Shedding Light on Hedge Funds

... often perform extensive research about the securities in which they invest. They then take speculative positions that other investors, with less information, might be unwilling to take (because the positions seem rather risky). These risky (but well- researched) investments can enhance the liquidity ...

... often perform extensive research about the securities in which they invest. They then take speculative positions that other investors, with less information, might be unwilling to take (because the positions seem rather risky). These risky (but well- researched) investments can enhance the liquidity ...

Gerhard Illing (2008) Money: Theory and Practise Chapter xx Liquidity

... similar investments they hold according to the market value. But the impact on the biggest banks was even more severe. In times of crisis, they were committed — either legally (for conduits) or to maintain their reputations (for SIV’s) — to stepping in to buy these securities. Since August 2007, ban ...

... similar investments they hold according to the market value. But the impact on the biggest banks was even more severe. In times of crisis, they were committed — either legally (for conduits) or to maintain their reputations (for SIV’s) — to stepping in to buy these securities. Since August 2007, ban ...

Peking University School of Transnational Law

... We will examine in greater detail the internal governance of private equity funds, including the relationship between fund managers and their investors, and the economic principles that drive the success of these funds. ...

... We will examine in greater detail the internal governance of private equity funds, including the relationship between fund managers and their investors, and the economic principles that drive the success of these funds. ...

Download Document

... that if more aggressive managers with higher tracking errors tend to also have more uncertainty in their means (i.e. r > 0), then it is possible that the adjusted IR for Manager L will actually approach the lower value of the much more conservative manager K. The lesson for asset owners and particul ...

... that if more aggressive managers with higher tracking errors tend to also have more uncertainty in their means (i.e. r > 0), then it is possible that the adjusted IR for Manager L will actually approach the lower value of the much more conservative manager K. The lesson for asset owners and particul ...

Managing Permanence Risk in the BioCarbon Fund

... Although integrally linked to overall portfolio risk management, the technical design of individual projects, and the structure of Emission Reductions Purchase Agreements (ERPAs) also enhances certainty in ER delivery and permanence. The BioCarbon Fund would primarily support projects that are perma ...

... Although integrally linked to overall portfolio risk management, the technical design of individual projects, and the structure of Emission Reductions Purchase Agreements (ERPAs) also enhances certainty in ER delivery and permanence. The BioCarbon Fund would primarily support projects that are perma ...

Portfolio Choice

... and J are equivalent and exist as tangency points between the two curves. This is known as the preferred portfolio for the theoretical relationships between expected return and standard deviation for risky and riskless assets. Note that the CAPM does not allow for investors to choose the makeup of t ...

... and J are equivalent and exist as tangency points between the two curves. This is known as the preferred portfolio for the theoretical relationships between expected return and standard deviation for risky and riskless assets. Note that the CAPM does not allow for investors to choose the makeup of t ...

Note 22 - Measurement of fair value of financial instruments

... The fair value of financial instruments that are traded in an active market is based on the market price on the balance sheet date. A market is regarded as active if the market prices are easily and regularly available from a stock exchange, trader, broker, industrial classification, quotation servi ...

... The fair value of financial instruments that are traded in an active market is based on the market price on the balance sheet date. A market is regarded as active if the market prices are easily and regularly available from a stock exchange, trader, broker, industrial classification, quotation servi ...

How to foster investments in long-term assets such as

... infrastructure projects and public-private partnerships (PPPs) are notably key in attracting private sector investors who must invest development funds up front in order to secure such projects and can make informed choices about the geography of the projects they choose to follow. Development of na ...

... infrastructure projects and public-private partnerships (PPPs) are notably key in attracting private sector investors who must invest development funds up front in order to secure such projects and can make informed choices about the geography of the projects they choose to follow. Development of na ...

treasurer- manager responsible for financing, cash management

... general public is called the initial public offering, or IPO. Investors who buy shares are contributing funds that will be used to pay for the firm’s investments in real assets. In return, they become part-owners of the firm and share in the future success of the enterprise. A new issue of securitie ...

... general public is called the initial public offering, or IPO. Investors who buy shares are contributing funds that will be used to pay for the firm’s investments in real assets. In return, they become part-owners of the firm and share in the future success of the enterprise. A new issue of securitie ...

CapStrStu

... A, B, and C form Dine, Inc. to operate a restaurant that C previously operated as a sole proprietorship. After the initial contribution (see diagram), Dine needs $1.8 million more capital to renovate the building, acquire equipment, and provide working capital. So, Dine obtains a $900,000 loan from ...

... A, B, and C form Dine, Inc. to operate a restaurant that C previously operated as a sole proprietorship. After the initial contribution (see diagram), Dine needs $1.8 million more capital to renovate the building, acquire equipment, and provide working capital. So, Dine obtains a $900,000 loan from ...

