Capital Markets Institutions, Instruments, and Risk

... Research on Trading Costs 605 Trading Arrangements for Institutional Investors 606 Block Trades 606 Program Trades 607 High-Frequency Trading 610 Key Points 614 Questions 618 ...

... Research on Trading Costs 605 Trading Arrangements for Institutional Investors 606 Block Trades 606 Program Trades 607 High-Frequency Trading 610 Key Points 614 Questions 618 ...

KIMBERLY-CLARK CORPORATION 401(K)

... employees. Employer matching contributions are accounted for separately and share in the net appreciation or depreciation in fair value of investments, dividends, interest and expenses in the same manner as contributions made by a participant. All employer matching contributions are invested accordi ...

... employees. Employer matching contributions are accounted for separately and share in the net appreciation or depreciation in fair value of investments, dividends, interest and expenses in the same manner as contributions made by a participant. All employer matching contributions are invested accordi ...

Country Commerce Philippines Brochure

... Issued in May 2015, the latest revision of the foreign investment negative list removed foreign equity restrictions on lending companies, financing companies, investment houses and rural banks. It also opened the practice of many previously closed professions to foreigners provided their countries e ...

... Issued in May 2015, the latest revision of the foreign investment negative list removed foreign equity restrictions on lending companies, financing companies, investment houses and rural banks. It also opened the practice of many previously closed professions to foreigners provided their countries e ...

Accrual of Interest Costs - Homepage

... resulting from domestic transactions are nonetheless shown in the IIP. The changes in positions are attributable to other changes in volume of assets (OCVA). ...

... resulting from domestic transactions are nonetheless shown in the IIP. The changes in positions are attributable to other changes in volume of assets (OCVA). ...

First Quarter 2015 Securities Markets Commentary Index

... notion that higher interest rates always have a negative effect on equity prices are only two pieces of a very complex puzzle and often are viewed quite differently by the markets than would appear on the surface. Quite simply there’s no way to forecast or predict what the markets will do, and that ...

... notion that higher interest rates always have a negative effect on equity prices are only two pieces of a very complex puzzle and often are viewed quite differently by the markets than would appear on the surface. Quite simply there’s no way to forecast or predict what the markets will do, and that ...

CIO Investment spotlight

... the Fed may need to slow growth due to abovetarget and rising inflationary pressures. Tighter financial conditions eventually lead to a weaker economy and share market, but for the moment this seems to be a risk well into the future. ...

... the Fed may need to slow growth due to abovetarget and rising inflationary pressures. Tighter financial conditions eventually lead to a weaker economy and share market, but for the moment this seems to be a risk well into the future. ...

Alleghany`s common stockholders` equity per share at year

... expansion of debt to increase the supply of money1. Much like the Madoff scheme, our financial system requires an ever increasing supply of borrowers to create the money necessary to pay the interest on all outstanding debt. In 2007 and 2008, it appears that we reached the limit of the ability of th ...

... expansion of debt to increase the supply of money1. Much like the Madoff scheme, our financial system requires an ever increasing supply of borrowers to create the money necessary to pay the interest on all outstanding debt. In 2007 and 2008, it appears that we reached the limit of the ability of th ...

There is a famous pendulum in Portland, Oregon named Principia

... that kept overall growth to a measly 2.2% are fading. Capital spending is likely past its nadir. Government purchases are no longer shrinking. Winter weather will be better than last year, given the strong El Niño effect. The Fed will stay accommodative, with gradual rate hikes. The caution inherite ...

... that kept overall growth to a measly 2.2% are fading. Capital spending is likely past its nadir. Government purchases are no longer shrinking. Winter weather will be better than last year, given the strong El Niño effect. The Fed will stay accommodative, with gradual rate hikes. The caution inherite ...

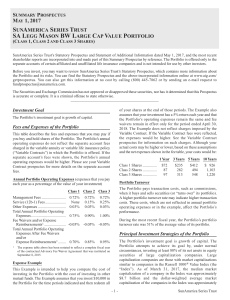

SAST - SA Legg Mason BW Large Cap Value

... SunAmerica Series Trust’s Statutory Prospectus and Statement of Additional Information dated May 1, 2017, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated ...

... SunAmerica Series Trust’s Statutory Prospectus and Statement of Additional Information dated May 1, 2017, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated ...

