Financial Accounting and Accounting Standards

... Net income in year of loss is lower. Net income in subsequent period may be higher than normal if expected reductions in sales price do not materialize. ...

... Net income in year of loss is lower. Net income in subsequent period may be higher than normal if expected reductions in sales price do not materialize. ...

The Effects of Unrecorded Assets and Information

... and Palepu (1999) found that the regression formula for current earnings and returns indicated that the higher the disclosure level, the greater the current earnings coefficient. Lundholm and Myers (2002) believed that increases in the current earnings coefficient, as mentioned previously, were caus ...

... and Palepu (1999) found that the regression formula for current earnings and returns indicated that the higher the disclosure level, the greater the current earnings coefficient. Lundholm and Myers (2002) believed that increases in the current earnings coefficient, as mentioned previously, were caus ...

Low for long? Causes and consequences of persistently low interest

... providing astute analysis of current economic events in the context of longerterm trends. It reminds us that the trend to lower interest rates originates from far before the Global Crisis of 2008-2009 and takes the view that this process will soon reverse. This view is based on a clear analysis of t ...

... providing astute analysis of current economic events in the context of longerterm trends. It reminds us that the trend to lower interest rates originates from far before the Global Crisis of 2008-2009 and takes the view that this process will soon reverse. This view is based on a clear analysis of t ...

Basel III: Dynamics of State Implementation

... developing countries whose sovereign debt remained on the books of U.S. banks.28 Those countries would use the funds to service their debt to U.S. banks, effectively transferring money from taxpayers to commercial banks.29 Voters, and thus Congress, were adamantly opposed to such a bail out, and the ...

... developing countries whose sovereign debt remained on the books of U.S. banks.28 Those countries would use the funds to service their debt to U.S. banks, effectively transferring money from taxpayers to commercial banks.29 Voters, and thus Congress, were adamantly opposed to such a bail out, and the ...

Landscape of social investment_03.indd - Eureka

... flows into projects that can achieve outsatnding social and economic returns in the future. Figure 1 (above) maps out the basic elements of social investment today as they occur across the three sectors. Social and ethical investment could be added to all three sectors. However, it should be noted th ...

... flows into projects that can achieve outsatnding social and economic returns in the future. Figure 1 (above) maps out the basic elements of social investment today as they occur across the three sectors. Social and ethical investment could be added to all three sectors. However, it should be noted th ...

Table of Contents

... architectural damage, rather than from the strong, rare events of which common probable maximum loss (PML) measurements are indicative. The Kajima demonstration is performed using three Tokyo buildings. A nine-story, steelreinforced-concrete building built in 1961 is analyzed as two designs: as-is, ...

... architectural damage, rather than from the strong, rare events of which common probable maximum loss (PML) measurements are indicative. The Kajima demonstration is performed using three Tokyo buildings. A nine-story, steelreinforced-concrete building built in 1961 is analyzed as two designs: as-is, ...

The Information Content of Options Trading

... Several of the prior studies (for example, Richards, 2005) have found that abnormal positive returns in the TWSE are associated with foreign inflows, whilst Barber et al. (2006) went on to use TWSE transaction data to demonstrate that individual investors were the main losers, and foreign instituti ...

... Several of the prior studies (for example, Richards, 2005) have found that abnormal positive returns in the TWSE are associated with foreign inflows, whilst Barber et al. (2006) went on to use TWSE transaction data to demonstrate that individual investors were the main losers, and foreign instituti ...

2 MB

... were also important in absorbing the fall in the euro deposits as a result of withdrawals in the period from August 1998 until May 1999 (Figure 3). Yet, the bankruptcy of a number of banks accentuated the credit crunch, which could not be mitigated by any foreign liquidity buffer. While this resulte ...

... were also important in absorbing the fall in the euro deposits as a result of withdrawals in the period from August 1998 until May 1999 (Figure 3). Yet, the bankruptcy of a number of banks accentuated the credit crunch, which could not be mitigated by any foreign liquidity buffer. While this resulte ...

Overview of IFRS

... 6. Minimum lease payments are the payments over the lease term that the lessee is, or can be required, to make excluding contingent rent, costs for services and taxes to be paid by and reimbursed to the lessor, together with: (a) in the case of the lessee, any residual value guaranteed by or on beh ...

