Introduction to Volatility

... Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate it. Also, well we will briefly cover the most significant related parameters and indicators used in conjunction with volatility in options analysis. Day-to-day market movements re ...

... Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate it. Also, well we will briefly cover the most significant related parameters and indicators used in conjunction with volatility in options analysis. Day-to-day market movements re ...

(ETFs) and Corporate Bond Liquidity Abstract

... Bond mutual funds are similar to bond ETFs in the sense that they give investors the opportunity to invest with a diverse exposure to various sectors of the fixed income market. ETFs are usually considered as a subset of the mutual fund asset class (close-ended mutual funds). Although on average a ...

... Bond mutual funds are similar to bond ETFs in the sense that they give investors the opportunity to invest with a diverse exposure to various sectors of the fixed income market. ETFs are usually considered as a subset of the mutual fund asset class (close-ended mutual funds). Although on average a ...

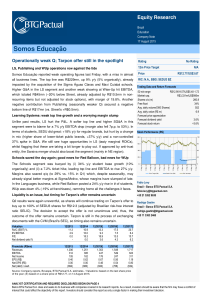

Somos Educação

... References herein to BTG Pactual include BTG Pactual S.A., BTG Pactual US Capital LLC, BTG Pactual Europe LLP, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual Colombia as applicable. This report is for distribution only under such circumstances as may be permitted by applicable law. This repo ...

... References herein to BTG Pactual include BTG Pactual S.A., BTG Pactual US Capital LLC, BTG Pactual Europe LLP, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual Colombia as applicable. This report is for distribution only under such circumstances as may be permitted by applicable law. This repo ...

Real Options, Volatility, and Stock Returns∗

... value, then the option to wait for new information can be valuable. Excellent illustrations of this logic can be found in Bernanke (1983), Brennan and Schwartz (1985), McDonald and Siegel (1986), Majd and Pindyck (1987), and Pindyck (1988), who provide some of the first treatments of real investment ...

... value, then the option to wait for new information can be valuable. Excellent illustrations of this logic can be found in Bernanke (1983), Brennan and Schwartz (1985), McDonald and Siegel (1986), Majd and Pindyck (1987), and Pindyck (1988), who provide some of the first treatments of real investment ...

Saving, Investment and the Financial System

... interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds comes from households who want to save some of their income. The demand for loanable funds comes from households and firms who want to borrow for investment. Harcourt, Inc. items and derived ite ...

... interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds comes from households who want to save some of their income. The demand for loanable funds comes from households and firms who want to borrow for investment. Harcourt, Inc. items and derived ite ...

International Monetary Fund Annual Report 1962

... rates in such a manner that they would not induce disturbing capital movements. The discount rates in the main centers have moved closer together. While the U.S. discount rate has stayed at 3 per cent since mid-1960, the rate in Germany has been brought down from 5 per cent to 3 per cent; and the ra ...

... rates in such a manner that they would not induce disturbing capital movements. The discount rates in the main centers have moved closer together. While the U.S. discount rate has stayed at 3 per cent since mid-1960, the rate in Germany has been brought down from 5 per cent to 3 per cent; and the ra ...

Emerging Equity Markets in a Globalizing World

... Netspar stimulates debate and fundamental research in the field of pensions, aging and retirement. The aging of the population is front-page news, as many baby boomers are now moving into retirement. More generally, people live longer and in better health while at the same time families choose to ha ...

... Netspar stimulates debate and fundamental research in the field of pensions, aging and retirement. The aging of the population is front-page news, as many baby boomers are now moving into retirement. More generally, people live longer and in better health while at the same time families choose to ha ...

Download attachment

... The thriving market of shari’ah-compliant securities reflects the growing need for longterm funding instruments in Islamic finance. While there may be a cyclical element of current demand resulting from high oil revenues in the GCC, this supplements an upswing in the supply of sukuk as a source of l ...

... The thriving market of shari’ah-compliant securities reflects the growing need for longterm funding instruments in Islamic finance. While there may be a cyclical element of current demand resulting from high oil revenues in the GCC, this supplements an upswing in the supply of sukuk as a source of l ...

株券等の大量保有の状況の開示に関する内閣府令

... acquired the company's Share Certificates, etc. jointly with another Officer or employee of the company (limited to the acquisition under a certain program wherein the Share Certificates, etc. are continuously acquired without depending on the individual's investment decisions, and wherein the amoun ...

... acquired the company's Share Certificates, etc. jointly with another Officer or employee of the company (limited to the acquisition under a certain program wherein the Share Certificates, etc. are continuously acquired without depending on the individual's investment decisions, and wherein the amoun ...

