Toromont Announces Fourth Quarter 2013 Results

... Words such as "plans", "intends", "outlook", "expects", "anticipates", "estimates", "believes", "likely", "should", "could", "will", "may" and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release is based on ...

... Words such as "plans", "intends", "outlook", "expects", "anticipates", "estimates", "believes", "likely", "should", "could", "will", "may" and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release is based on ...

SECURITIES AND EXCHANGE COMMISSION Washington, D. C.

... The Company cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Annual Report on Form 10-K (“Report”) or made by management of the Company involve risks and uncertainties and are subject to change based on v ...

... The Company cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Annual Report on Form 10-K (“Report”) or made by management of the Company involve risks and uncertainties and are subject to change based on v ...

Ch 14

... 7. a. change in dividend policy represents an unambiguous signal to investors concerning management’s assessment of the future prospects (i.e., earnings and cash flows) of the company. As insiders, management is perceived as having access to more complete information about the future profitability o ...

... 7. a. change in dividend policy represents an unambiguous signal to investors concerning management’s assessment of the future prospects (i.e., earnings and cash flows) of the company. As insiders, management is perceived as having access to more complete information about the future profitability o ...

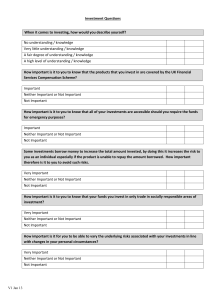

DT 20 questions - IndependentAdviceFrom.Me

... Investment Timeframe When do you intend to use the invested money? ...

... Investment Timeframe When do you intend to use the invested money? ...

9535 Testimony [Dave] - Maryland Public Service Commission

... Company (320 U.S. 591). In its 1942 decision, the U.S. Supreme Court stated: "The rate-making process under the (Natural Gas) Act, i.e., the fixing of 'just and reasonable' rates, involves a balancing of the investor and consumer interests...From the investor or company point of view it is important ...

... Company (320 U.S. 591). In its 1942 decision, the U.S. Supreme Court stated: "The rate-making process under the (Natural Gas) Act, i.e., the fixing of 'just and reasonable' rates, involves a balancing of the investor and consumer interests...From the investor or company point of view it is important ...

Liquidity Pricing of Illiquid Assets

... Keywords: Lliquidity, Asset Pricing, Risk Premium, Real Estate ...

... Keywords: Lliquidity, Asset Pricing, Risk Premium, Real Estate ...

Return Expectations from Venture Capital Deals in Europe

... Given the lack of private and institutional investment in early stage companies, European governments have become increasingly involved. The EVCA, the European Venture Capital Association, notes that government agencies contributed 40 % of capital fundraising in 2012 – making them the biggest VC con ...

... Given the lack of private and institutional investment in early stage companies, European governments have become increasingly involved. The EVCA, the European Venture Capital Association, notes that government agencies contributed 40 % of capital fundraising in 2012 – making them the biggest VC con ...

risk appetite renaissance - RBC Global Asset Management

... rotating into more volatile investments, undertaking a new enterprise, expanding an existing business or leaping from one employer to another. Even with this clarification in hand, there is a further complication: risk appetite is an unobserved variable. Unlike GDP growth or a dividend yield – for w ...

... rotating into more volatile investments, undertaking a new enterprise, expanding an existing business or leaping from one employer to another. Even with this clarification in hand, there is a further complication: risk appetite is an unobserved variable. Unlike GDP growth or a dividend yield – for w ...

Review of Securities Law - Ministry of Business, Innovation and

... nature of the investment and the key risks associated with it. The second will provide additional disclosures necessary for an investor to make their decision. We consider that there may be a case for prescribing the length of PDSs for simpler financial products. Both the long and short form PDS wil ...

... nature of the investment and the key risks associated with it. The second will provide additional disclosures necessary for an investor to make their decision. We consider that there may be a case for prescribing the length of PDSs for simpler financial products. Both the long and short form PDS wil ...

