International Real Business Cycles

... to generate significant positive comovement in employment even without any restrictions on financial markets.1 The paper then shows that when there are delays in investment (time-to-build), restricted financial markets of state non-contingent bonds, combined with a zero income effect on labor supply, ca ...

... to generate significant positive comovement in employment even without any restrictions on financial markets.1 The paper then shows that when there are delays in investment (time-to-build), restricted financial markets of state non-contingent bonds, combined with a zero income effect on labor supply, ca ...

Classic-Growth Stocks

... more than $13 billion in annual sales. It is possible that the company has saturated its flagship U.S. market and has little room to grow. McDonald's growth has indeed slowed down in recent years. Its year-on-year growth in revenue and operating earnings fell below 10% in the late 1990s, after being ...

... more than $13 billion in annual sales. It is possible that the company has saturated its flagship U.S. market and has little room to grow. McDonald's growth has indeed slowed down in recent years. Its year-on-year growth in revenue and operating earnings fell below 10% in the late 1990s, after being ...

HR Khan: Banks in India - challenges and opportunities

... platforms, without any role of a traditional financial intermediary like a bank or a non-banking financial institution. Crowd funding is a common term where small amounts of money from large number of individuals/organizations is raised to fund an art work, social cause or start-up venture through w ...

... platforms, without any role of a traditional financial intermediary like a bank or a non-banking financial institution. Crowd funding is a common term where small amounts of money from large number of individuals/organizations is raised to fund an art work, social cause or start-up venture through w ...

Housing and Urbanization in Africa: Unleashing a Formal Market

... impediments to housing therefore requires coordination that can come only from the head of government: ministries of housing have neither the political weight nor the analytic capacity to play this role effectively. Yet in Africa, housing has never received such high political priority. This in tur ...

... impediments to housing therefore requires coordination that can come only from the head of government: ministries of housing have neither the political weight nor the analytic capacity to play this role effectively. Yet in Africa, housing has never received such high political priority. This in tur ...

risk

... People’s willingness to pay the difference for borrowing today and their desire to receive a surplus on their savings give rise to an interest rate referred to as the pure time value of money. ...

... People’s willingness to pay the difference for borrowing today and their desire to receive a surplus on their savings give rise to an interest rate referred to as the pure time value of money. ...

(Former) Mid-City Trust and Savings Bank

... 1911 design of the first two stories was replaced with a Classical Revival-style arcade clad in limestone resting on a polished granite plinth. The half-round arches that form the arcade spring from square pilasters with cushion capitals. In width, the arches span the six structural bays at the cent ...

... 1911 design of the first two stories was replaced with a Classical Revival-style arcade clad in limestone resting on a polished granite plinth. The half-round arches that form the arcade spring from square pilasters with cushion capitals. In width, the arches span the six structural bays at the cent ...

Financial Services & Public Policy Alert June 2009

... Advisory Board, recommended a massive, globally coordinated restructuring of the legislative and regulatory system that governs the financial services industry (see K&L Gates Alert Group of Thirty Issues Roadmap for Financial Reforms). On May 26, 2009, the Committee on Capital Markets Regulation rel ...

... Advisory Board, recommended a massive, globally coordinated restructuring of the legislative and regulatory system that governs the financial services industry (see K&L Gates Alert Group of Thirty Issues Roadmap for Financial Reforms). On May 26, 2009, the Committee on Capital Markets Regulation rel ...

Neuberger Berman Millennium Fund

... The managers follow a disciplined selling strategy and may sell a stock when it fails to perform as expected, or when other opportunities appear more attractive. The fund has the ability to change its goal without shareholder approval, although it does not currently intend to do so. Small-Cap Stocks ...

... The managers follow a disciplined selling strategy and may sell a stock when it fails to perform as expected, or when other opportunities appear more attractive. The fund has the ability to change its goal without shareholder approval, although it does not currently intend to do so. Small-Cap Stocks ...

NEST Higher Risk Fund

... cent. We’ve reached our target weight for the LGIM Hybrid Property Fund and so our members have had the full benefit of this extra diversification. ...

... cent. We’ve reached our target weight for the LGIM Hybrid Property Fund and so our members have had the full benefit of this extra diversification. ...

Homeland Security Mutual - The Real Estate Roundtable

... • In typical real estate partnerships, before a financial partner enters the picture, a developer typically spends 3-5 years and hundreds of thousands to millions of dollars in architectural, engineering, consulting and legal costs to bring land to a buildable state—through zoning, plans, studies, a ...

... • In typical real estate partnerships, before a financial partner enters the picture, a developer typically spends 3-5 years and hundreds of thousands to millions of dollars in architectural, engineering, consulting and legal costs to bring land to a buildable state—through zoning, plans, studies, a ...

Nordea - Aktiespararna

... • Low losses, eg, Gold customers with automated credit scoring • Knowing and being close to Corporate customers • Diversification from Corporate and Household mix ...

... • Low losses, eg, Gold customers with automated credit scoring • Knowing and being close to Corporate customers • Diversification from Corporate and Household mix ...

On the resolution of banking crises

... bank failures around the world. Moreover, cross-country estimates suggest that output losses during banking crises have been, on average, large – over 10% of annual GDP. This paper reviews the merits of the various techniques used by authorities when resolving individual or widespread bank failures ...

