Consumption, inflation risk and dynamic hedging

... Introduction The importance of risk management has inspired empirical and theoretical contributions to investment and consumption decision making under uncertainty. Most of the literature on economic risk and risk behavior dealing with investment, consumption and hedging decisions has incorporated t ...

... Introduction The importance of risk management has inspired empirical and theoretical contributions to investment and consumption decision making under uncertainty. Most of the literature on economic risk and risk behavior dealing with investment, consumption and hedging decisions has incorporated t ...

Financial Soundness Indicators: - svgfsa.com

... • Assesses extent to which credit unions can provide a safe environment to protect their members’ money. ...

... • Assesses extent to which credit unions can provide a safe environment to protect their members’ money. ...

Active Management Performance Cycles

... These results are unlikely to surprise many investors; it is widely known that the strength of active management opportunities differs by asset and sub-asset class. Thus, in our research, we took a deeper dive to determine if there were market attributes that could help explain or even predict when ...

... These results are unlikely to surprise many investors; it is widely known that the strength of active management opportunities differs by asset and sub-asset class. Thus, in our research, we took a deeper dive to determine if there were market attributes that could help explain or even predict when ...

SCA prepares for growth and higher margins

... Colombia and Chile. SCA’s goal is organic growth of more than 50% over the next 5 years, from today’s USD 570m to USD 870m by 2010. Investments, acquisitions and divestments During the next few years, current investments will as before amount to about 5% of sales. Expansion investments (strategic in ...

... Colombia and Chile. SCA’s goal is organic growth of more than 50% over the next 5 years, from today’s USD 570m to USD 870m by 2010. Investments, acquisitions and divestments During the next few years, current investments will as before amount to about 5% of sales. Expansion investments (strategic in ...

Appendix - American Public Power Association

... by investors has long been recognized by economists. For example, Fisher and McGowan state: “Many users of accounting rates of return seem well aware that profits to total assets or stockholders equity may not be consistent from firm to firm or industry to industry and may not correspond to the econ ...

... by investors has long been recognized by economists. For example, Fisher and McGowan state: “Many users of accounting rates of return seem well aware that profits to total assets or stockholders equity may not be consistent from firm to firm or industry to industry and may not correspond to the econ ...

Bubbles and Crashes with Partially Sophisticated Investors!

... his expected payo¤. The payo¤ to an individual who buys a stock at time t and sells it at time s is simply (ps pt ). That is, we ignore discounting and risk aversion, and investment in our economy can only be driven by the belief that the selling price will be higher in the future.14 Beliefs about f ...

... his expected payo¤. The payo¤ to an individual who buys a stock at time t and sells it at time s is simply (ps pt ). That is, we ignore discounting and risk aversion, and investment in our economy can only be driven by the belief that the selling price will be higher in the future.14 Beliefs about f ...

Dublin City School District Comprehensive Annual Financial Report June 30, 2004

... The District provides a wide variety of educational and support services as mandated by the Ohio Revised Code or Board directives. During the 2003-2004 fiscal year the District’s fleet of 126 buses traveled approximately 10,000 miles each day providing transportation services to 7,805 public and 866 ...

... The District provides a wide variety of educational and support services as mandated by the Ohio Revised Code or Board directives. During the 2003-2004 fiscal year the District’s fleet of 126 buses traveled approximately 10,000 miles each day providing transportation services to 7,805 public and 866 ...

Holding Excess Foreign Reserves Versus Infrastructure Finance

... However, in reality, many countries that have adopted more flexible exchange rate regimes (including managed floats) do not allow for such variability. • Social (or opportunity) cost: This is the difference between the yield on reserves and the marginal productivity of an alternative investment5. In ...

... However, in reality, many countries that have adopted more flexible exchange rate regimes (including managed floats) do not allow for such variability. • Social (or opportunity) cost: This is the difference between the yield on reserves and the marginal productivity of an alternative investment5. In ...

Annual return 2014 - Guidance notes - Forms

... A charity must say whether or not it has a trading subsidiary. A trading subsidiary is a company owned and controlled by one or more charities which is set up in order to trade on their behalf. Its purpose is usually to create income for its parent charity or charities. The advantage of using tradin ...

... A charity must say whether or not it has a trading subsidiary. A trading subsidiary is a company owned and controlled by one or more charities which is set up in order to trade on their behalf. Its purpose is usually to create income for its parent charity or charities. The advantage of using tradin ...

Comparing different regulatory measures to control stock market volatility: a general equilibrium analysis

... that one can compare both the direct and indirect effects of these different measures on the financial and real sectors of an economy within the same economic setting. The dynamic, stochastic general equilibrium model we construct is of a production economy that is populated by multiple investors w ...

... that one can compare both the direct and indirect effects of these different measures on the financial and real sectors of an economy within the same economic setting. The dynamic, stochastic general equilibrium model we construct is of a production economy that is populated by multiple investors w ...

