypothesis is that people spend money based on perceived average life income. The life-cycle hypothesis is one variant: young and old spend more than they earn, middle age earn more than they spend. ...

... The permanent income hypothesis is that people spend money based on perceived average life income. The life-cycle hypothesis is one variant: young and old spend more than they earn, middle age earn more than they spend. ...

Practice Quizzes (Word)

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

... 1. Which of the following will result if there is a decrease in aggregate demand? a. expansion; inflation c. expansion; deflation b. recession; deflation d. recession; inflation 2. Which of the following scenarios can cause cost-push inflation (and therefore stagflation)? a. an increase in taxes on ...

MONEY DEVALUATION IN INDIA

... time now. So, the FII’s are in a dilemma whether to invest in India or not. Even though they have brought in record inflows to the country in this year, if they pull out, it will result in a decrease of inflow of dollars into the country. Therefore, the decrease in supply and increase in demand of d ...

... time now. So, the FII’s are in a dilemma whether to invest in India or not. Even though they have brought in record inflows to the country in this year, if they pull out, it will result in a decrease of inflow of dollars into the country. Therefore, the decrease in supply and increase in demand of d ...

Bank of England Inflation Report February 2015 Money and asset

... Constant-maturity unweighted average of secondary market spreads to swaps for the major UK lenders’ five-year euro senior unsecured bonds or a suitable proxy. Sterling average of two and three-year spreads on retail bonds, over relevant swap rates. Unweighted average of the five-year senior CDS prem ...

... Constant-maturity unweighted average of secondary market spreads to swaps for the major UK lenders’ five-year euro senior unsecured bonds or a suitable proxy. Sterling average of two and three-year spreads on retail bonds, over relevant swap rates. Unweighted average of the five-year senior CDS prem ...

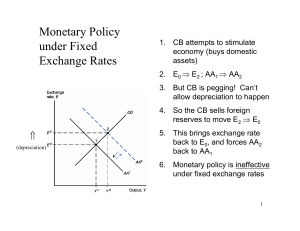

Fixed Exchange Rates and Macroeconomic Policy

... domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corrupt ...

... domestic inflation or to try to smooth out the domestic business cycle • The only hope for independent monetary policy is exchange controls to prevent traders buying or selling domestic currency • But exchange controls reduce trade and foreign direct investment, and present opportunities for corrupt ...

Fiscal policy

... fiscal drag The negative effect on the economy that occurs when average tax rates increase because taxpayers have moved into higher income brackets during an expansion. ...

... fiscal drag The negative effect on the economy that occurs when average tax rates increase because taxpayers have moved into higher income brackets during an expansion. ...

Powerpoint - DebtDeflation

... investment. It is a revolving fund which can be used over and over again. It does not absorb or exhaust any resources. The same ‘finance’ can tackle one investment after another.” (247) • So rather than money being destroyed when debt is repaid, money circulates indefinitely: amount of money (stock) ...

... investment. It is a revolving fund which can be used over and over again. It does not absorb or exhaust any resources. The same ‘finance’ can tackle one investment after another.” (247) • So rather than money being destroyed when debt is repaid, money circulates indefinitely: amount of money (stock) ...

Panel Discussion Bennett T. McCallum*

... that keeping its growth close to the target value will result in inflation close to the desired rate on average, over a span of years. Such is not the case for M1 or M2; the recent "stability" of M2 velocity is unlikely to obtain in the future. And GDP growth seems preferable to a direct inflation t ...

... that keeping its growth close to the target value will result in inflation close to the desired rate on average, over a span of years. Such is not the case for M1 or M2; the recent "stability" of M2 velocity is unlikely to obtain in the future. And GDP growth seems preferable to a direct inflation t ...

東吳大學

... variables are the same as those that determine the nominal variables the forces that determine the real variables are never the same as those that determine the nominal variables at full employment, the forces that determine the real variables are independent from those that determine the nominal ...

... variables are the same as those that determine the nominal variables the forces that determine the real variables are never the same as those that determine the nominal variables at full employment, the forces that determine the real variables are independent from those that determine the nominal ...

Multiple Choice Quiz 1. The labor force consists of A) the entire adult

... aggregate demand shifts right. b. increase, consumption decreases, aggregate demand shifts left. ...

... aggregate demand shifts right. b. increase, consumption decreases, aggregate demand shifts left. ...

The Case for Preserving Regulatory Distinctions

... Note that the defining characteristics of commercial banking would be the incurring of insured deposit liabilities as well as the making of commercial loans. The absurdity of nonbank banks would be ended, with some transitional grace period for the existing ones to convert. The linking of deposit mo ...

... Note that the defining characteristics of commercial banking would be the incurring of insured deposit liabilities as well as the making of commercial loans. The absurdity of nonbank banks would be ended, with some transitional grace period for the existing ones to convert. The linking of deposit mo ...