Financial Services Sector in Turkey

... • The Turkish banking sector has capital adequacy ratios (CAR) above the regulator limits of BRSA, which was 12%. Moreover, Turkey’s CAR exceeds that of Basel II, which was 8% and Basel III, which will gradually increase each year and will be set at a total capital ratio of 10.5% by January 2019. • ...

... • The Turkish banking sector has capital adequacy ratios (CAR) above the regulator limits of BRSA, which was 12%. Moreover, Turkey’s CAR exceeds that of Basel II, which was 8% and Basel III, which will gradually increase each year and will be set at a total capital ratio of 10.5% by January 2019. • ...

EMValWells

... these claims is to value the options as options, net the value of the options out from the aggregate equity value and divide by the actual number of shares ...

... these claims is to value the options as options, net the value of the options out from the aggregate equity value and divide by the actual number of shares ...

Form ADV - Boys Arnold

... account at the commencement of the relationship. Each client should note, however, that restrictions imposed by a client may adversely affect the composition and performance of the client’s investment portfolio. Each client should also note that his or her investment portfolio is treated individuall ...

... account at the commencement of the relationship. Each client should note, however, that restrictions imposed by a client may adversely affect the composition and performance of the client’s investment portfolio. Each client should also note that his or her investment portfolio is treated individuall ...

Why Should Older People Invest Less in Stocks Than Younger

... same as a short horizon; what matters for investment decisions is the length of time between rebalancing, not the investment horizon itself. The other reason for the irrelevance of low long-term risk is subtler. Even if investors can't rebalance their portfolios, they have to be concerned about the ...

... same as a short horizon; what matters for investment decisions is the length of time between rebalancing, not the investment horizon itself. The other reason for the irrelevance of low long-term risk is subtler. Even if investors can't rebalance their portfolios, they have to be concerned about the ...

Maximizing shareholder value: a new ideology for corporate

... became possible to use junk bonds to launch hostile takeovers of even the largest corporations (Gaughan 1996: 302). Milken orchestrated most of these hostile takeovers by gaining commitments from institutional investors and S&Ls to sell their shareholdings in the target company to the corporate raid ...

... became possible to use junk bonds to launch hostile takeovers of even the largest corporations (Gaughan 1996: 302). Milken orchestrated most of these hostile takeovers by gaining commitments from institutional investors and S&Ls to sell their shareholdings in the target company to the corporate raid ...

Common Stocks_Ch06

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

Foreign Direct Investment in an Emerging Market

... This paper focuses on the strategy formulation process by exploring how strategies, especially those for foreign direct investments (FDIs), are being formulated, and on what they are based. More specifically, this research analyzes how a company's strategy formulation process may change or may need ...

... This paper focuses on the strategy formulation process by exploring how strategies, especially those for foreign direct investments (FDIs), are being formulated, and on what they are based. More specifically, this research analyzes how a company's strategy formulation process may change or may need ...

Money Morning 24 November 2014

... The information , opinion, views contained in this document are as per prevailing conditions and are of the date of appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Ne ...

... The information , opinion, views contained in this document are as per prevailing conditions and are of the date of appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Ne ...

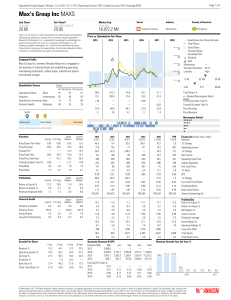

Max`s Group Inc MAXS

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

CCG AREUEA - Research Repository UCD

... risk and unsystematic (idiosyncratic) risk (see Merton’s (1987) model for a theoretical framework). In the empirical asset pricing literature, however, evidence on the role of idiosyncratic risk for equity pricing is mixed. Ang, Hodrick Xing and Zhang (2006) find the relationship between idiosyncrat ...

... risk and unsystematic (idiosyncratic) risk (see Merton’s (1987) model for a theoretical framework). In the empirical asset pricing literature, however, evidence on the role of idiosyncratic risk for equity pricing is mixed. Ang, Hodrick Xing and Zhang (2006) find the relationship between idiosyncrat ...

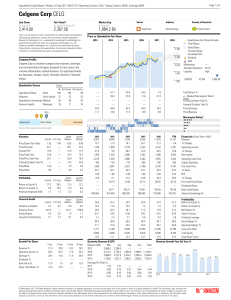

Celgene Corp CELG

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Fin30233_F2016_Hedging and VAR with DeltaGamma

... Since Delta-Gamma VaR is nonlinear function of Delta and Gamma, cannot simply add VaR, as in Delta-VaR. For portfolio of linear and/or nonlinear derivatives on a single underlying: 1) compute portfolio Delta Dp 2) compute portfolio Gamma Gp ...

