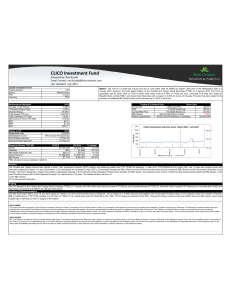

CLICO Investment Fund

... This report has been prepared by First Citizens Investment Services Limited, a subsidiary of First Citizens Bank Limited. It is provided for informational purposes only and without any obligation, whether contractual or otherwise. All information contained herein has been obtained from sources that ...

... This report has been prepared by First Citizens Investment Services Limited, a subsidiary of First Citizens Bank Limited. It is provided for informational purposes only and without any obligation, whether contractual or otherwise. All information contained herein has been obtained from sources that ...

Offshore Real Estate Investment Structures

... affording a degree of protection against inflation. This, combined with the relative strength of the US Dollar against other currencies, makes it opportune for US Dollar investors to diversify their portfolios to include UK and/or European real estate. The funding crisis and regulatory tightening o ...

... affording a degree of protection against inflation. This, combined with the relative strength of the US Dollar against other currencies, makes it opportune for US Dollar investors to diversify their portfolios to include UK and/or European real estate. The funding crisis and regulatory tightening o ...

serie documentos de trabajo ownership structure and risk at

... The property of Banks can be in hands of few or lots of investors. As Laeven and Levine (2009) and the Corporate Governance theory suggest, the capacity of owners to guide managers’ decisions concerning risk depends on the banking property distribution. The higher the ownership concentration the hig ...

... The property of Banks can be in hands of few or lots of investors. As Laeven and Levine (2009) and the Corporate Governance theory suggest, the capacity of owners to guide managers’ decisions concerning risk depends on the banking property distribution. The higher the ownership concentration the hig ...

Money and Banking

... Printed more money than there was value to back it (leads to high inflation) People lost confidence in the value of money ...

... Printed more money than there was value to back it (leads to high inflation) People lost confidence in the value of money ...

Ch.13

... – An increase in the perceived riskiness of the bond. – Expectations of any of the above ...

... – An increase in the perceived riskiness of the bond. – Expectations of any of the above ...

JPM US Value X (acc)

... http://www.jpmorganassetmanagement.lu/emea-remunerationpolicy . This policy includes details of how remuneration and benefits are calculated, including responsibilities and composition of the committee which oversees and controls the policy. A copy of this policy can be requested free of charge from ...

... http://www.jpmorganassetmanagement.lu/emea-remunerationpolicy . This policy includes details of how remuneration and benefits are calculated, including responsibilities and composition of the committee which oversees and controls the policy. A copy of this policy can be requested free of charge from ...

27 January 2017 Global developments Government bond yields, the

... Q3, compared to the 2.2% consensus forecast. Growth was held back be the strongest drag from trade since Q2 2010 while non-residential fixed investment was at a 5-quarter high. The early 2017 US growth indicators were strong however, with Markit Services PMI in January rising to 55.1 against consens ...

... Q3, compared to the 2.2% consensus forecast. Growth was held back be the strongest drag from trade since Q2 2010 while non-residential fixed investment was at a 5-quarter high. The early 2017 US growth indicators were strong however, with Markit Services PMI in January rising to 55.1 against consens ...

12 Billion Dirhams Profits of 65 Companies Listed on ADX 19

... demand and supply in order to determine prices. ...

... demand and supply in order to determine prices. ...

Sanlam Investment Management Value Fund Class A1

... date. Lump sum investment performances are quoted. The portfolio may invest in other unit trust portfolios which levy their own fees, and may result is a higher fee structure for our portfolio. All the portfolio options presented are approved collective investment schemes in terms of Collective Inve ...

... date. Lump sum investment performances are quoted. The portfolio may invest in other unit trust portfolios which levy their own fees, and may result is a higher fee structure for our portfolio. All the portfolio options presented are approved collective investment schemes in terms of Collective Inve ...

DRAFT Investment Policy Jan 22 2016(word doc)

... compliance has been achieved. The District shall not exceed fifty percent (50%) of the District’s total investment portfolio in any one (1) authorized investment type, with the exception of the following; LAIF and County of Santa Cruz Investment Pool. Current Government Sponsored Enterprises investm ...

... compliance has been achieved. The District shall not exceed fifty percent (50%) of the District’s total investment portfolio in any one (1) authorized investment type, with the exception of the following; LAIF and County of Santa Cruz Investment Pool. Current Government Sponsored Enterprises investm ...

