Fat Tails and their (Un)happy Endings

... value of equity is determined by a portfolio of options in several projects, or that each tranche comprises long and short options on the value of the portfolio.3 The natural advantage vis-à-vis the contingent claim approach is that the copula approach naturally accommodates several types of claims ...

... value of equity is determined by a portfolio of options in several projects, or that each tranche comprises long and short options on the value of the portfolio.3 The natural advantage vis-à-vis the contingent claim approach is that the copula approach naturally accommodates several types of claims ...

RDSP FAQs - Mackenzie Investments

... Yes. If the parent has been legally appointed as a guardian of the beneficiary or is otherwise authorized to act for the beneficiary, that parent can be the holder whether the child is a minor or over the age of majority. The Minister of Finance made a change to the existing rule in Budget 2012. Und ...

... Yes. If the parent has been legally appointed as a guardian of the beneficiary or is otherwise authorized to act for the beneficiary, that parent can be the holder whether the child is a minor or over the age of majority. The Minister of Finance made a change to the existing rule in Budget 2012. Und ...

Global Economics Weekly

... portfolio preferences. In a detailed analysis of the net asset positions of China and India, for example, economists Lane and Schmuckler (2006) show that the net investment positions of both are essentially ‘short equity, long debt’. Particularly following the 1997 Asian crisis, an increasing share ...

... portfolio preferences. In a detailed analysis of the net asset positions of China and India, for example, economists Lane and Schmuckler (2006) show that the net investment positions of both are essentially ‘short equity, long debt’. Particularly following the 1997 Asian crisis, an increasing share ...

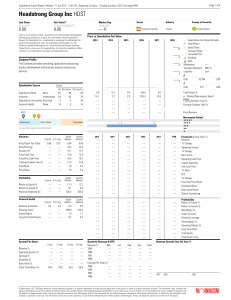

Headstrong Group Inc HDST

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Forthcoming, Journal of Empirical Finance Measuring The Market

... funds used positive feedback trading strategies. In this paper, we provide quantitative estimates on the market impact of hedge funds over a comprehensive set of market events, from the October 1987 stock market crash to the Asian Currency Crisis of 1997. ...

... funds used positive feedback trading strategies. In this paper, we provide quantitative estimates on the market impact of hedge funds over a comprehensive set of market events, from the October 1987 stock market crash to the Asian Currency Crisis of 1997. ...

Diversification Bias

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...

1. Introduction to risk

... and concentration has to be developed. An approach that incorporates size, maturity, credit quality and systematic risk into a single portfolio measure is required. 2.7. A key decision that has to be made when modeling credit risk is the choice of time horizon. Generally, the time horizon chosen sho ...

... and concentration has to be developed. An approach that incorporates size, maturity, credit quality and systematic risk into a single portfolio measure is required. 2.7. A key decision that has to be made when modeling credit risk is the choice of time horizon. Generally, the time horizon chosen sho ...

Fundamental indexation: an active value strategy in disguise

... that pricing errors are random (in particular, unrelated to valuation ratios), the theoretical case for a systematic outperformance of fundamental indexation breaks down. We can illustrate the strong value tilt of fundamental indices by regressing the returns of the RAFI 1000 index (the Research Aff ...

... that pricing errors are random (in particular, unrelated to valuation ratios), the theoretical case for a systematic outperformance of fundamental indexation breaks down. We can illustrate the strong value tilt of fundamental indices by regressing the returns of the RAFI 1000 index (the Research Aff ...

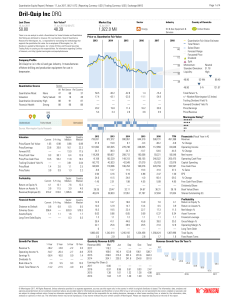

Dril-Quip Inc DRQ

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

More Finance Questions

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

ca-ipcc (1st group) financial management (71 imp questions)

... charges do not vary with the firms earnings before interest and tax, a magnified effect is produced on earnings per share. Whether the leverage is favourable in the sense increase in earnings per share more proportionately to the increased earnings before interest and tax depends on the profitabilit ...

... charges do not vary with the firms earnings before interest and tax, a magnified effect is produced on earnings per share. Whether the leverage is favourable in the sense increase in earnings per share more proportionately to the increased earnings before interest and tax depends on the profitabilit ...

