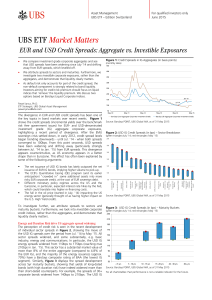

Market Matters EUR and USD Credit Spreads

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

Part 2A of Form ADV: Firm Brochure

... Because some types of investments, such as options and private placements, involve certain additional degrees of risk, they will only be implemented/recommended when consistent with the client's stated investment objectives, tolerance for risk, liquidity and suitability. Further, private placements ...

... Because some types of investments, such as options and private placements, involve certain additional degrees of risk, they will only be implemented/recommended when consistent with the client's stated investment objectives, tolerance for risk, liquidity and suitability. Further, private placements ...

Challenger - Submission to the Financial System Inquiry. Issues set

... The submission presents an international comparison of pension systems to identify possible parametric changes which could improve the performance and fiscal sustainability of Australia’s post-retirement arrangements. We consider the characteristics of products currently used in Australia to deliver ...

... The submission presents an international comparison of pension systems to identify possible parametric changes which could improve the performance and fiscal sustainability of Australia’s post-retirement arrangements. We consider the characteristics of products currently used in Australia to deliver ...

Chapter 12: The Cost of Capital

... • Same cost found in Chapter 12 as yield to maturity on bonds (kd). • e.g. Suppose that a company issues bonds with a before tax cost of 10%. • Since interest payments are tax deductible, the true cost of the debt is the after tax cost. • If the company’s tax rate (state and federal combined) is 40% ...

... • Same cost found in Chapter 12 as yield to maturity on bonds (kd). • e.g. Suppose that a company issues bonds with a before tax cost of 10%. • Since interest payments are tax deductible, the true cost of the debt is the after tax cost. • If the company’s tax rate (state and federal combined) is 40% ...

equity method of accounting

... Dividends from associate’s pre-acquisition earnings Dr Cash at bank Cr Investment in X Ltd Share of associate’s profit Dr Investment in X Ltd Cr Share of associate’s profit ...

... Dividends from associate’s pre-acquisition earnings Dr Cash at bank Cr Investment in X Ltd Share of associate’s profit Dr Investment in X Ltd Cr Share of associate’s profit ...

Benefits Accruing to Companies Listed at the

... private firms (those that file with the Securities and Exchange Commission (S.E.C.)), usually because they have issued public bonds) and show that they are more likely to go public if they have private equity investors. This supports Black and Gilson's (1998) view that stock market listings provide ...

... private firms (those that file with the Securities and Exchange Commission (S.E.C.)), usually because they have issued public bonds) and show that they are more likely to go public if they have private equity investors. This supports Black and Gilson's (1998) view that stock market listings provide ...

Are Workers' Enterprises entry policies conventional

... prices of WEs and PMFs are equal (Moretto and Rossini, 2005) with labour fixed after entry. Labour (firm) specific -> firms reluctant to vary it. Rigidity makes PMF close to WE. ...

... prices of WEs and PMFs are equal (Moretto and Rossini, 2005) with labour fixed after entry. Labour (firm) specific -> firms reluctant to vary it. Rigidity makes PMF close to WE. ...

NBER WORKING PAPER SERIES LEVERAGE CONSTRAINTS AND THE INTERNATIONAL TRANSMISSION OF SHOCKS

... financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet constraints and portfolio interdependence generate an important cross-country propagation effect. ...

... financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet constraints and portfolio interdependence generate an important cross-country propagation effect. ...

Eco Bulletin 3508.indd

... boomed in the 5 years to mid 2007. But that has now changed with a vengeance. Our estimates of HEW show that annual HEW dropped from $5.7bn in June 2007 to $4.1bn in December 2007. A further $1.8bn has been shaved off in Q1 2008. This is entirely consistent with the sharp fall in the value of housin ...

... boomed in the 5 years to mid 2007. But that has now changed with a vengeance. Our estimates of HEW show that annual HEW dropped from $5.7bn in June 2007 to $4.1bn in December 2007. A further $1.8bn has been shaved off in Q1 2008. This is entirely consistent with the sharp fall in the value of housin ...

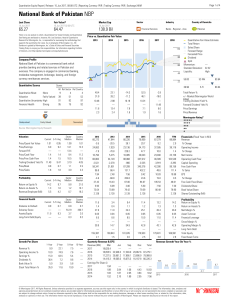

National Bank of Pakistan NBP

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Incentive Compensation – The White Swan in Risk Management

... definition, the peer comparators may be a homogenous group ...

... definition, the peer comparators may be a homogenous group ...