Hanke-Guttridge Discounted Cash Flow Methodology

... carrying values, the anticipated and enacted income tax rate, and estimated taxes payable for the current year. This liability may or may not be realized during any given year, which is why it is referred to as “deferred.” Minority interest, also known as “non-controlling interest,” is defined as a ...

... carrying values, the anticipated and enacted income tax rate, and estimated taxes payable for the current year. This liability may or may not be realized during any given year, which is why it is referred to as “deferred.” Minority interest, also known as “non-controlling interest,” is defined as a ...

The Role of Regulation in Incentivizing Investment in New

... restrictions. Regulators need to take note of the fact that co-investment and sharing agreements are complex and have often proven difficult for operators to commercially agree in practice. Co-investment agreements can involve several operators investing jointly in different infrastructure component ...

... restrictions. Regulators need to take note of the fact that co-investment and sharing agreements are complex and have often proven difficult for operators to commercially agree in practice. Co-investment agreements can involve several operators investing jointly in different infrastructure component ...

Trading Is Hazardous to Your Wealth: The Common Stock

... of 11.4 percent, while the market returns 17.9 percent. The average household earns an annual return of 16.4 percent, tilts its common stock investment toward high-beta, small, value stocks, and turns over 75 percent of its portfolio annually. Overconfidence can explain high trading levels and the r ...

... of 11.4 percent, while the market returns 17.9 percent. The average household earns an annual return of 16.4 percent, tilts its common stock investment toward high-beta, small, value stocks, and turns over 75 percent of its portfolio annually. Overconfidence can explain high trading levels and the r ...

Xinfu Chen Mathematical Finance II - Pitt Mathematics

... Note that the weight changes at the end of period. For a multiple period investment, one may consider adjusting the weights from time to time. ...

... Note that the weight changes at the end of period. For a multiple period investment, one may consider adjusting the weights from time to time. ...

Smart Money: The Effect of Education on Financial Behavior

... balance sheet, the shift from de…ned bene…t to de…ned contribution pension plans, and the growing importance of private retirement accounts, require individuals to choose the amount they save, as well as the mix of assets in which they invest. Yet, participation in …nancial markets is far from unive ...

... balance sheet, the shift from de…ned bene…t to de…ned contribution pension plans, and the growing importance of private retirement accounts, require individuals to choose the amount they save, as well as the mix of assets in which they invest. Yet, participation in …nancial markets is far from unive ...

The Governance and Financial management of Endowed Charitable

... and identifies key issues that might help improve their governance and financial management. It is aimed at the lay reader with no particular expertise in law, finance or investment management. There are 900 endowed charitable foundations in England and Wales with annual income exceeding £500k, of a ...

... and identifies key issues that might help improve their governance and financial management. It is aimed at the lay reader with no particular expertise in law, finance or investment management. There are 900 endowed charitable foundations in England and Wales with annual income exceeding £500k, of a ...

CLAREMONT McKENNA COLLEGE STOCK MARKET SENTIMENT

... discount on closed-end funds could be a proxy for investor sentiment, a systematic risk factor that is priced into securities held mainly by individual investors. Lee et al. acknowledge that their paper only measures the effect of differential sentiment between individual and institutional investor ...

... discount on closed-end funds could be a proxy for investor sentiment, a systematic risk factor that is priced into securities held mainly by individual investors. Lee et al. acknowledge that their paper only measures the effect of differential sentiment between individual and institutional investor ...

CHAPTER 5 DEPOSITS AND INVESTMENTS

... moneys, together with interest or other investment income accrued on those moneys, will be required to refund the debt. [Ohio Rev. Code §133.34(D)]. Ohio Rev. Code §135.13 requires depositing inactive funds in certificates of deposit maturing not later than the end of the depository designation pe ...

... moneys, together with interest or other investment income accrued on those moneys, will be required to refund the debt. [Ohio Rev. Code §133.34(D)]. Ohio Rev. Code §135.13 requires depositing inactive funds in certificates of deposit maturing not later than the end of the depository designation pe ...

Foreign Direct Investment in India and China: The Creation of a Balanced Regime in a Globalized Economy

... But despite recent changes and current successes, there may be a need for further change, especially within the legal investment regimes13 that govern foreign investment, including foreign direct investment (FDI)14 and mergers and acquisitions (M&A).15 Even with the recent liberalization of their re ...

