Broker-Dealer Trading Activities

... Regular and rigorous reviews - “An important focus of the NASD’s examination program concerns the review of a member’s procedures to regularly and rigorously examine execution quality likely to be obtained from the different markets or market makers trading a security. The requirement to regularly a ...

... Regular and rigorous reviews - “An important focus of the NASD’s examination program concerns the review of a member’s procedures to regularly and rigorously examine execution quality likely to be obtained from the different markets or market makers trading a security. The requirement to regularly a ...

Financial Instruments

... Interest is defined as compensation for the time value of money. By way of example, if the asset is held for trading purposes to make short term gains from any increase in its market value, it should be classified at fair value. Classification of financial liabilities Financial liabilities should ge ...

... Interest is defined as compensation for the time value of money. By way of example, if the asset is held for trading purposes to make short term gains from any increase in its market value, it should be classified at fair value. Classification of financial liabilities Financial liabilities should ge ...

Equilibrium in Securities Markets with Heterogeneous

... The relative weights of income and dividend in consumption vary over time, which lead to time-varying covariances between the stock market’s dividend process and the state prices. Consequently, the stock market risk premium is time-varying in line with the evidence from empirical studies, cf. Cochra ...

... The relative weights of income and dividend in consumption vary over time, which lead to time-varying covariances between the stock market’s dividend process and the state prices. Consequently, the stock market risk premium is time-varying in line with the evidence from empirical studies, cf. Cochra ...

1 Two periods market

... The key proof is the Minkowski separation theorem: if C1 C2 are non empty convex subset of Rk , C1 being closed and C2 being compact, there exists a ∈ Rk , non null, b1 , b2 ∈ R such that ha, xi ≤ b1 < b2 ≤ ha, yi, ∀x ∈ C1 , y ∈ C2 . P Let us denote the simplex ∆n = {y ∈ (R+ )n+1 , i yi = 1}. Proof: ...

... The key proof is the Minkowski separation theorem: if C1 C2 are non empty convex subset of Rk , C1 being closed and C2 being compact, there exists a ∈ Rk , non null, b1 , b2 ∈ R such that ha, xi ≤ b1 < b2 ≤ ha, yi, ∀x ∈ C1 , y ∈ C2 . P Let us denote the simplex ∆n = {y ∈ (R+ )n+1 , i yi = 1}. Proof: ...

Download attachment

... For establishing a MCo., a party applies to the CLA for registration. For granting registration, the CLA evaluates the application in the framework of the above-mentioned law. When a MCo., registered with the CLA, it submits another application for initiating operations - floatation of Modarabas. Th ...

... For establishing a MCo., a party applies to the CLA for registration. For granting registration, the CLA evaluates the application in the framework of the above-mentioned law. When a MCo., registered with the CLA, it submits another application for initiating operations - floatation of Modarabas. Th ...

The Stock Market and Capital Accumulation

... This paper interprets data from the U.S. nonfarm, nonfinancial corporate sector within the zero-rent framework. I calculate the quantity of capital from the observed value of corporate securities. I also calculate the product of capital, the amount of output produced each year by a unit of capital. ...

... This paper interprets data from the U.S. nonfarm, nonfinancial corporate sector within the zero-rent framework. I calculate the quantity of capital from the observed value of corporate securities. I also calculate the product of capital, the amount of output produced each year by a unit of capital. ...

Inflation Risk Management in Project Finance

... terms do not correspond. Consequent financial risk can erode their differential, represented by net equity, through a profit & loss imbalance producing a net loss. When volatility is high and liquid ity shrinks, the issue becomes even more important, as it happens during crises and recessions. Imbal ...

... terms do not correspond. Consequent financial risk can erode their differential, represented by net equity, through a profit & loss imbalance producing a net loss. When volatility is high and liquid ity shrinks, the issue becomes even more important, as it happens during crises and recessions. Imbal ...

- Franklin Templeton Investments

... approach to analyze the prepayment behavior of individual ARMs to identify those with the most attractive prepayment profiles and focused on seasoned ARMs. Such securities have typically been through several interest-rate cycles and therefore tend to be less sensitive to changes in interest rates, c ...

... approach to analyze the prepayment behavior of individual ARMs to identify those with the most attractive prepayment profiles and focused on seasoned ARMs. Such securities have typically been through several interest-rate cycles and therefore tend to be less sensitive to changes in interest rates, c ...

Taxation and Economic Efficiency

... framework (Lucas (1967) and Treadway (1968)). In such a setting, firms invest until the market value of an additional unit of capital equals the after-tax cost of purchasing and installing it. That is, managers invest as long as each dollar spent raises the market value of the firm by more than one ...

... framework (Lucas (1967) and Treadway (1968)). In such a setting, firms invest until the market value of an additional unit of capital equals the after-tax cost of purchasing and installing it. That is, managers invest as long as each dollar spent raises the market value of the firm by more than one ...