Document

... of the fastest rates in the EU. According to the Commission winter 2017 forecast, real GDP is projected to have increased by 3.3 % in 2016 due mainly to favourable developments in net exports, as well as solid household spending growth amidst a strong labour market recovery. Overall investment activ ...

... of the fastest rates in the EU. According to the Commission winter 2017 forecast, real GDP is projected to have increased by 3.3 % in 2016 due mainly to favourable developments in net exports, as well as solid household spending growth amidst a strong labour market recovery. Overall investment activ ...

Chapter 6 Common Stocks

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

ANNUAL REPORT 2013

... In overseas instant noodles, prices were raised last fiscal year from the latter half of the second quarter through the third quarter, which proved effective, and we continued to subsequently strengthen partnerships with major retailers. We also conducted aggressive marketing activities for core pro ...

... In overseas instant noodles, prices were raised last fiscal year from the latter half of the second quarter through the third quarter, which proved effective, and we continued to subsequently strengthen partnerships with major retailers. We also conducted aggressive marketing activities for core pro ...

Excess demand and equilibration in multi-security financial

... that supplies and payoff distributions are known in an experimental context (because they are design features), making excess demand readily computable (up to an additive constant). In the field, neither supplies nor payoff distributions are known accurately and the exercises we perform in this artic ...

... that supplies and payoff distributions are known in an experimental context (because they are design features), making excess demand readily computable (up to an additive constant). In the field, neither supplies nor payoff distributions are known accurately and the exercises we perform in this artic ...

strategija promocije investicija crne gore

... infrastructure development, poverty reduction, etc. The benefits achieved through the increase in FDI's have created strong competition in the global market of free capital, all with the aim to attract as many and as diverse FDI's as possible. The general trend in the global FDI market is the erasur ...

... infrastructure development, poverty reduction, etc. The benefits achieved through the increase in FDI's have created strong competition in the global market of free capital, all with the aim to attract as many and as diverse FDI's as possible. The general trend in the global FDI market is the erasur ...

2004 - British Museum

... will be needed to finance or underwrite future development of the Museum and the Trustees have further agreed that £5m may be drawn down from reserves over the next two years to facilitate progress on a number of major projects. Investments It is the Trustees’ policy to invest the Museum’s Trust Fun ...

... will be needed to finance or underwrite future development of the Museum and the Trustees have further agreed that £5m may be drawn down from reserves over the next two years to facilitate progress on a number of major projects. Investments It is the Trustees’ policy to invest the Museum’s Trust Fun ...

Indian Private Equity: Route to Resurgence

... Private equity managers, investors and executives at portfolio companies are already taking steps in this direction by employing the lessons learned in recent years. Private equity firms are refining their investment strategies, focusing on high-quality entrepreneurs and capturing greater levels of ...

... Private equity managers, investors and executives at portfolio companies are already taking steps in this direction by employing the lessons learned in recent years. Private equity firms are refining their investment strategies, focusing on high-quality entrepreneurs and capturing greater levels of ...

Evolutionary Theory, Kinship, and Childbirth in Cross

... than men and are more discriminating when selecting a mate because they have a lower potential rate of reproduction than men do. Men tend to maximize their Darwinian fitness by competing with each other for opportunities to mate, producing additional offspring as a result.2 Cross-cultural research o ...

... than men and are more discriminating when selecting a mate because they have a lower potential rate of reproduction than men do. Men tend to maximize their Darwinian fitness by competing with each other for opportunities to mate, producing additional offspring as a result.2 Cross-cultural research o ...

Stochastic dominance and behavior towards risk: The market for

... the S&P 500 by a whopping 482%1. Technology stocks in general showed a similar trend, as evident from NASDAQ 100 Index which quadrupled over the same period, and outperformed the S&P 500 index by 268%. Following the peak of the bull market, prices of Internet stocks fell by more than 80% through the ...

... the S&P 500 by a whopping 482%1. Technology stocks in general showed a similar trend, as evident from NASDAQ 100 Index which quadrupled over the same period, and outperformed the S&P 500 index by 268%. Following the peak of the bull market, prices of Internet stocks fell by more than 80% through the ...

Modern Portfolio Theory: Is There Any Opportunity for Real Estate

... Real estate has its own characteristics, which significantly affect the environment of real estate portfolio management. Unlike real estate investment, stocks, bonds and other paper investments are purchased merely for investment purposes; whereas investors purchase real estate for an operational pur ...

... Real estate has its own characteristics, which significantly affect the environment of real estate portfolio management. Unlike real estate investment, stocks, bonds and other paper investments are purchased merely for investment purposes; whereas investors purchase real estate for an operational pur ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.