... But despite recent changes and current successes, there may be a need for further change, especially within the legal investment regimes13 that govern foreign investment, including foreign direct investment (FDI)14 and mergers and acquisitions (M&A).15 Even with the recent liberalization of their re ...

Information Disclosure in Speculative Markets

... A large literature on voluntary disclosure of information exists, going back to Grossman (1981) and Milgrom (1981) who use an adverse selection argument to show that full revelation is always optimal if there are no costs of disclosure and the uninformed parties know about the existence of private i ...

... A large literature on voluntary disclosure of information exists, going back to Grossman (1981) and Milgrom (1981) who use an adverse selection argument to show that full revelation is always optimal if there are no costs of disclosure and the uninformed parties know about the existence of private i ...

Foreign Direct Investment

... Slide 6-15, 6-16 Horizontal FDI when and why? Impediments to the sale of know-how FDI would seem to be more expensive and risky than exporting or licensing, so there must be some other good reasons for firms to undertake horizontal FDI. Transportation costs can make export infeasible, especially for ...

... Slide 6-15, 6-16 Horizontal FDI when and why? Impediments to the sale of know-how FDI would seem to be more expensive and risky than exporting or licensing, so there must be some other good reasons for firms to undertake horizontal FDI. Transportation costs can make export infeasible, especially for ...

intermediate-financial-management-10th-edition

... stock’s expected and required returns differ, so individuals may think there are bargains to be bought or dogs to be sold. Also, new information is constantly hitting the market and changing the opinions of marginal investors, and this leads to swings in the market. New technology is causing new inf ...

... stock’s expected and required returns differ, so individuals may think there are bargains to be bought or dogs to be sold. Also, new information is constantly hitting the market and changing the opinions of marginal investors, and this leads to swings in the market. New technology is causing new inf ...

Risk Transformation Aligning risk and the pursuit of

... platforms can present high barriers to effective, efficient business, compliance, and risk management. A well-planned, well-executed enterprise risk data architecture can help overcome these barriers by making it possible to build the right data repositories and to avoid ad hoc solutions. An integra ...

... platforms can present high barriers to effective, efficient business, compliance, and risk management. A well-planned, well-executed enterprise risk data architecture can help overcome these barriers by making it possible to build the right data repositories and to avoid ad hoc solutions. An integra ...

annual report

... of value and then focus a variety of resources from R&D, manufacturing, sales, and service on developing globally strategic products that are globally number-one or truly unique, and also offer optimal solutions. In addition, we intend to expand the aftermarket business, which is expected to ensure ...

... of value and then focus a variety of resources from R&D, manufacturing, sales, and service on developing globally strategic products that are globally number-one or truly unique, and also offer optimal solutions. In addition, we intend to expand the aftermarket business, which is expected to ensure ...

Chapter 9

... Therefore, Ziege should accept projects A, C, E, F, and H. b. With only $13 million to invest in its capital budget, Ziege must choose the best combination of Projects A, C, E, F, and H. Collectively, the projects would account for an investment of $21 million, so naturally not all these projects ma ...

... Therefore, Ziege should accept projects A, C, E, F, and H. b. With only $13 million to invest in its capital budget, Ziege must choose the best combination of Projects A, C, E, F, and H. Collectively, the projects would account for an investment of $21 million, so naturally not all these projects ma ...

Farm Financials Starting with Schedule F

... • Most of the entries are based on cash that came in or was paid out during the year • A big exception is depreciation, a non-cash expense that can vary a lot from year to year • It only pertains to the farm business; the farm family’s personal expenses aren’t included ...

... • Most of the entries are based on cash that came in or was paid out during the year • A big exception is depreciation, a non-cash expense that can vary a lot from year to year • It only pertains to the farm business; the farm family’s personal expenses aren’t included ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.

![9535 Testimony [Dave] - Maryland Public Service Commission](http://s1.studyres.com/store/data/009524184_1-6690ffe236a26be1dddea21ad3b9b7b9-300x300.png)