Chapter 15: Raising Capital

... The Registration Statement does not initially contain the price of the new issue ...

... The Registration Statement does not initially contain the price of the new issue ...

- Interroll

... Interroll Group is a worldwide leading provider of high-quality key products and services for internal logistics. The company offers a broad product range in the four product groups “Rollers”, “Drives”, “Conveyors & S orters” and “Pallet & Carton Flow” to around 23,000 customers around the world. ...

... Interroll Group is a worldwide leading provider of high-quality key products and services for internal logistics. The company offers a broad product range in the four product groups “Rollers”, “Drives”, “Conveyors & S orters” and “Pallet & Carton Flow” to around 23,000 customers around the world. ...

CHAPTER 16

... Convertible debt and debt with stock warrants are similar in that: (1) both allow the issuer to issue debt at a lower interest cost than would generally be available for nonconvertible debt; (2) both allow the holders to purchase the issuer’s stock at less than market value if the stock appreciates ...

... Convertible debt and debt with stock warrants are similar in that: (1) both allow the issuer to issue debt at a lower interest cost than would generally be available for nonconvertible debt; (2) both allow the holders to purchase the issuer’s stock at less than market value if the stock appreciates ...

NBER WORKING PAPER SERIES AN EMPIRICAL INVESTIGATION

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

PDF

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

Introduction_to_Volatility

... Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate it. Also, well we will briefly cover the most significant related parameters and indicators used in conjunction with volatility in options analysis. Day-to-day market movements re ...

... Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate it. Also, well we will briefly cover the most significant related parameters and indicators used in conjunction with volatility in options analysis. Day-to-day market movements re ...

NOTAS EXPLICATIVAS ÀS INFORMAÇÕES TRIMESTRAIS DE 30

... As described in Note 22.c to the financial statements, Telemar Participações S.A. (“TmarPart”), the former Parent Company, was merged into the Company on September 1, 2015. TmarPart’s assets included the acquisition accounting adjustments (“Step-up adjustments”), when the acquisition of Brasil Telec ...

... As described in Note 22.c to the financial statements, Telemar Participações S.A. (“TmarPart”), the former Parent Company, was merged into the Company on September 1, 2015. TmarPart’s assets included the acquisition accounting adjustments (“Step-up adjustments”), when the acquisition of Brasil Telec ...

Analysis of stock performance based on

... has a solid focus on the cash flows to the enterprise created from core operations, and is theoretically equivalent to other valuation techniques such as the discounted cash flow mode and the price to earnings ratio. Furthermore, RoIC was found to be the preferred quality measure as the measure capt ...

... has a solid focus on the cash flows to the enterprise created from core operations, and is theoretically equivalent to other valuation techniques such as the discounted cash flow mode and the price to earnings ratio. Furthermore, RoIC was found to be the preferred quality measure as the measure capt ...

annual report - Skydive Australia

... has established procedures whereby compliance with existing environmental regulations an new regulations are monitored annually. This process includes procedures to be followed should an incident adversely impact the environment. The directors are not aware of any breaches during the period covered ...

... has established procedures whereby compliance with existing environmental regulations an new regulations are monitored annually. This process includes procedures to be followed should an incident adversely impact the environment. The directors are not aware of any breaches during the period covered ...

Key Credit Factors For The Regulated Utilities

... 3. These criteria apply to entities where regulated utilities represent a material part of their business, other than U.S. public power, water, sewer, gas, and electric cooperative utilities that are owned by federal, state, or local governmental bodies or by ratepayers. A regulated utility is defin ...

... 3. These criteria apply to entities where regulated utilities represent a material part of their business, other than U.S. public power, water, sewer, gas, and electric cooperative utilities that are owned by federal, state, or local governmental bodies or by ratepayers. A regulated utility is defin ...

Risk Factors A number of risk factors affect Prudential`s operating

... fluctuations. Prudential’s operations in the US and Asia, which represent a significant proportion of operating profit based on longer-term investment returns and shareholders’ funds, generally write policies and invest in assets denominated in local currencies. Although this practice limits the eff ...

... fluctuations. Prudential’s operations in the US and Asia, which represent a significant proportion of operating profit based on longer-term investment returns and shareholders’ funds, generally write policies and invest in assets denominated in local currencies. Although this practice limits the eff ...

Accounting for Leases

... e) the leased assets are of such a specialized nature that only the lessee can use them without major modifications. In addition, following indicators of situations that individually or in combination could also lead to a lease being classified as a finance lease are: if the lessee can cancel the le ...

... e) the leased assets are of such a specialized nature that only the lessee can use them without major modifications. In addition, following indicators of situations that individually or in combination could also lead to a lease being classified as a finance lease are: if the lessee can cancel the le ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.