Knowledge in a nutshell - UBS

... future development, but underestimate how much the overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a ...

... future development, but underestimate how much the overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a ...

Amlak International for Real Estate Finance Company

... commitment is not expected to result in the drawdown, commitment fees are recognised on a straight-line basis over the commitment period. Investment in joint ventures A joint venture is a type of joint arrangement whereby the parties that have joint control of the arrangement have rights to the net ...

... commitment is not expected to result in the drawdown, commitment fees are recognised on a straight-line basis over the commitment period. Investment in joint ventures A joint venture is a type of joint arrangement whereby the parties that have joint control of the arrangement have rights to the net ...

(ZMD-TSX) -$0.28 Target - $0.55 (BUY)

... worked over a five month period. The participants included 503 males with an average age of 53 years and 343 females with an average age of 45 years. This demonstrates that adoption occurred among doctors who have been practicing for many years, a group which many believed would have been resistant ...

... worked over a five month period. The participants included 503 males with an average age of 53 years and 343 females with an average age of 45 years. This demonstrates that adoption occurred among doctors who have been practicing for many years, a group which many believed would have been resistant ...

Chapter 6

... In general, the IRR rule works for a stand-alone project if all of the project’s negative cash flows precede its positive cash flows. whenever the cost of capital is below the IRR of 14%, the project has a positive NPV and you should undertake the investment. ...

... In general, the IRR rule works for a stand-alone project if all of the project’s negative cash flows precede its positive cash flows. whenever the cost of capital is below the IRR of 14%, the project has a positive NPV and you should undertake the investment. ...

Document

... firms and provide them with the best chance for profit with the most limited risk As the transition economies move closer and closer to free markets, they still compose only a small percentage of the world’s FDI inflows. Is there anything that these countries can do with their macroeconomic policies ...

... firms and provide them with the best chance for profit with the most limited risk As the transition economies move closer and closer to free markets, they still compose only a small percentage of the world’s FDI inflows. Is there anything that these countries can do with their macroeconomic policies ...

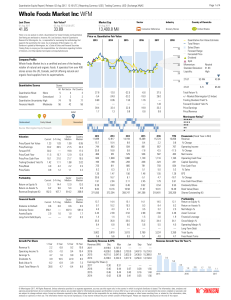

Whole Foods Market Inc WFM

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Economic Plan Supporting the Canada

... combined sewer overflows are the higher priority, funding may need to be directed towards combined sewer overflows prior to developing or upgrading wastewater facilities to meet the proposed National Performance Standards. Similary, where work to achieve the Effluent Discharge Objectives established ...

... combined sewer overflows are the higher priority, funding may need to be directed towards combined sewer overflows prior to developing or upgrading wastewater facilities to meet the proposed National Performance Standards. Similary, where work to achieve the Effluent Discharge Objectives established ...

Estimating Risk Premiums

... estimates in markets like the United States, with a large and diverisified stock market and a long history of returns on both stocks and government bonds. We will argue, however, that they yield meaningless estimates for both the beta and the risk premium in other countries, where the equity markets ...

... estimates in markets like the United States, with a large and diverisified stock market and a long history of returns on both stocks and government bonds. We will argue, however, that they yield meaningless estimates for both the beta and the risk premium in other countries, where the equity markets ...

The Handbook of Mortgage-Backed Securities, 7th Edition

... a separate prospectus for each offering in order to facilitate quicker access to capital markets. 14 This effectively allowed “off-the-shelf” offerings, as long as credit rating agencies assigned an “investment grade” 15 rating to the ABS and less than 20% of the underlying asset pool consisted of d ...

... a separate prospectus for each offering in order to facilitate quicker access to capital markets. 14 This effectively allowed “off-the-shelf” offerings, as long as credit rating agencies assigned an “investment grade” 15 rating to the ABS and less than 20% of the underlying asset pool consisted of d ...

Russian BCS Holding International Ltd. Assigned

... its equity as of the same date. We understand that the group follows a conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at mid-year 2012. Single-name issuer concentrations are high, reflecting the limit ...

... its equity as of the same date. We understand that the group follows a conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at mid-year 2012. Single-name issuer concentrations are high, reflecting the limit ...

Estimating the country risk premium in emerging markets: the case

... There have been a lot of empirical tests on the validity of the CAPM. Research has tested many areas of the CAPM application, but has mostly been concentrated on the stability of the beta coefficient over time and the strength and the nature of the linear relationship that exists between the risk and ...

... There have been a lot of empirical tests on the validity of the CAPM. Research has tested many areas of the CAPM application, but has mostly been concentrated on the stability of the beta coefficient over time and the strength and the nature of the linear relationship that exists between the risk and ...

Estate freezes: recognizing the opportunity

... Variations on an estate freeze: the section 85 share exchange and a trust A section 85 share exchange is a slightly different type of estate freeze, again named for the section of the Income Tax Act that governs it. Rather than have the company redeem shares, the owner creates a holding company, and ...

