ACCO_120_09

... Non-LIFO disclosures may be provided, as long as they are not on the face of the income statement. ...

... Non-LIFO disclosures may be provided, as long as they are not on the face of the income statement. ...

Financial Accounting and Accounting Standards

... than it could reduce its costs. As a result its percent in 1992 to 40 percent in 1993. Though the drop of 4 percent seems small, its impact on the bottom line caused Apple’s stock price to drop from $57 per share on June 1, 1993, to $27.50 by midJuly 1993. As another, more recent example, Nike—the l ...

... than it could reduce its costs. As a result its percent in 1992 to 40 percent in 1993. Though the drop of 4 percent seems small, its impact on the bottom line caused Apple’s stock price to drop from $57 per share on June 1, 1993, to $27.50 by midJuly 1993. As another, more recent example, Nike—the l ...

whole foods market, inc.

... September 30, 2007, we operated 276 stores organized into 11 geographic operating regions, each with its own leadership team: 263 stores in 37 U.S. states and the District of Columbia; seven stores in Canada; and six stores in the United Kingdom. This includes 74 stores (net of divested locations) a ...

... September 30, 2007, we operated 276 stores organized into 11 geographic operating regions, each with its own leadership team: 263 stores in 37 U.S. states and the District of Columbia; seven stores in Canada; and six stores in the United Kingdom. This includes 74 stores (net of divested locations) a ...

SCHULMAN A INC - Nasdaq`s INTEL Solutions

... Chief Executive Officer (“CEO”), who is the Chief Operating Decision Maker (“CODM”), to identify reportable segments. During fiscal 2010, the Company completed the purchase of McCann Color, Inc. (“McCann Color”), a producer of high-quality color concentrates, based in North Canton, Ohio. The busines ...

... Chief Executive Officer (“CEO”), who is the Chief Operating Decision Maker (“CODM”), to identify reportable segments. During fiscal 2010, the Company completed the purchase of McCann Color, Inc. (“McCann Color”), a producer of high-quality color concentrates, based in North Canton, Ohio. The busines ...

1/20/04 All rights reserved IS EQUITY

... Unfortunately, the empirical evidence bearing on these questions is sparse and conflicting. Although two recent studies indicate that some large public companies repurchase a substantial number of shares in the year in which they grant stock options,10 other studies and much anecdotal evidence sugge ...

... Unfortunately, the empirical evidence bearing on these questions is sparse and conflicting. Although two recent studies indicate that some large public companies repurchase a substantial number of shares in the year in which they grant stock options,10 other studies and much anecdotal evidence sugge ...

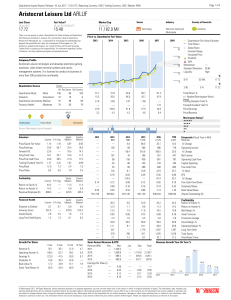

Aristocrat Leisure Ltd ARLUF

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

Derivative Market Operations

... between the two parties) and are customized according to the needs of the parties. Since these contracts do not fall under the purview of rules and regulations of an exchange, they generally suffer from counterparty risk i.e. the risk that one of the parties to the contract may not fulfill his or he ...

... between the two parties) and are customized according to the needs of the parties. Since these contracts do not fall under the purview of rules and regulations of an exchange, they generally suffer from counterparty risk i.e. the risk that one of the parties to the contract may not fulfill his or he ...

retail inventory method

... Expense recorded when loss in utility occurs. Profit on sale recognized at the point of sale. ...

... Expense recorded when loss in utility occurs. Profit on sale recognized at the point of sale. ...

21 CANDLESTICKS EVERY TRADER SHOULD KNOW

... have gone down too far too fast. Most of the traders who want to sell have done so and there are bargains -- at least in the short term -- to be had. There are many overbought and oversold indicators, such as CCI, RSI, and Williams' % R. However, one of the best is stochastics, which essentially mea ...

... have gone down too far too fast. Most of the traders who want to sell have done so and there are bargains -- at least in the short term -- to be had. There are many overbought and oversold indicators, such as CCI, RSI, and Williams' % R. However, one of the best is stochastics, which essentially mea ...

flowers foods, inc. - corporate

... Statements contained in this filing and certain other written or oral statements made from time to time by the company and its representatives that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements r ...

... Statements contained in this filing and certain other written or oral statements made from time to time by the company and its representatives that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements r ...

NBER WORKING PAPER SERIES AND CAPITAL STRUCTURE

... default probabilities (especially their time variation) for investment grade firms. By definition, these firms rarely default, which makes the model-generated spreads sensitive to small measurement errors in the conditional default probabilities.2 This model explicitly connects the conditional defau ...

