Financially distressed firms are more likely to issue equity

... The higher the firms leverage, the higher debt level the firm has relative to the market value of equity. Leverage is an important measure the ability for a firm to attract new debt and the cost of that new debt. The trade-off theory combines the benefits of debt with the costs of debt in one model. ...

... The higher the firms leverage, the higher debt level the firm has relative to the market value of equity. Leverage is an important measure the ability for a firm to attract new debt and the cost of that new debt. The trade-off theory combines the benefits of debt with the costs of debt in one model. ...

Fiat and GM: The Troubled Alliance

... (with the aim to achieve cost savings of 2 billion euro’s by 2005). It also aimed to share technological know-how of diesel engines. - Seeing that the auto industry is an oligopolistic market Fiat was not allowed to enter into other alliances if it sought to divest its auto arm. How did the alliance ...

... (with the aim to achieve cost savings of 2 billion euro’s by 2005). It also aimed to share technological know-how of diesel engines. - Seeing that the auto industry is an oligopolistic market Fiat was not allowed to enter into other alliances if it sought to divest its auto arm. How did the alliance ...

northstar realty europe corp. - corporate

... future changes in foreign, federal, state and local tax law that may have an adverse impact on the cash flow and value of our investments; ...

... future changes in foreign, federal, state and local tax law that may have an adverse impact on the cash flow and value of our investments; ...

Download attachment

... Regulations Pertinent to Accounting policies to be adopted and the necessary forms needed to prepare and present reports and financial statements – Takaful .................... Article (1) – Preparation of Financial Statements .......................................................... Article (2) – ...

... Regulations Pertinent to Accounting policies to be adopted and the necessary forms needed to prepare and present reports and financial statements – Takaful .................... Article (1) – Preparation of Financial Statements .......................................................... Article (2) – ...

Review of the Differentiated Nature and Scope of Financial Regulation

... At their 15 November 2008 meeting, the G-20 Leaders called for a review of the differentiated nature and scope of regulation in the banking, securities, and insurance sectors. This report responds to the following declaration: “The appropriate bodies should review the differentiated nature of regula ...

... At their 15 November 2008 meeting, the G-20 Leaders called for a review of the differentiated nature and scope of regulation in the banking, securities, and insurance sectors. This report responds to the following declaration: “The appropriate bodies should review the differentiated nature of regula ...

The information content of share repurchases

... problem caused by free cash flow. In general, if shareholders can restrict the assets under management control, it is harder for management to over-invest in negative net present value projects, to consume perquisites, or to be slothful (Grossman and Hart 1980, Easterbrook 1984, Jensen 1986, Stulz 1 ...

... problem caused by free cash flow. In general, if shareholders can restrict the assets under management control, it is harder for management to over-invest in negative net present value projects, to consume perquisites, or to be slothful (Grossman and Hart 1980, Easterbrook 1984, Jensen 1986, Stulz 1 ...

Top 10 Stock Screening Strategies That Make

... (portfolio) is generated. The period’s returns are calculated using the % change in price from the beginning of the holding period to the end of the holding period, plus any applicable dividends. The returns for the portfolio is the arithmetic mean of the returns for the individual companies in the ...

... (portfolio) is generated. The period’s returns are calculated using the % change in price from the beginning of the holding period to the end of the holding period, plus any applicable dividends. The returns for the portfolio is the arithmetic mean of the returns for the individual companies in the ...

Book CHI IPE 141 13628.indb

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

basics of equity derivatives

... markets. Margining, monitoring and surveillance of the activities of various participants become extremely difficult in these kind of mixed markets. History of derivatives markets Early forward contracts in the US addressed merchants' concerns about ensuring that there were buyers and sellers for c ...

... markets. Margining, monitoring and surveillance of the activities of various participants become extremely difficult in these kind of mixed markets. History of derivatives markets Early forward contracts in the US addressed merchants' concerns about ensuring that there were buyers and sellers for c ...

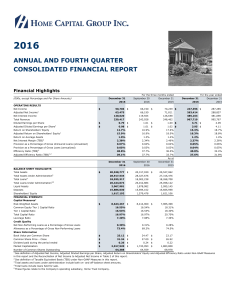

2016 Q4 Report - Home Capital Group

... the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in connection with business objectives and targets, Company strategies, operations, anticipated financial results and t ...

... the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in connection with business objectives and targets, Company strategies, operations, anticipated financial results and t ...

Rise of Cross-Asset Correlations

... Below we consider the impact of cross-asset correlation on the risk and reward of multi-asset portfolios. The volatility of a multi-asset portfolio increases with the level of cross-asset correlation and the volatility of the assets in the portfolio.3 Hence, the higher the cross-asset correlation, t ...

... Below we consider the impact of cross-asset correlation on the risk and reward of multi-asset portfolios. The volatility of a multi-asset portfolio increases with the level of cross-asset correlation and the volatility of the assets in the portfolio.3 Hence, the higher the cross-asset correlation, t ...