... Variations on an estate freeze: the section 85 share exchange and a trust A section 85 share exchange is a slightly different type of estate freeze, again named for the section of the Income Tax Act that governs it. Rather than have the company redeem shares, the owner creates a holding company, and ...

investment banking outline

... a. long-term investmt w/high leverage 1. better when mrkt is going up - leads to high return on equity 2. can borrow even more w/hedging b/c will have short position w/every long position 3. investmts in bonds instead of equity b/c less volatile b. private c. limited to accredited investors - net wo ...

... a. long-term investmt w/high leverage 1. better when mrkt is going up - leads to high return on equity 2. can borrow even more w/hedging b/c will have short position w/every long position 3. investmts in bonds instead of equity b/c less volatile b. private c. limited to accredited investors - net wo ...

FOR IMMEDIATE RELEASE Contact: Kelly Youngblood

... HOUSTON, Texas - Halliburton (NYSE: HAL) announced today that it is commencing a modified “Dutch auction” tender offer to repurchase shares of its common stock for an aggregate purchase price of up to $3.3 billion. Pursuant to the tender offer, company stockholders may tender all or a portion of the ...

... HOUSTON, Texas - Halliburton (NYSE: HAL) announced today that it is commencing a modified “Dutch auction” tender offer to repurchase shares of its common stock for an aggregate purchase price of up to $3.3 billion. Pursuant to the tender offer, company stockholders may tender all or a portion of the ...

Master of Science in Finance

... Management. The Investment Management concentration is designed for students interested in pursuing an investment career and completing the Chartered Financial Analyst (CFA) examinations. The Financial Analyst concentration is designed for students interested in corporate finance, investment banking ...

... Management. The Investment Management concentration is designed for students interested in pursuing an investment career and completing the Chartered Financial Analyst (CFA) examinations. The Financial Analyst concentration is designed for students interested in corporate finance, investment banking ...

Canadian Real Estate Magazine September 2011

... Brantford, Nipissing University and Mohawk College) has been a primary catalyst for investment initiatives in the downtown core. Collectively, these institutions have injected millions of dollars into the local economy and have created a new culture in the city’s downtown. Currently, Laurier Brantfo ...

... Brantford, Nipissing University and Mohawk College) has been a primary catalyst for investment initiatives in the downtown core. Collectively, these institutions have injected millions of dollars into the local economy and have created a new culture in the city’s downtown. Currently, Laurier Brantfo ...

Cetera Advisor Networks LLC

... Each advisory program requires a program-specific minimum account opening balance. At its sole discretion, the Firm may waive the minimum account size. If you establish a new account and deposit funds less than the minimum opening balance requirement, your funds will not be managed until the minimum ...

... Each advisory program requires a program-specific minimum account opening balance. At its sole discretion, the Firm may waive the minimum account size. If you establish a new account and deposit funds less than the minimum opening balance requirement, your funds will not be managed until the minimum ...

Probability and Impact Rating System

... ratings available to the public. This is to ensure that adverse PAIRS ratings and associated SOARS stances, or changes in ratings/stances, do not provoke a market over-reaction or lead to an unwarranted loss of confidence in the entity on the part of its beneficiaries. ...

... ratings available to the public. This is to ensure that adverse PAIRS ratings and associated SOARS stances, or changes in ratings/stances, do not provoke a market over-reaction or lead to an unwarranted loss of confidence in the entity on the part of its beneficiaries. ...

Adverse Selection, Liquidity, and Market Breakdown

... The equilibrium price of the risky asset is equal to the lesser of two amounts: the discounted value of ...

... The equilibrium price of the risky asset is equal to the lesser of two amounts: the discounted value of ...

MSCI Factor Indices

... (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited, including without limitation (as applicable), any liability for death or personal injury to ...

... (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited, including without limitation (as applicable), any liability for death or personal injury to ...

Submission 15 attachment - Maritime Super

... moderate expected range of volatility in returns. These types of investments are well suited to diversified portfolios of growth assets although any large or total loss of equity capital in a large project would be significantly detrimental to investment returns received by fund members in any inves ...

... moderate expected range of volatility in returns. These types of investments are well suited to diversified portfolios of growth assets although any large or total loss of equity capital in a large project would be significantly detrimental to investment returns received by fund members in any inves ...

MODERN RISK MANAGEMENT

... • There are several types of risks which any bank or corporation has to face. Today and tomorrow we are focusing especially on two of them, namely market risk (risk caused by changes in market prices) and credit risk (risk caused by changes in creditworthiness of our debtors or counterparties). • O ...

... • There are several types of risks which any bank or corporation has to face. Today and tomorrow we are focusing especially on two of them, namely market risk (risk caused by changes in market prices) and credit risk (risk caused by changes in creditworthiness of our debtors or counterparties). • O ...

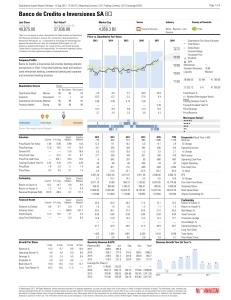

Banco de Credito e Inversiones SA BCI

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.