Exam 2

... 5. Calculate the five-year holding period return for the Vanguard Total Bond Fund: (5 points) (1-.086)(1-(-.008))(1.114)(1-.084)(1-.083)=1.4089-1=40.89% Year Return ...

... 5. Calculate the five-year holding period return for the Vanguard Total Bond Fund: (5 points) (1-.086)(1-(-.008))(1.114)(1-.084)(1-.083)=1.4089-1=40.89% Year Return ...

Long-Term Capital Market Assumptions

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

55-Internal Audit for Treasury Market Risk Management

... Checklist for Internal Audit XI. Investment in Debt Securities • Frequency of interest payments. • Information about the issuer and the credit rating. • Terms of issue such as use of issue proceeds, monitoring agency, formation of trustees, secured or unsecured nature of bonds, assets underlying th ...

... Checklist for Internal Audit XI. Investment in Debt Securities • Frequency of interest payments. • Information about the issuer and the credit rating. • Terms of issue such as use of issue proceeds, monitoring agency, formation of trustees, secured or unsecured nature of bonds, assets underlying th ...

Curriculum at a Glance Personal Finance Grade 9

... Personal Finance Grade 9-12 Beginning with the Class of 2019, all graduating seniors will be mandated to take a Personal Finance class in order to meet graduation requirements. Personal Finance helps students build a solid foundation for financial independence and future financial decisions. Student ...

... Personal Finance Grade 9-12 Beginning with the Class of 2019, all graduating seniors will be mandated to take a Personal Finance class in order to meet graduation requirements. Personal Finance helps students build a solid foundation for financial independence and future financial decisions. Student ...

download

... opaque boxes to which savers entrust their wealth and from which borrowers take satchels-full of money with the promise to repay. Massive bureaucracies peer into banks' mysterious workings, hoping to sight trouble before deposits are put at risk. Lest depositors lose faith, governments offer them ne ...

... opaque boxes to which savers entrust their wealth and from which borrowers take satchels-full of money with the promise to repay. Massive bureaucracies peer into banks' mysterious workings, hoping to sight trouble before deposits are put at risk. Lest depositors lose faith, governments offer them ne ...

Investment Outlook

... • Equities still outperform for long-term investors • Retirement real estate could regain traction after market digests 2003-04 run-up ...

... • Equities still outperform for long-term investors • Retirement real estate could regain traction after market digests 2003-04 run-up ...

FM11 Ch 19 Instructors Manual

... e. A prospectus summarizes information about a new security issue and the issuing company. A “red herring,” or preliminary prospectus, may be distributed to potential buyers prior to approval of the registration statement by the SEC. After the registration has become effective, the securities, acco ...

... e. A prospectus summarizes information about a new security issue and the issuing company. A “red herring,” or preliminary prospectus, may be distributed to potential buyers prior to approval of the registration statement by the SEC. After the registration has become effective, the securities, acco ...

Hatchtech - Business.gov.au

... “Venture capital has been integral to Hatchtech’s growth and successful outcome, in particular through the significant involvement of Dr Paul Kelly, Chairman of Hatchtech and OneVentures Partner who served as Executive Chairman for several years,” said Dr Michelle Deaker, CEO and Managing Director o ...

... “Venture capital has been integral to Hatchtech’s growth and successful outcome, in particular through the significant involvement of Dr Paul Kelly, Chairman of Hatchtech and OneVentures Partner who served as Executive Chairman for several years,” said Dr Michelle Deaker, CEO and Managing Director o ...

Positioning your portfolio for rising interest rates

... Considerations for fixed-income investments 1. Make sure your fixed-income portfolio is diversified. Bond sensitivity to interest-rate movements is based on several factors, including credit quality and the type of security. You should examine the bond funds in your portfolio to see how well-diversi ...

... Considerations for fixed-income investments 1. Make sure your fixed-income portfolio is diversified. Bond sensitivity to interest-rate movements is based on several factors, including credit quality and the type of security. You should examine the bond funds in your portfolio to see how well-diversi ...

