homework 3 (chapter 34) eco 11 fall 2006 udayan roy

... d. In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money. According to liquidity preference theory, an increase in the pri ...

... d. In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money. According to liquidity preference theory, an increase in the pri ...

Some pertinent questions!

... Maturity Mismatches & SBP motive The maturity mismatched aspect has increased for banks operation in Pakistan during recent years. However, SBP has introduced tiered cash reserves requirements for demand and time liabilities to encourage banks to mobilize long term ...

... Maturity Mismatches & SBP motive The maturity mismatched aspect has increased for banks operation in Pakistan during recent years. However, SBP has introduced tiered cash reserves requirements for demand and time liabilities to encourage banks to mobilize long term ...

Inflation - Mr. P. Ronan

... These economists dispute the link between increases in the money supply and inflation. They do so, on a number of grounds. They argue that keeping a tight control over money supply so as to control spending is highly questionable. Spending they say is not only dependant on the amount of money in the ...

... These economists dispute the link between increases in the money supply and inflation. They do so, on a number of grounds. They argue that keeping a tight control over money supply so as to control spending is highly questionable. Spending they say is not only dependant on the amount of money in the ...

Chapter 20 – Practice Questions 1. Which of the following is correct

... 7. Some countries have high minimum wages and require a lengthy and costly process to get permission to open a business a. Reducing either the minimum wage or the time and cost to open a business would have no effect on the long-run aggregate supply curve. b. Reducing the minimum wage and the time a ...

... 7. Some countries have high minimum wages and require a lengthy and costly process to get permission to open a business a. Reducing either the minimum wage or the time and cost to open a business would have no effect on the long-run aggregate supply curve. b. Reducing the minimum wage and the time a ...

STANDING AT THE ABYSS: MONETARY POLICY AT THE ZERO LOWER BOUND

... authority’s position as the monopoly supplier of narrow money. The monetary authority should stabilise macroeconomic fluctuations, lowering the real interest rate during times of recession to stimulate demand and investment by increasing the quantity of reserves it lends to commercial banks (and vic ...

... authority’s position as the monopoly supplier of narrow money. The monetary authority should stabilise macroeconomic fluctuations, lowering the real interest rate during times of recession to stimulate demand and investment by increasing the quantity of reserves it lends to commercial banks (and vic ...

WHATDUNNIT? THE GREAT DEPRESSION MYSTERY

... Activity 30.2 to the students. Tell them not to reveal their occupations to others. 3. Tell the students that U.S. prosperity in the 1920s had been based to a large extent on the sale of houses and automobiles. Consumers for the first time could buy houses and cars on the installment plan, and they ...

... Activity 30.2 to the students. Tell them not to reveal their occupations to others. 3. Tell the students that U.S. prosperity in the 1920s had been based to a large extent on the sale of houses and automobiles. Consumers for the first time could buy houses and cars on the installment plan, and they ...

HE9091 Principles of Economics

... This course covers fundamental tools and applications of concepts in microeconomics and macroeconomics. The section on microeconomics focuses on markets as a mechanism for allocating scarce resources. Using tools of welfare economics, it analyses demand, supply, market system and the concepts of ela ...

... This course covers fundamental tools and applications of concepts in microeconomics and macroeconomics. The section on microeconomics focuses on markets as a mechanism for allocating scarce resources. Using tools of welfare economics, it analyses demand, supply, market system and the concepts of ela ...

BD104_fme_lnt_003_Ma..

... (a) A higher price level reduces the real value or purchasing power of the public’s accumulated savings balances. (b) Real value of assets with fixed money values (eg. savings accounts, bonds etc.) diminishes. (c) As a result, the public is poorer in real terms and will reduce spending. ...

... (a) A higher price level reduces the real value or purchasing power of the public’s accumulated savings balances. (b) Real value of assets with fixed money values (eg. savings accounts, bonds etc.) diminishes. (c) As a result, the public is poorer in real terms and will reduce spending. ...

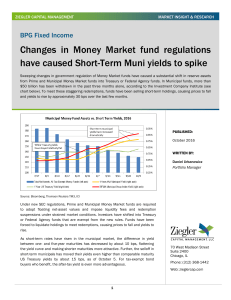

Changes In Money Market Fund Regulations

... short-term municipals has moved their yields even higher than comparable maturity US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...

... short-term municipals has moved their yields even higher than comparable maturity US Treasury yields by about 15 bps, as of October 5. For tax-exempt bond buyers who benefit, the after-tax yield is even more advantageous. ...

List of Key Concepts and Graphs

... Key terms: Expansionary fiscal policy, contractionary fiscal policy, budget deficit, budget surplus, built-in stabilizer, discretionary policy, progressive tax system, regressive tax system, proportional tax system, crowding-out effect, net export effect, Federal Reserve Board of Governors, open-mar ...

... Key terms: Expansionary fiscal policy, contractionary fiscal policy, budget deficit, budget surplus, built-in stabilizer, discretionary policy, progressive tax system, regressive tax system, proportional tax system, crowding-out effect, net export effect, Federal Reserve Board of Governors, open-mar ...

ch25 - Index of

... The main components of spending that depend on the real interest rate are spending by households on durable goods and investment – When these components of spending are sensitive to the interest rate, then the Fed can influence the economy through small variations in its target federal funds rate ...

... The main components of spending that depend on the real interest rate are spending by households on durable goods and investment – When these components of spending are sensitive to the interest rate, then the Fed can influence the economy through small variations in its target federal funds rate ...

The Conduct of Monetary Policy Kevin M. Warsh

... panics, a central bank may well be able to pull the proverbial rabbit out of the hat. Nevertheless, we should push strongly against the view that central bank heroics in times of panic can be replicated in more benign periods. Monetary policy may be considerably more limited in scope and efficacy wh ...

... panics, a central bank may well be able to pull the proverbial rabbit out of the hat. Nevertheless, we should push strongly against the view that central bank heroics in times of panic can be replicated in more benign periods. Monetary policy may be considerably more limited in scope and efficacy wh ...

W C B ?

... contention exists whether a central bank should seek to achieve both monetary and financial stability, and whether this is indeed even possible. Proponents of financial stability standards, seen to be supportive of a “leaning against the wind” strategy, advocate measures to introduce countercyclical ...

... contention exists whether a central bank should seek to achieve both monetary and financial stability, and whether this is indeed even possible. Proponents of financial stability standards, seen to be supportive of a “leaning against the wind” strategy, advocate measures to introduce countercyclical ...

The CORE Problem Part 3 of X parts

... was appointed as RECEIVER over the bankrupt United States in reorganization plan #26, in 1950, Title 5, section 903, Public Law 94-564. The Secretary of Treasury of Puerto Rico, title 27, code of federal regulations, section 251.11, the title “Secretary of the Treasury” is a euphemistic abbreviation ...

... was appointed as RECEIVER over the bankrupt United States in reorganization plan #26, in 1950, Title 5, section 903, Public Law 94-564. The Secretary of Treasury of Puerto Rico, title 27, code of federal regulations, section 251.11, the title “Secretary of the Treasury” is a euphemistic abbreviation ...

“Banking, Finance, and Money: a Socio

... historical record, such as it exists, the essential point is that it sheds light on an alternative approach to finance, banks, and money. To that end, we would locate the origin of money in credit and debt relations, with the money of account emphasized as the numeraire in which credits and debts a ...

... historical record, such as it exists, the essential point is that it sheds light on an alternative approach to finance, banks, and money. To that end, we would locate the origin of money in credit and debt relations, with the money of account emphasized as the numeraire in which credits and debts a ...