NBER WORKING PAPER SERIES MACROECONOMICS WITH FINANCIAL FRICTIONS: A SURVEY Markus K. Brunnermeier

... when individuals only face (uninsurable) idiosyncratic shocks. Holding liquid assets, which can be sold with limited price impact, allows individuals to self-insure against their idiosyncratic shock when they hit their borrowing constraint. As a consequence, assets that pay off in all states, like a ...

... when individuals only face (uninsurable) idiosyncratic shocks. Holding liquid assets, which can be sold with limited price impact, allows individuals to self-insure against their idiosyncratic shock when they hit their borrowing constraint. As a consequence, assets that pay off in all states, like a ...

Chapt17

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

“Macroeconomics with Financial Frictions”

... when individuals only face (uninsurable) idiosyncratic shocks. Holding liquid assets, which can be sold with limited price impact, allows individuals to self-insure against their idiosyncratic shock when they hit their borrowing constraint. As a consequence, assets that pay off in all states, like a ...

... when individuals only face (uninsurable) idiosyncratic shocks. Holding liquid assets, which can be sold with limited price impact, allows individuals to self-insure against their idiosyncratic shock when they hit their borrowing constraint. As a consequence, assets that pay off in all states, like a ...

Finding Smart Beta in the Factor Zoo_pdf

... The P-value of Sharpe ratio differences represents the probability that the Sharpe ratios of the long and short portfolios are from the same distribution. A P-value below 5% is required to conclude that two Sharpe ratios are significantly different from each other (with 95% confidence). After Fama a ...

... The P-value of Sharpe ratio differences represents the probability that the Sharpe ratios of the long and short portfolios are from the same distribution. A P-value below 5% is required to conclude that two Sharpe ratios are significantly different from each other (with 95% confidence). After Fama a ...

Chapter 10 - Blackwell Publishing

... Short-Term Riskless Debt = Stock - Stock Index Futures A trader might create a synthetic T-bill by holding stock and selling futures: Synthetic T-bill = Stock - Stock Index Futures This is a synthetic T-bill rather than an actual T-bill. While the portfolio will mimic the price movements of a T-bill ...

... Short-Term Riskless Debt = Stock - Stock Index Futures A trader might create a synthetic T-bill by holding stock and selling futures: Synthetic T-bill = Stock - Stock Index Futures This is a synthetic T-bill rather than an actual T-bill. While the portfolio will mimic the price movements of a T-bill ...

SELECTIVE INSURANCE GROUP INC (Form: 8-K

... After-tax net investment income declined 20% Total return on equity was 12.3% and operating return on equity was 8.5% Branchville, NJ – April 29, 2015 – Selective Insurance Group, Inc. (NASDAQ: SIGI) today reported its financial results for the first quarter ended March 31, 2015. Net income ...

... After-tax net investment income declined 20% Total return on equity was 12.3% and operating return on equity was 8.5% Branchville, NJ – April 29, 2015 – Selective Insurance Group, Inc. (NASDAQ: SIGI) today reported its financial results for the first quarter ended March 31, 2015. Net income ...

Greenko Restricted Group Financial Statements

... We have audited the accompanying combined financial statements of the Restricted Group which consists of the Greenko Dutch B.V. ("the Company"), a wholly owned subsidiary of Greenko Energy Holdings ("the Parent") and certain entities under common control of the Parent, as listed in note 3.1 to the c ...

... We have audited the accompanying combined financial statements of the Restricted Group which consists of the Greenko Dutch B.V. ("the Company"), a wholly owned subsidiary of Greenko Energy Holdings ("the Parent") and certain entities under common control of the Parent, as listed in note 3.1 to the c ...

Produced non-financial assets

... transaction accounts of the SNA. • Thus, the sub-total of uses-side minus sub-total of resources side of the KTA gives the balance of real transactions - net lending / borrowing. • The financial account of the SNA corresponds to the financial transactions of the KTA. • The KTA shows: the difference ...

... transaction accounts of the SNA. • Thus, the sub-total of uses-side minus sub-total of resources side of the KTA gives the balance of real transactions - net lending / borrowing. • The financial account of the SNA corresponds to the financial transactions of the KTA. • The KTA shows: the difference ...

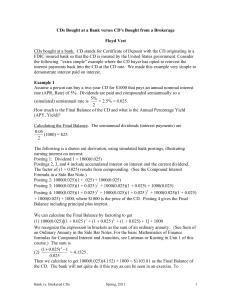

The Risk-Free Rate`s Impact on Stock Returns with Representative

... different industries to avoid covariance between stocks in the same industry. Furthermore, the investor must also be aware of the covariance between securities from different industries (Markowitz, 1952). In the genesis of the Capital Asset Pricing Model (CAPM), Sharpe (1964) and Lintner (1965) adde ...

... different industries to avoid covariance between stocks in the same industry. Furthermore, the investor must also be aware of the covariance between securities from different industries (Markowitz, 1952). In the genesis of the Capital Asset Pricing Model (CAPM), Sharpe (1964) and Lintner (1965) adde ...

Intermediate Accounting

... What are the Characteristics of Property, Plant, And Equipment? (Slide 1 of 3) • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included ...

... What are the Characteristics of Property, Plant, And Equipment? (Slide 1 of 3) • Property, plant, and equipment (alternatively called plant assets, fixed assets, or operational assets) are the tangible noncurrent assets that a company uses in the normal operations of its business. • To be included ...

Chapter 27 Risk Management and Financial Engineering

... rading in virtually all types of financial instruments has increased since the mid1990s, but no markets have experienced growth rates as explosive as those for the financial instruments used for hedging and risk management. Since the collapse of the Bretton Woods fixed exchange rate regime in 1973, cor ...

... rading in virtually all types of financial instruments has increased since the mid1990s, but no markets have experienced growth rates as explosive as those for the financial instruments used for hedging and risk management. Since the collapse of the Bretton Woods fixed exchange rate regime in 1973, cor ...

Investment and Spending Policy Community Colleges of New

... not less than three elected members of the Board of Directors. The Investment Committee shall be responsible for the development and execution of investment policies and procedures. It may elect an investment manager(s) to advise it with respect to the funds and investments of the Foundation. It sha ...

... not less than three elected members of the Board of Directors. The Investment Committee shall be responsible for the development and execution of investment policies and procedures. It may elect an investment manager(s) to advise it with respect to the funds and investments of the Foundation. It sha ...

OptionsIQ

... an option. They include: underlying price, exercise price, amount of time remaining until expiration, the volatility of the underlying asset, the risk-free rate of interest over the life of the option, and the dividend yield rate of the asset. There are several models available to price options usin ...

... an option. They include: underlying price, exercise price, amount of time remaining until expiration, the volatility of the underlying asset, the risk-free rate of interest over the life of the option, and the dividend yield rate of the asset. There are several models available to price options usin ...