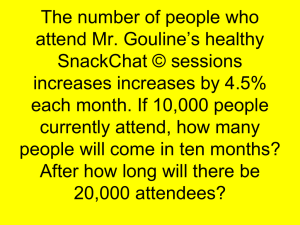

The value of Mr. Gouline’s car is cut in half every three

... 75 pound block of radium, but it is too heavy. If he waits until the radium is 60 pounds, how long will he have to wait? ...

... 75 pound block of radium, but it is too heavy. If he waits until the radium is 60 pounds, how long will he have to wait? ...

The Decision-Making Process

... more of your resources (time, money, and effort). personal opportunity costs may involve time, health, or energy. For example, time spent on studying usually means lost time for leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financi ...

... more of your resources (time, money, and effort). personal opportunity costs may involve time, health, or energy. For example, time spent on studying usually means lost time for leisure or working. However, this trade-off may be appropriate since your learning and grades will likely improve. financi ...

Wells Fargo/BlackRock Short-Term Investment Fund Disclosure

... exposed to the risk that the other party will not fulfill its contract obligation. Similarly, the Fund is exposed to the same risk if it engages in a reverse repurchase agreement where a broker-dealer agrees to buy securities and the Fund agrees to repurchase them at a later date. Debt securities an ...

... exposed to the risk that the other party will not fulfill its contract obligation. Similarly, the Fund is exposed to the same risk if it engages in a reverse repurchase agreement where a broker-dealer agrees to buy securities and the Fund agrees to repurchase them at a later date. Debt securities an ...

i1632e05

... Other sources of funding: Some NGOs, Foundations or companies support carbon sequestration projects and it is worthwhile contacting them with a well developed Project Concept Note: The Nature Conservancy (www.nature.org), Flora and Fauna International (www.fauna-flora.org), Amazonas Sustainable Foun ...

... Other sources of funding: Some NGOs, Foundations or companies support carbon sequestration projects and it is worthwhile contacting them with a well developed Project Concept Note: The Nature Conservancy (www.nature.org), Flora and Fauna International (www.fauna-flora.org), Amazonas Sustainable Foun ...

GrowthProspectus - Fortress Fund Managers

... developing countries. Both the supply and demand have been inhibited by factors such as fear of loss of family control, lack of tradition and understanding of equity investment and over-reliance on bank overdraft financing. This low level of market activity results in relatively inefficient markets, ...

... developing countries. Both the supply and demand have been inhibited by factors such as fear of loss of family control, lack of tradition and understanding of equity investment and over-reliance on bank overdraft financing. This low level of market activity results in relatively inefficient markets, ...

Europe`s financial crisis: What does it mean for private equity?

... powder” tracked by Preqin, this would reduce to around 2.5 years’ worth of uninvested capital for 2011. As for the competitor population, the period immediately following the collapse of Lehman saw the withdrawal of much of the non-typical private equity-style investors such as hedge funds and ultr ...

... powder” tracked by Preqin, this would reduce to around 2.5 years’ worth of uninvested capital for 2011. As for the competitor population, the period immediately following the collapse of Lehman saw the withdrawal of much of the non-typical private equity-style investors such as hedge funds and ultr ...

Not Too Hot, Not Too Cold (with the exception of Japan)

... RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends ...

... RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends ...

Debt position of the Government of India

... bonds, etc. It also includes borrowings through treasury bills including treasury bills issued to State Governments, commercial banks and other parties, as well as non-negotiable, non-interest bearing rupee securities issued to international financial institutions viz., the International Monetary Fu ...

... bonds, etc. It also includes borrowings through treasury bills including treasury bills issued to State Governments, commercial banks and other parties, as well as non-negotiable, non-interest bearing rupee securities issued to international financial institutions viz., the International Monetary Fu ...

Income Trusts: Is There a Bubble?

... generally provide unit holders with frequent and relatively stable distributions of operating cash flows from their underlying business. The underlying assets of an income trust are normally mature businesses with low-tomoderate growth with a predictable stream of free cash flow. With average yields ...

... generally provide unit holders with frequent and relatively stable distributions of operating cash flows from their underlying business. The underlying assets of an income trust are normally mature businesses with low-tomoderate growth with a predictable stream of free cash flow. With average yields ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.