Imperial Money Market Pool

... the Pool. The Pool is required to pay applicable taxes on the management fees paid to CIBC. Refer to the Simplified Prospectus for the maximum annual management fee rate. For the period ended December 31, 2016, 100% of the management fees collected from the Pool was attributable to general administr ...

... the Pool. The Pool is required to pay applicable taxes on the management fees paid to CIBC. Refer to the Simplified Prospectus for the maximum annual management fee rate. For the period ended December 31, 2016, 100% of the management fees collected from the Pool was attributable to general administr ...

Pace University FY11 Financial Statements

... in temporarily restricted net assets and are reclassified to unrestricted net assets when the purpose or time restrictions are met. Contributions subject to donor-imposed stipulations that the corpus be maintained permanently are recognized as increases in permanently restricted net assets. Conditio ...

... in temporarily restricted net assets and are reclassified to unrestricted net assets when the purpose or time restrictions are met. Contributions subject to donor-imposed stipulations that the corpus be maintained permanently are recognized as increases in permanently restricted net assets. Conditio ...

Economic Update - IMA Michigan Council

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

Chapter 1

... Overall Performance Measuring and Insurer’s Overall Performance He investment income ratio compares the amount of net investment income (investment income minus investment expenses) with earned premiums over a specific period of time. The investment income ratio is calculated as shown: Investment i ...

... Overall Performance Measuring and Insurer’s Overall Performance He investment income ratio compares the amount of net investment income (investment income minus investment expenses) with earned premiums over a specific period of time. The investment income ratio is calculated as shown: Investment i ...

Chapter 6

... Fifth, securitization allows for innovation over time. Financial firms seeking to lower the cost of funds to borrowers can broaden the range of assets that are transformed into securities. They can also learn to shape the securities, customizing them to fit the preferences of the ultimate buyers.2 ...

... Fifth, securitization allows for innovation over time. Financial firms seeking to lower the cost of funds to borrowers can broaden the range of assets that are transformed into securities. They can also learn to shape the securities, customizing them to fit the preferences of the ultimate buyers.2 ...

Corporate Finance Chap 1

... Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any more debt or once the marginal benefits coming from debt financing reduces, equity is issued. This theory maintains that businesses adhere to a hierarchy of financing sources and prefe ...

... Once internal funds have been used and on its depletion, debts are issued, and when it is not sensible to issue any more debt or once the marginal benefits coming from debt financing reduces, equity is issued. This theory maintains that businesses adhere to a hierarchy of financing sources and prefe ...

KIWIS LIKE BUYING HOUSES MORE ... BUSINESSES Talk to PricewaterhouseCoopers Annual Tax Conference

... be rational for householders to take these into account in their savings decisions. Through various Crown Financial Institutions, and in particular the New Zealand Super Fund, the Government indirectly holds about $600 million of New Zealand equities onshore and about $1,800 million offshore. Throug ...

... be rational for householders to take these into account in their savings decisions. Through various Crown Financial Institutions, and in particular the New Zealand Super Fund, the Government indirectly holds about $600 million of New Zealand equities onshore and about $1,800 million offshore. Throug ...

Charting A Course Towards Your Financial Goals

... 500 listed stocks, and bonds that are investment grade or better. 5. Our process is both “top-down” and “bottom-up” using the S&P 500 listed companies as our base. We begin with our macro economic view—both domestic and global. Based on where we are in the economic cycle, we apply sector weightings ...

... 500 listed stocks, and bonds that are investment grade or better. 5. Our process is both “top-down” and “bottom-up” using the S&P 500 listed companies as our base. We begin with our macro economic view—both domestic and global. Based on where we are in the economic cycle, we apply sector weightings ...

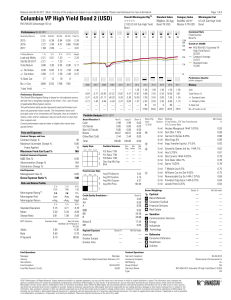

Columbia VP High Yield Bond 2 (USD)

... the fund on the dividend declaration date. Due to foreign tax credits or realized capital losses, after-tax returns may be greater than before-tax returns. After-tax returns for exchange-traded funds are based on net asset value. Money Market Fund Disclosures If money market fund(s) are included in ...

... the fund on the dividend declaration date. Due to foreign tax credits or realized capital losses, after-tax returns may be greater than before-tax returns. After-tax returns for exchange-traded funds are based on net asset value. Money Market Fund Disclosures If money market fund(s) are included in ...