... 6. Minimum lease payments are the payments over the lease term that the lessee is, or can be required, to make excluding contingent rent, costs for services and taxes to be paid by and reimbursed to the lessor, together with: (a) in the case of the lessee, any residual value guaranteed by or on beh ...

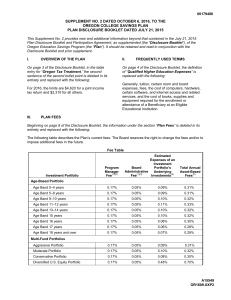

Disclosure Booklet - Oregon College Savings Plan

... Principal Plus Interest Portfolio. These payments, along with other factors, are considered by the issuer when determining the interest rate credited to the Board under the funding agreement. Investment Cost Example. The example in the following table is intended to help you compare the cost of inve ...

... Principal Plus Interest Portfolio. These payments, along with other factors, are considered by the issuer when determining the interest rate credited to the Board under the funding agreement. Investment Cost Example. The example in the following table is intended to help you compare the cost of inve ...

A comparative technical, cost and profit efficiency

... the control of bank management, and (ii) determining factors associated with bank operations, that is, the determinants of efficiency at the firm level. For example, country-specific and macroeconomic factors, such as GDP, interest rates, labour union power, unemployment rates and government regula ...

... the control of bank management, and (ii) determining factors associated with bank operations, that is, the determinants of efficiency at the firm level. For example, country-specific and macroeconomic factors, such as GDP, interest rates, labour union power, unemployment rates and government regula ...

eurazeo sells approximately one third of its stake in elis

... traditional boundaries, creating new and buoyant business lines, while building on its history of operational excellence. The appeal of this business model, combining steady growth and cash flow generation, is reflected in its excellent share price performance. We continue to believe that the compan ...

... traditional boundaries, creating new and buoyant business lines, while building on its history of operational excellence. The appeal of this business model, combining steady growth and cash flow generation, is reflected in its excellent share price performance. We continue to believe that the compan ...

Chapter 23- Real Estate Investment Trusts

... stock, and there must be at least 100 different shareholders. (“Look-Through Provision” enacted 1993: pension funds not limited by the five-or-fewer rule.) 2. Asset Test: >= 75% of a REIT’s total assets must be real estate, mortgages, cash, or federal government securities, and 75% or more of the RE ...

... stock, and there must be at least 100 different shareholders. (“Look-Through Provision” enacted 1993: pension funds not limited by the five-or-fewer rule.) 2. Asset Test: >= 75% of a REIT’s total assets must be real estate, mortgages, cash, or federal government securities, and 75% or more of the RE ...

Switching Bubbles: From Outside to Inside

... when they are old, instead of lending money to old investors. Section 4 studies what happens when the economy switches between the Outside and the Inside Bubble. I show that investment and debt of entrepreneurs are lower. In particular, the investment of both middle-aged and young entrepreneurs are ...

... when they are old, instead of lending money to old investors. Section 4 studies what happens when the economy switches between the Outside and the Inside Bubble. I show that investment and debt of entrepreneurs are lower. In particular, the investment of both middle-aged and young entrepreneurs are ...

New Foreign Investment Regimes of Russia and other Republics of

... In the cold war atmosphere of economic and political rivalry, international trade, investment, and economic cooperation with the U.S.S.R. were primarily reserved for other countries of the Communist block. Rather unexpectedly, several major breakthroughs drastically altered this condition. With the ...

... In the cold war atmosphere of economic and political rivalry, international trade, investment, and economic cooperation with the U.S.S.R. were primarily reserved for other countries of the Communist block. Rather unexpectedly, several major breakthroughs drastically altered this condition. With the ...

Dreyfus Variable Investment Fund: Quality Bond Portfolio

... An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money. • ...

... An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money. • ...

lease term

... In addition to the information given earlier, the lessor (RentPro) knows that the collectibility of the lease payments is reasonably predictable, and there are no future costs to be incurred. RentPro’s performance is substantially complete as far as the lease is concerned. RentPro is not a manufactu ...

