IFC Russia Capitalization Fund

... Government purchases bad assets at nominal, ‘bad bank’ assets sold at market price Government is effectively re-capitalizing … may only work where banks are state-owned N.B.: ‘Chinese’ not an accurate name – governments have been bailing out banks for centuries ...

... Government purchases bad assets at nominal, ‘bad bank’ assets sold at market price Government is effectively re-capitalizing … may only work where banks are state-owned N.B.: ‘Chinese’ not an accurate name – governments have been bailing out banks for centuries ...

Novo CapitalMgmt

... our current account deficit. And over time, as the value of China’s and other emerging economies’ currencies continue to rise, the spending subsidy created by the super-cheap goods from China will dissipate. In addition, China’s policy shift toward tighter money puts U.S. politicians and regulators ...

... our current account deficit. And over time, as the value of China’s and other emerging economies’ currencies continue to rise, the spending subsidy created by the super-cheap goods from China will dissipate. In addition, China’s policy shift toward tighter money puts U.S. politicians and regulators ...

Investigating the Market-Structure - Performance Relationship in the

... This paper employs a two-stage estimation procedure to evaluate the impact of bank concentration on performance. In the first stage of the estimation process, a stochastic cost frontier is estimated for the dominant commercial banks in Jamaica over the period 1989 – 2005, using both translog and Cob ...

... This paper employs a two-stage estimation procedure to evaluate the impact of bank concentration on performance. In the first stage of the estimation process, a stochastic cost frontier is estimated for the dominant commercial banks in Jamaica over the period 1989 – 2005, using both translog and Cob ...

Asset Pricing Implication of Innovation (cont`d)

... • Avoid look-ahead bias: make sure sorting variables are observable to investors at formation (financial reporting lag) • Rebalance once a year (reduce transaction cost) ...

... • Avoid look-ahead bias: make sure sorting variables are observable to investors at formation (financial reporting lag) • Rebalance once a year (reduce transaction cost) ...

Deutsche Invest I Top Asia - Deutsche Asset Management

... fluctuate sharply in either direction within short periods of time. Please note that not all share classes and subfunds respectively are registered in every country. Units issued by Deutsche Invest SICAV may only be sold or offered for sale in jurisdictions in which such offer or sale is permitted. ...

... fluctuate sharply in either direction within short periods of time. Please note that not all share classes and subfunds respectively are registered in every country. Units issued by Deutsche Invest SICAV may only be sold or offered for sale in jurisdictions in which such offer or sale is permitted. ...

Investment Update - Australia Post Superannuation Scheme

... businesses worth more. The same goes for real estate and other assets that depend on employment and consumer demand. In difficult economic times investors can lose confidence in the value of their investments and may switch to safe options like cash. This often drives down the value of shares and re ...

... businesses worth more. The same goes for real estate and other assets that depend on employment and consumer demand. In difficult economic times investors can lose confidence in the value of their investments and may switch to safe options like cash. This often drives down the value of shares and re ...

fund risks - Royal London pensions for employers and trustees

... depending on their particular theme or investment policy. We have detailed which of these risks are applicable on the individual factsheet available for each fund. Exchange rate This fund invests in investments outside the UK. This means that the value of these investments will decrease or increase ...

... depending on their particular theme or investment policy. We have detailed which of these risks are applicable on the individual factsheet available for each fund. Exchange rate This fund invests in investments outside the UK. This means that the value of these investments will decrease or increase ...

EQEO Performance Summary

... Qatar Islamic Bank, the country’s first Islamic bank, has total assets of QAR39bn. It operates through a network of 25 branches and holds a 9% loan market share. The basic structure that QIB aims to create has a strong focus on capital markets and wholesale finance activities, which are still genera ...

... Qatar Islamic Bank, the country’s first Islamic bank, has total assets of QAR39bn. It operates through a network of 25 branches and holds a 9% loan market share. The basic structure that QIB aims to create has a strong focus on capital markets and wholesale finance activities, which are still genera ...

On My Radar: Fed Stuck Between Three Rocks and a Hard Place

... ripple effects can be significant. Add in sizable debt and they can cause major disruption and crisis. The Fed agreed to backtrack on the rate hike thing with Janet Yellen sounding more dovish than she has since taking office. That is a major change from her comments in December and January. So the big ...

... ripple effects can be significant. Add in sizable debt and they can cause major disruption and crisis. The Fed agreed to backtrack on the rate hike thing with Janet Yellen sounding more dovish than she has since taking office. That is a major change from her comments in December and January. So the big ...

UBS Investor Watch

... Global events are creating greater uncertainty for investors… As the world gets smaller and more connected, nearly all investors believe global events have a greater impact on the U.S. markets than they used to. Investors realize they can no longer ignore the impact of these forces on their portfoli ...

