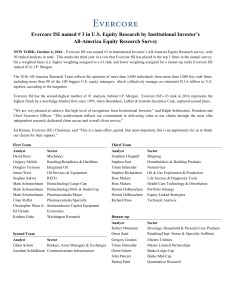

Evercore ISI named # 3 in US Equity Research by

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

Building Investment

... regions will have the opportunity to grow and prosper. Growing our economy requires investment to flow beyond our major centres and out to our regional economies. While the regions are diverse, they provide much of the primary products so vital to our export success. Investment can help our regions ...

... regions will have the opportunity to grow and prosper. Growing our economy requires investment to flow beyond our major centres and out to our regional economies. While the regions are diverse, they provide much of the primary products so vital to our export success. Investment can help our regions ...

Five Ways to Ramp Up Fee Income

... they are getting a firmer grasp of how much money they can expect to lose complying with the Dodd-Frank act and new restrictions on overdraft fees. The changes may not be as costly as initially expected, and will likely be offset through new fees and products.” The race is on in 2010 for winning and ...

... they are getting a firmer grasp of how much money they can expect to lose complying with the Dodd-Frank act and new restrictions on overdraft fees. The changes may not be as costly as initially expected, and will likely be offset through new fees and products.” The race is on in 2010 for winning and ...

External Financial Stress and External Financing Vulnerability in Turkey: Some

... Turkish banking system to a financial stress abroad has increased in the last decade. These results could be one of the consequences of the structural change in the Turkish economy after the 2001 financial crisis. Before 2001, there was an implicit foreign exchange rate peg guarantee of the governme ...

... Turkish banking system to a financial stress abroad has increased in the last decade. These results could be one of the consequences of the structural change in the Turkish economy after the 2001 financial crisis. Before 2001, there was an implicit foreign exchange rate peg guarantee of the governme ...

On the Markets - Morgan Stanley Locator

... xperience suggests that after a sevenyear bull market, which took the major stock indexes to all-time highs, subsequent years would inevitably bring lower returns. Still, when the Global Investment Committee recently published its strategic, or seven-year forecasts, it trimmed the annualized US equi ...

... xperience suggests that after a sevenyear bull market, which took the major stock indexes to all-time highs, subsequent years would inevitably bring lower returns. Still, when the Global Investment Committee recently published its strategic, or seven-year forecasts, it trimmed the annualized US equi ...

Key Investor Information

... able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend redemptions of its shares. Operational risk: Failures at service providers could lead to disruptions of fund operations or losses. ...

... able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend redemptions of its shares. Operational risk: Failures at service providers could lead to disruptions of fund operations or losses. ...

Slides

... Of the elements on the assets side, cash may or may not be necessary for the operations of the business. Often, it is estimated that cash equal to about 2% of revenues is sufficient for business purposes – the rest is excess cash. Revenue for the years ending 12/02 and 12/01 were $25112m. And $26935 ...

... Of the elements on the assets side, cash may or may not be necessary for the operations of the business. Often, it is estimated that cash equal to about 2% of revenues is sufficient for business purposes – the rest is excess cash. Revenue for the years ending 12/02 and 12/01 were $25112m. And $26935 ...

Jerry L. Jordan RESTRUCTURING FINANCIAL INSTITUTIONS IN GLOBAL ECONOMY

... $800 billion. That amount, of course, does not include foreign currency—denominated liabilities of banks domiciled in the United States, since such balances were prohibited before January 1, 1990. In recent years, mutnal funds of assets denominated in foreign currencies have become more common. Incr ...

... $800 billion. That amount, of course, does not include foreign currency—denominated liabilities of banks domiciled in the United States, since such balances were prohibited before January 1, 1990. In recent years, mutnal funds of assets denominated in foreign currencies have become more common. Incr ...

Document

... • Most, if not all, open-end mutual funds permit you to transfer all or any part of your investment from one fund to another fund within its family. This kind of transfer is commonly called "switching" ...

... • Most, if not all, open-end mutual funds permit you to transfer all or any part of your investment from one fund to another fund within its family. This kind of transfer is commonly called "switching" ...

From big to great: The world`s leading institutional investors forge

... definitions. For example, in private equity they might require 15 percent returns, over a maximum of 7 years. But when every investor uses the same definitions, they find the same deals. The result? An auction, in which the successful bidder often suffers from the “winner’s curse.” By 2020, leading ...

... definitions. For example, in private equity they might require 15 percent returns, over a maximum of 7 years. But when every investor uses the same definitions, they find the same deals. The result? An auction, in which the successful bidder often suffers from the “winner’s curse.” By 2020, leading ...

