ab large cap growth fund

... Past performance does not guarantee future results. Morningstar ratings are specific metrics of performance and do not represent absolute performance of any fund. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return ...

... Past performance does not guarantee future results. Morningstar ratings are specific metrics of performance and do not represent absolute performance of any fund. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return ...

FREE Sample Here

... Full file at http://emailtestbank.com/ Test-Bank-for-Bank-Management-7th-Edition--by-Koch 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforce ...

... Full file at http://emailtestbank.com/ Test-Bank-for-Bank-Management-7th-Edition--by-Koch 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforce ...

Special Section—Policy Options for Managing Capital Inflows in

... Gross inflows in other investments, however, rose significantly in 2006 in the PRC and Korea. It is also important to note that portfolio flows have become large relative to the size of domestic capital markets in several of these economies, as this carries a potential direct impact on asset prices— ...

... Gross inflows in other investments, however, rose significantly in 2006 in the PRC and Korea. It is also important to note that portfolio flows have become large relative to the size of domestic capital markets in several of these economies, as this carries a potential direct impact on asset prices— ...

Housing and Urbanization in Africa : Unleashing a Formal Market

... The issue which we address in this paper is why such a process has not happened in Africa. Our hypothesis is that the peculiarity of housing as a household asset produced by the non-tradable sector exposes it to multiple points of vulnerability not found together either in private consumer goods, or ...

... The issue which we address in this paper is why such a process has not happened in Africa. Our hypothesis is that the peculiarity of housing as a household asset produced by the non-tradable sector exposes it to multiple points of vulnerability not found together either in private consumer goods, or ...

an analysis of investor`s confidence and risk taking aptitude from the

... found that younger investors were more likely than older investors to buy stocks at the peak of the Internet bubble, the inexperienced retail or individual investor is more likely than the professional to be subject to sentiment. Jaffar & Namasivayan (2006) argued that the investors in the age group ...

... found that younger investors were more likely than older investors to buy stocks at the peak of the Internet bubble, the inexperienced retail or individual investor is more likely than the professional to be subject to sentiment. Jaffar & Namasivayan (2006) argued that the investors in the age group ...

Chapter_2_Presentation

... averse investors by assuming investors are risk neutral. That is, they are indifferent between the sure thing and the 50/50 gamble. As such, the firm’s market value will be $260.33 at time 0. ...

... averse investors by assuming investors are risk neutral. That is, they are indifferent between the sure thing and the 50/50 gamble. As such, the firm’s market value will be $260.33 at time 0. ...

The case for multi asset investment

... This document is for Investment Professionals only, and should not be relied upon by private investors. This document is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior ...

... This document is for Investment Professionals only, and should not be relied upon by private investors. This document is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior ...

2. Dr. Yeah Kim Leng - Malaysia Property Inc.

... Salient features of sovereign ratings Ordinal measure of the ability and willingness of sovereign governments to repay their ...

... Salient features of sovereign ratings Ordinal measure of the ability and willingness of sovereign governments to repay their ...

myanmar – schedule of specific commitments

... (a) Subject to the Union of Myanmar Foreign Investment Law, Myanmar Immigration (Emergency Provisions) Act 1947, The Foreigners Act 1846, The Registration of Foreigners Act 1940, The Registration of Foreigners Rules 1948 and Immigration rules and ...

... (a) Subject to the Union of Myanmar Foreign Investment Law, Myanmar Immigration (Emergency Provisions) Act 1947, The Foreigners Act 1846, The Registration of Foreigners Act 1940, The Registration of Foreigners Rules 1948 and Immigration rules and ...

Direct Investing In Farmland and Real Assets

... US Farmland is the key point of focus for government-sponsored agricultural support, insurance and stabilization payments. These payments are capitalized into the value of land, tending to raise values, and providing a floor to possible price depreciation. Estimates vary widely: Goodwin et al. (2003 ...

... US Farmland is the key point of focus for government-sponsored agricultural support, insurance and stabilization payments. These payments are capitalized into the value of land, tending to raise values, and providing a floor to possible price depreciation. Estimates vary widely: Goodwin et al. (2003 ...

Chapter 1 - Test bank for TextBook

... Full file at http://textbooktestbank.eu/Bank-Management-7th-Edition-Test-Bank-Koch 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforcement Ac ...

... Full file at http://textbooktestbank.eu/Bank-Management-7th-Edition-Test-Bank-Koch 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforcement Ac ...

Free market in death? Europe`s new bail

... During the financial crisis, multiple government bail-outs of failing banks were necessary to prevent financial market meltdown. A legal framework to wind up banks effectively, quickly and without causing considerable contagion within the industry was missing. To protect taxpayers’ money in the futu ...

... During the financial crisis, multiple government bail-outs of failing banks were necessary to prevent financial market meltdown. A legal framework to wind up banks effectively, quickly and without causing considerable contagion within the industry was missing. To protect taxpayers’ money in the futu ...

social housing bonds

... linked. This, and the aggressive approach taken by lenders looking to use change of control to force re-pricing of existing loan facilities, act as deterrents to mergers. There is currently little expectation of significant consolidation in the sector. Investors in the sector The market is currently ...

