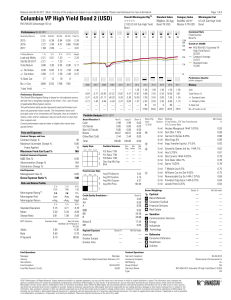

Columbia VP High Yield Bond 2 (USD)

... in the fund. All data presented is based on the most current information available to Morningstar, Inc. Morningstar Investment Management, LLC, a registered investment adviser and wholly owned subsidiary of Morningstar, Inc., provides various institutional investment consulting services, including a ...

... in the fund. All data presented is based on the most current information available to Morningstar, Inc. Morningstar Investment Management, LLC, a registered investment adviser and wholly owned subsidiary of Morningstar, Inc., provides various institutional investment consulting services, including a ...

An Empirical Analysis of the Profitability of Technical Analysis

... market hypothesis. Not only do the principles contradict the EMH, but they also put the meanvariance framework into question: if TA can generate risk adjusted profits above a reasonable benchmark, why is the profit opportunities arbitraged away? Menkhoff and Taylor (2007) state that given TA’s assum ...

... market hypothesis. Not only do the principles contradict the EMH, but they also put the meanvariance framework into question: if TA can generate risk adjusted profits above a reasonable benchmark, why is the profit opportunities arbitraged away? Menkhoff and Taylor (2007) state that given TA’s assum ...

Fund Analysis, Cash-Flow Analysis, and Financial Planning

... arise than using a single-point estimate of monthly cash flows. ...

... arise than using a single-point estimate of monthly cash flows. ...

Short selling around the world with applications to the S…

... market, subsequent stock returns are far less than the market.5 In other words, when short selling is limited, investors pay prices that are too high for stocks. Although at first it might seem good to have stock prices that are too high, it is not good. As the stock price eventually falls, many inv ...

... market, subsequent stock returns are far less than the market.5 In other words, when short selling is limited, investors pay prices that are too high for stocks. Although at first it might seem good to have stock prices that are too high, it is not good. As the stock price eventually falls, many inv ...

Margin-based Asset Pricing and Deviations from the Law of One Price

... The specification of the margin requirement is key to our results. First, we make the realistic assumption that both long and short positions use capital; in contrast, a linear constraint, as often assumed in the literature, implies that shorting frees up capital. While bases with natural properties ...

... The specification of the margin requirement is key to our results. First, we make the realistic assumption that both long and short positions use capital; in contrast, a linear constraint, as often assumed in the literature, implies that shorting frees up capital. While bases with natural properties ...

Accounting for Partnership Lecture

... • The admission of a partner by purchase of an interest in the firm is a personal transaction between one or more existing partners and the new partner • Price paid is negotiated and determined by the individuals involved • The price may be equal to or different from the capital equity acquired • An ...

... • The admission of a partner by purchase of an interest in the firm is a personal transaction between one or more existing partners and the new partner • Price paid is negotiated and determined by the individuals involved • The price may be equal to or different from the capital equity acquired • An ...

The Equity Imperative - Improving Active Risk

... at 0.4 (Manager B). Which of these managers should we select? Exhibit 3 (on page 7) details the excess return and tracking error metrics for the two options. Tracking error is the expected tracking error of the total equity allocation relative to the benchmark index. A traditional risk concentration ...

... at 0.4 (Manager B). Which of these managers should we select? Exhibit 3 (on page 7) details the excess return and tracking error metrics for the two options. Tracking error is the expected tracking error of the total equity allocation relative to the benchmark index. A traditional risk concentration ...

Considering the effects of operating lease capitalization on

... be provided. When complaining, the issues mentioned more often are the ballooning effect in the balance sheets (so that issue is seen as an advantage by some and as an inconvenient for some others), economic effects such as leverage, and compliance costs and complexity derived from implementation. T ...

... be provided. When complaining, the issues mentioned more often are the ballooning effect in the balance sheets (so that issue is seen as an advantage by some and as an inconvenient for some others), economic effects such as leverage, and compliance costs and complexity derived from implementation. T ...

NBER WORKING PAPER SERIES AND CAPITAL STRUCTURE

... and assume exogenous bankruptcy costs. I calibrate the model with nine states, which are able to capture richer dynamics of the business cycle and make it possible to separate the effects of time-varying expected growth rates from economic uncertainty. Moreover, I estimate firms’ default losses via ...

... and assume exogenous bankruptcy costs. I calibrate the model with nine states, which are able to capture richer dynamics of the business cycle and make it possible to separate the effects of time-varying expected growth rates from economic uncertainty. Moreover, I estimate firms’ default losses via ...

CLV Methodology

... (as with all magic…in economics…there’s a catch) Using a 10% annual rate of return, the present value of the coin’s expected pay-out is about $82. Copyright © 2009, SAS Institute Inc. All rights reserved. ...

... (as with all magic…in economics…there’s a catch) Using a 10% annual rate of return, the present value of the coin’s expected pay-out is about $82. Copyright © 2009, SAS Institute Inc. All rights reserved. ...

Depression Babies

... Few papers analyze the effect of past cohort-specific experiences. Most closely related is the paper by Greenwood and Nagel (2006), which shows that young mutual fund managers, who had relatively more exposure to technology stocks in the late 1990s, increased their holdings particularly after quart ...

... Few papers analyze the effect of past cohort-specific experiences. Most closely related is the paper by Greenwood and Nagel (2006), which shows that young mutual fund managers, who had relatively more exposure to technology stocks in the late 1990s, increased their holdings particularly after quart ...

Answers to Concepts Review and Critical Thinking Questions

... 8. Financing possibly could have been arranged if the company had taken quick enough action. Sometimes it becomes apparent that help is needed only when it is too late, again emphasizing the need for planning. 9. All three were important, but the lack of cash or, more generally, financial resources ...

... 8. Financing possibly could have been arranged if the company had taken quick enough action. Sometimes it becomes apparent that help is needed only when it is too late, again emphasizing the need for planning. 9. All three were important, but the lack of cash or, more generally, financial resources ...