Positioning your portfolio for rising interest rates

... Bond sensitivity to interest-rate movements is based on several factors, including credit quality and the type of security. You should examine the bond funds in your portfolio to see how well-diversified they are. They should include a good mix of corporate bonds (both investment grade and high yiel ...

... Bond sensitivity to interest-rate movements is based on several factors, including credit quality and the type of security. You should examine the bond funds in your portfolio to see how well-diversified they are. They should include a good mix of corporate bonds (both investment grade and high yiel ...

Market Perspective

... The eurozone economy has been growing in line with its traditionally-subdued trend, but with no noticeable inflation. The ECB continues to buy large quantities of bonds in an attempt to force the pace. Negative yields have spread further, as more and more bonds have seen their prices squeezed higher ...

... The eurozone economy has been growing in line with its traditionally-subdued trend, but with no noticeable inflation. The ECB continues to buy large quantities of bonds in an attempt to force the pace. Negative yields have spread further, as more and more bonds have seen their prices squeezed higher ...

Konzept Issue 04 - FT Alphaville

... finance we also have pieces exploring the impact of recently instituted TLAC rules and whether or not insurers pose a systemic risk. Finally a bit a magic – credit investment magic that is, as we dig into the seemingly unusual performance of bonds following a ratings downgrade. ...

... finance we also have pieces exploring the impact of recently instituted TLAC rules and whether or not insurers pose a systemic risk. Finally a bit a magic – credit investment magic that is, as we dig into the seemingly unusual performance of bonds following a ratings downgrade. ...

Issue in Financial Stability—Activity and Financing in the Vehicle

... financing for their operations. However, it is possible to obtain a rough estimate by looking at the two publicly traded importers, since they are two of the five largest companies in the field. At the end of the third quarter of 2016, the total assets of these two companies alone totaled about NIS ...

... financing for their operations. However, it is possible to obtain a rough estimate by looking at the two publicly traded importers, since they are two of the five largest companies in the field. At the end of the third quarter of 2016, the total assets of these two companies alone totaled about NIS ...

Present and Future Values

... Objective(s) of Investment The objective of investment is to tailor the pattern of cashflows over time, in order to fit our needs. ...

... Objective(s) of Investment The objective of investment is to tailor the pattern of cashflows over time, in order to fit our needs. ...

April/May 2015 by Thomas S. Moore, CFA

... rate of inflation, and we believe the Fed has the means to achieve it. Rightly or wrongly, its leaders believe they have the tools to contain inflation if it starts to accelerate too fast. That is a risky strategy but could turn out to be a good trade-off. Living through a short period of time with ...

... rate of inflation, and we believe the Fed has the means to achieve it. Rightly or wrongly, its leaders believe they have the tools to contain inflation if it starts to accelerate too fast. That is a risky strategy but could turn out to be a good trade-off. Living through a short period of time with ...

title slide is in sentence case. green background. 2016 half

... • Our differentiated retail and commercial business model has delivered another good financial performance • Following the EU referendum the outlook for the UK economy is uncertain – Deceleration of growth anticipated – Precise impact depends on a number of factors including political and economic o ...

... • Our differentiated retail and commercial business model has delivered another good financial performance • Following the EU referendum the outlook for the UK economy is uncertain – Deceleration of growth anticipated – Precise impact depends on a number of factors including political and economic o ...

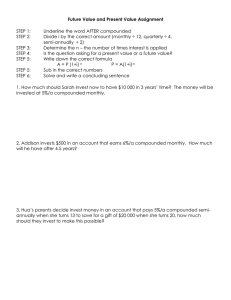

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

THE DREYFUS CORPORATION August 11, 2016 Mr. Dale

... A secondary rationale for elimination of the Class 1 List cited by Mr. Johnson’s communication is that, under the Amended Rule, money market funds will be permitted to impose a temporary redemption gate of up to 10 days: “Changes in rules adopted by the SEC affect other NAIC requirements as well; no ...

... A secondary rationale for elimination of the Class 1 List cited by Mr. Johnson’s communication is that, under the Amended Rule, money market funds will be permitted to impose a temporary redemption gate of up to 10 days: “Changes in rules adopted by the SEC affect other NAIC requirements as well; no ...

Banking Sector

... companies, changes in the market conditions, micro and macro factors and forces affecting capital markets like interest rate risk, credit risk, liquidity risk and reinvestment risk. Derivative products may also be affected by various risks including but not limited to counter party risk, market risk ...

... companies, changes in the market conditions, micro and macro factors and forces affecting capital markets like interest rate risk, credit risk, liquidity risk and reinvestment risk. Derivative products may also be affected by various risks including but not limited to counter party risk, market risk ...