NBER VOLUNTARY WELFARE RESEARCH

... analysis is of interest in its own right, but it also provides an essential ingredient in the following evaluation of the case for voluntary debt reduction. At this stage it is sufficient to observe that (5) implies that debt reduction does not help the creditors if it depresses investment or raises ...

... analysis is of interest in its own right, but it also provides an essential ingredient in the following evaluation of the case for voluntary debt reduction. At this stage it is sufficient to observe that (5) implies that debt reduction does not help the creditors if it depresses investment or raises ...

Endogenous risk in a DSGE model with capital-constrained …nancial intermediaries Hans Dewachter

... that capital constraints on …nancial intermediaries are an important factor for understanding the risk attitude of these institutions. Gilchrist and Zakrajeck (2012) relate the predictive power of their bond premium for the business cycle to the risk-bearing capacity of the marginal investors in the ...

... that capital constraints on …nancial intermediaries are an important factor for understanding the risk attitude of these institutions. Gilchrist and Zakrajeck (2012) relate the predictive power of their bond premium for the business cycle to the risk-bearing capacity of the marginal investors in the ...

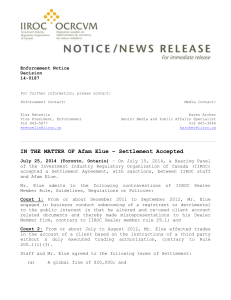

14-0187 Attachment - Settlement Agreement - Afam Elue

... IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. Created in 2008 through the consolidation of the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high qual ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. Created in 2008 through the consolidation of the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high qual ...

Recessions and balanced portfolio returns

... Executive Summary. Given the rising risk of a renewed U.S. recession, investors may wonder about the merits of a more “defensive” posture for their broad portfolio. To provide perspective, we calculated the historical returns of a balanced 50% equity/50% bond portfolio under two distinct U.S. busine ...

... Executive Summary. Given the rising risk of a renewed U.S. recession, investors may wonder about the merits of a more “defensive” posture for their broad portfolio. To provide perspective, we calculated the historical returns of a balanced 50% equity/50% bond portfolio under two distinct U.S. busine ...

options markets - AUEB e

... • Option issued by a company to executives • When the option is exercised the company issues more stock ...

... • Option issued by a company to executives • When the option is exercised the company issues more stock ...

4d. Minutes 26 November Appendix D RTF

... Anthony Mayer: No. I can let you have separately a schedule of all members so not to waste your time. There are, on a board of ten, two members of the black and ethnic minorities; three women; we have got three people who are experts in responsible investment. Just to give you an example, Michael De ...

... Anthony Mayer: No. I can let you have separately a schedule of all members so not to waste your time. There are, on a board of ten, two members of the black and ethnic minorities; three women; we have got three people who are experts in responsible investment. Just to give you an example, Michael De ...

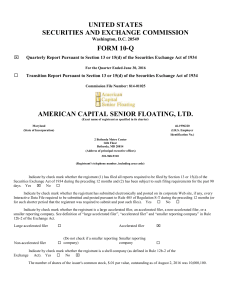

american capital senior floating, ltd. - corporate

... Increase in prepaid expenses and other assets Decrease in interest payable (Decrease) increase in other liabilities and accrued expenses Decrease in payable to affiliate Increase (decrease) in management fee payable ...

... Increase in prepaid expenses and other assets Decrease in interest payable (Decrease) increase in other liabilities and accrued expenses Decrease in payable to affiliate Increase (decrease) in management fee payable ...

Speculative Growth, Overreaction, and the Welfare Cost of Technology-Driven Bubbles

... contrast, the price-dividend ratio in long-run U.S. stock market data is volatile and highly persistent–close to a random walk. The model result obtains because rational agents understand that technology shocks give rise to both income and substitution effects which work in opposite directions. The t ...

... contrast, the price-dividend ratio in long-run U.S. stock market data is volatile and highly persistent–close to a random walk. The model result obtains because rational agents understand that technology shocks give rise to both income and substitution effects which work in opposite directions. The t ...

Annual Report

... activities: fiduciary management, internal control and socially responsible investment. MN has been involved in fiduciary management right from the start and we are one of the parties that has developed this concept to the full. We advise and support clients throughout the entire asset management pr ...

... activities: fiduciary management, internal control and socially responsible investment. MN has been involved in fiduciary management right from the start and we are one of the parties that has developed this concept to the full. We advise and support clients throughout the entire asset management pr ...

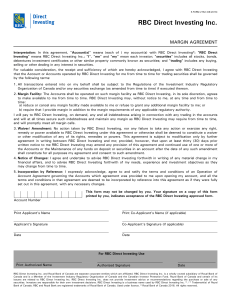

Margin Agreement - RBC Direct Investing

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.