... Since Delta-Gamma VaR is nonlinear function of Delta and Gamma, cannot simply add VaR, as in Delta-VaR. For portfolio of linear and/or nonlinear derivatives on a single underlying: 1) compute portfolio Delta Dp 2) compute portfolio Gamma Gp ...

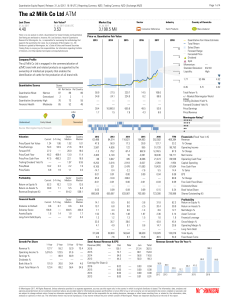

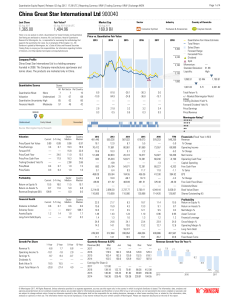

China Great Star International Ltd 900040

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

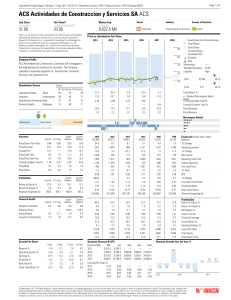

ACS Actividades de Construccion y Servicios SA ACS

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

investing for the future

... begin to set up a BIB immediately, it would not make its first loans until 2014, or more likely 2015. It is to be hoped that by then the UK economy will be well out of the current recession and growing at a reasonably healthy pace. If it is not, then the economy clearly has fundamental weaknesses we ...

... begin to set up a BIB immediately, it would not make its first loans until 2014, or more likely 2015. It is to be hoped that by then the UK economy will be well out of the current recession and growing at a reasonably healthy pace. If it is not, then the economy clearly has fundamental weaknesses we ...

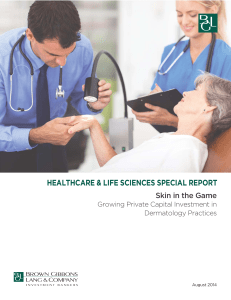

Middle Market Leverage Multiples

... Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments have been made by private equity sponsors. Over the past year, the number of new funds seeking an investment in dermatology has grown dramatically. Existing platforms have continued ...

... Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments have been made by private equity sponsors. Over the past year, the number of new funds seeking an investment in dermatology has grown dramatically. Existing platforms have continued ...

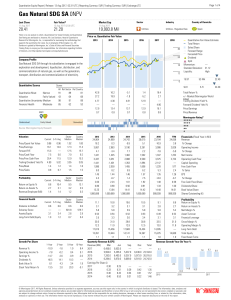

Gas Natural SDG SA 0NPV

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Capital Directions

... in-depth information about your financial goals, time horizon, risk tolerance, tax situation and other circumstances that are unique to you. To obtain this information, your Financial Advisor will talk with you to learn and understand your needs. For instance, you may be planning to change careers; ...

... in-depth information about your financial goals, time horizon, risk tolerance, tax situation and other circumstances that are unique to you. To obtain this information, your Financial Advisor will talk with you to learn and understand your needs. For instance, you may be planning to change careers; ...

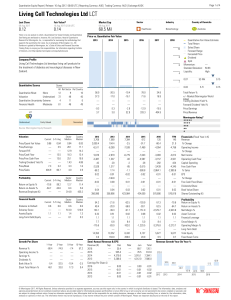

Living Cell Technologies Ltd LCT

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Markscheme - Humanities @ IICS

... UAE in 2007 (paragraph ) when it had to lower interest rates to maintain peg to US dollar • when the exchange rate is fixed to a currency that is weak, it can lead to imported inflation when the costs of imported resources rise • low value of US dollar causes relatively cheaper exports and expensiv ...

... UAE in 2007 (paragraph ) when it had to lower interest rates to maintain peg to US dollar • when the exchange rate is fixed to a currency that is weak, it can lead to imported inflation when the costs of imported resources rise • low value of US dollar causes relatively cheaper exports and expensiv ...

View Marcia Wagner`s PowerPoint presentation here

... For Transactions Prior to June 9, 2017 ◦ BD firms and reps may continue to earn commissions (variable compensation) ◦ Grandfathered transaction must not have violated ...

... For Transactions Prior to June 9, 2017 ◦ BD firms and reps may continue to earn commissions (variable compensation) ◦ Grandfathered transaction must not have violated ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.