Corporate Governance, Ownership Structure Perspective and Firm

... a positive relationship between Tobin’s Q and the level of nonmanagement control while management group control in excess of its proportional ownership is negatively related to Tobin’s Q. The findings of Lemmon and Lins (2003) give evidence of higher stock returns when management directly owns a lar ...

... a positive relationship between Tobin’s Q and the level of nonmanagement control while management group control in excess of its proportional ownership is negatively related to Tobin’s Q. The findings of Lemmon and Lins (2003) give evidence of higher stock returns when management directly owns a lar ...

Asymmetric investment returns and the

... Here r is the average interest/dividend rate applying to foreign liabilities, which has averaged 1.3 percentage points below the rate of nominal GDP growth since 1990. On this basis, stabilising US NFLs at 50-60 per cent of GDP would require the primary deficit to fall to under 1 per cent of GDP, a ...

... Here r is the average interest/dividend rate applying to foreign liabilities, which has averaged 1.3 percentage points below the rate of nominal GDP growth since 1990. On this basis, stabilising US NFLs at 50-60 per cent of GDP would require the primary deficit to fall to under 1 per cent of GDP, a ...

Reference manual - Index derivatives

... altered, the index value is multiplied by a new factor. This adjustment ensures that users get meaningful results when comparing index values at two different points in time, even though the index’s composition may not be the same on those two occasions. ...

... altered, the index value is multiplied by a new factor. This adjustment ensures that users get meaningful results when comparing index values at two different points in time, even though the index’s composition may not be the same on those two occasions. ...

AVENTINE RENEWABLE ENERGY HOLDINGS INC

... requirements of comprehensive income to improve the comparability, consistency, and transparency of financial reporting and to increase the prominence of items reported in other comprehensive income. ASU 2011-05 requires that all non-owner changes in stockholders’ equity be presented either in a sin ...

... requirements of comprehensive income to improve the comparability, consistency, and transparency of financial reporting and to increase the prominence of items reported in other comprehensive income. ASU 2011-05 requires that all non-owner changes in stockholders’ equity be presented either in a sin ...

Monetary Policy and Speculative Stock Markets

... the role of learning in an otherwise rational model. This enables to reproduce excess volatility of asset prices as well as a relatively high standard deviation of stock prices. As in my model, under rational expectations a monetary policy that targets asset prices induces a welfare-loss, while it i ...

... the role of learning in an otherwise rational model. This enables to reproduce excess volatility of asset prices as well as a relatively high standard deviation of stock prices. As in my model, under rational expectations a monetary policy that targets asset prices induces a welfare-loss, while it i ...

Alberta Capital Finance Authority

... Chair’s Report There is no doubt that 2016 presented a very challenging year for Albertans. Although the price of oil advanced cautiously over the year, unemployment continued its advance as well starting the year at 7.4% and finishing 2016 up 1% at 8.5%. This level of unemployment is significant. ...

... Chair’s Report There is no doubt that 2016 presented a very challenging year for Albertans. Although the price of oil advanced cautiously over the year, unemployment continued its advance as well starting the year at 7.4% and finishing 2016 up 1% at 8.5%. This level of unemployment is significant. ...

Wells Fargo Short Term Investment Fund

... money market instruments with an overall dollar-weighted average maturity of 60 days or less. Risk versus returns. The Fund is designed for investors who seek current income, preservation of capital and liquidity. There is no guarantee the Fund will be able to maintain a $1.00 per unit net asset val ...

... money market instruments with an overall dollar-weighted average maturity of 60 days or less. Risk versus returns. The Fund is designed for investors who seek current income, preservation of capital and liquidity. There is no guarantee the Fund will be able to maintain a $1.00 per unit net asset val ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... haircut than otherwise available, this always lowers its required return. The required returns of other securities either all increase or all decrease, depending on what happens to the shadow cost of capital. The most intuitive case is that the shadow cost of capital decreases due to the new source ...

... haircut than otherwise available, this always lowers its required return. The required returns of other securities either all increase or all decrease, depending on what happens to the shadow cost of capital. The most intuitive case is that the shadow cost of capital decreases due to the new source ...

gentherm incorporated - corporate

... In February, 2016, the FASB issued ASU 2016-02, “Leases (Topic 842).” ASU 2016-02 requires lessees to recognize on their balance sheet a liability to make lease payments and a right-of-use asset representing its right to use the underlying asset for the lease term. Payments to be made in optional pe ...

... In February, 2016, the FASB issued ASU 2016-02, “Leases (Topic 842).” ASU 2016-02 requires lessees to recognize on their balance sheet a liability to make lease payments and a right-of-use asset representing its right to use the underlying asset for the lease term. Payments to be made in optional pe ...

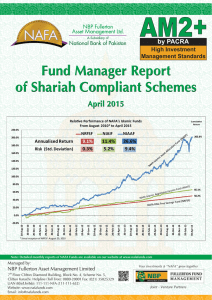

Islamic FMR- April 2015_(Complete)

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

Differences in target-firm characteristics and premiums paid by

... and determinants of the speed at which capital is invested. Phalippou & Gottschalg (2009) on the other hand, investigate whether historical performance of private equity funds surpasses that of public equity. They find that private equity firms do not outperform the S&P 500 but in contrary underper ...

... and determinants of the speed at which capital is invested. Phalippou & Gottschalg (2009) on the other hand, investigate whether historical performance of private equity funds surpasses that of public equity. They find that private equity firms do not outperform the S&P 500 but in contrary underper ...

JZCP Annual Report and Financial Statements 2016

... Investment Adviser to take advantage of a wider range of investment opportunities, providing the flexibility to adapt as market opportunities warrant. This combined with a series of financings and realisations have significantly increased the liquidity in JZCP, whilst at the same time deleveraging t ...

... Investment Adviser to take advantage of a wider range of investment opportunities, providing the flexibility to adapt as market opportunities warrant. This combined with a series of financings and realisations have significantly increased the liquidity in JZCP, whilst at the same time deleveraging t ...

Money market instruments

... 1.1 The time deposit takes the form of a bank account, arranged for an agreed upon time period. It is a non-negotiable instrument, which means that there is no secondary market in which it would be possible to trade these instruments. 1.2 Maturities of time deposits can vary over a wide range from s ...

... 1.1 The time deposit takes the form of a bank account, arranged for an agreed upon time period. It is a non-negotiable instrument, which means that there is no secondary market in which it would be possible to trade these instruments. 1.2 Maturities of time deposits can vary over a wide range from s ...

11: Corporate Finance: Corporate Investing and Financing Decisions

... Explanation: Correct answer: B Anytime there is a publicly held corporation and in any business that issued debt, there is the potential for agency problems. An agency relationship is created when decision-making authority is delegated to an agent without the agent being fully responsible for the de ...

... Explanation: Correct answer: B Anytime there is a publicly held corporation and in any business that issued debt, there is the potential for agency problems. An agency relationship is created when decision-making authority is delegated to an agent without the agent being fully responsible for the de ...