Risk Management Claims

... Let u denote the unhedged payoff, h the hedged payoff, bu the initial safe debt capacity and bh the safe debt capacity of the hedged firm. The safe debt capacity is important if it can add value. Consider the tax shelter value. Let represent all deductions from earnings that are possible; this w ...

... Let u denote the unhedged payoff, h the hedged payoff, bu the initial safe debt capacity and bh the safe debt capacity of the hedged firm. The safe debt capacity is important if it can add value. Consider the tax shelter value. Let represent all deductions from earnings that are possible; this w ...

quarterly update - Strategic Asset Management Group

... earnings we’re at fair value. After some adjustment for the oil sector’s earnings hit and from the dollar’s strength, probably both 1-time events likely to end within 12 months, S&P 500 Index earnings could come in this year around $115 to $120 a share, lower than previous forecasts by 5%. Our relat ...

... earnings we’re at fair value. After some adjustment for the oil sector’s earnings hit and from the dollar’s strength, probably both 1-time events likely to end within 12 months, S&P 500 Index earnings could come in this year around $115 to $120 a share, lower than previous forecasts by 5%. Our relat ...

File - get all chapter wise notes

... The capital of a company is divide into small units called share. If a company issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (II) preference share. a) ...

... The capital of a company is divide into small units called share. If a company issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (II) preference share. a) ...

Alternative Investment Funds 2015 - Skadden, Arps, Slate, Meagher

... are generally prohibited from registration with the SEC and instead must comply with the registration requirements of the states in which the adviser conducts business. The state-level registration requirements and exemptions vary on a state-by-state basis. Registering as an investment adviser with ...

... are generally prohibited from registration with the SEC and instead must comply with the registration requirements of the states in which the adviser conducts business. The state-level registration requirements and exemptions vary on a state-by-state basis. Registering as an investment adviser with ...

The Value of Loyal Customers - Federal Reserve Bank of Philadelphia

... customer loyalty comes into the picture, customers become particularly valuable to those businesses that need to spend resources to attract them. A company’s base of existing and repeat customers becomes an asset for the firm, while the money it spends on marketing and selling activities aimed at at ...

... customer loyalty comes into the picture, customers become particularly valuable to those businesses that need to spend resources to attract them. A company’s base of existing and repeat customers becomes an asset for the firm, while the money it spends on marketing and selling activities aimed at at ...

The Subprime Crisis And The Yin and Yang of Financial

... – A capital discipline designed to improve risk management had the unintended consequence of help creating a new market sector ...

... – A capital discipline designed to improve risk management had the unintended consequence of help creating a new market sector ...

NBER WORKING PAPER SERIES FINANCIAL FRICTIONS, INVESTMENT AND TOBIN'S Q Guido Lorenzoni

... The standard model of investment with convex adjustment costs predicts that movements in the investment rate should be entirely explained by changes in Tobin’s q. This prediction has generally been rejected in empirical studies, which show that cash flow and other measures of current profitability h ...

... The standard model of investment with convex adjustment costs predicts that movements in the investment rate should be entirely explained by changes in Tobin’s q. This prediction has generally been rejected in empirical studies, which show that cash flow and other measures of current profitability h ...

Ch10

... on longer-term securities as well as liquidity in terms of holding shorter-term liquid securities. The split-maturity approach overcomes these drawbacks by allocating larger proportions of the investment portfolio to both shorter-term and longer-term securities. This balances both earnings and liqui ...

... on longer-term securities as well as liquidity in terms of holding shorter-term liquid securities. The split-maturity approach overcomes these drawbacks by allocating larger proportions of the investment portfolio to both shorter-term and longer-term securities. This balances both earnings and liqui ...

Stocks

... Historically was an open auction: buy low and sell high is goal NASDAQ--—Nat’l Association of Securities Dealers ...

... Historically was an open auction: buy low and sell high is goal NASDAQ--—Nat’l Association of Securities Dealers ...

What Is Investing? - Brooklyn Public Library

... # of years to double = (72/i) I = interest rate ...

... # of years to double = (72/i) I = interest rate ...

Country Commerce Argentina Brochure

... Newly elected President Mauricio Macri, of the centre-right coalition Cambiemos (Let's Change), has pledged to ease or end many interventionist policies. He plans to replace the management of the central bank, increase the transparency of official economic data and statistics, end capital controls, ...

... Newly elected President Mauricio Macri, of the centre-right coalition Cambiemos (Let's Change), has pledged to ease or end many interventionist policies. He plans to replace the management of the central bank, increase the transparency of official economic data and statistics, end capital controls, ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.