Working Capital

... relationship between the spaces – both public (exterior) and private (interior) – created by the speculative office development process; the economic, environmental and social sustainability of such development; and the role of innovative new financial instruments in creating a global property marke ...

... relationship between the spaces – both public (exterior) and private (interior) – created by the speculative office development process; the economic, environmental and social sustainability of such development; and the role of innovative new financial instruments in creating a global property marke ...

Large Cap Growth Factsheet

... euro over the past 12 months. This will have a meaningful effect on multinationals and any company with overseas revenue exposure. Clearly the stronger dollar has caused companies to adjust their 2015 year EPS estimates. However, as long as unit volume growth remains healthy, we expect the market to ...

... euro over the past 12 months. This will have a meaningful effect on multinationals and any company with overseas revenue exposure. Clearly the stronger dollar has caused companies to adjust their 2015 year EPS estimates. However, as long as unit volume growth remains healthy, we expect the market to ...

Sample Questions 3 - U of L Class Index

... D) $350,000 you will pay to Fred Singles to promote your new clubs. E) $125,000 you will receive by selling the existing production equipment which must be upgraded if you produce the new supersized clubs. ...

... D) $350,000 you will pay to Fred Singles to promote your new clubs. E) $125,000 you will receive by selling the existing production equipment which must be upgraded if you produce the new supersized clubs. ...

MAKING THE INVESTMENT PLAN WORK FOR EUROPE

... requires explicit project selection criteria that: ...

... requires explicit project selection criteria that: ...

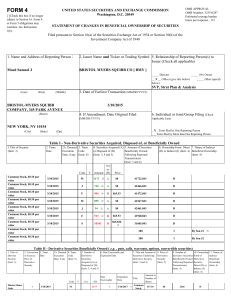

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

BUSINESS BRIEFING TOKYO: MOVING UP THE YIELD CURVE

... Non-prime offices generally afford investors easier access into Tokyo’s office market, as the city’s prime offices remain tightly held by developers and institutional investors, who have investment mandates to adhere to. Unlike investment grade assets, non-prime offices are owned by a wide variety o ...

... Non-prime offices generally afford investors easier access into Tokyo’s office market, as the city’s prime offices remain tightly held by developers and institutional investors, who have investment mandates to adhere to. Unlike investment grade assets, non-prime offices are owned by a wide variety o ...

FREE Sample Here

... 1. Deregulation of financial institutions and mergers have created a more competitive environment for retail brokerage houses. TRUE ...

... 1. Deregulation of financial institutions and mergers have created a more competitive environment for retail brokerage houses. TRUE ...

AMP Capital Understanding Infrastructure – a reference guide

... asset/investment should be considered prior to investment. The traditional definition of infrastructure has also expanded over time to encompass social infrastructure which includes hospitals, education facilities and various other public private partnerships (PPPs). These social assets display the ...

... asset/investment should be considered prior to investment. The traditional definition of infrastructure has also expanded over time to encompass social infrastructure which includes hospitals, education facilities and various other public private partnerships (PPPs). These social assets display the ...

Expand Into Value Added Services

... investment and fund management services, investment banking, financial trading (including foreign exchange, securities and derivatives). Captive insurance or reinsurance management services, reinsurance underwriting, actuarial services, insurance claims management, hedge fund administration, and any ...

... investment and fund management services, investment banking, financial trading (including foreign exchange, securities and derivatives). Captive insurance or reinsurance management services, reinsurance underwriting, actuarial services, insurance claims management, hedge fund administration, and any ...

I_Ch05

... The HPR is a simple and unambiguous measure of investment return over a single period However, investors are often interested in average returns over longer periods of time In this case, return measurement is more ambiguous, i.e., there may be different methods to measure multi-period returns – Arit ...

... The HPR is a simple and unambiguous measure of investment return over a single period However, investors are often interested in average returns over longer periods of time In this case, return measurement is more ambiguous, i.e., there may be different methods to measure multi-period returns – Arit ...

ภาพนิ่ง 1

... Unable to build new mode of K accumulation (Thaksin Gov’t) Why did Thaksin’s gov’t want less independent BOT? It was a real sector gov’t who captured the state & used state power for benefiting its constituencies, cronies & inner circle Further amend bankruptcy law in favor of debtors State d ...

... Unable to build new mode of K accumulation (Thaksin Gov’t) Why did Thaksin’s gov’t want less independent BOT? It was a real sector gov’t who captured the state & used state power for benefiting its constituencies, cronies & inner circle Further amend bankruptcy law in favor of debtors State d ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.