4394-4400 - International Journal of Management and Humanity

... investors because of extensive experience in investing in different countries, they can see the flaws in the financial system and regulatory And ultimately with abuse of it leads harm the country and their profits. The research literature Definition of Foreign Direct Investment (FDI) There are vario ...

... investors because of extensive experience in investing in different countries, they can see the flaws in the financial system and regulatory And ultimately with abuse of it leads harm the country and their profits. The research literature Definition of Foreign Direct Investment (FDI) There are vario ...

Private Equity Investment in Latin America

... (as opposed to an offshore jurisdiction), the potential lack of a clear and reliable legal framework to enforce minority rights, and the potential inability of the local judiciary system to resolve controversies efficiently. As in any direct investment, there is the risk of changes in or disagreemen ...

... (as opposed to an offshore jurisdiction), the potential lack of a clear and reliable legal framework to enforce minority rights, and the potential inability of the local judiciary system to resolve controversies efficiently. As in any direct investment, there is the risk of changes in or disagreemen ...

Pointers

... a little more than two months after that decline, a portfolio of stocks purchased on December 31, 1986, would have still returned about a 5% gain for the year. Source: Fortune Magazine October 24, 1988 issue ...

... a little more than two months after that decline, a portfolio of stocks purchased on December 31, 1986, would have still returned about a 5% gain for the year. Source: Fortune Magazine October 24, 1988 issue ...

The Basics of Risk

... event or outcome where there is some peril of loss or injury. For stocks, it is the potential to either make or lose money on the investment over time. For stocks, risk is often measured as the variability or volatility of stock returns and thus includes both potential worse-thanexpected as well ...

... event or outcome where there is some peril of loss or injury. For stocks, it is the potential to either make or lose money on the investment over time. For stocks, risk is often measured as the variability or volatility of stock returns and thus includes both potential worse-thanexpected as well ...

12-1

... make money • They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns • Market efficiency will not protect you from wrong choices if you do not diversify – you still don’t want to ...

... make money • They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns • Market efficiency will not protect you from wrong choices if you do not diversify – you still don’t want to ...

Questions Every Banker Would Like to Ask About

... What are the primary private banking risks? Private banking embodies a number of risk factors: (1) operational risk, (2) reputation risk, (3) legal risk, (4) relationship risk, and (5) credit risk. The combination of more competition and increasingly complex products offering higher yields, which fu ...

... What are the primary private banking risks? Private banking embodies a number of risk factors: (1) operational risk, (2) reputation risk, (3) legal risk, (4) relationship risk, and (5) credit risk. The combination of more competition and increasingly complex products offering higher yields, which fu ...

FOREIGN DIRECT INVESTMENT AS A MEANS OF FINANCING

... It may be thought that since equity is acquired in exchange for finance, those firms which are taken over by FDI, are left with finance as a result of such take-over, which they can use for undertaking productive investment elsewhere. But this is precisely the fallacy referred to above, namely the c ...

... It may be thought that since equity is acquired in exchange for finance, those firms which are taken over by FDI, are left with finance as a result of such take-over, which they can use for undertaking productive investment elsewhere. But this is precisely the fallacy referred to above, namely the c ...

Summary Prospectus

... “Interactive Data”). Interactive Data is not affiliated with ProShares Trust or any of its affiliates. ProShares Trust or its affiliates has entered into a license agreement with Interactive Data to use the Indices. Neither ProShares Trust nor ProShares UltraShort 3-7 Year Treasury, ProShares Ultra ...

... “Interactive Data”). Interactive Data is not affiliated with ProShares Trust or any of its affiliates. ProShares Trust or its affiliates has entered into a license agreement with Interactive Data to use the Indices. Neither ProShares Trust nor ProShares UltraShort 3-7 Year Treasury, ProShares Ultra ...

Greetings and happy spring to you! Wow, it`s an understatement to

... upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less t ...

... upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less t ...

Office Market Report Spring 2016 - DPC

... The main focus of potential buyers was directed in recent years at mainly prime properties. Demand is for prime properties with an excellent location, long lease terms and good tenant covenant. Although demand is still high, the supply is very low with correspondingly high price. In addition to clas ...

... The main focus of potential buyers was directed in recent years at mainly prime properties. Demand is for prime properties with an excellent location, long lease terms and good tenant covenant. Although demand is still high, the supply is very low with correspondingly high price. In addition to clas ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.