The Growing Role of Alternative Investments

... view preexisting portfolio holdings, unlike when they invest in public equities. Committees instead must rely on a manager’s past success in allocating capital for similar private equity closed-end funds. Hedge funds pursue a wide range of strategies and, thus, have a broad range of risk and return ...

... view preexisting portfolio holdings, unlike when they invest in public equities. Committees instead must rely on a manager’s past success in allocating capital for similar private equity closed-end funds. Hedge funds pursue a wide range of strategies and, thus, have a broad range of risk and return ...

Balance of Payments BoP Account Definitions

... the world – enabling the country to sell more of its goods abroad. The financial capital outflow is seen as an investment because it Involves acquisition of assets that are expected to pay a future return. This can be seen as net foreign investment. Thus, in general, a country with a higher level of ...

... the world – enabling the country to sell more of its goods abroad. The financial capital outflow is seen as an investment because it Involves acquisition of assets that are expected to pay a future return. This can be seen as net foreign investment. Thus, in general, a country with a higher level of ...

Investment Policy

... The initial Strategy may be replaced by another Strategy (“the revised Strategy”) at any time during the year, on one or more occasions, subject to the same process of approval. The initial Strategy should specify circumstances in which a revised Strategy is to be prepared, but a revised Strategy ma ...

... The initial Strategy may be replaced by another Strategy (“the revised Strategy”) at any time during the year, on one or more occasions, subject to the same process of approval. The initial Strategy should specify circumstances in which a revised Strategy is to be prepared, but a revised Strategy ma ...

Pension fund equity investment

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

London planning and the coming crisis

... important historic stock of social housing has been eroded by sales • キ highly differentiated local environments, schools and services increase price differences • キ long commuter journeys increase price differences • キ housing development industry's most profitable strategy has been to keep output ...

... important historic stock of social housing has been eroded by sales • キ highly differentiated local environments, schools and services increase price differences • キ long commuter journeys increase price differences • キ housing development industry's most profitable strategy has been to keep output ...

Big Banks In Small Countries

... so-called “light-touch” regulation and supervision that did not properly monitor or prevent the accumulation of risks.6 The crisis hit hard those banks that had invested heavily in U.S. mortgage-backed securities or had lent significantly to finance domestic bubbles (primarily related to housing and ...

... so-called “light-touch” regulation and supervision that did not properly monitor or prevent the accumulation of risks.6 The crisis hit hard those banks that had invested heavily in U.S. mortgage-backed securities or had lent significantly to finance domestic bubbles (primarily related to housing and ...

The value of Mr. Gouline’s car is cut in half every three

... investor, and the value of his investments doubles every seven years. If he has $1,000 now, how long will it take for him to have $15,000, assuming he makes no additional investment? ...

... investor, and the value of his investments doubles every seven years. If he has $1,000 now, how long will it take for him to have $15,000, assuming he makes no additional investment? ...

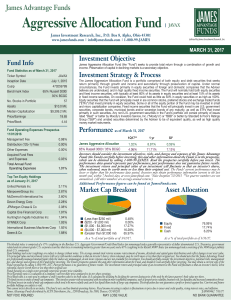

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Harbor Mid Cap Value Fund

... effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may ...

... effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may ...

Afghanistan`s only private equity fund launched InFrontier

... enterprises in underserved markets, particularly in fragile states. We believe that InFrontier can set an example, also for private investors, by demonstrating that market based investments in one of the world's most challenging countries are possible, thereby contributing to financial ecosystem dev ...

... enterprises in underserved markets, particularly in fragile states. We believe that InFrontier can set an example, also for private investors, by demonstrating that market based investments in one of the world's most challenging countries are possible, thereby contributing to financial ecosystem dev ...

FDR and the Banks - Constitutional Rights Foundation

... allow certain kinds of investment banking by commercial banks. In 1999, a Republican Congress and Democratic president, Bill Clinton, repealed two key sections of the Glass-Steagall Act. This repeal eliminated most of the remaining barriers that stopped commercial banks from engaging in investment a ...

... allow certain kinds of investment banking by commercial banks. In 1999, a Republican Congress and Democratic president, Bill Clinton, repealed two key sections of the Glass-Steagall Act. This repeal eliminated most of the remaining barriers that stopped commercial banks from engaging in investment a ...

Personal Finance Economics

... the purchases of new homes by consumers. The amount of real investment is critical to economic growth. Financial investment and real investment are connected, but they are not the same. Thus, when you hear a casual reference to "investment," be clear in your own mind on whether it is financial inves ...

... the purchases of new homes by consumers. The amount of real investment is critical to economic growth. Financial investment and real investment are connected, but they are not the same. Thus, when you hear a casual reference to "investment," be clear in your own mind on whether it is financial inves ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.