Since upgrades are rare, bonds issuers have stronger incentives to

... category (Shah 2007), and a stronger market response to one-notch rating revisions that are across two adjacent broad ratings than to revisions within the same broad rating category (see the Appendix). Thus, to test whether managers smooth earnings to manage credit ratings, we examine whether manage ...

... category (Shah 2007), and a stronger market response to one-notch rating revisions that are across two adjacent broad ratings than to revisions within the same broad rating category (see the Appendix). Thus, to test whether managers smooth earnings to manage credit ratings, we examine whether manage ...

2015 Annual Report With Form 10-K

... everyday copy paper to paper used for reports like this one, or for your favorite book. We have a paper option for just about any application. We market recognized brands such as Xerox® Paper and Specialty Media, Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and EarthChoice®. ...

... everyday copy paper to paper used for reports like this one, or for your favorite book. We have a paper option for just about any application. We market recognized brands such as Xerox® Paper and Specialty Media, Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and EarthChoice®. ...

PowerPoint - McGraw Hill Higher Education

... What is Net Income? Net income is not an asset it’s an increase in owners’ equity from profits of the business. ...

... What is Net Income? Net income is not an asset it’s an increase in owners’ equity from profits of the business. ...

1 AS FILED WITH THE SECURITIES AND EXCHANGE

... Development ("IPD") and Western International University, Inc. ("WIU"), is a leading provider of higher education programs for working adults based on the number of working adults enrolled in its programs. The Company believes that its teaching/learning model differentiates its programs from those o ...

... Development ("IPD") and Western International University, Inc. ("WIU"), is a leading provider of higher education programs for working adults based on the number of working adults enrolled in its programs. The Company believes that its teaching/learning model differentiates its programs from those o ...

Expected Returns on Major Asset Classes

... about the primary function of each asset class in a portfolio (stocks for harvesting growth-related premia, certain alternative assets for collecting illiquidity premia, Treasuries for deflation hedging, and so on) as well as for diversifying across economic scenarios. Among many potential underlyin ...

... about the primary function of each asset class in a portfolio (stocks for harvesting growth-related premia, certain alternative assets for collecting illiquidity premia, Treasuries for deflation hedging, and so on) as well as for diversifying across economic scenarios. Among many potential underlyin ...

A purely theoretical study on economic growth in small open

... input, and an exogenous saving rate. The model predicts that different economies converge to different steady state positions in the long run, dependent upon the saving rate and the rate of population growth. A country with a higher saving rate and a lower population growth rate ends up with a highe ...

... input, and an exogenous saving rate. The model predicts that different economies converge to different steady state positions in the long run, dependent upon the saving rate and the rate of population growth. A country with a higher saving rate and a lower population growth rate ends up with a highe ...

STUDY ON MERGERS: A RATIONALE FOR CONGLOMERATE MERGERS by NICOLAS S. MAJLUF Engineering, Universidad Catolica de Chile

... ABSTRACT Mergers are not a new phenomenon, but rather an on-going process in the business environment. They correspond to the combination of two (or more) firms into a unique business concern. This study is grounded on the notion that looking at mergers from a financial point of view may provide a v ...

... ABSTRACT Mergers are not a new phenomenon, but rather an on-going process in the business environment. They correspond to the combination of two (or more) firms into a unique business concern. This study is grounded on the notion that looking at mergers from a financial point of view may provide a v ...

DOC - Investor Relations

... Statements contained in this Annual Report on Form 10-K, as amended (this “Annual Report”) of SPAR Group, Inc. (“SGRP”, and together with its subsidiaries, the “SPAR Group” or the “Company”), include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as ame ...

... Statements contained in this Annual Report on Form 10-K, as amended (this “Annual Report”) of SPAR Group, Inc. (“SGRP”, and together with its subsidiaries, the “SPAR Group” or the “Company”), include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as ame ...

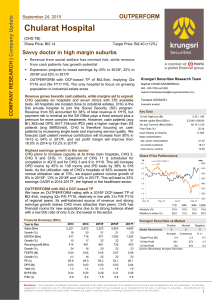

OUTPERFORM Chularat Hospital

... We value CHG using the DCF method for 2016F with a 9.3% discount rate and 3% nominal terminal growth. We assume a risk-free rate of 4.0%, market risk premium of 6.0%, and beta of 0.89 to derive our discount rate, based on projected 1% debt and 99% equity weighting in 2016F. We assume a gross profit ...

... We value CHG using the DCF method for 2016F with a 9.3% discount rate and 3% nominal terminal growth. We assume a risk-free rate of 4.0%, market risk premium of 6.0%, and beta of 0.89 to derive our discount rate, based on projected 1% debt and 99% equity weighting in 2016F. We assume a gross profit ...

northstar realty europe corp. - corporate

... the effects of being an externally-managed company, including our reliance on NSAM and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial base management and incentive fees to our manager, the allocation of investments by NSAM among us and ...

