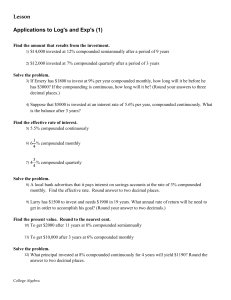

Lesson Applications to Log`s and Exp`s (1)

... has $3000? If the compounding is continuous, how long will it be? (Round your answers to three decimal places.) ...

... has $3000? If the compounding is continuous, how long will it be? (Round your answers to three decimal places.) ...

Prioritizing Projects to Maximize Return on Investment

... Examples of processes relative to a revenue business goal include: • Customer Analytics: Are we selling all possible products/services to existing clients? • Market Analysis: Are we selling the products that the market is ready to buy? • Customer Satisfaction Management: Are we answering our clie ...

... Examples of processes relative to a revenue business goal include: • Customer Analytics: Are we selling all possible products/services to existing clients? • Market Analysis: Are we selling the products that the market is ready to buy? • Customer Satisfaction Management: Are we answering our clie ...

NYU-SEC5 - Wharton Finance

... Random level of credit Asset in fixed supply = B1 with prob. k(B1) pays R with certainty ...

... Random level of credit Asset in fixed supply = B1 with prob. k(B1) pays R with certainty ...

Conventional Direction to Unconventional Measures: Using

... towards a larger European budget. The report recommends that various additional sources of financing should be considered beyond the measures set out in the Juncker Plan. These additional sources of financing should neither lead to permanent transfers between countries, nor undermine the incentives ...

... towards a larger European budget. The report recommends that various additional sources of financing should be considered beyond the measures set out in the Juncker Plan. These additional sources of financing should neither lead to permanent transfers between countries, nor undermine the incentives ...

LIQUIDITY PAPER v4 - Institute and Faculty of Actuaries

... using futures. For example, a life company could go short in equity futures but long in gilts. The latter, being carried out in the cash market will result in a drain which will not be immediately offset by the sale of underlying assets. Such large transactions are difficult to model and will probab ...

... using futures. For example, a life company could go short in equity futures but long in gilts. The latter, being carried out in the cash market will result in a drain which will not be immediately offset by the sale of underlying assets. Such large transactions are difficult to model and will probab ...

large cap growth review - North Carolina State Treasurer

... We focus on a few key statistics in determining which mangers fit well in the NC SRP Large Cap Growth fund. One of the key characteristics for measuring down market performance is Downside Capture, which is the percentage of the market’s negative performance that the manager also produces. The Downs ...

... We focus on a few key statistics in determining which mangers fit well in the NC SRP Large Cap Growth fund. One of the key characteristics for measuring down market performance is Downside Capture, which is the percentage of the market’s negative performance that the manager also produces. The Downs ...

TYPES OF RATIO

... made for distribution from the total amount of assets employed by that business. This is why we ignore tax and interest charges when calculating ROCE for a limited company. These items will fluctuate at the whim of agencies such as the government and the Bank of England. Therefore if we were to meas ...

... made for distribution from the total amount of assets employed by that business. This is why we ignore tax and interest charges when calculating ROCE for a limited company. These items will fluctuate at the whim of agencies such as the government and the Bank of England. Therefore if we were to meas ...

inside: 3 Market update 4 What makes a confident investor? 6 Dos

... assumptions on which the outlooks given in this publication are based are reasonable, the outlooks may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The results ultimately achieved may differ materially from our outlooks. Material contained ...

... assumptions on which the outlooks given in this publication are based are reasonable, the outlooks may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The results ultimately achieved may differ materially from our outlooks. Material contained ...

Role of Financial Institutions - We can offer most test bank and

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

Allens: Legal guide to investment in Vietnam

... in 1986 Vietnam introduced the Ð i m i (or ‘economic renovation’) policy, a key aim of which was to open Vietnam to foreign investment. The reforms introduced under this policy have transformed Vietnam from a centrally planned economy to a socialistoriented market economy. Vietnam’s efforts to attra ...

... in 1986 Vietnam introduced the Ð i m i (or ‘economic renovation’) policy, a key aim of which was to open Vietnam to foreign investment. The reforms introduced under this policy have transformed Vietnam from a centrally planned economy to a socialistoriented market economy. Vietnam’s efforts to attra ...

Global timber investments, wood costs, regulation, and risk

... common criteria and indicators (C&I) of SFM to compare the rigor of forestry laws and policies, and then classifying them by degree of regulation e mandatory or voluntary e and by type of approach e process, prescriptive, or outcome based. We simplified the McGinley schema for this analysis by simpl ...

... common criteria and indicators (C&I) of SFM to compare the rigor of forestry laws and policies, and then classifying them by degree of regulation e mandatory or voluntary e and by type of approach e process, prescriptive, or outcome based. We simplified the McGinley schema for this analysis by simpl ...

