Uncertainty shocks, asset supply and pricing over the business cycle

... of future innovations as well as agents’ perceived ambiguity. A convenient technical feature of our setup is that agents’ endogenous response to changes in uncertainty is reflected in the coefficients of the MS-VAR. Indeed, since ambiguity affects the worst case conditional mean, a linear approximat ...

... of future innovations as well as agents’ perceived ambiguity. A convenient technical feature of our setup is that agents’ endogenous response to changes in uncertainty is reflected in the coefficients of the MS-VAR. Indeed, since ambiguity affects the worst case conditional mean, a linear approximat ...

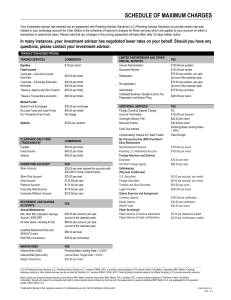

Futures - HSBC Broking Services

... 2. You may be called upon at short notice to deposit additional margin deposits or interest payments. If the required margin deposits or interest payments are not provided within the prescribed time, your position or collateral may be liquidated without your prior consent. You will remain liable f ...

... 2. You may be called upon at short notice to deposit additional margin deposits or interest payments. If the required margin deposits or interest payments are not provided within the prescribed time, your position or collateral may be liquidated without your prior consent. You will remain liable f ...

September 30th 2015 - Fondazione Sodalitas

... Investing in GHG emission reductions is very profitable. Based on its unrivalled database, CDP estimates the average IRR of such investments to be around 33% and for performance leaders even higher to 55%! CFO should start considering these investments as positive for cash flows… Investment in R ...

... Investing in GHG emission reductions is very profitable. Based on its unrivalled database, CDP estimates the average IRR of such investments to be around 33% and for performance leaders even higher to 55%! CFO should start considering these investments as positive for cash flows… Investment in R ...

Market Efficiency: A Theoretical Distinction and So What?

... The capital asset pricing model (CAPM) is an elegant theory. With the aid of some simplifying assumptions, it comes to dramatic conclusions about practical matters, such as how to choose an investment portfolio, how to forecast the expected return of a security or asset class, how to price a new sec ...

... The capital asset pricing model (CAPM) is an elegant theory. With the aid of some simplifying assumptions, it comes to dramatic conclusions about practical matters, such as how to choose an investment portfolio, how to forecast the expected return of a security or asset class, how to price a new sec ...

The impact of short-selling constraints on financial market

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

International Financial Integration in the Aftermath of the

... globalization during the so-called Great Moderation period, with advanced economies “long equity, short debt” and emerging/developing economies “long debt, short equity.” This asymmetric pattern proved to be important factor in terms of the global risk distribution during the global financial crisis ...

... globalization during the so-called Great Moderation period, with advanced economies “long equity, short debt” and emerging/developing economies “long debt, short equity.” This asymmetric pattern proved to be important factor in terms of the global risk distribution during the global financial crisis ...

MULTINATIONAL FINANCIAL MANAGEMENT: AN OVERVIEW

... imperfections, using the various instruments and tools that are available, while at the same time maximizing the benefits from an expanded global ...

... imperfections, using the various instruments and tools that are available, while at the same time maximizing the benefits from an expanded global ...

Securing money to help community food enterprises to grow

... This report examines the funding needs of community food enterprises and how they can continue to use food to achieve a wide variety of important social and environmental benefits. The report was written following a series of community food finance meetings, bringing together organisations that assi ...

... This report examines the funding needs of community food enterprises and how they can continue to use food to achieve a wide variety of important social and environmental benefits. The report was written following a series of community food finance meetings, bringing together organisations that assi ...

Risk Measures and Risk Capital Allocation

... the position and the cost of this instrument (minimum cash) measures the risk of the position. Alternatively risk measures can be obtained from acceptance sets. An acceptance set A Lp(P) is a set of all ‘acceptable’ risks. This set is determined by regulators or investment managers of a company. For ...

... the position and the cost of this instrument (minimum cash) measures the risk of the position. Alternatively risk measures can be obtained from acceptance sets. An acceptance set A Lp(P) is a set of all ‘acceptable’ risks. This set is determined by regulators or investment managers of a company. For ...

0.1 Front matter.PM

... effort, and maybe even transformable with a little more. In a soundbite, the U.S. financial system performs dismally at its advertised task, that of efficiently directing society’s savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the ...

... effort, and maybe even transformable with a little more. In a soundbite, the U.S. financial system performs dismally at its advertised task, that of efficiently directing society’s savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the ...

Evaluation of Active Management of the Norwegian Government

... performance broken down by fixed income and equity strategies and by external vs. internal performance. NBIM also provided information about fees, capital allocations to external funds, and benchmarks returns, all in NOK. Given the sensitive nature of this information it is not all detailed in o ...

... performance broken down by fixed income and equity strategies and by external vs. internal performance. NBIM also provided information about fees, capital allocations to external funds, and benchmarks returns, all in NOK. Given the sensitive nature of this information it is not all detailed in o ...

Government Intervention in Venture Capital in Canada: Toward

... requirements of portfolio companies, particularly at the later stages of financing. Beyond this general perception that the market, left to its own devices, has not provided sufficient venture capital, the rationale for government involvement varies with the level of government. In addition, the cal ...