... bank failures around the world. Moreover, cross-country estimates suggest that output losses during banking crises have been, on average, large – over 10% of annual GDP. This paper reviews the merits of the various techniques used by authorities when resolving individual or widespread bank failures ...

Working Paper No. 532 Old Wine in a New Bottle: Subprime

... mortgage companies securitized and sold off these loans. This is known as the “originationdistribution” model. The volume of MBS originated and traded reached $3 trillion in 2005 in a U.S. housing mortgage industry of $10 trillion (Farzad, Goldstein, Henry, and Palmeri 2007b). Securitization enabled ...

... mortgage companies securitized and sold off these loans. This is known as the “originationdistribution” model. The volume of MBS originated and traded reached $3 trillion in 2005 in a U.S. housing mortgage industry of $10 trillion (Farzad, Goldstein, Henry, and Palmeri 2007b). Securitization enabled ...

Q1 Global Brief 2014

... volatility and a surprise rate hike here in SA. It is completely understandable that investors would question their investment strategy during times like these. Many wonder how their portfolio would stand up to more interest rate hikes and lament the fact that they may not have had enough hard curre ...

... volatility and a surprise rate hike here in SA. It is completely understandable that investors would question their investment strategy during times like these. Many wonder how their portfolio would stand up to more interest rate hikes and lament the fact that they may not have had enough hard curre ...

IFM7 Chapter 17

... If more buy orders than sell orders come in, the company may create and sell new shares. If sell orders exceed buy orders, the company will buy the excess and thus offset the imbalance. The company can also offer new shares to its employees if it wants to raise additional equity capital, or it can r ...

... If more buy orders than sell orders come in, the company may create and sell new shares. If sell orders exceed buy orders, the company will buy the excess and thus offset the imbalance. The company can also offer new shares to its employees if it wants to raise additional equity capital, or it can r ...

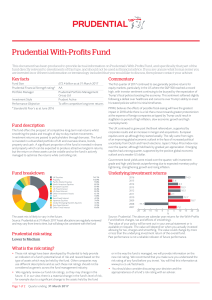

Prudential With

... For investments in the With-Profits Fund, the value of the policy depends on how much profit the fund makes and how we decide to distribute that profit. Policyholders receive a distribution of profits by means of bonuses, or other methods as specified in the relevant policy documentation. There are ...

... For investments in the With-Profits Fund, the value of the policy depends on how much profit the fund makes and how we decide to distribute that profit. Policyholders receive a distribution of profits by means of bonuses, or other methods as specified in the relevant policy documentation. There are ...

Implementing Macroprudential Policies

... That is, less time is spent on debating whether or not there is an asset bubble, and more time is spent on the consequences of what would happen if it were a bubble and it were to burst. Second, this emphasis on vulnerabilities helps to avoid a natural tendency to assess the current situation rather ...

... That is, less time is spent on debating whether or not there is an asset bubble, and more time is spent on the consequences of what would happen if it were a bubble and it were to burst. Second, this emphasis on vulnerabilities helps to avoid a natural tendency to assess the current situation rather ...

International Interbank Borrowing During the Global Crisis

... empirical link between sudden stops and current account reversals. Kaminsky (2008) shows that the risk of a sudden stop increases with the extent of financial integration. Calvo et al. (2008) point to the link between sudden stops and reliance on short-term bank borrowing. Earlier research on the gl ...

... empirical link between sudden stops and current account reversals. Kaminsky (2008) shows that the risk of a sudden stop increases with the extent of financial integration. Calvo et al. (2008) point to the link between sudden stops and reliance on short-term bank borrowing. Earlier research on the gl ...

the LKE fact sheet here

... Taxes would increase for thousands of commercial property owners. For a typical property owner who defers his or her gain on a commercial property, repealing like-kind exchanges would raise the effective tax rate on the taxpayer’s investment (including rental income and gain; nine-year holding perio ...

... Taxes would increase for thousands of commercial property owners. For a typical property owner who defers his or her gain on a commercial property, repealing like-kind exchanges would raise the effective tax rate on the taxpayer’s investment (including rental income and gain; nine-year holding perio ...

Economic Developments in 2016 Economic Developments

... The moderation in gross national savings had also contributed to the narrowing S-I gap in Malaysia (Chart 7). The moderating trend was attributable mainly to lower private sector savings amid sustained savings by the public sector. Private savings were lower, stemming from the modest growth in the o ...

... The moderation in gross national savings had also contributed to the narrowing S-I gap in Malaysia (Chart 7). The moderating trend was attributable mainly to lower private sector savings amid sustained savings by the public sector. Private savings were lower, stemming from the modest growth in the o ...

2011 EU-wide stress test results: no need for Dexia to raise

... 2011 EU-wide stress test results: no need for Dexia to raise additional capital Dexia was subject to the 2011 EU-wide stress test conducted by the European Banking Authority (EBA), in cooperation with the National Bank of Belgium, the European Central Bank (ECB), the European Commission (EC) and the ...

... 2011 EU-wide stress test results: no need for Dexia to raise additional capital Dexia was subject to the 2011 EU-wide stress test conducted by the European Banking Authority (EBA), in cooperation with the National Bank of Belgium, the European Central Bank (ECB), the European Commission (EC) and the ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.