... linked. This, and the aggressive approach taken by lenders looking to use change of control to force re-pricing of existing loan facilities, act as deterrents to mergers. There is currently little expectation of significant consolidation in the sector. Investors in the sector The market is currently ...

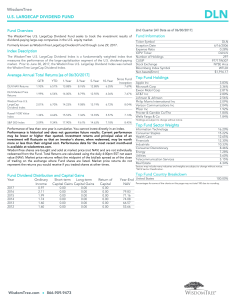

WisdomTree LargeCap Dividend Fund

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

passing the baton - RiverFront Investment Group

... RiverFront sees a positive environment for US equities in 2017, with tax reform, deregulation, and fiscal stimuli supporting corporate earnings. The only problem is that this good news is currently largely priced into US equity markets, in our view. RiverFront’s Price Matters® valuation framework su ...

... RiverFront sees a positive environment for US equities in 2017, with tax reform, deregulation, and fiscal stimuli supporting corporate earnings. The only problem is that this good news is currently largely priced into US equity markets, in our view. RiverFront’s Price Matters® valuation framework su ...

FREE Sample Here

... From https://testbankgo.eu/p/Test-Bank-For-Bank-Management-7th-Edition-Koch-MacDonal 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforcement ...

... From https://testbankgo.eu/p/Test-Bank-For-Bank-Management-7th-Edition-Koch-MacDonal 44. The _________ requires disclosure of a bank’s privacy policy. a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforcement ...

第三章 物流管理

... Speculation in the forward market Long position(多头)is the position speculator take when they purchase a foreign currency on the spot or forward market with the anticipation of selling it at a higher future spot price. Short position(空头)is the position speculator take when they borrow or sell forwa ...

... Speculation in the forward market Long position(多头)is the position speculator take when they purchase a foreign currency on the spot or forward market with the anticipation of selling it at a higher future spot price. Short position(空头)is the position speculator take when they borrow or sell forwa ...

PXP Vietnam Emerging Equity Fund

... The information contained in this presentation and communicated during any delivery of the presentation, including the talks given by the presenters, any question and answer session and any document or material distributed at or in connection with the presentation are only being made, supplied or di ...

... The information contained in this presentation and communicated during any delivery of the presentation, including the talks given by the presenters, any question and answer session and any document or material distributed at or in connection with the presentation are only being made, supplied or di ...

coronation global managed fund

... reflects heightened geopolitical concerns in various regions of the world, as well as a slightly more sanguine approach to what US President Donald Trump can or may do over the next few years. Global equities were amongst the global asset classes that did well, rising 6.9%, and thereby continuing it ...

... reflects heightened geopolitical concerns in various regions of the world, as well as a slightly more sanguine approach to what US President Donald Trump can or may do over the next few years. Global equities were amongst the global asset classes that did well, rising 6.9%, and thereby continuing it ...

Macroprudential Policy with Liquidity Panics - SIEPR

... growth or output levels. Such requirements are seen as a buffer that must be accumulated in good times, at the expense of lower investment levels, to eventually cope with financial crises by limiting banks losses or agency frictions. However, we show that this trade-off can disappear once we take in ...

... growth or output levels. Such requirements are seen as a buffer that must be accumulated in good times, at the expense of lower investment levels, to eventually cope with financial crises by limiting banks losses or agency frictions. However, we show that this trade-off can disappear once we take in ...

The Changing Landscape of the Financial Services

... the market shares and profitability of very small and small banking organizations—defined as having total assets of less than $50 million and between $50 million and $300 million, respectively—fell sharply. As Table 1 indicates, over the 198999 period, the share of domestic assets held by small bank ...

... the market shares and profitability of very small and small banking organizations—defined as having total assets of less than $50 million and between $50 million and $300 million, respectively—fell sharply. As Table 1 indicates, over the 198999 period, the share of domestic assets held by small bank ...

The Impact of AI and Technology on Financial Services

... information regarding someone's creditworthiness based on transactions they have engaged in with other parties in the past. Blockchain also provides for the application of ‘smart contracts’. Each node in the peer-to-peer network acts as its own title registry, executing transfer of ownership. The co ...

... information regarding someone's creditworthiness based on transactions they have engaged in with other parties in the past. Blockchain also provides for the application of ‘smart contracts’. Each node in the peer-to-peer network acts as its own title registry, executing transfer of ownership. The co ...

Growth potential of Canadian Stock Market

... BMO Canadian Market GICs are issued by Bank of Montreal Mortgage Corporation and guaranteed by Bank of Montreal. The principal amount of a BMO Canadian Market GIC is guaranteed and is repayable upon maturity, but there is no guarantee of earning any return linked to the performance of underlying ind ...

... BMO Canadian Market GICs are issued by Bank of Montreal Mortgage Corporation and guaranteed by Bank of Montreal. The principal amount of a BMO Canadian Market GIC is guaranteed and is repayable upon maturity, but there is no guarantee of earning any return linked to the performance of underlying ind ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.