... In addition to the information given earlier, the lessor (RentPro) knows that the collectibility of the lease payments is reasonably predictable, and there are no future costs to be incurred. RentPro’s performance is substantially complete as far as the lease is concerned. RentPro is not a manufactu ...

102finalmc

... a. demand loanable funds by buying bonds. b. demand loanable funds by selling bonds. c. supply loanable funds by buying bonds. d. supply loanable funds by selling bonds. 5. Which of the following is correct? a. Some bonds have terms as short as a few months. b. Because they are so risky, junk bonds ...

... a. demand loanable funds by buying bonds. b. demand loanable funds by selling bonds. c. supply loanable funds by buying bonds. d. supply loanable funds by selling bonds. 5. Which of the following is correct? a. Some bonds have terms as short as a few months. b. Because they are so risky, junk bonds ...

Financial Innovation, Collateral and Investment. Ana Fostel John Geanakoplos August 6, 2015

... promises that can be backed by collateral, that is, by a change in J. In the incomplete markets literature, financial innovations were modeled by securities with new kinds of payoffs. Financial innovations of that kind do have an effect on asset prices and real allocations, but the direction of the ...

... promises that can be backed by collateral, that is, by a change in J. In the incomplete markets literature, financial innovations were modeled by securities with new kinds of payoffs. Financial innovations of that kind do have an effect on asset prices and real allocations, but the direction of the ...

downstream securities regulation

... that the financial services component of securities regulation is a separate genre of securities regulation, different in important respects from its more renowned counterpart; that it does not revolve around securities issuers; and, critically, that it need not rely solely on disclosure and antifra ...

... that the financial services component of securities regulation is a separate genre of securities regulation, different in important respects from its more renowned counterpart; that it does not revolve around securities issuers; and, critically, that it need not rely solely on disclosure and antifra ...

Should Tender Offer Arbitrage Be Regulated

... HARV. J.LEGIS. 431, 432-33 (1968). This increase in tender offers gave rise to passage of the Williams Act, but that Act in no way dampened the incidence of tender offers. On the contrary, such offers have occurred with increasing frequency in the 1970s. See, e.g., Ehrbar, supra note 14, at 83 (refe ...

... HARV. J.LEGIS. 431, 432-33 (1968). This increase in tender offers gave rise to passage of the Williams Act, but that Act in no way dampened the incidence of tender offers. On the contrary, such offers have occurred with increasing frequency in the 1970s. See, e.g., Ehrbar, supra note 14, at 83 (refe ...

Sequential Sales, Learning, and Cascades

... CONSIDER A SCENARIO IN which an issuer is selling a new security of uncertain value, for example, an IPO (initial public offering) of stock or high-yield debt, through an underwriter. The S.E.C. has banned variable -price sales. While the value of this new security is highly uncertain to individual ...

... CONSIDER A SCENARIO IN which an issuer is selling a new security of uncertain value, for example, an IPO (initial public offering) of stock or high-yield debt, through an underwriter. The S.E.C. has banned variable -price sales. While the value of this new security is highly uncertain to individual ...

excessive leverage and bankers` pay

... compensation. Given that excessive leverage can lead to institution failure, financial instability and allocative inefficiencies (analytically explained in Part III) it is clear that leverage-induced executive decisions have governance implications and entail high agency costs, as management adopts ...

... compensation. Given that excessive leverage can lead to institution failure, financial instability and allocative inefficiencies (analytically explained in Part III) it is clear that leverage-induced executive decisions have governance implications and entail high agency costs, as management adopts ...

american capital senior floating, ltd. - corporate

... (Exact name of registrant as specified in its charter) Maryland (State of Incorporation) ...

... (Exact name of registrant as specified in its charter) Maryland (State of Incorporation) ...

Dynamic Volatility Targeting

... asset falls, but more importantly, the rate of the increase in the price of puts increases as the price of the underlying asset falls. Conversely, the rate of the decrease in the price of puts decreases as the price of the underlying asset rises. This characteristic is unique to a long options posit ...

... asset falls, but more importantly, the rate of the increase in the price of puts increases as the price of the underlying asset falls. Conversely, the rate of the decrease in the price of puts decreases as the price of the underlying asset rises. This characteristic is unique to a long options posit ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.