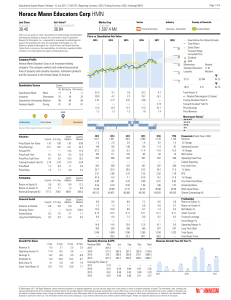

Horace Mann Educators Corp HMN

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

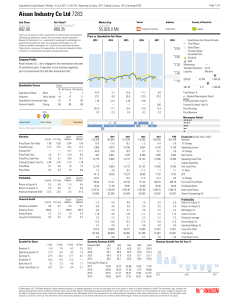

Aisan Industry Co Ltd 7283

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Prudential Requirements Consultation Paper

... product is a particular challenge for the FSC and the industry. Mechanisms readily available in some other markets, such as a full range of hedging tools or a deep and liquid money market, are either not available or only in very restricted forms. The financial conservatism of Jamaican retail invest ...

... product is a particular challenge for the FSC and the industry. Mechanisms readily available in some other markets, such as a full range of hedging tools or a deep and liquid money market, are either not available or only in very restricted forms. The financial conservatism of Jamaican retail invest ...

The Performance of IPO Investment Strategies and Pseudo Market

... choice of IPO investment strategies to be irrelevant. Since we calculate the performance of all investment strategies by the very same monthly returns of the IPOs and the benchmarks, any difference in performance among strategies must be due to the different methods of aggregating monthly returns im ...

... choice of IPO investment strategies to be irrelevant. Since we calculate the performance of all investment strategies by the very same monthly returns of the IPOs and the benchmarks, any difference in performance among strategies must be due to the different methods of aggregating monthly returns im ...

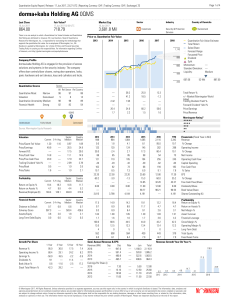

dorma+kaba Holding AG 0QMS

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

Value Creation in Private Equity

... share, institutionalization, brand creation and diversification of customer base, to name a few factors, resulted in above market multiple expansion. The median entry multiple for private equity deals was 10% lower than that of public benchmarks, while the exit multiple was 1% lower than the benchma ...

... share, institutionalization, brand creation and diversification of customer base, to name a few factors, resulted in above market multiple expansion. The median entry multiple for private equity deals was 10% lower than that of public benchmarks, while the exit multiple was 1% lower than the benchma ...

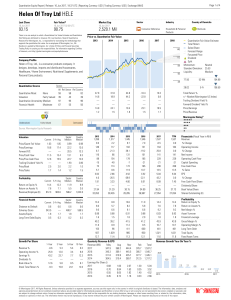

Helen Of Troy Ltd HELE

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

... guarantee the completeness or accuracy of the assumptions or models used in determining the quantitative equity ratings. In addition, there is the risk that the price target will not be met due to such things as unforeseen changes in demand for the company’s products, changes in management, technolo ...

The Diamond Investment Promise

... for investment. Without knowing the price, investors cannot asses an investment or make an informed decision about buying or selling. Great efforts are being made by the burgeoning diamond investment entities to provide price information in a transparent and objective way. A third issue is the need ...

... for investment. Without knowing the price, investors cannot asses an investment or make an informed decision about buying or selling. Great efforts are being made by the burgeoning diamond investment entities to provide price information in a transparent and objective way. A third issue is the need ...

doc

... the rate at which the PPF curve shifts out is a function of choice of consumption/saving (producer /consumer goods) today; at the steady-state equilibrium choice of producer goods and consumer goods, capital is created at the rate it wears out – the PPF will not shift out if this point is chosen; if ...

... the rate at which the PPF curve shifts out is a function of choice of consumption/saving (producer /consumer goods) today; at the steady-state equilibrium choice of producer goods and consumer goods, capital is created at the rate it wears out – the PPF will not shift out if this point is chosen; if ...

The impact of the Credit Crunch on the Sterling Corporate Bond

... predominantly driven by cash flow (e.g. the need to invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets ...

... predominantly driven by cash flow (e.g. the need to invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.