... the effects of being an externally-managed company, including our reliance on NSAM and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial base management and incentive fees to our manager, the allocation of investments by NSAM among us and ...

How Do Mergers Create Value? A Comparison of Taxes, Market

... sample of 236 successful tender offers during 1963–1984. In their overview of the literature related to mergers, Jensen and Ruback (1983, p. 47) state, “Knowledge of the sources of takeover gains still eludes us.” In spite of considerable related research since this statement, Kaplan (2000) and Andr ...

... sample of 236 successful tender offers during 1963–1984. In their overview of the literature related to mergers, Jensen and Ruback (1983, p. 47) state, “Knowledge of the sources of takeover gains still eludes us.” In spite of considerable related research since this statement, Kaplan (2000) and Andr ...

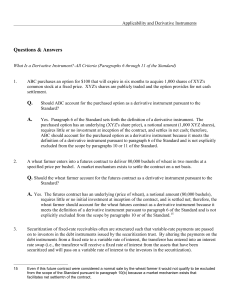

class01

... Yes. Because the contract is settled with assets that, while being associated with both the underlying and in a denomination equal to the notional amount, are readily convertible to cash (i.e., there is a liquid market for conforming 1-4 family conventional mortgage loans). For this reason, we belie ...

... Yes. Because the contract is settled with assets that, while being associated with both the underlying and in a denomination equal to the notional amount, are readily convertible to cash (i.e., there is a liquid market for conforming 1-4 family conventional mortgage loans). For this reason, we belie ...

Managerial Discretion, Matching and the Market

... Overall, our results suggest that depreciation choices are relatively close to meeting the matching objective, which is reassuring given how the standard is written, but still somewhat aggressive and highly so relative to the value relevance objective. This means that expenses are being delayed in t ...

... Overall, our results suggest that depreciation choices are relatively close to meeting the matching objective, which is reassuring given how the standard is written, but still somewhat aggressive and highly so relative to the value relevance objective. This means that expenses are being delayed in t ...

Firm Selection and Corporate Cash Holdings

... to go public. The assumed mean reversion in the productivity process implies these firms have higher funding needs and choose higher cash balances at entry to save up for future investment opportunities in order to avoid equity issuance costs. As these firms grow, they reduce their cash holdings giv ...

... to go public. The assumed mean reversion in the productivity process implies these firms have higher funding needs and choose higher cash balances at entry to save up for future investment opportunities in order to avoid equity issuance costs. As these firms grow, they reduce their cash holdings giv ...

Bad News Travels Slowly: Size, Analyst Coverage

... Although all of our evidence is consistent with the sort of gradualinformation-f low model in Hong and Stein ~1999!, it is also possible to put forward an alternative explanation of the data. In particular, it may be that analyst coverage is a proxy for differences in transactions costs that are som ...

... Although all of our evidence is consistent with the sort of gradualinformation-f low model in Hong and Stein ~1999!, it is also possible to put forward an alternative explanation of the data. In particular, it may be that analyst coverage is a proxy for differences in transactions costs that are som ...

Investor Sentiment and the Mean-Variance Relation

... to measure volatility innovation, as the unexpected change in current return volatility and as the unexpected change in future return volatility. Evidently these two measures are highly correlated, since the volatility process is persistent. The unexpected change in future variance is theoretically ...

... to measure volatility innovation, as the unexpected change in current return volatility and as the unexpected change in future return volatility. Evidently these two measures are highly correlated, since the volatility process is persistent. The unexpected change in future variance is theoretically ...

Firm Selection and Corporate Cash Holdings

... to go public. The assumed mean reversion in the productivity process implies these firms have higher funding needs and choose higher cash balances at entry to save up for future investment opportunities in order to avoid equity issuance costs. As these firms grow, they reduce their cash holdings giv ...

... to go public. The assumed mean reversion in the productivity process implies these firms have higher funding needs and choose higher cash balances at entry to save up for future investment opportunities in order to avoid equity issuance costs. As these firms grow, they reduce their cash holdings giv ...

FX Outlook: 2017

... term growth and productivity outlook on the back of expectations of a targeted fiscal infrastructure package, changes in the regulatory environment and tax reforms (i.e. lower taxes) under the Trump administration. Longer term, concerns about changes in trade and immigration policy could have macroe ...

... term growth and productivity outlook on the back of expectations of a targeted fiscal infrastructure package, changes in the regulatory environment and tax reforms (i.e. lower taxes) under the Trump administration. Longer term, concerns about changes in trade and immigration policy could have macroe ...