A Model of Capital and Crises Zhiguo He Arvind Krishnamurthy May 2011

... common characteristics: risk premia rise, interest rates fall, conditional volatilities of asset prices rise, correlations between assets rise, and investors “‡y to the quality” of a riskless liquid bond. This paper o¤ers an account of a …nancial crisis in which intermediaries play the central role. ...

... common characteristics: risk premia rise, interest rates fall, conditional volatilities of asset prices rise, correlations between assets rise, and investors “‡y to the quality” of a riskless liquid bond. This paper o¤ers an account of a …nancial crisis in which intermediaries play the central role. ...

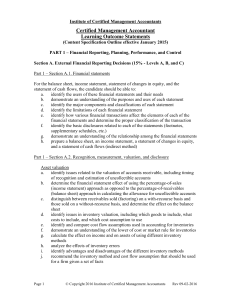

Certified Management Accountant

... q. demonstrate how price, efficiency, spending, and mix variances can be applied in service companies as well as manufacturing companies r. analyze factory overhead variances by calculating variable overhead spending variance, variable overhead efficiency variance, fixed overhead spending variance, ...

... q. demonstrate how price, efficiency, spending, and mix variances can be applied in service companies as well as manufacturing companies r. analyze factory overhead variances by calculating variable overhead spending variance, variable overhead efficiency variance, fixed overhead spending variance, ...

Scarcity, Risk Premiums and the Pricing of Commodity Futures

... without adjusting production schedules, or to reduce stock-out risks. The productive value of inventories is high if storage levels are low. Therefore, low inventories imply high convenience yields, and vice versa. These implications are derived from the “theory of storage” (developed by Working [19 ...

... without adjusting production schedules, or to reduce stock-out risks. The productive value of inventories is high if storage levels are low. Therefore, low inventories imply high convenience yields, and vice versa. These implications are derived from the “theory of storage” (developed by Working [19 ...

CHAPTER 10

... After 46 years, it was time for a change, and in 2001 that change came to Walt Disney Company’s Disneyland when it opened California Adventure. In Chapter 9, we noted the importance of this $1.4-billion investment by Walt Disney Co., its second park in Anaheim. Disney’s hope with this new park was t ...

... After 46 years, it was time for a change, and in 2001 that change came to Walt Disney Company’s Disneyland when it opened California Adventure. In Chapter 9, we noted the importance of this $1.4-billion investment by Walt Disney Co., its second park in Anaheim. Disney’s hope with this new park was t ...

Financial Presentation

... These forward-looking statements are based on a series of assumptions, both general and specific, in particular the application of accounting principles and methods in accordance with IFRS (International Financial Reporting Standards) as adopted in the European Union, as well as the application of e ...

... These forward-looking statements are based on a series of assumptions, both general and specific, in particular the application of accounting principles and methods in accordance with IFRS (International Financial Reporting Standards) as adopted in the European Union, as well as the application of e ...

Dynamic Correlation or Tail Dependence Hedging for Portfolio

... that allows for extreme co-movements. However, they find statistically insignificant and economically negligible intertemporal hedging demands, even in the presence of a riskless asset, so that the welfare impact on the investor from behaving myopically is negligible. To the contrary, in our setup i ...

... that allows for extreme co-movements. However, they find statistically insignificant and economically negligible intertemporal hedging demands, even in the presence of a riskless asset, so that the welfare impact on the investor from behaving myopically is negligible. To the contrary, in our setup i ...

Size Premia in the Canadian Equity Market

... First, monthly equity returns are calculated based on month-end share prices. A monthly return for a particular equity is determined by dividing the current month-end price by the previous month-end price and subtracting one. Second, ten size portfolios are created by ranking all equities by market ...

... First, monthly equity returns are calculated based on month-end share prices. A monthly return for a particular equity is determined by dividing the current month-end price by the previous month-end price and subtracting one. Second, ten size portfolios are created by ranking all equities by market ...

Quid pro quo? What factors influence IPO allocations to

... investment banks and by issuers as an important factor in the IPO allocation process. When looking at the behaviour of investors in the month after the IPO we do not find evidence that those investors who go on to sell their shares quickly after the IPO received lower levels of allocation in that IP ...

... investment banks and by issuers as an important factor in the IPO allocation process. When looking at the behaviour of investors in the month after the IPO we do not find evidence that those investors who go on to sell their shares quickly after the IPO received lower levels of allocation in that IP ...

Jubilant LifesciencesJULS.NS JOL IN

... approved and this implies sales of USD3.8mn per approved ANDA. However, there is considerable contribution from methylprednisolone, which contributes ~USD40mn in annual sales. Hence ex methylprednisolone, sales per approved ANDA stand at USD 2.3mn. The company has received a spate of approvals in th ...

... approved and this implies sales of USD3.8mn per approved ANDA. However, there is considerable contribution from methylprednisolone, which contributes ~USD40mn in annual sales. Hence ex methylprednisolone, sales per approved ANDA stand at USD 2.3mn. The company has received a spate of approvals in th ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.