... requirements of portfolio companies, particularly at the later stages of financing. Beyond this general perception that the market, left to its own devices, has not provided sufficient venture capital, the rationale for government involvement varies with the level of government. In addition, the cal ...

athens-clarke county, georgia comprehensive annual financial

... Management assumes full responsibility for the completeness and reliability of the information contained in this report, based upon a comprehensive framework of internal control that it has established for this purpose. Because the cost of internal control should not exceed anticipated benefits; the ...

... Management assumes full responsibility for the completeness and reliability of the information contained in this report, based upon a comprehensive framework of internal control that it has established for this purpose. Because the cost of internal control should not exceed anticipated benefits; the ...

The international actor of Turkish capital markets 2006 ANNUAL

... and of great importance to Turkish capital markets, Takasbank now aims to step up its international activities. Hence, as we are leaving behind a year full of success, we thought it would be a good idea to focus somewhat more broadly on our international activities in our Annual Report. During 2006, ...

... and of great importance to Turkish capital markets, Takasbank now aims to step up its international activities. Hence, as we are leaving behind a year full of success, we thought it would be a good idea to focus somewhat more broadly on our international activities in our Annual Report. During 2006, ...

The Good, the Bad, and the Ugly: An inquiry into the causes and

... the same demand spillover effects. Some profitable investments, which are subject to the borrowing constraints, do not improve the net worth of other borrowers. This means that when an improved net worth allows more saving to flow into such profitable investments, saving may be redirected away from ...

... the same demand spillover effects. Some profitable investments, which are subject to the borrowing constraints, do not improve the net worth of other borrowers. This means that when an improved net worth allows more saving to flow into such profitable investments, saving may be redirected away from ...

CHAPTER 11

... macro factors. Sometimes, however, rather than using a market proxy, it is more useful to focus directly on the ultimate sources of risk. This can be useful in risk assessment, for example, when measuring one’s exposures to particular sources of uncertainty. ...

... macro factors. Sometimes, however, rather than using a market proxy, it is more useful to focus directly on the ultimate sources of risk. This can be useful in risk assessment, for example, when measuring one’s exposures to particular sources of uncertainty. ...

View/Open

... Rs.433.977 million in same period of last year due blockade of funds in GST Refunds and in increased trade debts. Cash from financing activities: For funding of CapEx requirement company obtained medium term loan of Rs.100 million from Pak Libya Holding (Pvt.) Co. Limited and also issued Right Share ...

... Rs.433.977 million in same period of last year due blockade of funds in GST Refunds and in increased trade debts. Cash from financing activities: For funding of CapEx requirement company obtained medium term loan of Rs.100 million from Pak Libya Holding (Pvt.) Co. Limited and also issued Right Share ...

Innovation and productivity growth in the EU services sector

... level of R&D investment to meet the Lisbon target of 3 percent of GDP, this alone would not have an immediate impact on its economic performance. What is needed is a sustained increase in the level of investment that would over time expand Europe’s R&D capital stock. Figure 4 shows the decomposition ...

... level of R&D investment to meet the Lisbon target of 3 percent of GDP, this alone would not have an immediate impact on its economic performance. What is needed is a sustained increase in the level of investment that would over time expand Europe’s R&D capital stock. Figure 4 shows the decomposition ...

Intangible Assets

... Purchased from another party either separately or as part of a business combination. If purchased separately, eg. buying rights to a book before making it into a film, cost can be established as the purchase price and any other expenses associated with readying the asset for its intended use. ...

... Purchased from another party either separately or as part of a business combination. If purchased separately, eg. buying rights to a book before making it into a film, cost can be established as the purchase price and any other expenses associated with readying the asset for its intended use. ...

employment protection, investment, and firm growth

... employees that is equivalent to mandated employee benefits. Under the Coase principal, if labor markets are perfect, wages fall to cover the cost of the benefit without productivity or employment consequences (Coase, 1960). However, labor markets are not frictionless, and in general, employment prot ...

... employees that is equivalent to mandated employee benefits. Under the Coase principal, if labor markets are perfect, wages fall to cover the cost of the benefit without productivity or employment consequences (Coase, 1960). However, labor markets are not frictionless, and in general, employment prot ...

The Effect of Debt on the Cost of Equity in a Regulatory Setting

... equity estimate based on market data automatically depends on the market-value capital structure of that company. 5. Failure to recognize and adjust for differences in the financial risk of sample companies and the regulated entity can result in material errors in cost of equity estimation. Ignoring ...

... equity estimate based on market data automatically depends on the market-value capital structure of that company. 5. Failure to recognize and adjust for differences in the financial risk of sample companies and the regulated entity can result in material errors in cost of equity estimation. Ignoring ...

Corporate Finance

... Bottom line: Large cash balances would not be tolerated in this company. Expect to face relentless pressure to pay out more dividends. ...

... Bottom line: Large cash balances would not be tolerated in this company. Expect to face relentless pressure to pay out more dividends. ...

Should Tender Offer Arbitrage Be Regulated

... persist for long and usually represent only temporary lags on the part of the covertible security in catching up with changes in the price of its equivalent. Moreover, the price differential is usually so small as to make this form of arbitrage profitable only for those who can deal in volume with l ...

... persist for long and usually represent only temporary lags on the part of the covertible security in catching up with changes in the price of its equivalent. Moreover, the price differential is usually so small as to make this form of arbitrage profitable only for those who can deal in volume with l ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.