NHA Mortgage-Backed Securities

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

capital markets players survey 2013

... markets, productive projects will remain unexploited. This effectively cuts economic growth from what would have been possible given the presence of efficient capital markets. Stimulating economic growth and development requires long term funding, far longer than the duration for which most lenders ...

... markets, productive projects will remain unexploited. This effectively cuts economic growth from what would have been possible given the presence of efficient capital markets. Stimulating economic growth and development requires long term funding, far longer than the duration for which most lenders ...

CHAPTER 13 Capital Structure and Leverage

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

Vanguard Ultra-Short-Term Bond Fund Prospectus Investor Shares

... retirement or savings plan, your plan administrator or your benefits office can provide you with detailed information on how to participate in your plan. Tax Information The Fund’s distributions may be taxable as ordinary income or capital gain. If you are investing through a tax-advantaged account, ...

... retirement or savings plan, your plan administrator or your benefits office can provide you with detailed information on how to participate in your plan. Tax Information The Fund’s distributions may be taxable as ordinary income or capital gain. If you are investing through a tax-advantaged account, ...

Schwab Advisor Cash Reserves

... Schwab Advisor Cash Reserves (the fund) seeks the highest current income consistent with stability of capital and liquidity. To pursue its goal, the fund invests in high-quality, short-term money market investments issued by U.S. and foreign issuers. Examples of these securities include commercial p ...

... Schwab Advisor Cash Reserves (the fund) seeks the highest current income consistent with stability of capital and liquidity. To pursue its goal, the fund invests in high-quality, short-term money market investments issued by U.S. and foreign issuers. Examples of these securities include commercial p ...

HNWI Asset Allocation in the USA 2015 Brochure

... Compiled and curated by a team of expert research specialists, the database comprises dossiers on over 60,000 HNWIs from around the world. - With the wealth report as the foundation for our research and analysis, we are able obtain an unsurpassed level of granularity, insight and authority on the HN ...

... Compiled and curated by a team of expert research specialists, the database comprises dossiers on over 60,000 HNWIs from around the world. - With the wealth report as the foundation for our research and analysis, we are able obtain an unsurpassed level of granularity, insight and authority on the HN ...

Chapter 10: An Overview of Risk Management

... – moral-hazard: having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. – adverse selection: those who purchase insurance against risk are more likely than the general population to be at risk ...

... – moral-hazard: having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss. – adverse selection: those who purchase insurance against risk are more likely than the general population to be at risk ...

Lazard Emerging Markets Debt

... mid-2016, both developed markets and emerging markets have posted improved diffusion index measures, which tend to lead economic growth by two to three quarters. The improvement in these measures has been volatile, but overall positive trends have persisted for quite some time. This gives us increas ...

... mid-2016, both developed markets and emerging markets have posted improved diffusion index measures, which tend to lead economic growth by two to three quarters. The improvement in these measures has been volatile, but overall positive trends have persisted for quite some time. This gives us increas ...

Mutual Fund Performance and the Incentive to Generate Alpha

... Most studies of retail mutual funds implicitly assume a homogeneous product market, where funds primarily compete on after-fee performance for homogeneous investors. Yet, the fees that retail mutual funds charge (expense ratios, including 12b-1 fees, plus any sales loads) can be used to provide inve ...

... Most studies of retail mutual funds implicitly assume a homogeneous product market, where funds primarily compete on after-fee performance for homogeneous investors. Yet, the fees that retail mutual funds charge (expense ratios, including 12b-1 fees, plus any sales loads) can be used to provide inve ...

venture capital pre-investment decision making process

... in the decision process by analyzing external and internal information provided by the investee (contractual agreement, internal reports, press release). The third approach was an interview with executives and investment analysts of VC firms. The study reveals that decision making process and criter ...

... in the decision process by analyzing external and internal information provided by the investee (contractual agreement, internal reports, press release). The third approach was an interview with executives and investment analysts of VC firms. The study reveals that decision making process and criter ...

Revenue-generating projects

... operating costs (i.e. negative net revenue), it cannot obviously contribute to financing the project investment costs indirectly by borrowing money or attracting capital from investors.11 Therefore, since the objective of the funding-gap method is to identify the part of the project investment cost ...

... operating costs (i.e. negative net revenue), it cannot obviously contribute to financing the project investment costs indirectly by borrowing money or attracting capital from investors.11 Therefore, since the objective of the funding-gap method is to identify the part of the project investment cost ...

AZTEC MUSEUM ASSOCIATION TRUST RESOLUTION

... b. To establish and employ criteria for the investment of the funds of the Aztec Museum Association, Inc. consistent with the limitation upon investments as stated in the Trust Agreement; c. To establish and maintain accurate records of any funds that may have been contributed to the Aztec Museum As ...

... b. To establish and employ criteria for the investment of the funds of the Aztec Museum Association, Inc. consistent with the limitation upon investments as stated in the Trust Agreement; c. To establish and maintain accurate records of any funds that may have been contributed to the Aztec Museum As ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.