tactallocbrochure - Railroad Street Weaith Management LLC

... Asset Allocation is broadly defined as an investment strategy which assigns specific percentages of a portfolio to the different asset types discussed earlier. The portfolio is then periodically rebalanced to the target percentages. The theory behind asset allocation is that by spreading exposure ac ...

... Asset Allocation is broadly defined as an investment strategy which assigns specific percentages of a portfolio to the different asset types discussed earlier. The portfolio is then periodically rebalanced to the target percentages. The theory behind asset allocation is that by spreading exposure ac ...

Ch10 - U of L Class Index

... The ex-dividend date determines whether or not you get the dividend • On the ex-dividend date, the price of a share of stock tends to fall by about the amount of the dividend to be ...

... The ex-dividend date determines whether or not you get the dividend • On the ex-dividend date, the price of a share of stock tends to fall by about the amount of the dividend to be ...

Public/SIC Education Presentations/REITS[1]

... As mentioned earlier, you can divest quickly if a situation came up where you had to have money. They provide significant dividend income with slow to moderate growth. ...

... As mentioned earlier, you can divest quickly if a situation came up where you had to have money. They provide significant dividend income with slow to moderate growth. ...

Global Equity Outlook 2Q2015: Preparing for the New Market Leaders

... businesses have been reducing earnings estimates. Big oil importers like Europe, Japan, China and India are benefitting from lower energy prices. However, while the deflationary impact is a potential risk for Europe and Japan, it is a blessing for India. Oil exporters like Russia and Brazil may cont ...

... businesses have been reducing earnings estimates. Big oil importers like Europe, Japan, China and India are benefitting from lower energy prices. However, while the deflationary impact is a potential risk for Europe and Japan, it is a blessing for India. Oil exporters like Russia and Brazil may cont ...

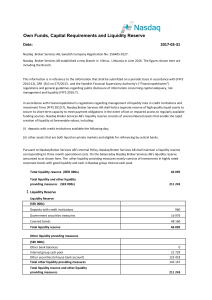

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

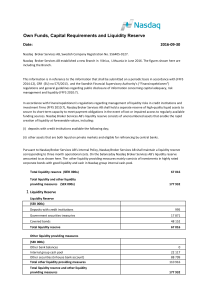

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

APRA PAIRS Model

... Problem asset management including compliance with prudential requirements Information systems and portfolio management The role and functioning of independent credit review process ...

... Problem asset management including compliance with prudential requirements Information systems and portfolio management The role and functioning of independent credit review process ...

CDS Spread Determinants

... For lower credit rating firms, leverage ,historical volatility and risk-free rate are more sensitive to CDS spread than higher credit rating firms.. ...

... For lower credit rating firms, leverage ,historical volatility and risk-free rate are more sensitive to CDS spread than higher credit rating firms.. ...

A Project Report Presentation On *SBI Mutual Fund

... government, but also by private companies, banks and financial institutions and other entities such as ...

... government, but also by private companies, banks and financial institutions and other entities such as ...

Investor Brochure - Mackenzie Global Low Volatility Fund

... The Global Low Volatility Fund is one of Mackenzie’s low volatility options to help investors sustain their confidence in a changing world. The Fund seeks to give investors: • Enhanced protection from drawdowns during periods of market stress • A means of controlling volatility • The ability to main ...

... The Global Low Volatility Fund is one of Mackenzie’s low volatility options to help investors sustain their confidence in a changing world. The Fund seeks to give investors: • Enhanced protection from drawdowns during periods of market stress • A means of controlling volatility • The ability to main ...

key assumptions - Fisher College of Business

... concern of inflationary pressures. The GDP gap is expected to persist, however, so the unemployment rate is projected to drop only slightly before stabilizing at around 6%. Inflation is expected to remain stable at about 2%. Both fiscal and monetary policy is expected to be expansionary through 200 ...

... concern of inflationary pressures. The GDP gap is expected to persist, however, so the unemployment rate is projected to drop only slightly before stabilizing at around 6%. Inflation is expected to remain stable at about 2%. Both fiscal and monetary policy is expected to be expansionary through 200 ...

- CREN - Croatian Real Estate Newsletter

... can keep the same level of social entitlements in the medium term (including the pension fund), and keep up the same pace of fiscal expenses, and at the same time expect more than 5% growth in the longer run, I will tell you right away that this is not possible. There is a great deal that economists ...

... can keep the same level of social entitlements in the medium term (including the pension fund), and keep up the same pace of fiscal expenses, and at the same time expect more than 5% growth in the longer run, I will tell you right away that this is not possible. There is a great deal that economists ...

FINANCIAL DERIVATIVES FOR BEGINNERS

... Financial Derivatives Derivatives are mainly used to mitigate future risks, however they do not add value since hedging is a zero sum game and secondly investors mostly use them on do it yourself alternatives basis. Derivatives markets can be traced back to middle ages. They were ...

... Financial Derivatives Derivatives are mainly used to mitigate future risks, however they do not add value since hedging is a zero sum game and secondly investors mostly use them on do it yourself alternatives basis. Derivatives markets can be traced back to middle ages. They were ...

Consolidated net income

... accounting for business combinations and the presentation of consolidated financial statements. • In general, the criteria for when consolidated financial statements should be presented and which companies should be consolidated are the same as under current standards. ...

... accounting for business combinations and the presentation of consolidated financial statements. • In general, the criteria for when consolidated financial statements should be presented and which companies should be consolidated are the same as under current standards. ...

citibank, na colombo, sri lanka

... Due to other customers Other borrowings Total financial liabilities ...

... Due to other customers Other borrowings Total financial liabilities ...

Chapter 8

... The return on a portfolio is the average return of the stocks in it, weighted by the dollars invested in each stock. The portfolio's return has a probability distribution with a mean and variance. These are the portfolio's expected return and risk. The expected return is the weighted average of the ...

... The return on a portfolio is the average return of the stocks in it, weighted by the dollars invested in each stock. The portfolio's return has a probability distribution with a mean and variance. These are the portfolio's expected return and risk. The expected return is the weighted average of the ...

Chapter 14

... It may also be helpful in showing possible future trends Past performance may not be a useful indicator of adequacy for the future ...

... It may also be helpful in showing possible future trends Past performance may not be a useful indicator of adequacy for the future ...

Integrated Approach to Managing Risk and

... balance sheet. For example, consider the treasury function. Such monitoring the risk can be used for position management but it is not used for structural balance sheet management, formulating funding strategies using balance sheet items like loans and deposits. Applications for senior management ar ...

... balance sheet. For example, consider the treasury function. Such monitoring the risk can be used for position management but it is not used for structural balance sheet management, formulating funding strategies using balance sheet items like loans and deposits. Applications for senior management ar ...

![Public/SIC Education Presentations/REITS[1]](http://s1.studyres.com/store/data/012509441_1-4ac192bb5fd15c4b63c90980bf3e65d9-300x300.png)