Free Full text

... implement structural reforms to diversify the economy and further reduce unemployment. Directors encouraged the authorities to continue to move toward risk-based supervision and to increase resources for entities safeguarding stability of the large and interconnected financial system. Given global r ...

... implement structural reforms to diversify the economy and further reduce unemployment. Directors encouraged the authorities to continue to move toward risk-based supervision and to increase resources for entities safeguarding stability of the large and interconnected financial system. Given global r ...

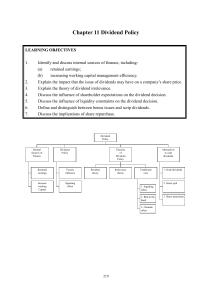

Chapter 11 Dividend Policy

... 3.3.5 In many situations, income in the form of dividends is taxed in a different way from income in the form of capital gains. This distortion in the personal tax system can have an impact on investors’ preferences. 3.3.6 From the corporate point of view this further complicates the dividend decisi ...

... 3.3.5 In many situations, income in the form of dividends is taxed in a different way from income in the form of capital gains. This distortion in the personal tax system can have an impact on investors’ preferences. 3.3.6 From the corporate point of view this further complicates the dividend decisi ...

S2AV: A valuation methodology for insurance companies

... cases buyers will generally want to discount these cash flows at the investor’s required rate of return. Traditionally this meant a projection of statutory profits, with a certain level of capital locked in, usually expressed as a percentage of Solvency I statutory minimum solvency margin, i.e., eff ...

... cases buyers will generally want to discount these cash flows at the investor’s required rate of return. Traditionally this meant a projection of statutory profits, with a certain level of capital locked in, usually expressed as a percentage of Solvency I statutory minimum solvency margin, i.e., eff ...

structured life insurance and investment products for retail investors

... the retail investor. Nowadays, the intention behind the portfolio decisions of private households is influenced to a great extend by the demographic change which has been observed in the last twenty years. Decreasing birth rates combined with increasing life expectancy cause a gap in the national ol ...

... the retail investor. Nowadays, the intention behind the portfolio decisions of private households is influenced to a great extend by the demographic change which has been observed in the last twenty years. Decreasing birth rates combined with increasing life expectancy cause a gap in the national ol ...

Chapter 19 Savings and Investment Strategies

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

PF 8.01

... lifestyles make saving 30% unrealistic, start a plan to continually save/invest a fixed amount • Use a “step” approach; aim to increase % each year ...

... lifestyles make saving 30% unrealistic, start a plan to continually save/invest a fixed amount • Use a “step” approach; aim to increase % each year ...

Answers to Before You Go On Questions

... The impact of a project on a firm’s overall value or on its stock price does not depend on how the project affects the company’s accounting earnings. It depends only on how the project affects the company’s free cash flows. ...

... The impact of a project on a firm’s overall value or on its stock price does not depend on how the project affects the company’s accounting earnings. It depends only on how the project affects the company’s free cash flows. ...

pieta house cpsos limited trustees` report and accounts

... to inform attendees of the responsibilities of directors and their expected contributions to the work of the Board. Those expressing a continuing interest are then invited to participate in advisory groups. Advisory groups comprise of an existing director(s), a member(s) of the management team and p ...

... to inform attendees of the responsibilities of directors and their expected contributions to the work of the Board. Those expressing a continuing interest are then invited to participate in advisory groups. Advisory groups comprise of an existing director(s), a member(s) of the management team and p ...

Mutual Funds and Bubbles: The Surprising Role of Contractual

... changes in the advisory contract. Though the number of cases in which the contract changed is very small, it is shown that such changes benefit the investors. In a similar vein, Almazan et al. (2004) look at the constraints imposed on mutual fund managers in terms of trading restrictions. We build o ...

... changes in the advisory contract. Though the number of cases in which the contract changed is very small, it is shown that such changes benefit the investors. In a similar vein, Almazan et al. (2004) look at the constraints imposed on mutual fund managers in terms of trading restrictions. We build o ...

united states securities and exchange commission

... forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: the risk that BCD’s business will not be integrated successfully into the Company’s; the risk that the expected benefits of the acquisition may not be realized; the risk t ...

... forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: the risk that BCD’s business will not be integrated successfully into the Company’s; the risk that the expected benefits of the acquisition may not be realized; the risk t ...

registration of asset-backed securities

... PROSPECTUS: the primary disclosure document(s), by whatever name known, utilized for the purpose of offering and selling ASSET-BACKED SECURITIES to the public. RATING AGENCY: Standard and Poor's Ratings Group, a division of McGraw Hill Company; Moody's Investors Service, Inc.; Fitch Investors Servic ...

... PROSPECTUS: the primary disclosure document(s), by whatever name known, utilized for the purpose of offering and selling ASSET-BACKED SECURITIES to the public. RATING AGENCY: Standard and Poor's Ratings Group, a division of McGraw Hill Company; Moody's Investors Service, Inc.; Fitch Investors Servic ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.