... Global events are creating greater uncertainty for investors… As the world gets smaller and more connected, nearly all investors believe global events have a greater impact on the U.S. markets than they used to. Investors realize they can no longer ignore the impact of these forces on their portfoli ...

Algebra with Finance

... and to question outcomes using mathematical analysis and data to support their findings. The course offers students multiple opportunities to use, construct, question, model, and interpret financial situations through symbolic algebraic representations, graphical representations, geometric represent ...

... and to question outcomes using mathematical analysis and data to support their findings. The course offers students multiple opportunities to use, construct, question, model, and interpret financial situations through symbolic algebraic representations, graphical representations, geometric represent ...

aaa

... Hindered by the current global and regional economic slowdown, FDI inflows to Asia are expected to decline in 2016 by about 15 percent, reverting to their 2014 level, it added. "Global economy is yet to get back strong shape overcoming the financial and economic downturn in 2008-09, but it would be ...

... Hindered by the current global and regional economic slowdown, FDI inflows to Asia are expected to decline in 2016 by about 15 percent, reverting to their 2014 level, it added. "Global economy is yet to get back strong shape overcoming the financial and economic downturn in 2008-09, but it would be ...

Five steps for European banks to shape up

... the banks’ valuation. Until recently, banks have generally been levering down (through the increase of capital and the reduction/realignment of assets) and cutting costs: they have been acting in a more risk-averse and defensive manner. Internally, banks also face a ‘cultural challenge’ to find a ba ...

... the banks’ valuation. Until recently, banks have generally been levering down (through the increase of capital and the reduction/realignment of assets) and cutting costs: they have been acting in a more risk-averse and defensive manner. Internally, banks also face a ‘cultural challenge’ to find a ba ...

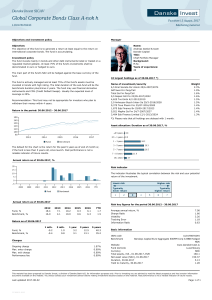

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... and to present a review of this work to the Commission two years after the rule becomes ...

... and to present a review of this work to the Commission two years after the rule becomes ...

March 2000, Volume 37, Number 1

... they had not been pyramid schemes from the outset, at some point, probably during early 1996, these companies too became pyramid schemes. When they collapsed, it was clear that their liabilities massively exceeded their assets. Mania: the events of 1996 Two events set the stage for the pyramid-schem ...

... they had not been pyramid schemes from the outset, at some point, probably during early 1996, these companies too became pyramid schemes. When they collapsed, it was clear that their liabilities massively exceeded their assets. Mania: the events of 1996 Two events set the stage for the pyramid-schem ...

15 The Financial Crisis and the Great Recession

... Approximately 11 million homebuyers faced foreclosure from 2008 to mid-2012, accounting for about one of every four mortgages in the United States. Tens of millions were made poorer, if not “officially” poor. Clearly, the massive loss of speculative financial wealth on Wall Street (much of it relate ...

... Approximately 11 million homebuyers faced foreclosure from 2008 to mid-2012, accounting for about one of every four mortgages in the United States. Tens of millions were made poorer, if not “officially” poor. Clearly, the massive loss of speculative financial wealth on Wall Street (much of it relate ...

The Role of a Corporate Bond Market in an Economy

... public bond issue. A mature bond market will therefore also include the opportunity for what is known as private placements. Investors in such instruments are usually referred to as relationship investors because they must monitor the company’s performance themselves and are therefore typically prov ...

... public bond issue. A mature bond market will therefore also include the opportunity for what is known as private placements. Investors in such instruments are usually referred to as relationship investors because they must monitor the company’s performance themselves and are therefore typically prov ...

Speech by Jon Cunliffe at the Greater Birmingham Chamber of

... Expected rejection: I do not want to apply for external finance as I believe I would be turned down (agree). Cost of funds: I do not want to apply for external finance as I believe it is too expensive (agree). Maturity: I am able to borrow at the maturity I need (disagree). Collateral: is not a cons ...

... Expected rejection: I do not want to apply for external finance as I believe I would be turned down (agree). Cost of funds: I do not want to apply for external finance as I believe it is too expensive (agree). Maturity: I am able to borrow at the maturity I need (disagree). Collateral: is not a cons ...

Lyxor Green Bond (DR) UCITS ETF

... section of the Key Investor Information Document (KIID). The prospectus in English and the KIID in French are available free of charge on www.lyxoretf.com or upon request to [email protected]. The attention of investors is drawn to the fact that, the prospectus is only available in English. U ...

... section of the Key Investor Information Document (KIID). The prospectus in English and the KIID in French are available free of charge on www.lyxoretf.com or upon request to [email protected]. The attention of investors is drawn to the fact that, the prospectus is only available in English. U ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.