149th REPORT!OF THE INVESTMENTS COMMITTEE

... The forecasted growth rate in France for 2007 would be around 2.1 per cent which was lower than expected. France’s growth rate has been on a plateau since 2004 and below the average growth by 70 basis points in comparison to other European countries. Further growth should be fostered by the increase ...

... The forecasted growth rate in France for 2007 would be around 2.1 per cent which was lower than expected. France’s growth rate has been on a plateau since 2004 and below the average growth by 70 basis points in comparison to other European countries. Further growth should be fostered by the increase ...

Draft Policy Statement to Regulation 81

... for renewal prospectuses, which may include costs associated with legal fees relating to the preparation of a prospectus, costs associated with the distribution of the securities of the mutual fund, including underwriting, agency or similar costs, the cost of printing a prospectus, any fees that may ...

... for renewal prospectuses, which may include costs associated with legal fees relating to the preparation of a prospectus, costs associated with the distribution of the securities of the mutual fund, including underwriting, agency or similar costs, the cost of printing a prospectus, any fees that may ...

Clarion Partners and Pacific Industrial Acquire Premier Orange

... operators, the Clarion Partners Industrial Group is focused exclusively on the logistics sector, with particular emphasis on bulk warehouse/distribution facilities. The Group manages a 585 property portfolio (consisting of more than 100 million square feet and currently valued at more than $7.2 bill ...

... operators, the Clarion Partners Industrial Group is focused exclusively on the logistics sector, with particular emphasis on bulk warehouse/distribution facilities. The Group manages a 585 property portfolio (consisting of more than 100 million square feet and currently valued at more than $7.2 bill ...

Course Syllabus - Lee County Schools

... companies earn profits. This course also introduces students to the main concepts behind investing and discriminates among different ways to invest money. Students examine contemporary issues including the level of personal saving in the United States, ethics in the financial services industry, and ...

... companies earn profits. This course also introduces students to the main concepts behind investing and discriminates among different ways to invest money. Students examine contemporary issues including the level of personal saving in the United States, ethics in the financial services industry, and ...

Principles of Economics, Case and Fair,9e

... © 2009 Pearson Education, Inc. Publishing as Prentice Hall Principles of Economics 9e by Case, Fair and Oster ...

... © 2009 Pearson Education, Inc. Publishing as Prentice Hall Principles of Economics 9e by Case, Fair and Oster ...

Economic Costs of the Nordic Banking Crises

... defined on the basis of its negative economic effects. This raises the question of the transmission mechanisms between the banking sector and the real economy. It may therefore be instructive to give a brief review of transmission mechanisms outlined in the literature: o A sharp reduction in bank le ...

... defined on the basis of its negative economic effects. This raises the question of the transmission mechanisms between the banking sector and the real economy. It may therefore be instructive to give a brief review of transmission mechanisms outlined in the literature: o A sharp reduction in bank le ...

Chapter 2: Investment and Physical Capital

... Transition is typically thought of as re-writing the rules, and progress in transition is measured by what is still missing among the rules — and now institutions as well. But the big problem for Russia is not what is missing, but rather what is there — as a result of 70 years of misallocation. The ...

... Transition is typically thought of as re-writing the rules, and progress in transition is measured by what is still missing among the rules — and now institutions as well. But the big problem for Russia is not what is missing, but rather what is there — as a result of 70 years of misallocation. The ...

Global Financial Instability: Framework, Events, Issues

... risks are likely to be the most eager to take out a loan, even at a high rate of interest, because they are less concerned with paying the loan back. Thus, the lender must be concerned that the parties who are the most likely to produce an undesirable or adverse outcome are most likely to be selecte ...

... risks are likely to be the most eager to take out a loan, even at a high rate of interest, because they are less concerned with paying the loan back. Thus, the lender must be concerned that the parties who are the most likely to produce an undesirable or adverse outcome are most likely to be selecte ...

Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

... With the initialization of reforms in Indian economy in 1991 and onwards, the economy has seen great growth in almost all segment of the economy. As a part of global treaties, India was forced to open its doors for private players for business. Gradually, almost all sectors of Indian economy were op ...

... With the initialization of reforms in Indian economy in 1991 and onwards, the economy has seen great growth in almost all segment of the economy. As a part of global treaties, India was forced to open its doors for private players for business. Gradually, almost all sectors of Indian economy were op ...

The importance of a well-diversified portfolio

... understandable or perhaps even essential to question whether the old rules about having a well-diversified portfolio still apply. The answer? As much as ever. ...

... understandable or perhaps even essential to question whether the old rules about having a well-diversified portfolio still apply. The answer? As much as ever. ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.