... default probabilities (especially their time variation) for investment grade firms. By definition, these firms rarely default, which makes the model-generated spreads sensitive to small measurement errors in the conditional default probabilities.2 This model explicitly connects the conditional defau ...

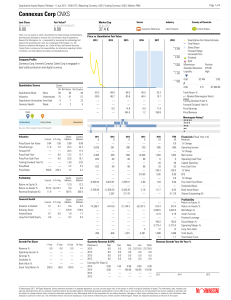

Connexus Corp CNXS

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

Does Corporate Governance Affect Dividend Policy?

... protection of minority shareholders interests in transition countries, the question arises if shareholders are able to extract from listed companies some returns in the form of dividends, La Porta, Lopez-de-Silanes, Shleifer, and Vishny (2000), hereafter referred to as LLSV, present that dividend p ...

... protection of minority shareholders interests in transition countries, the question arises if shareholders are able to extract from listed companies some returns in the form of dividends, La Porta, Lopez-de-Silanes, Shleifer, and Vishny (2000), hereafter referred to as LLSV, present that dividend p ...

What makes a great value investor?

... depends on how it would fit into the portfolio and how it would affect the diversification of the portfolio. Kennox’s literature identifies two quantitative measures of diversification which it stresses are not rigid. These are that it is unlikely that any one region will exceed 35% of the portfolio ...

... depends on how it would fit into the portfolio and how it would affect the diversification of the portfolio. Kennox’s literature identifies two quantitative measures of diversification which it stresses are not rigid. These are that it is unlikely that any one region will exceed 35% of the portfolio ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period before the ending date of the period covered by the report, determined as an unweighted arithmetic average of th ...

... Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period before the ending date of the period covered by the report, determined as an unweighted arithmetic average of th ...

FREE Sample Here

... 17. Shareholders' equity is equal to: a. total assets plus total liabilities. b. net fixed assets minus total liabilities. C. fixed assets minus long-term debt plus net working capital. d. net working capital plus total assets. e. total assets minus net working capital. ...

... 17. Shareholders' equity is equal to: a. total assets plus total liabilities. b. net fixed assets minus total liabilities. C. fixed assets minus long-term debt plus net working capital. d. net working capital plus total assets. e. total assets minus net working capital. ...

Market Consistent Embedded Value Report 2015

... In most markets, interest rates recovered towards midyear and stayed comparatively stable, exceptions being Switzerland and Asia Pacific, were rates went down considerably towards the end of the year. Spreads decreased in the Eurozone but increased in the US and Korea. Equity markets increased in Eu ...

... In most markets, interest rates recovered towards midyear and stayed comparatively stable, exceptions being Switzerland and Asia Pacific, were rates went down considerably towards the end of the year. Spreads decreased in the Eurozone but increased in the US and Korea. Equity markets increased in Eu ...

Changes in Ownership Structure

... In a survey of officers of stock insurers, Greene and Johnson (1980) reported that the ability to diversify and acquire other firms is an important advantage of the stock form over the mutual form, since the stock form allows insurers to issue additional shares when an infusion of capital is needed. ...

... In a survey of officers of stock insurers, Greene and Johnson (1980) reported that the ability to diversify and acquire other firms is an important advantage of the stock form over the mutual form, since the stock form allows insurers to issue additional shares when an infusion of capital is needed. ...

Informed Trading, Flow Toxicity and the Impact on Intraday Trading

... microstructure models focus on when informed traders take liquidity from uninformed traders or market makers. Toxicity, within this framework, refers to cases where uninformed investors have been providing liquidity at a loss due to adverse selection. For example, a limit order in the LOB might be p ...

... microstructure models focus on when informed traders take liquidity from uninformed traders or market makers. Toxicity, within this framework, refers to cases where uninformed investors have been providing liquidity at a loss due to adverse selection. For example, a limit order in the LOB might be p ...

DIME COMMUNITY BANCSHARES INC

... Directors are elected by a plurality of the votes cast in person or by proxy at the Annual Meeting. The holders of Common Stock may not vote their shares cumulatively for the election of Directors. With respect to the election of the three nominees for Director, shares as to which the "WITHHOLD AUTH ...

... Directors are elected by a plurality of the votes cast in person or by proxy at the Annual Meeting. The holders of Common Stock may not vote their shares cumulatively for the election of Directors. With respect to the election of the three nominees for Director, shares as to which the "WITHHOLD AUTH ...