Re-building and Recovery - RBS: Investor relations

... Certain sections in this presentation contain ‘forward-looking statements’ as that term is defined in the United States Private Securities Litigation Reform Act of 1995, such as statements that include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘believes’, ‘should’, ‘intend’, ‘plan’, ‘ ...

... Certain sections in this presentation contain ‘forward-looking statements’ as that term is defined in the United States Private Securities Litigation Reform Act of 1995, such as statements that include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘believes’, ‘should’, ‘intend’, ‘plan’, ‘ ...

US marinas set to become `asset class`

... developments on potential marina sites. The strategy at that time meant that the prices paid weren’t meeting the typical investment returns expected on an income-producing marina property. In today’s marketplace, marinas are being purchased based on their income-producing potential, and as overall d ...

... developments on potential marina sites. The strategy at that time meant that the prices paid weren’t meeting the typical investment returns expected on an income-producing marina property. In today’s marketplace, marinas are being purchased based on their income-producing potential, and as overall d ...

Investment Promotion Manual

... agencies, tourism councils, Philippine embassies and consulates, foreign diplomatic community, other business groups, consultants and the academe. The medium is also widely distributed during meetings, inward and outward investment promotion missions. (See Annex F for a sample of the bulletin.) C. I ...

... agencies, tourism councils, Philippine embassies and consulates, foreign diplomatic community, other business groups, consultants and the academe. The medium is also widely distributed during meetings, inward and outward investment promotion missions. (See Annex F for a sample of the bulletin.) C. I ...

How Fed policy affects Treasury Inflation-Protected

... relative to various asset classes – in periods of monetary easing and increasing inflation. However, they have the potential to add value in any environment. ...

... relative to various asset classes – in periods of monetary easing and increasing inflation. However, they have the potential to add value in any environment. ...

Financial Stability Report

... to stimulate demand for exports from emerging and developing economies. However, risks to the projected growth include lower than expected inflation in advanced economies, increased financial volatility in emerging market economies and increased cost of capital which will likely dampen investment an ...

... to stimulate demand for exports from emerging and developing economies. However, risks to the projected growth include lower than expected inflation in advanced economies, increased financial volatility in emerging market economies and increased cost of capital which will likely dampen investment an ...

FTSE Value-Stocks Index Series Extended with a New

... FTSE is a global leader in indexing and analytical solutions. FTSE calculates thousands of unique indices that measure and benchmark markets and asset classes in more than 80 countries around the world. FTSE indices are used extensively by market participants worldwide for investment analysis, perfo ...

... FTSE is a global leader in indexing and analytical solutions. FTSE calculates thousands of unique indices that measure and benchmark markets and asset classes in more than 80 countries around the world. FTSE indices are used extensively by market participants worldwide for investment analysis, perfo ...

(Attachment: 1)Report (50K/bytes)

... properties suitable for downsizing or properties in a geographical area of high demand. This criterion would enable the purchase of suitable dwellings on the open market in areas of high demand and to meet an identified housing need. 5.1.4 An existing unit on a new build site where this could increa ...

... properties suitable for downsizing or properties in a geographical area of high demand. This criterion would enable the purchase of suitable dwellings on the open market in areas of high demand and to meet an identified housing need. 5.1.4 An existing unit on a new build site where this could increa ...

From Quantity to Quality

... Improve the clarity with which firms describe their services to consumers; Address the potential for adviser remuneration to distort consumer outcome by ending commission-based payment; Increase the professional standards of financial advisers by examination. ...

... Improve the clarity with which firms describe their services to consumers; Address the potential for adviser remuneration to distort consumer outcome by ending commission-based payment; Increase the professional standards of financial advisers by examination. ...

Final Results - caledonian trust plc

... house prices. In these circumstances a large development of a block of flats or a number of houses requiring heavy infrastructure investment would result in an illiquid investment with very limited or nil profit margin: accordingly, we continue to delay any major investment ..." and only undertake " ...

... house prices. In these circumstances a large development of a block of flats or a number of houses requiring heavy infrastructure investment would result in an illiquid investment with very limited or nil profit margin: accordingly, we continue to delay any major investment ..." and only undertake " ...

High Yield Bond Prices – Are They Exhausted?

... investment class at this time is higher than ever. Some could argue that price changes were not the same in different areas of the low credit quality universe. Exhibit 4 clearly demonstrates that the relationship is similar at all levels. While the Gillette Wealth Management Group does not promote l ...

... investment class at this time is higher than ever. Some could argue that price changes were not the same in different areas of the low credit quality universe. Exhibit 4 clearly demonstrates that the relationship is similar at all levels. While the Gillette Wealth Management Group does not promote l ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.